Severance pay is compensation an employer may provide to an employee upon termination of employment. As recruiters, understanding severance is important for managing candidate expectations and ensuring compliance.

This guide breaks down everything you need to know about severance packages, from calculation methods to legal considerations. We'll also cover negotiating strategies and common pitfalls to avoid, helping you navigate this sensitive aspect of the hiring process.

Table of contents

What is Severance Pay?

Severance pay is compensation given to an employee upon termination of their employment, typically in cases of layoffs or job elimination. Understanding severance pay is important for HR professionals and recruiters as it affects both the company's financial planning and the employee's transition process.

Imagine a tech startup that needs to downsize due to market changes, and they offer severance packages to departing employees. This scenario highlights how severance pay can help maintain goodwill, support employees during job transitions, and potentially protect the company from legal issues.

What is Severance Pay?

Severance pay is a financial compensation package provided to employees when they are laid off or terminated from their job. It acts as a cushion to help them transition during the period they are unemployed.

Typically, severance pay includes a lump sum based on the employee's length of service, salary, and company policies. It might also encompass benefits like continued health insurance or job placement services.

The purpose of severance pay is to support employees financially while they seek new employment opportunities. This practice not only aids employees but also helps maintain a positive relationship between the departing employee and the company.

Employers often offer severance pay to reduce the risk of legal claims related to the termination. It can also enhance the company's employer branding by demonstrating a commitment to treating employees fairly.

Severance agreements may include clauses that prevent employees from disclosing company information or working with competitors. Understanding these terms is crucial for both employers and employees to ensure a smooth transition.

Why Do Companies Offer Severance Packages?

Companies offer severance packages for a few key reasons. It's like a peace offering and a thank you all rolled into one!

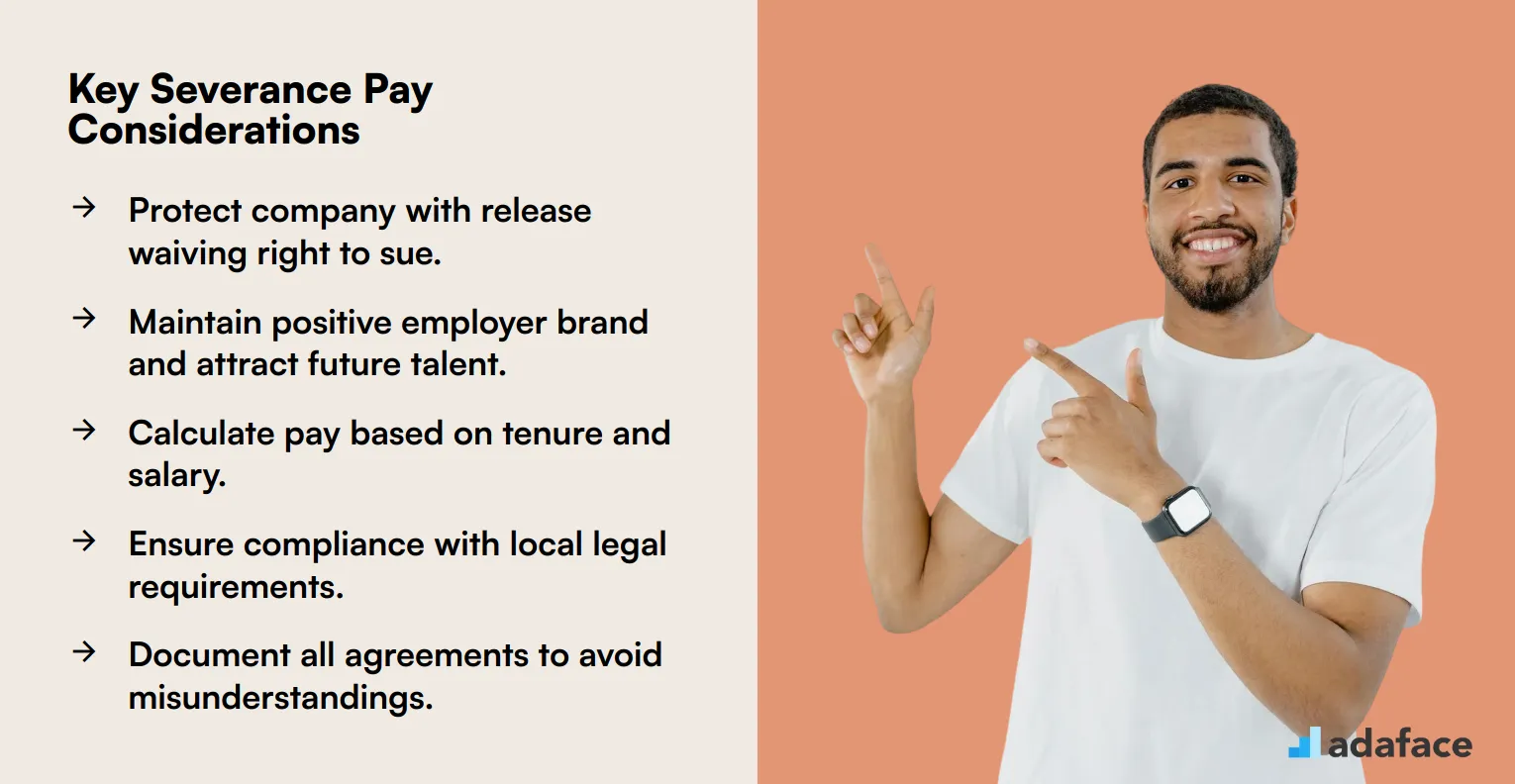

One major reason is to protect the company from potential legal issues. By offering severance, employers often require employees to sign a release waiving their right to sue for wrongful termination or other claims, which is a key part of a retention strategy.

