In the competitive field of tax preparation, hiring the right candidate is critical for ensuring accurate and compliant tax filings. Crafting the right interview questions can help bridge the skills gap and highlight a candidate's knowledge and proficiency in accounting.

This blog post provides a comprehensive guide to interview questions tailored for various levels of tax preparers, from junior to top-tier professionals. Alongside situational and technical questions, we cover the nuances of tax law and deduction strategies to assist in identifying the most capable candidates.

By using this structured list of interview questions, you can streamline your hiring process and enhance the quality of your recruits. Pairing these questions with the accounting test from our test library can further aid in selecting the most suitable candidate for your team.

Table of contents

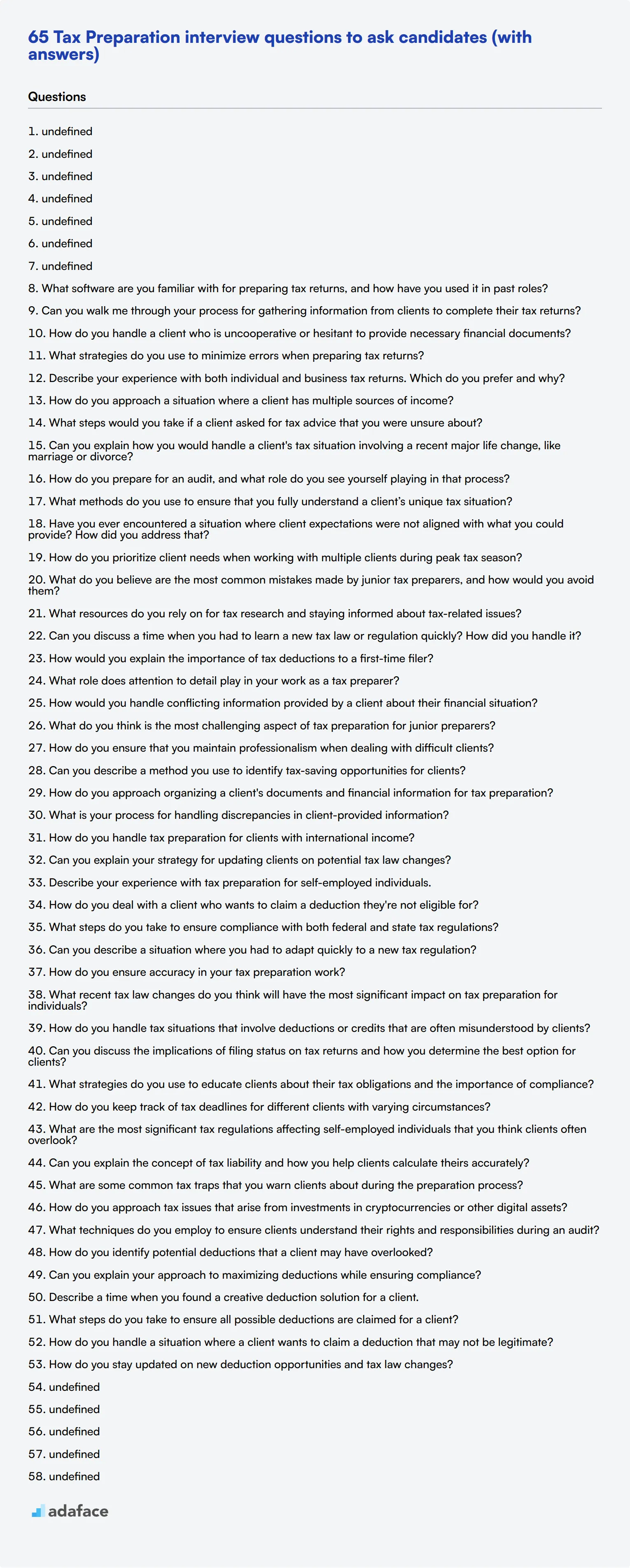

7 general Tax Preparation interview questions and answers to assess candidates

To make sure you're not hiring someone who thinks 'tax' is just a three-letter word, use these interview questions to uncover your candidate's tax knowledge and skills. Whether you're an interviewer new to the tax world or a seasoned hiring manager, these questions are designed to help you assess whether the candidate is ready to tackle the complexities of tax preparation.

1. Can you explain the importance of accuracy in tax preparation?

Accuracy in tax preparation is crucial because even small errors can lead to significant issues, such as penalties, interest charges, or audits. It ensures compliance with tax laws and regulations, which protects both the client and the preparer from legal repercussions.

A detailed-oriented candidate will emphasize the need for precision in calculations and data entry. Look for candidates who mention using checks and balances, such as double-checking work or utilizing software tools to minimize errors.

2. How do you keep up with the ever-changing tax laws and regulations?

Staying updated with tax laws is essential as they frequently change and can impact how taxes are prepared. Candidates might discuss subscribing to tax newsletters, attending workshops or webinars, and using online resources from trusted financial sites.

Ideally, a candidate should demonstrate a proactive approach to continuous learning and mention specific resources they rely on. This indicates their commitment to remaining current in their field.

3. What steps do you take to ensure confidentiality and security of client information during tax preparation?

Ensuring client confidentiality is a critical aspect of tax preparation. Candidates should mention using secure systems for storing and transmitting sensitive data, as well as following best practices for data protection.

Look for candidates who show a clear understanding of the ethical and legal importance of maintaining client privacy, as well as familiarity with relevant security protocols.

4. Describe a time when you had to deal with a complex tax scenario. How did you handle it?

Handling complex tax scenarios requires problem-solving skills and a solid understanding of tax laws. Candidates might describe a situation where they had to navigate intricate regulations or multiple sources of income, explaining their step-by-step process in resolving the issue.

Strong candidates will demonstrate analytical skills and the ability to apply their knowledge creatively to find solutions. Look for examples that highlight their ability to collaborate with others or seek additional resources when necessary.

5. How do you manage deadlines and prioritize tasks during busy tax seasons?

Managing deadlines during tax season requires excellent organizational skills. Candidates might explain using scheduling tools, setting priorities based on urgency and complexity, and maintaining clear communication with clients to ensure timely submission.

An ideal response will indicate a candidate's ability to work efficiently under pressure while maintaining high-quality standards. Look for strategies that show their capability to balance multiple tasks without compromising accuracy.

6. What is your approach to explaining complex tax concepts to clients who lack financial expertise?

Explaining tax concepts to clients involves breaking down complex ideas into simple, understandable terms. Candidates may describe using analogies or visual aids to help clients grasp intricate details without feeling overwhelmed.

Effective communicators will emphasize empathy and patience in their approach. Look for candidates who show a knack for tailoring their explanations to the client's level of understanding, ensuring clarity and transparency.

7. How would you handle a situation where you discovered a mistake in a tax return that has already been filed?

Discovering a mistake in a filed tax return requires immediate and appropriate action. Candidates should mention promptly notifying the client, assessing the impact of the error, and taking corrective steps, such as filing an amended return if necessary.

An ideal candidate will demonstrate accountability and a thorough understanding of the rectification process. Look for their ability to communicate openly with clients and a commitment to resolving the issue efficiently and transparently.

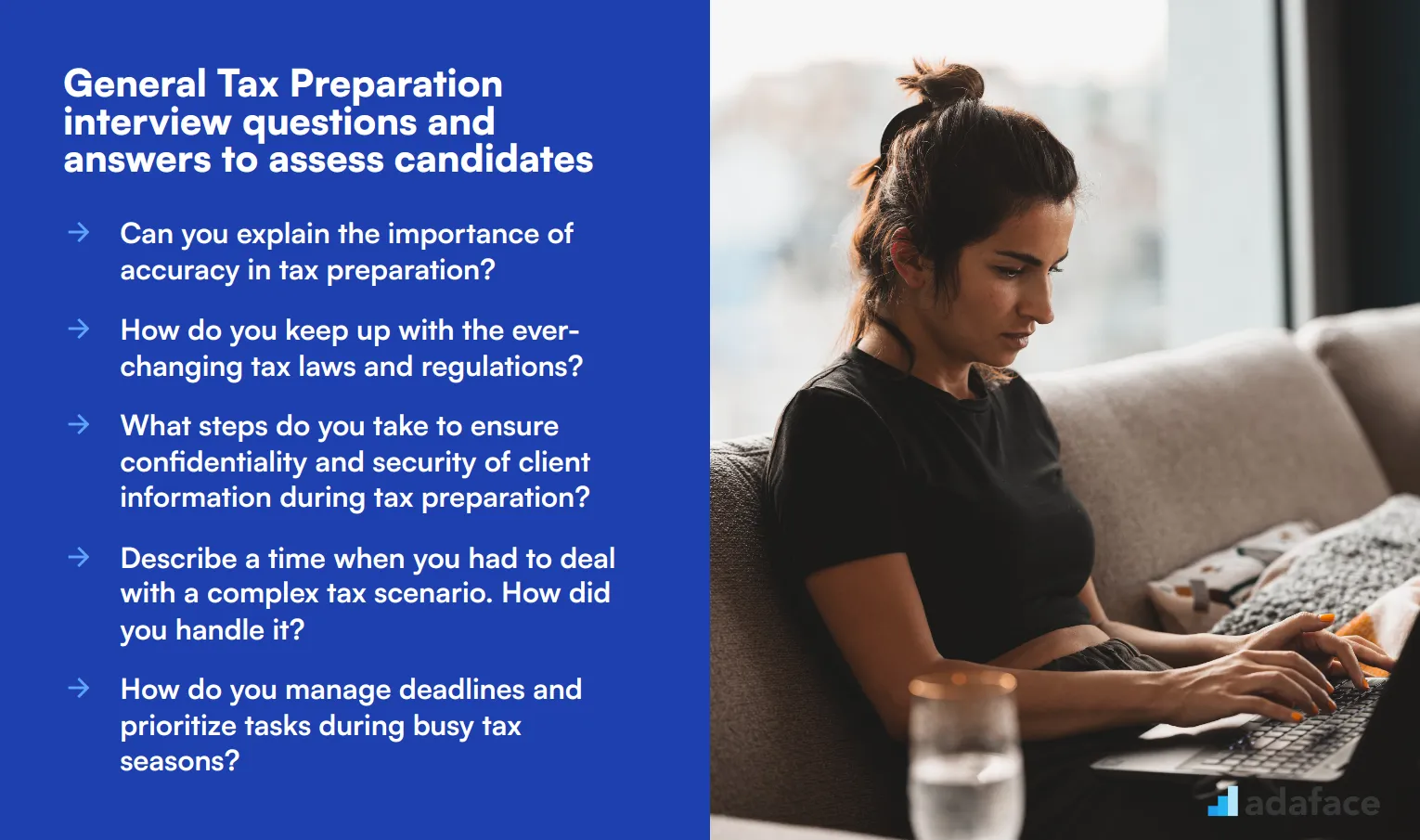

20 Tax Preparation interview questions to ask junior preparers

To effectively gauge a junior tax preparer's capabilities, use these targeted questions during the interview process. They will help you uncover whether candidates possess the necessary skills and understanding for the role, ensuring you make an informed hiring decision. For more insights on job descriptions, check out this accounting specialist resource.

- What software are you familiar with for preparing tax returns, and how have you used it in past roles?

- Can you walk me through your process for gathering information from clients to complete their tax returns?

- How do you handle a client who is uncooperative or hesitant to provide necessary financial documents?

- What strategies do you use to minimize errors when preparing tax returns?

- Describe your experience with both individual and business tax returns. Which do you prefer and why?

- How do you approach a situation where a client has multiple sources of income?

- What steps would you take if a client asked for tax advice that you were unsure about?

- Can you explain how you would handle a client's tax situation involving a recent major life change, like marriage or divorce?

- How do you prepare for an audit, and what role do you see yourself playing in that process?

- What methods do you use to ensure that you fully understand a client’s unique tax situation?

- Have you ever encountered a situation where client expectations were not aligned with what you could provide? How did you address that?

- How do you prioritize client needs when working with multiple clients during peak tax season?

- What do you believe are the most common mistakes made by junior tax preparers, and how would you avoid them?

- What resources do you rely on for tax research and staying informed about tax-related issues?

- Can you discuss a time when you had to learn a new tax law or regulation quickly? How did you handle it?

- How would you explain the importance of tax deductions to a first-time filer?

- What role does attention to detail play in your work as a tax preparer?

- How would you handle conflicting information provided by a client about their financial situation?

- What do you think is the most challenging aspect of tax preparation for junior preparers?

- How do you ensure that you maintain professionalism when dealing with difficult clients?

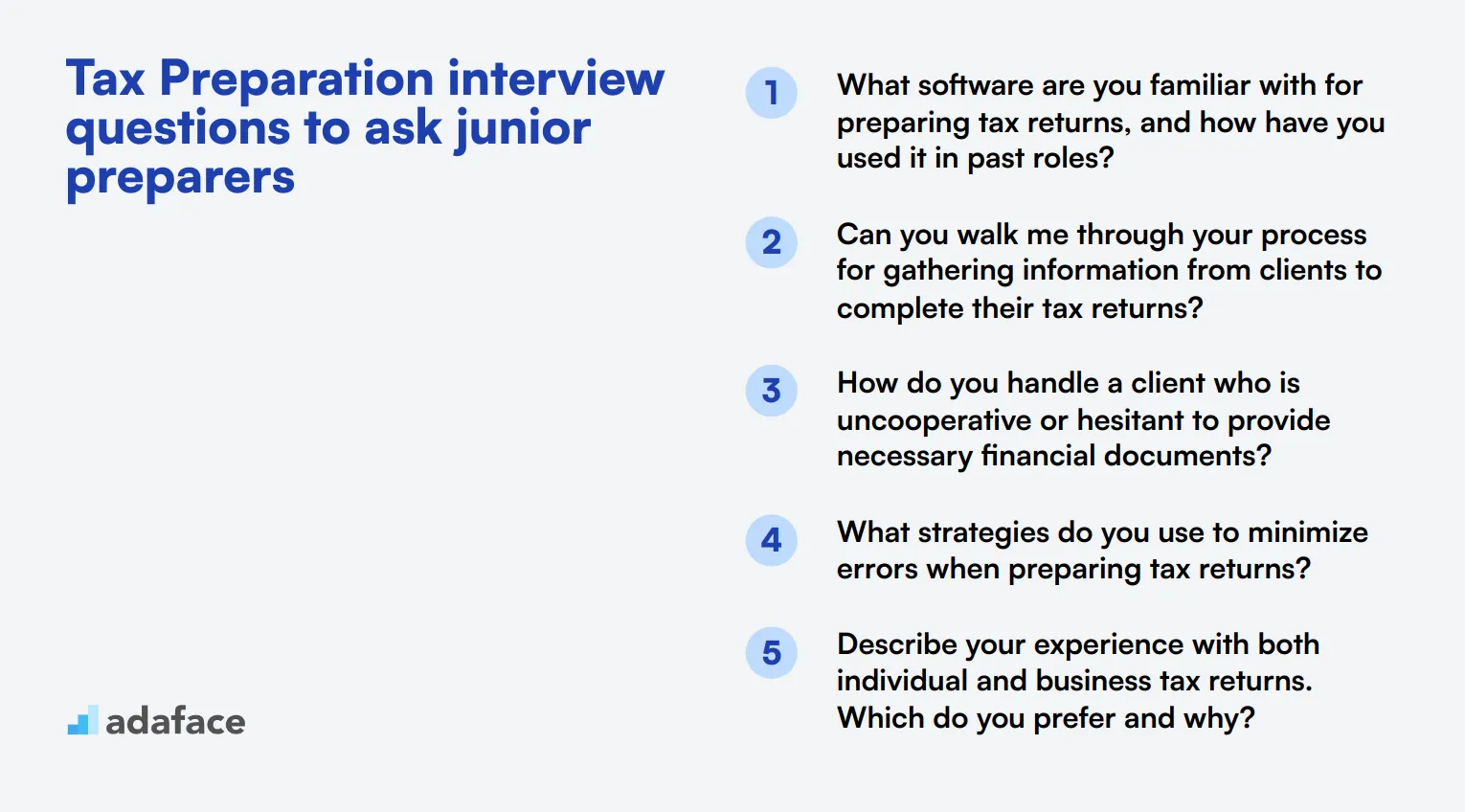

10 intermediate Tax Preparation interview questions and answers to ask mid-tier preparers.

To ensure you’re selecting the right mid-tier tax preparers, these intermediate interview questions can help you dig a little deeper. They are designed to evaluate candidates' ability to handle more complex tax scenarios and their adaptability to different client needs. Use these questions to identify candidates who not only know their tax codes but can also think critically and communicate effectively.

1. Can you describe a method you use to identify tax-saving opportunities for clients?

Identifying tax-saving opportunities requires a thorough understanding of tax laws and the unique situations of each client. I often start by reviewing previous tax returns for any overlooked deductions or credits. This includes looking into areas such as charitable contributions, education credits, and potential home office deductions for self-employed clients.

A proactive approach involves staying updated with any new tax legislation that could benefit my clients. By understanding specific changes, such as alterations in income brackets or deductions, I can advise my clients on strategies like income deferral or maximizing retirement contributions to reduce taxable income.

The best answers will show a candidate's proactive approach and knowledge of how to apply tax laws effectively to benefit clients. Look for examples where candidates have successfully implemented strategies that saved clients money.

2. How do you approach organizing a client's documents and financial information for tax preparation?

Organizing a client's documents starts with creating a checklist of required forms and information, such as W-2s, 1099s, and receipts for deductions. I encourage my clients to maintain a digital folder throughout the year to compile these documents, which simplifies the process during tax season.

I also use tax preparation software to categorize and manage client information, ensuring nothing is missed. This systematic approach helps in keeping track of all necessary documentation and makes it easier to update or change any information as needed.

Interviewers should look for candidates who have a clear, organized approach to managing documents and can demonstrate the use of technology to streamline the process. This shows efficiency and reduces the chance of errors.

3. What is your process for handling discrepancies in client-provided information?

When I encounter discrepancies in client-provided information, my first step is to verify the data by cross-referencing with available documents, such as bank statements or employer records. It's crucial to ensure all entries are accurate before proceeding further.

If necessary, I reach out to the client for clarification and additional documentation. Clear communication is essential to resolving these discrepancies promptly and ensuring the client's tax return is filed correctly.

An ideal candidate will demonstrate strong problem-solving skills and an ability to communicate effectively with clients. They should be able to provide examples of how they resolved past discrepancies efficiently.

4. How do you handle tax preparation for clients with international income?

Handling international income involves understanding the tax treaties and regulations that apply to the specific countries involved. I ensure compliance by familiarizing myself with the foreign income tax credit and exclusion rules, as well as any double taxation agreements.

I often recommend clients to maintain detailed records of all foreign income and taxes paid, as these are necessary for accurate reporting. Understanding the nuances of foreign bank account reporting (FBAR) requirements is also essential for clients with international accounts.

Candidates should demonstrate a sound knowledge of international tax laws and express a willingness to continue learning due to the complexity and variability of this area. Look for specific experiences where they successfully managed international income reporting.

5. Can you explain your strategy for updating clients on potential tax law changes?

I keep my clients informed about potential tax law changes by subscribing to reliable tax news sources and newsletters. Whenever there's a significant update, I assess how it might impact my clients and communicate these insights through regular updates or personalized emails.

I also conduct annual tax planning sessions with my clients where we discuss any upcoming changes and strategies to optimize their tax situation in light of these adjustments.

The ideal candidate will be proactive in communicating with clients and will have a systematic approach to staying updated on tax legislation. They should demonstrate clear methods for ensuring clients understand how changes may affect them.

6. Describe your experience with tax preparation for self-employed individuals.

My experience with self-employed clients involves guiding them through potential deductions unique to their situation, such as home office expenses, business use of vehicles, and health insurance premiums.

I emphasize the importance of maintaining organized records and often recommend software solutions to simplify tracking income and expenses. This not only helps in accurate tax preparation but also assists clients in optimizing their financial management throughout the year.

Candidates should show a comprehensive understanding of the challenges faced by self-employed individuals and provide examples of how they have helped clients navigate these complexities successfully.

7. How do you deal with a client who wants to claim a deduction they're not eligible for?

When a client wants to claim an ineligible deduction, I explain the tax law clearly and provide evidence of why the deduction does not apply. It's important to maintain a professional tone and ensure the client understands the potential consequences of inaccurate filings.

I also explore alternative deductions or credits they might be eligible for, to ensure they still benefit as much as legally possible from their tax situation.

A strong candidate response will highlight their ability to communicate effectively and educate clients, ensuring compliance without compromising client relationships.

8. What steps do you take to ensure compliance with both federal and state tax regulations?

Ensuring compliance with federal and state tax regulations requires a thorough understanding of both sets of laws. I start by staying informed through continuous professional education and resources like state tax department updates.

I use compliance checklists that cover federal and specific state requirements for each client. This systematic approach helps in ensuring that nothing is overlooked, and all compliance boxes are checked before filing.

Candidates should demonstrate their commitment to staying informed and detail-oriented. Look for examples of how they have successfully ensured compliance for clients in the past.

9. Can you describe a situation where you had to adapt quickly to a new tax regulation?

In one instance, I had to adapt quickly when new tax legislation was passed shortly before tax season. I immediately attended webinars and read updates from trusted tax bodies to grasp the changes.

I then assessed which of my clients would be affected and prepared communication to explain these changes and any necessary adjustments to their filing strategy.

Look for candidates who show initiative in learning and adapting to changes swiftly. They should be able to discuss how they communicated these changes to clients and ensure they were implemented correctly.

10. How do you ensure accuracy in your tax preparation work?

Accuracy in tax preparation is achieved through a meticulous approach. I double-check entries against source documents and use tax software that flags potential errors or inconsistencies.

I also conduct a final review of each tax return with a checklist to ensure all calculations and entries comply with current tax laws. This step minimizes the risk of errors before submission.

Candidates should emphasize their attention to detail and describe their process for review and verification. Look for methods that demonstrate a commitment to high standards and precision.

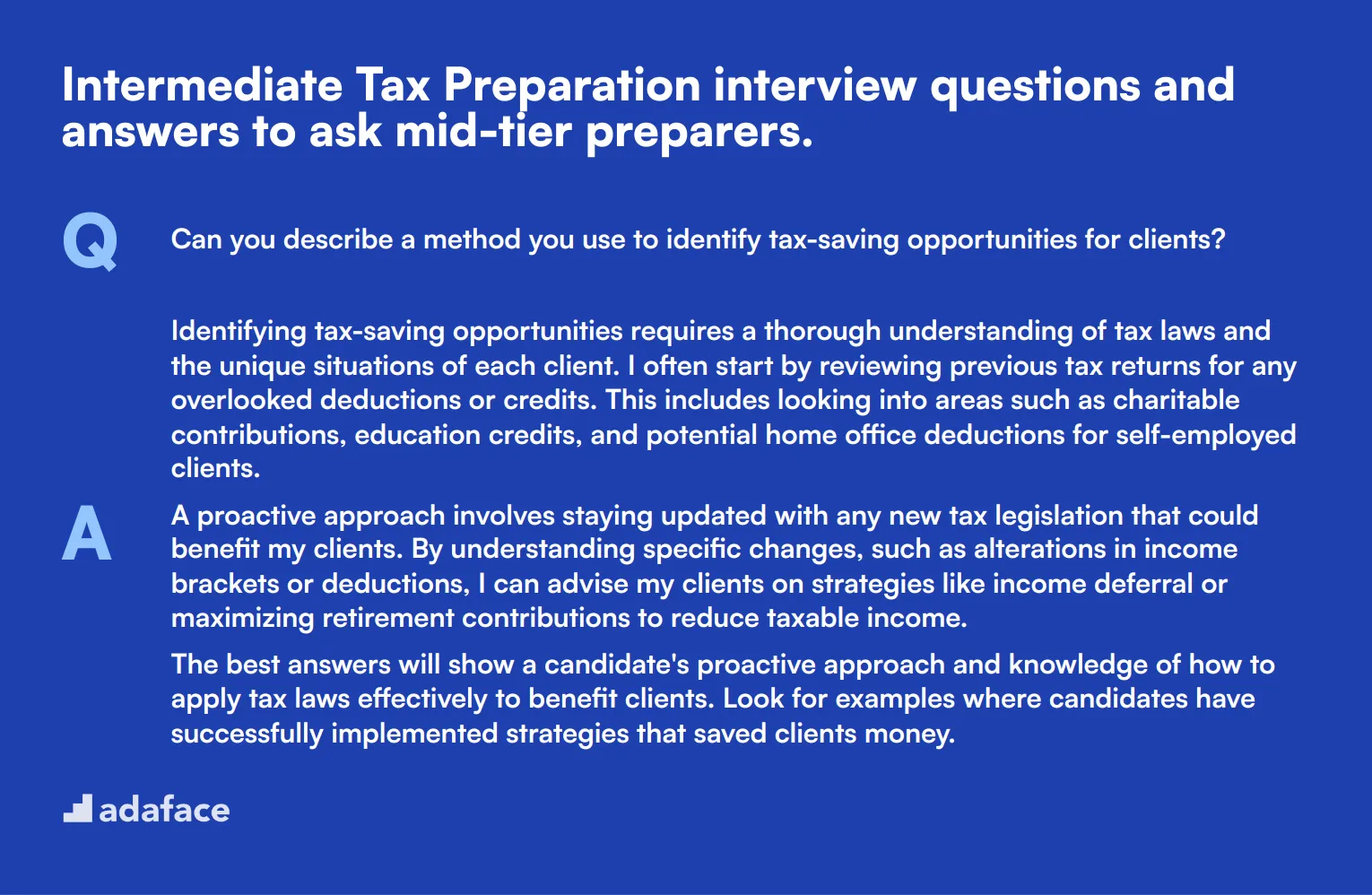

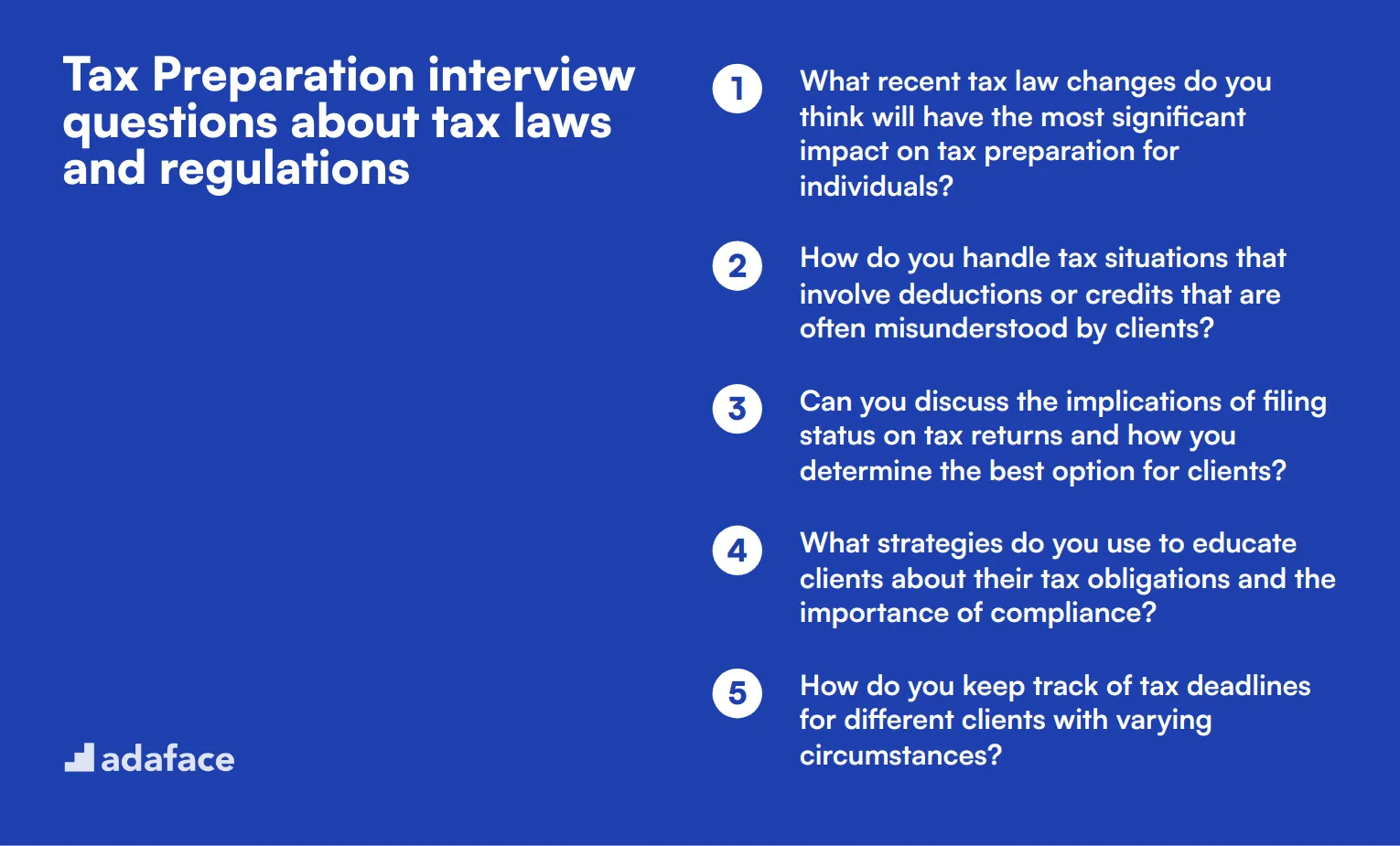

14 Tax Preparation interview questions about tax laws and regulations

To evaluate candidates' knowledge of tax laws and regulations, use this list of targeted questions. These inquiries are designed to reveal the applicant's understanding and practical experience in navigating the complexities of taxation. For more job-specific insights, check out our accountant job description.

- What recent tax law changes do you think will have the most significant impact on tax preparation for individuals?

- How do you handle tax situations that involve deductions or credits that are often misunderstood by clients?

- Can you discuss the implications of filing status on tax returns and how you determine the best option for clients?

- What strategies do you use to educate clients about their tax obligations and the importance of compliance?

- How do you keep track of tax deadlines for different clients with varying circumstances?

- What are the most significant tax regulations affecting self-employed individuals that you think clients often overlook?

- Can you explain the concept of tax liability and how you help clients calculate theirs accurately?

- What are some common tax traps that you warn clients about during the preparation process?

- How do you approach tax issues that arise from investments in cryptocurrencies or other digital assets?

- What techniques do you employ to ensure clients understand their rights and responsibilities during an audit?

6 Tax Preparation interview questions and answers related to deduction strategies

To make sure you're picking the best tax preparer for your team, it's essential to ask questions that dig into their strategies for maximizing deductions. Use this list of questions to assess how well candidates can navigate the complex world of tax deductions, ensuring you find someone who can save your clients money while staying within the lines.

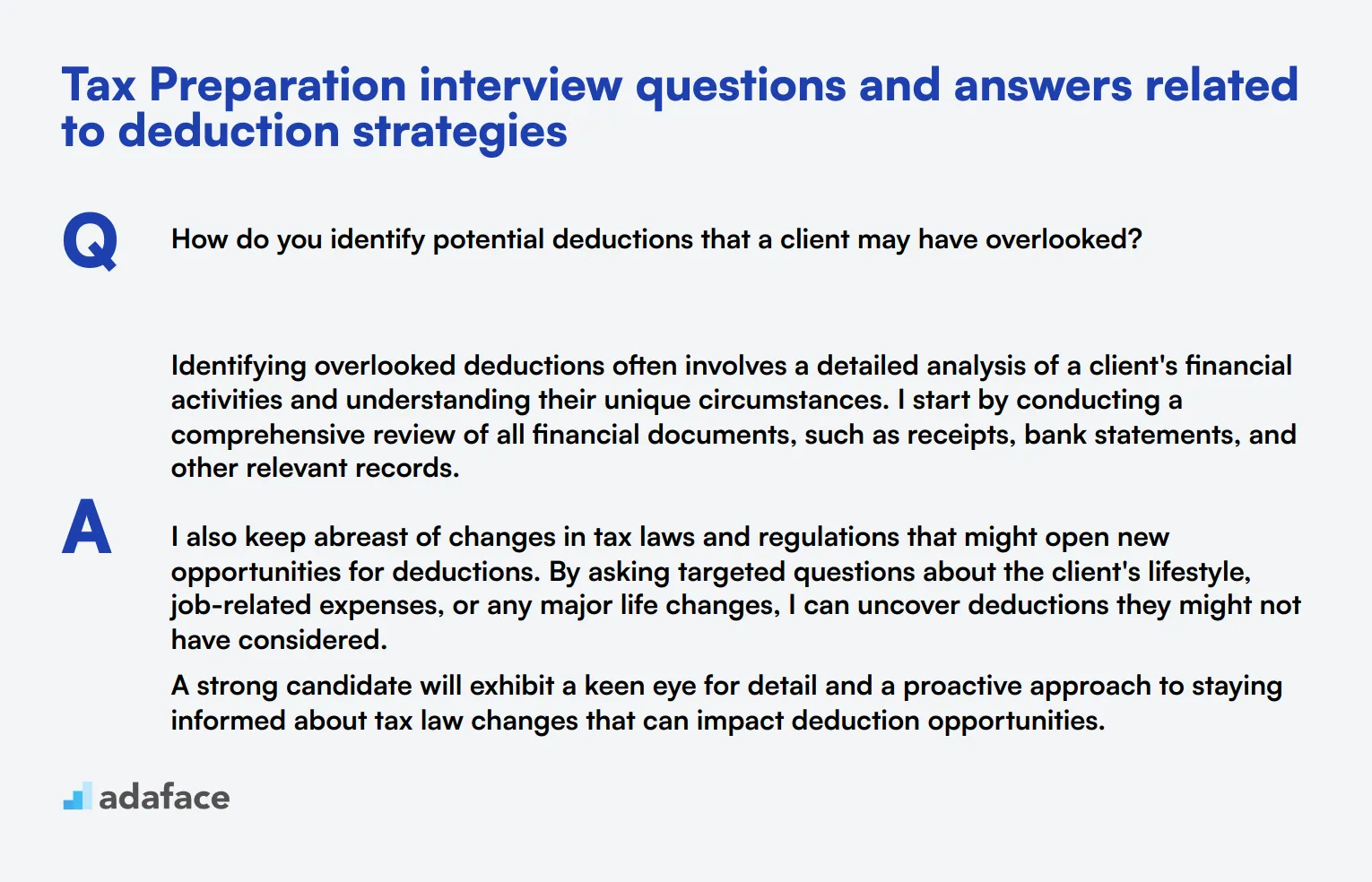

1. How do you identify potential deductions that a client may have overlooked?

Identifying overlooked deductions often involves a detailed analysis of a client's financial activities and understanding their unique circumstances. I start by conducting a comprehensive review of all financial documents, such as receipts, bank statements, and other relevant records.

I also keep abreast of changes in tax laws and regulations that might open new opportunities for deductions. By asking targeted questions about the client's lifestyle, job-related expenses, or any major life changes, I can uncover deductions they might not have considered.

A strong candidate will exhibit a keen eye for detail and a proactive approach to staying informed about tax law changes that can impact deduction opportunities.

2. Can you explain your approach to maximizing deductions while ensuring compliance?

My approach to maximizing deductions involves balancing aggressive tax strategies with strict compliance to tax laws. I start by ensuring I have a thorough understanding of the client's financial situation and then apply my knowledge of tax codes to identify all eligible deductions.

I prioritize transparency and documentation, ensuring that every deduction is backed by proper records and justifications. This not only maximizes the client's return but also safeguards against potential audits.

Candidates should demonstrate a sound understanding of tax laws and a methodical approach to applying them, ensuring they can maximize deductions without crossing into non-compliance.

3. Describe a time when you found a creative deduction solution for a client.

Once, I had a client who was unaware they could deduct home office expenses. After reviewing their work-from-home setup, I calculated the percentage of their home used exclusively for business and helped them claim a significant deduction.

This required a creative application of the home office deduction rules and a thorough assessment of the client's work environment. We ensured all relevant expenses, such as utilities and internet costs, were included.

Ideal candidates should show a track record of finding innovative solutions that adhere to tax laws. Look for examples of how they have successfully applied these solutions in real-life scenarios.

4. What steps do you take to ensure all possible deductions are claimed for a client?

To ensure all deductions are claimed, I begin by thoroughly gathering and organizing all financial documents related to the client's income and expenses. This provides a complete picture of opportunities for deductions.

I also maintain a checklist of common and uncommon deductions applicable to various client categories, such as freelancers or small business owners, to ensure nothing is missed.

Look for candidates who demonstrate meticulous organizational skills and a systematic approach to reviewing financial documents, as these are key traits for maximizing deductions.

5. How do you handle a situation where a client wants to claim a deduction that may not be legitimate?

When faced with a client wanting to claim an illegitimate deduction, I explain the potential risks and consequences, including audits and penalties. It's crucial to educate clients about what qualifies as a legitimate deduction.

I then work with them to explore other valid deductions they might be eligible for, ensuring they receive the maximum legal benefit without compromising integrity.

An ideal response should demonstrate the candidate's ability to communicate effectively and maintain ethical standards, even when under pressure from clients.

6. How do you stay updated on new deduction opportunities and tax law changes?

To stay updated on new deduction opportunities and tax law changes, I regularly attend tax seminars and webinars, subscribe to professional tax publications, and participate in online forums with other tax professionals.

I also make it a point to review IRS updates and newsletters, which provide official information on changes that may affect deductions and tax obligations.

Look for candidates who actively engage in continuous learning and professional development, as this shows their dedication to staying informed and providing the best service to clients.

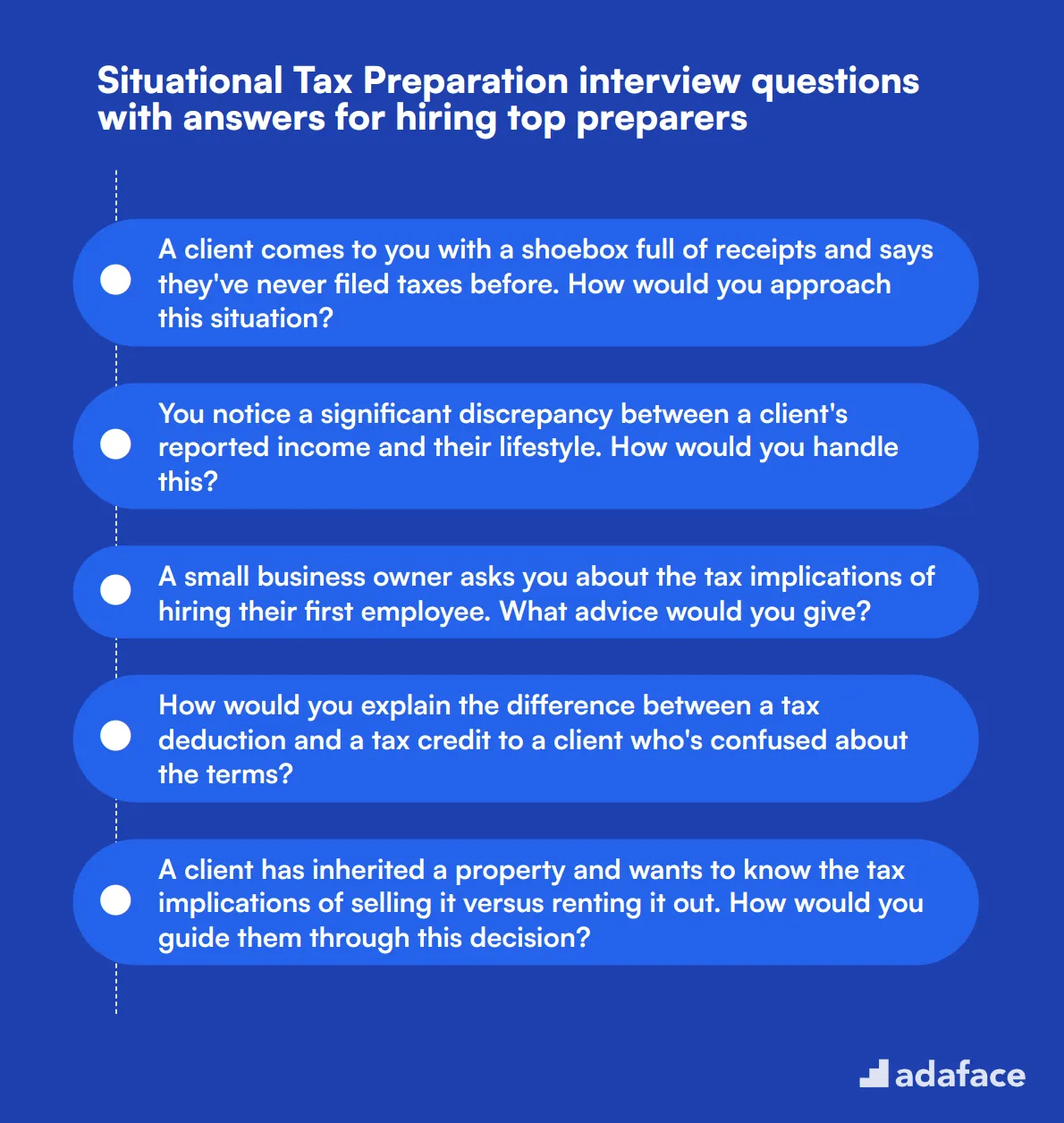

8 situational Tax Preparation interview questions with answers for hiring top preparers

Ready to find the cream of the crop for your tax preparation team? These situational interview questions will help you separate the wheat from the chaff. Use them to assess candidates' problem-solving skills, client interactions, and technical know-how in real-world scenarios. Remember, the best preparers aren't just number crunchers – they're also excellent communicators and quick thinkers!

1. A client comes to you with a shoebox full of receipts and says they've never filed taxes before. How would you approach this situation?

An ideal response should include the following steps:

- Reassure the client and explain the process in simple terms

- Organize the receipts by category (income, expenses, etc.)

- Schedule a longer appointment to gather all necessary information

- Educate the client on basic record-keeping for future tax seasons

- Discuss potential penalties for late filing and how to mitigate them

Look for candidates who demonstrate patience, organizational skills, and the ability to educate clients without overwhelming them. A great answer will also touch on the importance of building trust with new clients for long-term relationships.

2. You notice a significant discrepancy between a client's reported income and their lifestyle. How would you handle this?

A strong candidate should outline an approach that balances professionalism with due diligence:

- Review all provided documentation thoroughly

- Schedule a follow-up meeting with the client to discuss the discrepancy

- Ask open-ended questions about income sources and lifestyle choices

- Explain the importance of accurate reporting and potential consequences of underreporting

- If necessary, request additional documentation to support the reported income

The ideal response should emphasize tact and diplomacy while also showing a commitment to ethical practices. Look for candidates who can navigate sensitive conversations and maintain integrity in challenging situations.

3. A small business owner asks you about the tax implications of hiring their first employee. What advice would you give?

A comprehensive answer should cover several key points:

- Explanation of employer responsibilities (payroll taxes, workers' compensation, etc.)

- Overview of required forms (W-4, I-9, state-specific forms)

- Discussion of potential tax credits for hiring (e.g., Work Opportunity Tax Credit)

- Advice on setting up a payroll system or using a payroll service

- Importance of keeping accurate records for tax purposes

Look for candidates who can break down complex information into digestible advice for small business owners. The ability to provide practical, actionable guidance is crucial for a tax preparer working with diverse clients.

4. How would you explain the difference between a tax deduction and a tax credit to a client who's confused about the terms?

An effective explanation should be clear and relatable:

- Tax deduction: Reduces the amount of income subject to tax. Like a discount on your taxable income.

- Tax credit: Directly reduces the amount of tax owed. Like a gift card applied to your tax bill.

- Provide a simple example: "If you're in the 22% tax bracket, a $1,000 deduction saves you $220, while a $1,000 credit saves you $1,000."

The ideal candidate should be able to simplify complex tax concepts without losing accuracy. Look for answers that use analogies or everyday examples to make the explanation more relatable to clients with varying levels of financial literacy.

5. A client has inherited a property and wants to know the tax implications of selling it versus renting it out. How would you guide them through this decision?

A thorough response should cover the following aspects:

- Explain the concept of stepped-up basis for inherited property

- Outline the potential capital gains tax on selling the property

- Discuss the ongoing tax implications of rental income

- Highlight deductions available for rental properties (maintenance, property management, etc.)

- Mention the possibility of depreciation recapture if the property is sold after being rented

Look for candidates who can provide a balanced view of both options, considering the client's long-term financial goals. The ability to explain complex tax concepts in simple terms and guide clients through important financial decisions is crucial for a top-tier tax preparer.

Which Tax Preparation skills should you evaluate during the interview phase?

While one interview may not reveal everything about a candidate, focusing on specific tax preparation skills can provide significant insight into their capabilities. These core skills are essential for ensuring that candidates are well-prepared to handle the complexities of tax preparation tasks effectively.

Attention to Detail

To assess this skill, consider using an assessment test with relevant multiple-choice questions that evaluate a candidate's attention to detail. You can explore our test on Attention to Detail for a focused evaluation.

You can also gauge attention to detail through targeted interview questions. For instance, asking about their process for reviewing completed tax returns can be insightful.

Can you describe your process for ensuring accuracy when preparing tax returns?

When asking this question, look for a structured response that highlights their systematic approach to reviewing information. Candidates should mention techniques they use to catch errors, such as cross-referencing data or using checklists.

Tax Law Knowledge

To evaluate tax law knowledge, consider utilizing an assessment test with relevant multiple-choice questions. For example, our test covering Finance might include aspects related to tax regulations.

You might also explore targeted questions that test their understanding of recent tax law changes. Asking about a specific tax law reform and its implications could be effective.

What recent changes in tax laws do you think have the most significant impact on individuals or businesses?

When candidates respond, pay attention to their depth of knowledge and the examples they provide. A well-informed candidate should demonstrate an understanding of both the law's specifics and its broader implications.

Analytical Skills

Assess candidates' analytical skills with a targeted test that includes relevant multiple-choice questions. Though we don’t have a specific test for this skill, a general competency assessment could be beneficial.

To further evaluate this skill, consider asking candidates to explain how they approach problem-solving in tax preparation situations.

Can you provide an example of a time when you had to analyze financial data to solve a tax-related problem?

Listen for a clear explanation of their analytical thought process and the steps they took to reach a conclusion. Strong candidates will detail how they dissected information and arrived at their final recommendations.

Tips for Effective Tax Preparation Interview Questions

Before putting your new knowledge into action, consider these tips to maximize the effectiveness of your tax preparation interviews.

1. Implement Skills Tests Before Interviews

Skills tests can provide objective data on a candidate's abilities before the interview stage. This approach saves time and ensures you're interviewing the most qualified candidates.

For tax preparation roles, consider using accounting tests or financial accounting tests to evaluate core competencies. These assessments can measure knowledge of tax laws, financial statements, and accounting principles.

By using skills tests, you can focus your interviews on exploring a candidate's problem-solving abilities and cultural fit. This strategy allows for more targeted and productive conversations during the interview process.

2. Curate a Balanced Set of Interview Questions

With limited interview time, it's important to select questions that cover key aspects of the role. Aim for a mix of technical, situational, and behavioral questions to get a well-rounded view of the candidate.

Consider incorporating questions about Excel skills or data analysis, as these are often relevant in tax preparation. Additionally, include questions that assess soft skills like communication and attention to detail.

By carefully curating your question set, you can efficiently evaluate a candidate's technical knowledge, problem-solving abilities, and interpersonal skills in one interview.

3. Master the Art of Follow-Up Questions

Asking follow-up questions is key to understanding a candidate's true depth of knowledge and experience. This technique helps you distinguish between candidates who have memorized answers and those with genuine expertise.

For example, after asking about handling a complex tax situation, follow up with, "What specific IRS regulations guided your approach?" This probes the candidate's understanding of tax laws and their ability to apply them in real-world scenarios.

Evaluate Tax Preparation Skills with Interview Questions and Tests

If you're looking to hire someone with tax preparation skills, it's important to assess their abilities accurately. The most effective way to do this is by using skill tests. Consider using an accounting test or financial accounting test to gauge candidates' knowledge and proficiency.

After using these tests to shortlist the best applicants, you can invite them for interviews. To streamline your hiring process and find the right tax preparer for your team, explore our accounting and finance tests or sign up to access our full range of assessment tools.

Accounting Assessment Test

Download Tax Preparation interview questions template in multiple formats

Tax Preparation Interview Questions FAQs

Ask a mix of general, skill-level specific, technical, and situational questions to assess candidates' knowledge, experience, and problem-solving abilities.

Use questions about specific tax laws, recent changes, and hypothetical scenarios to gauge their understanding and ability to apply tax regulations.

Ask candidates about various deduction scenarios, common pitfalls, and how they stay updated on changing deduction rules and limits.

Tailor your questions to reflect different experience levels, focusing on basic concepts for juniors and more complex scenarios for mid-tier candidates.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources