SAP FICO consultants play a key role in managing and optimizing financial processes within an organization. They ensure that financial accounting and controlling modules are seamlessly integrated, providing accurate financial data and insights.

Skills required for an SAP FICO consultant include a deep understanding of SAP modules, financial accounting principles, and business processes. Additionally, they need strong analytical skills and the ability to communicate effectively with both technical and non-technical stakeholders.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job SAP FICO Consultant skill tests.

In this post, we will explore 8 essential SAP FICO Consultant skills, 8 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

8 fundamental SAP FICO Consultant skills and traits

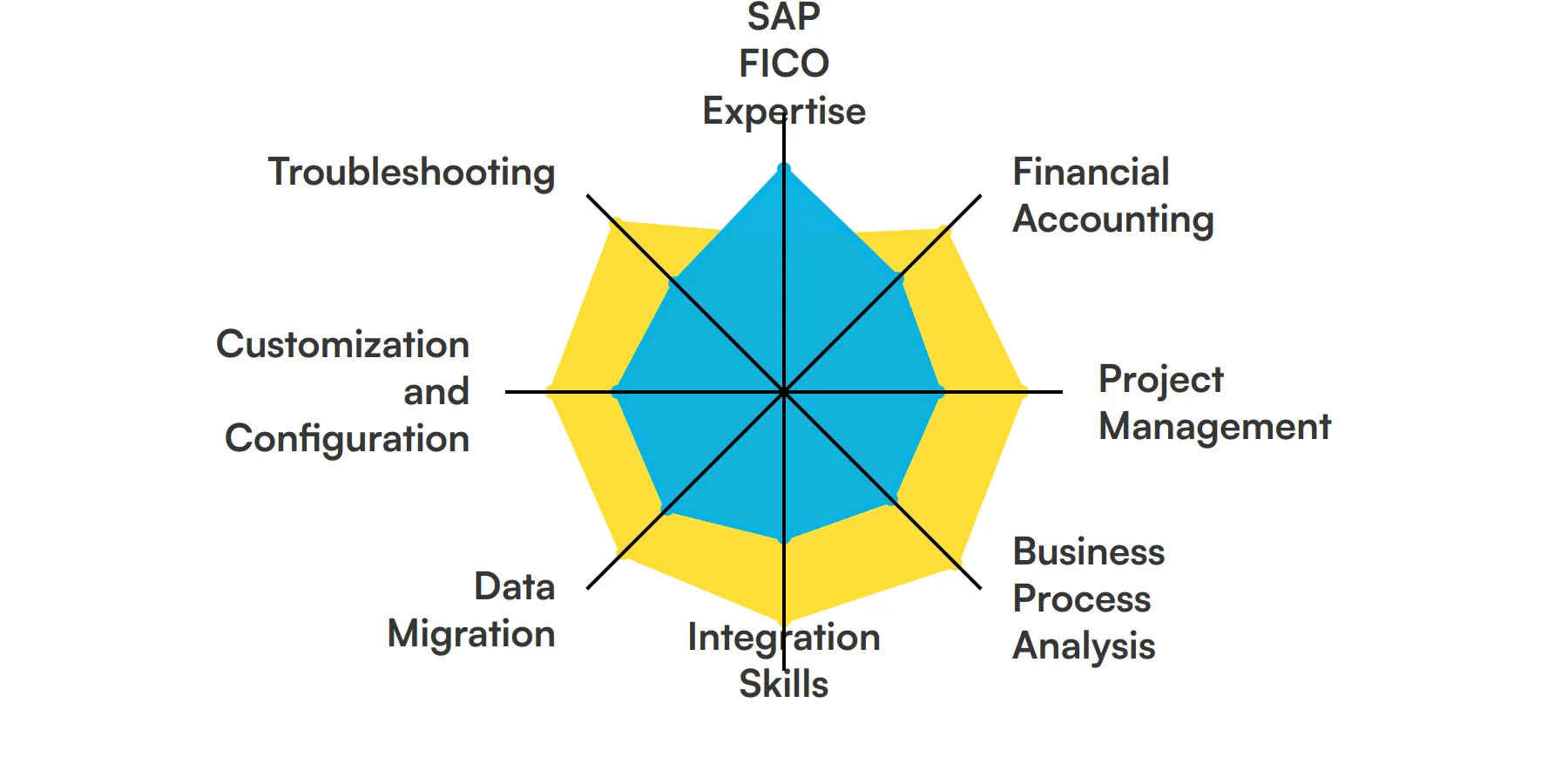

The best skills for SAP FICO Consultants include SAP FICO Expertise, Financial Accounting, Project Management, Business Process Analysis, Integration Skills, Data Migration, Customization and Configuration and Troubleshooting.

Let’s dive into the details by examining the 8 essential skills of a SAP FICO Consultant.

SAP FICO Expertise

Understanding the SAP Financial Accounting (FI) and Controlling (CO) modules is fundamental for an SAP FICO consultant. This skill involves configuring and managing financial transactions in SAP to support a company's business processes, ensuring accurate financial reporting and analysis.

For more insights, check out our guide to writing a SAP FICO Consultant Job Description.

Financial Accounting

An SAP FICO consultant must have a strong grasp of financial principles and accounting practices. This knowledge helps in aligning SAP FICO functions with standard accounting procedures and regulatory requirements, crucial for maintaining the financial health of the organization.

Project Management

Efficient project management ensures that SAP FICO implementations are completed within scope, time, and budget. The role often requires managing resources, timelines, and stakeholder expectations, making this skill essential for successful project execution.

Business Process Analysis

A consultant needs to analyze and understand business processes to effectively customize and implement SAP FICO systems. This involves identifying client needs and configuring SAP solutions to enhance financial operations and reporting.

Check out our guide for a comprehensive list of interview questions.

Integration Skills

SAP FICO does not work in isolation. The consultant must integrate it with other SAP modules like MM, SD, PP, and HR. This skill is about ensuring seamless data flow and functionality across different business areas, enhancing operational coherence.

Data Migration

Data migration is critical when upgrading or implementing new SAP FICO systems. The consultant must ensure that historical financial data is accurately transferred to the new system, maintaining data integrity and compliance.

For more insights, check out our guide to writing a Data Engineer Job Description.

Customization and Configuration

Tailoring SAP FICO to meet specific business requirements is a key responsibility. This includes customizing ledgers, account setups, and financial reports, ensuring the system aligns perfectly with client business practices.

Troubleshooting

Identifying and resolving issues within SAP FICO modules is a regular duty for consultants. Quick problem-solving ensures minimal disruption to financial operations, maintaining business continuity and system reliability.

8 secondary SAP FICO Consultant skills and traits

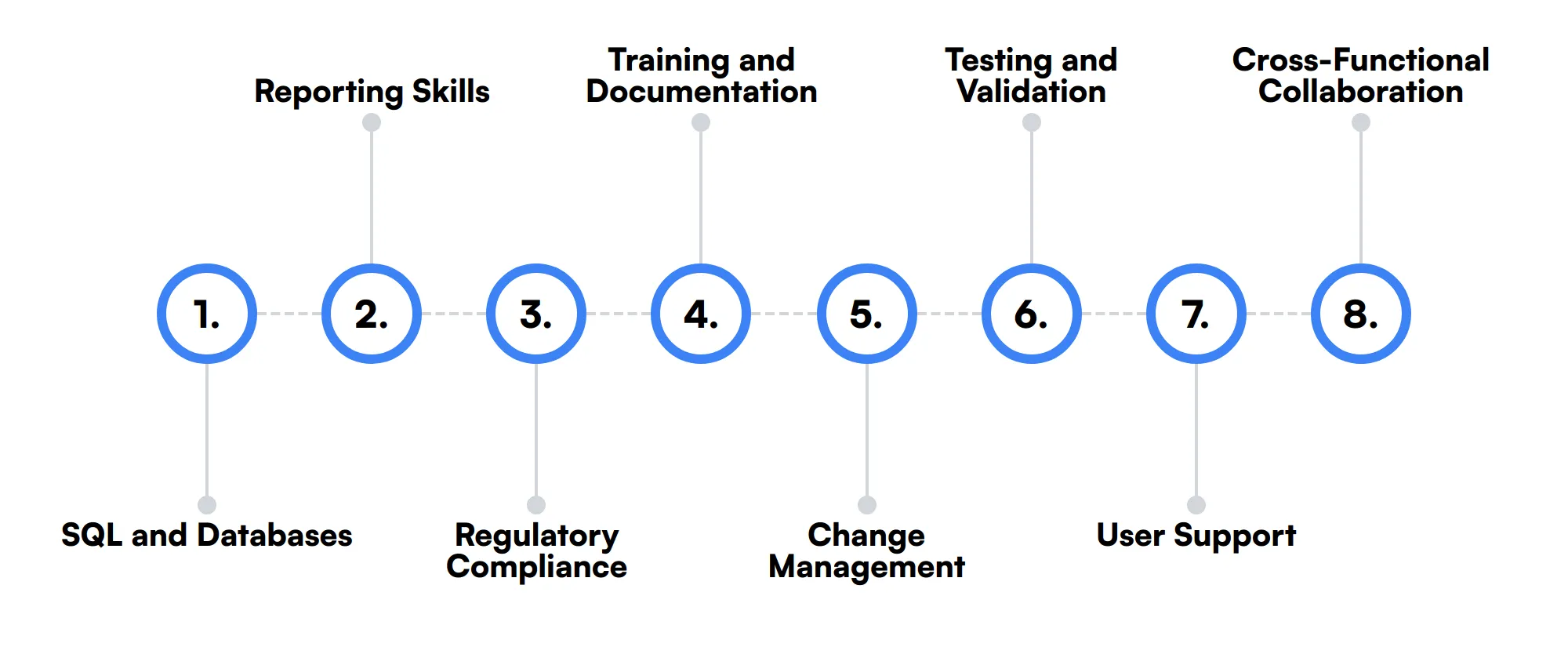

The best skills for SAP FICO Consultants include SQL and Databases, Reporting Skills, Regulatory Compliance, Training and Documentation, Change Management, Testing and Validation, User Support and Cross-Functional Collaboration.

Let’s dive into the details by examining the 8 secondary skills of a SAP FICO Consultant.

SQL and Databases

Knowledge of SQL and database management helps in handling data queries and integration issues that arise within SAP environments, supporting effective data analysis and reporting.

Reporting Skills

Creating detailed reports using SAP FICO data is essential for making informed business decisions. Proficiency in report generation tools and techniques is necessary for presenting financial data clearly and effectively.

Regulatory Compliance

Understanding local and international financial regulations ensures that the SAP FICO configurations comply with legal standards, helping to avoid legal penalties and financial discrepancies.

Training and Documentation

Preparing user manuals and conducting training sessions are often required to educate clients on the new or updated SAP FICO systems, ensuring smooth operation and user competence.

Change Management

The ability to manage and facilitate change during SAP FICO deployments is important for minimizing resistance and enhancing the adoption of new systems and processes.

Testing and Validation

Conducting thorough testing and validation of SAP FICO functionalities ensures that the system operates as expected and meets all specified requirements before going live.

User Support

Providing ongoing support and maintenance for SAP FICO systems helps in addressing user queries and issues, ensuring continuous system performance and user satisfaction.

Cross-Functional Collaboration

Working effectively with other departments and technical teams is crucial for integrating and aligning SAP FICO functionalities with broader organizational processes.

How to assess SAP FICO Consultant skills and traits

Assessing the skills and traits of an SAP FICO Consultant can be a challenging task. It's not just about verifying their SAP FICO expertise, but also understanding their proficiency in financial accounting, project management, and business process analysis. These consultants need to have a well-rounded skill set that includes integration skills, data migration, customization and configuration, and troubleshooting abilities.

Traditional resumes and interviews might not give you a complete picture of a candidate's capabilities. This is where skills-based assessments come into play. By using tools like Adaface on-the-job skill tests, you can significantly improve the quality of your hires by 2x and reduce screening time by 85%. These assessments help you evaluate a candidate's practical knowledge and problem-solving skills, ensuring they are the right fit for your organization.

Let’s look at how to assess SAP FICO Consultant skills with these 6 talent assessments.

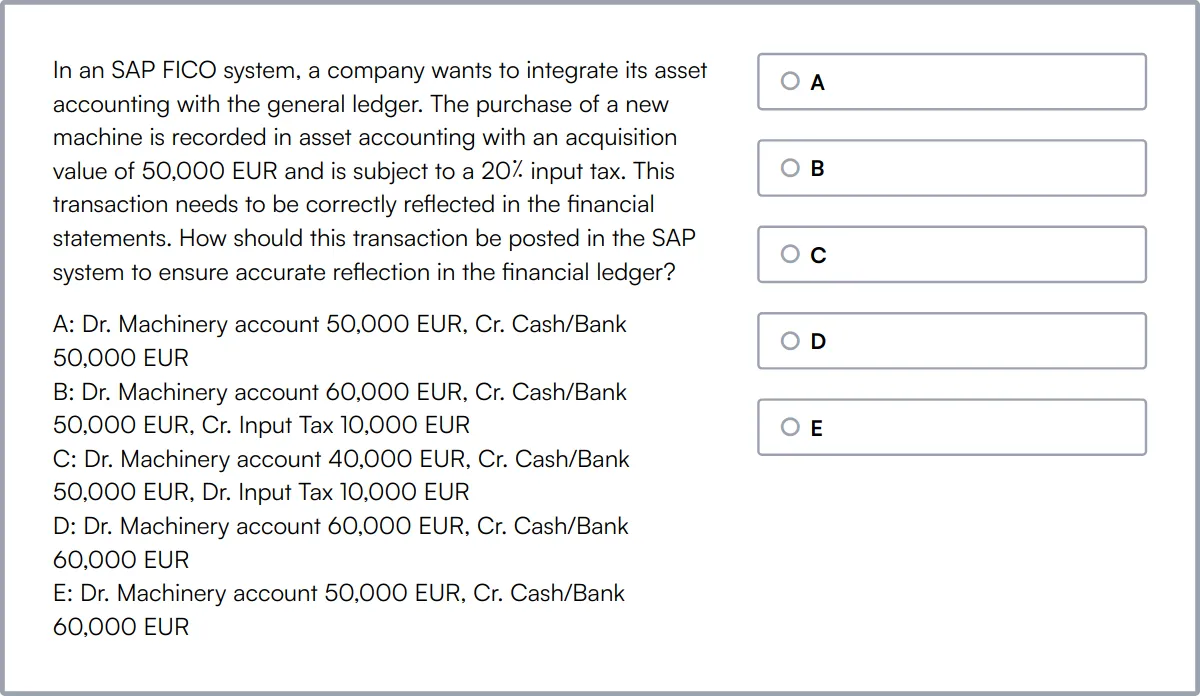

SAP FICO Test (Financial Accounting & Controlling)

Our SAP FICO Test evaluates candidates on their technical knowledge and practical skills related to general ledger accounting, accounts payable, accounts receivable, asset accounting, financial statements, and controlling.

The test assesses their understanding of general ledger accounting, cost & profit centers, accrual engine, financial statement versions (FSVs), asset under construction (AuC), MIGO and MITO transactions, COPA records, and the MTO process.

Successful candidates demonstrate the ability to configure and customize SAP FI to meet business requirements and are familiar with SAP FI best practices, design patterns, and techniques.