Severance packages also help maintain a positive employer brand and public image. Treating departing employees fairly can boost morale among remaining staff and attract future talent.

Finally, severance pay can ease the transition for the departing employee. It provides financial support while they search for new employment, which can be a stressful time.

How is Severance Pay Calculated?

Severance pay calculation typically depends on several factors specific to the company and the employee's situation. The most common method is based on the employee's length of service and current salary, often calculated as one or two weeks' pay for each year of employment.

Some organizations use a flat rate system, offering a set amount regardless of tenure. Others may factor in additional elements like the employee's position, performance history, or reason for termination.

It's important to note that severance pay policies can vary widely between companies and industries. Some employers might offer additional benefits such as continued health insurance coverage or outplacement services as part of the severance package.

Legal requirements for severance pay also differ by location and circumstances of termination. In some cases, severance may be mandated by law, while in others, it's entirely at the employer's discretion.

Employers should clearly outline their severance pay calculation method in company policies or employment contracts. This transparency helps set expectations and can be a valuable tool for employee retention and company reputation management.

Legal Considerations for Severance Pay

When considering severance pay, it's important to understand the legal framework that governs it. Different countries and regions have varying laws regarding severance, and these laws can impact how packages are structured and offered. Employers must ensure compliance with these legal requirements to avoid potential legal disputes or penalties. Understanding the legal landscape is crucial for HR professionals to navigate severance pay effectively.

In some jurisdictions, severance pay might be mandated by law, while in others, it could be a matter of company policy or contractual agreement. It's essential for recruiters and hiring managers to be aware of these distinctions to manage expectations and obligations. Additionally, severance agreements often include clauses that protect the employer, such as confidentiality and non-compete clauses. These elements must be crafted carefully to be enforceable and fair.

Another legal consideration is the potential for discrimination claims if severance packages are not offered uniformly across similar roles. HR professionals should ensure that severance policies are applied consistently to avoid any perception of bias. This is particularly important in diverse workplaces, where different groups may have varying needs and expectations regarding severance.

Tax implications are also a legal consideration for severance pay. Depending on the jurisdiction, severance payments might be subject to different tax treatments, affecting both the employer and the employee. HR and finance teams should collaborate to understand these implications and communicate them clearly to employees. This ensures transparency and helps maintain trust during the transition process.

Negotiating Severance Pay: Tips for Employers

Negotiating severance pay requires a balanced approach, keeping in mind both the employee's contributions and the company's financial health. It's like figuring out a fair price when you're selling something valuable.

Start by understanding your company's standard practices and legal obligations, this is where HR analytics can help. Next, consider the employee's tenure, performance, and the circumstances of their departure.

Be transparent and empathetic during the negotiation process, which is key to candidate experience. Clearly explain the reasons behind the severance offer and be open to discussing potential adjustments.

Explore alternatives to cash payments, such as continued benefits or outplacement services. These can sometimes provide more value to the employee while being more cost-effective for the company.

Document all agreements in writing to avoid misunderstandings later. A well-documented agreement protects both the employer and the employee, ensuring a smooth transition.

Common Mistakes in Handling Severance Pay

Handling severance pay can be tricky, and it's easy to make mistakes that can lead to legal issues or damage to your company's reputation. One common mistake is failing to clearly outline the terms of severance pay in the initial employment contract, which can lead to misunderstandings later on.

Another frequent error is not considering the implications of severance pay on company finances, especially during periods of hiring surges. This oversight can strain budgets and affect the company's ability to hire new talent effectively.

Some companies also neglect to document the severance process properly, which can result in disputes or claims of unfair treatment. Proper documentation is crucial to ensure transparency and fairness in the severance process.

It's also important to avoid offering inconsistent severance packages to employees in similar positions, as this can lead to claims of discrimination or favoritism. Consistency in severance agreements helps maintain trust and fairness within the organization.

Lastly, failing to communicate the severance process clearly and empathetically can damage employee morale and the company's employer branding. Clear communication helps departing employees feel respected and valued, even as they leave the organization.

Wrapping Up Severance Pay Insights

Severance Pay FAQs

Several factors can impact severance pay, including the employee's tenure, position, reason for termination, and company policy. Contractual agreements and local laws may also play a role in determining the final amount.

In many jurisdictions, severance pay is not legally required unless stipulated in an employment contract or collective bargaining agreement. However, some countries or states may have laws mandating severance in specific situations, such as mass layoffs.

Clear and transparent communication is key to preventing disputes. Employers should have a well-defined severance policy, clearly explain the terms of the package to the employee, and obtain a signed release agreement to protect against future claims. Understanding unconscious bias in hiring can also help ensure fairness throughout the process.

Severance pay is generally considered taxable income and is subject to federal, state, and local taxes. Employers are required to withhold taxes from severance payments, and employees will receive a W-2 form reporting the income.

Yes, employees can often negotiate their severance package. Common negotiation points include the amount of severance pay, continuation of benefits, outplacement services, and non-disparagement clauses. Employers should be prepared to discuss these aspects openly and fairly.

Severance pay is a one-time payment from the employer upon termination, while unemployment benefits are provided by the government to eligible individuals who have lost their job through no fault of their own. Receiving severance pay may affect eligibility for unemployment benefits in some jurisdictions.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated terms