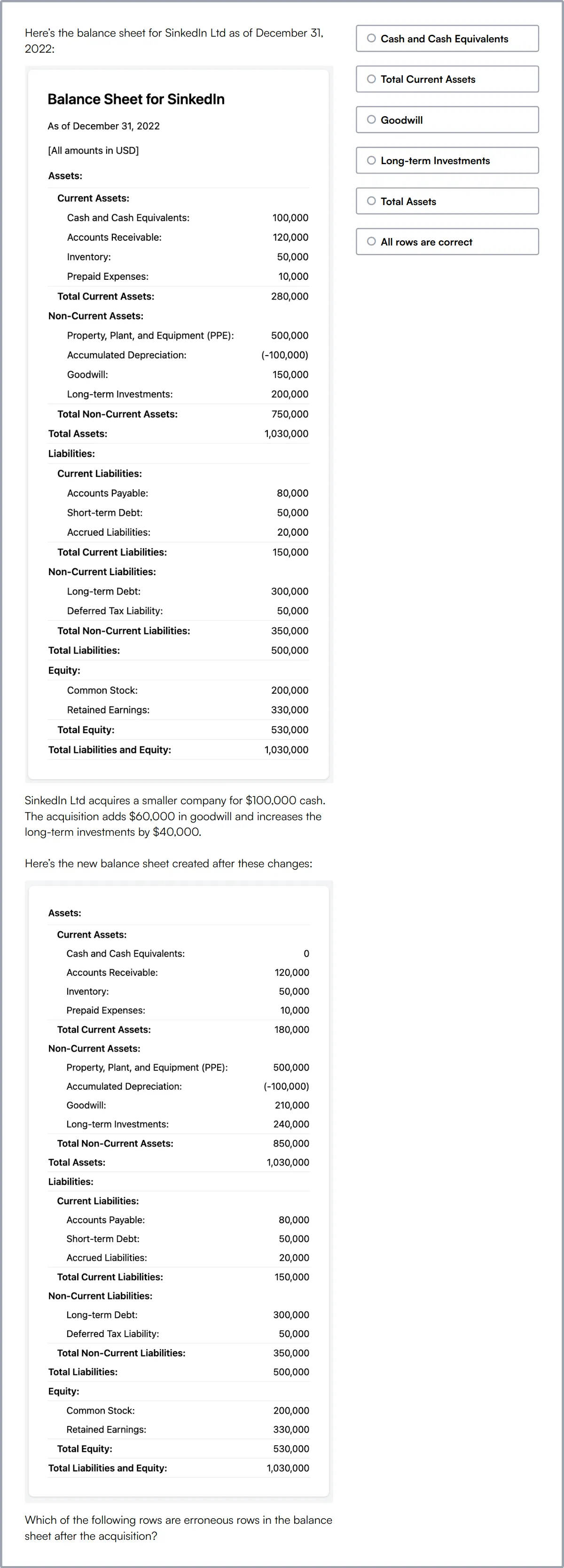

Financial Accounting Online Test

Our Financial Accounting Test evaluates a candidate's knowledge and skills related to financial statements and reporting, accounting principles and concepts, budgeting and forecasting, tax compliance and planning, auditing and internal controls, financial analysis and decision-making, and financial software and tools.

The test assesses their understanding of financial statements, accounting principles, double-entry bookkeeping, assets and liabilities, income and expense recognition, financial ratios, cash flow statement, inventory valuation, depreciation and amortization, and financial analysis.

Candidates are evaluated on their ability to interpret and analyze financial data, apply accounting standards and regulations, and communicate financial information effectively to stakeholders.

Project Management Test

Our Project Management Test assesses a candidate's ability to plan projects from conception to implementation, map timelines, assess risks, allocate budgets, execute the project life-cycle in a phase-wise manner, manage stakeholders, debug issues and deliver a product or service.

The test evaluates their skills in cost and budget estimation, situational judgement, understanding of key project roles and stages, designing a project plan, resolving issues and handling changes, managing and controlling resources, stakeholder management, prioritizing tasks in real-time, basics of agile project management and Scrum, basics of traditional (waterfall) project management, risk analysis, and creating and analyzing project reports.

Successful candidates demonstrate the ability to take ownership of a project and work with a team to deliver it.

Data Interpretation Assessment Test

Our Data Interpretation Test evaluates a candidate's ability to analyze complex data, extract meaningful insights and structure observations from multiple data sources like tables, charts and graphs.

The test assesses their skills in reading data, drawing inferences, interpreting graphs, analyzing charts, analyzing tables, and data visualization.

Candidates who perform well demonstrate strong analytical skills and the ability to interpret and present data effectively.

SAP Hybris Online Test

Our SAP Hybris Online Test evaluates candidates on their knowledge and skills in areas such as e-commerce, product content management, order management, pricing and promotions, customer service, and integration with other SAP modules.

The test assesses their understanding of data transfer object (DTO), Hybris accelerator, model view controller pattern, builder design pattern, flexible search query, Hybris V5, and widget application.

Candidates who excel in this test demonstrate a strong understanding of the SAP Hybris Commerce platform and related technologies.

Informatica MDM Online Test

Our Informatica MDM Online Test evaluates a candidate's knowledge and understanding of various topics related to Informatica Master Data Management (MDM) software.

The test assesses their proficiency in MDM Hub Store building schema, MDM Hub Store match & merge, MDM Hub Store unmerge, MDM Hub Store SIF, and metadata validation.

Candidates who perform well demonstrate strong skills in data modeling, data quality, data integration, synchronization, and cleansing.

Summary: The 8 key SAP FICO Consultant skills and how to test for them

| SAP FICO Consultant skill | How to assess them |

|---|---|

| 1. SAP FICO Expertise | Evaluate proficiency in SAP FICO modules and functionalities. |

| 2. Financial Accounting | Assess understanding of financial principles and accounting practices. |

| 3. Project Management | Review ability to plan, execute, and finalize projects. |

| 4. Business Process Analysis | Check capability to analyze and improve business processes. |

| 5. Integration Skills | Test ability to integrate SAP FICO with other systems. |

| 6. Data Migration | Examine skills in transferring data between systems accurately. |

| 7. Customization and Configuration | Assess skills in tailoring SAP FICO to business needs. |

| 8. Troubleshooting | Evaluate problem-solving skills in resolving system issues. |

SAP FICO Test (Financial Accounting & Controlling)

SAP FICO Consultant skills FAQs

What are the key SAP FICO expertise areas a consultant should master?

A proficient SAP FICO consultant should have a deep understanding of financial accounting and controlling modules, including general ledger, accounts receivable, accounts payable, asset accounting, and cost center accounting.

How important is business process analysis for an SAP FICO consultant?

Business process analysis is critical as it helps the consultant understand and map the client's financial workflows to SAP functionalities, ensuring the system aligns with business objectives.

What role does data migration play in SAP FICO projects?

Data migration is a key task in SAP FICO projects, involving the transfer of financial data from legacy systems to the SAP environment, which is crucial for a seamless transition and system effectiveness.

Can you explain the importance of integration skills for SAP FICO consultants?

Integration skills are important as they enable the consultant to ensure that the SAP FICO module works seamlessly with other SAP modules like MM, SD, and PP, which is essential for the holistic performance of the business system.

What should recruiters look for when assessing a candidate's customization and configuration skills in SAP FICO?

Recruiters should look for candidates who can demonstrate their ability to tailor the SAP FICO system according to specific business needs and configure the system to optimize financial operations and reporting.

Why is knowledge of SQL and databases important for SAP FICO consultants?

Understanding SQL and databases is important for SAP FICO consultants as it helps them manage and query the underlying database effectively, especially when custom reports and data extraction are needed.

What is the significance of regulatory compliance in the SAP FICO consulting role?

Regulatory compliance is significant as consultants must ensure that the financial reporting done through SAP FICO adheres to local and international accounting standards and regulations.

How does cross-functional collaboration enhance the effectiveness of an SAP FICO consultant?

Cross-functional collaboration enhances effectiveness by enabling the consultant to understand and integrate the needs of various business units, leading to a more comprehensive and aligned implementation.

Assess and hire the best SAP FICO Consultants with Adaface

Assessing and finding the best SAP FICO Consultant is quick and easy when you use talent assessments. You can check out our product tour, sign up for our free plan to see talent assessments in action or view the demo here:

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources