Risk analysts play a key role in identifying and evaluating potential risks that could impact an organization's financial health and operational stability. They use their expertise to forecast and mitigate risks, ensuring that businesses can make informed decisions and maintain a competitive edge.

The skills required for a risk analyst include proficiency in data analysis, financial modeling, and risk assessment techniques. Additionally, strong analytical thinking, attention to detail, and effective communication are crucial for success in this role.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Risk Analyst skill tests.

In this post, we will explore 8 essential Risk Analyst skills, 10 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

8 fundamental Risk Analyst skills and traits

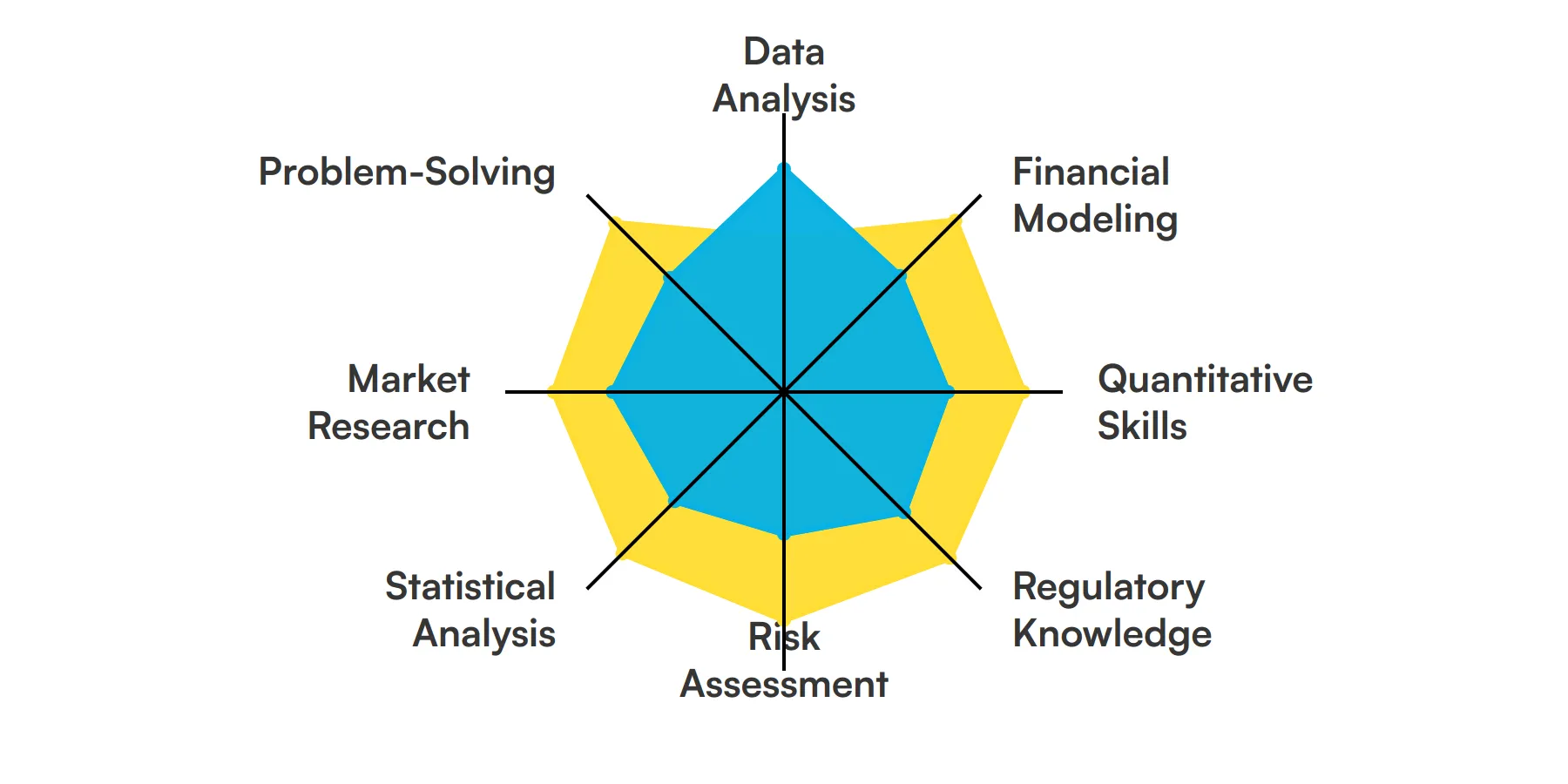

The best skills for Risk Analysts include Data Analysis, Financial Modeling, Quantitative Skills, Regulatory Knowledge, Risk Assessment, Statistical Analysis, Market Research and Problem-Solving.

Let’s dive into the details by examining the 8 essential skills of a Risk Analyst.

Data Analysis

Data analysis is the backbone of a risk analyst's role. It involves examining large datasets to identify patterns, trends, and anomalies that could indicate potential risks. By leveraging statistical tools and software, risk analysts can make informed decisions to mitigate these risks.

For more insights, check out our guide to writing a Data Analyst Job Description.

Financial Modeling

Financial modeling is crucial for predicting future financial performance and assessing the impact of different risk scenarios. Risk analysts use financial models to simulate various market conditions and evaluate the potential outcomes, helping organizations prepare for uncertainties.

Quantitative Skills

Quantitative skills are essential for interpreting numerical data and performing complex calculations. Risk analysts rely on these skills to develop risk metrics, perform stress testing, and create risk assessment reports that guide strategic decision-making.

Regulatory Knowledge

Understanding regulatory requirements is key for compliance and risk management. Risk analysts must stay updated on laws and regulations that affect their industry, ensuring that their risk assessments and recommendations align with legal standards.

Risk Assessment

Risk assessment involves identifying, evaluating, and prioritizing risks. Risk analysts use various methodologies to assess the likelihood and impact of different risks, enabling organizations to allocate resources effectively to mitigate these risks.

Statistical Analysis

Statistical analysis helps in making sense of data through the application of statistical techniques. Risk analysts use statistical methods to analyze historical data, forecast future trends, and validate the accuracy of their risk models.

Market Research

Market research is vital for understanding the external factors that could impact an organization. Risk analysts conduct market research to gather information on market trends, competitor activities, and economic conditions, which helps in identifying potential risks.

Problem-Solving

Problem-solving skills are necessary for developing effective risk mitigation strategies. Risk analysts must be able to think critically and creatively to identify solutions that minimize risk while maximizing opportunities for the organization.

10 secondary Risk Analyst skills and traits

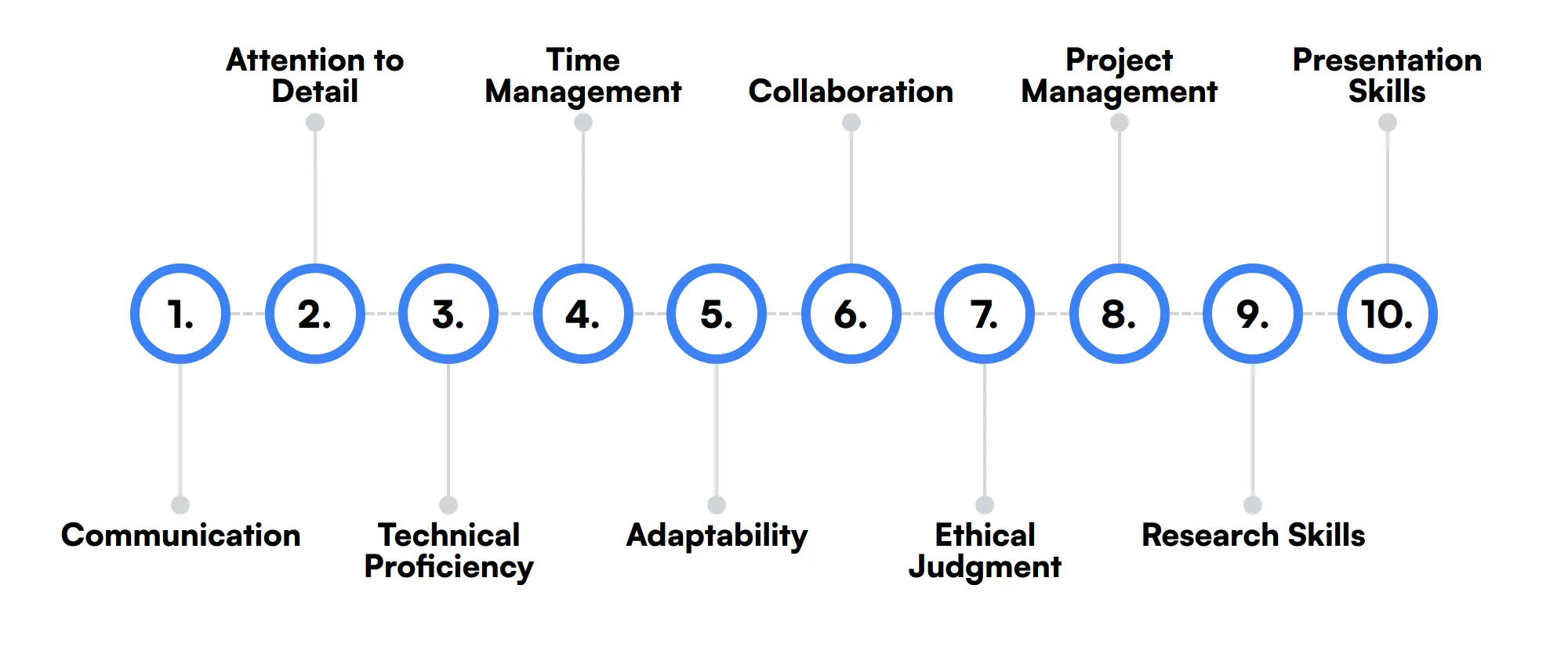

The best skills for Risk Analysts include Communication, Attention to Detail, Technical Proficiency, Time Management, Adaptability, Collaboration, Ethical Judgment, Project Management, Research Skills and Presentation Skills.

Let’s dive into the details by examining the 10 secondary skills of a Risk Analyst.

Communication

Effective communication is important for conveying complex risk information to stakeholders. Risk analysts must be able to present their findings clearly and persuasively to ensure that decision-makers understand the implications of various risks.

Attention to Detail

Attention to detail is crucial for identifying subtle risk indicators that others might overlook. Risk analysts need to meticulously review data and documents to ensure accuracy in their risk assessments and recommendations.

Technical Proficiency

Technical proficiency in software tools and programming languages is beneficial for automating data analysis and modeling tasks. Risk analysts often use tools like Excel, R, Python, and specialized risk management software to enhance their efficiency.

Time Management

Time management skills help risk analysts prioritize tasks and meet deadlines. Given the fast-paced nature of risk management, being able to manage time effectively ensures that risk assessments are completed promptly and accurately.

Adaptability

Adaptability is important for responding to changing market conditions and emerging risks. Risk analysts must be flexible and open to adjusting their strategies as new information becomes available.

Collaboration

Collaboration skills are essential for working with cross-functional teams. Risk analysts often need to coordinate with finance, operations, and compliance departments to gather information and implement risk management strategies.

Ethical Judgment

Ethical judgment is necessary for making decisions that align with the organization's values and regulatory requirements. Risk analysts must consider the ethical implications of their recommendations and ensure that they promote responsible risk management practices.

Project Management

Project management skills help in organizing and overseeing risk management initiatives. Risk analysts often lead projects that require careful planning, resource allocation, and progress tracking to achieve desired outcomes.

Research Skills

Research skills are important for gathering and analyzing information from various sources. Risk analysts use research to stay informed about industry trends, emerging risks, and best practices in risk management.

Presentation Skills

Presentation skills are necessary for sharing risk analysis findings with stakeholders. Risk analysts must be able to create compelling presentations that effectively communicate their insights and recommendations.

How to assess Risk Analyst skills and traits

Assessing the skills and traits of a Risk Analyst involves more than just glancing at a resume. It requires a deep dive into their ability to handle complex data and make predictive analyses that are crucial for business decision-making. Understanding how to evaluate these skills effectively is key to identifying top talent.

While traditional interviews offer a glimpse into a candidate's experience, they often fall short in testing real-world application of skills such as data analysis, financial modeling, and statistical analysis. This is where practical assessments come into play. By incorporating real-life scenarios that a Risk Analyst might face, you can see how they apply their quantitative skills, regulatory knowledge, and problem-solving abilities in action.

To streamline this process and ensure a thorough evaluation, many companies turn to Adaface assessments. These tests are designed to measure all the necessary skills of a Risk Analyst, from risk assessment to market research. By using Adaface, companies have reported an 85% reduction in screening time, making it a smart choice for efficient hiring. Learn more about these assessments here.

Let’s look at how to assess Risk Analyst skills with these 6 talent assessments.

Data Analysis Test

Our Data Analysis Test evaluates a candidate's ability to analyze and interpret data effectively. It focuses on practical skills such as data modeling, business analysis, and the use of SQL for data queries.

The test assesses candidates on their proficiency in handling data operations, investigating data correlations, and utilizing popular data tools like Excel. It includes scenario-based questions that challenge candidates to predict outcomes, detect anomalies, and visualize data using charts and graphs.

Candidates who perform well on this test demonstrate a strong ability to extract meaningful insights from data and make informed business decisions. The test is tailored to match the specific requirements of your data analyst job description, ensuring relevance and effectiveness.

Financial & Excel Modeling Test

The Financial & Excel Modeling Test assesses a candidate's expertise in financial analysis and Excel-based modeling. It covers essential financial concepts such as financial forecasting, reporting, and risk management.

This test evaluates the candidate's ability to create and maintain financial models, incorporating elements like cash flow statements, depreciation schedules, and valuation techniques. It also tests proficiency in Excel functionalities, including macros and advanced data manipulation.

High-scoring candidates are adept at financial planning and investment analysis, demonstrating a comprehensive understanding of financial statements and the ability to apply theoretical concepts in practical scenarios.

Quantitative Aptitude Online Test

Our Quantitative Aptitude Online Test measures a candidate's numerical and mathematical abilities. It includes topics such as arithmetic, algebra, geometry, and probability.

The test challenges candidates with scenario-based questions that require the application of quantitative reasoning, logical reasoning, and numerical analysis to solve complex problems.

Successful candidates will demonstrate a strong aptitude for problem-solving and data analysis, crucial for roles requiring precise numerical analysis and decision-making.

GDPR Online Test

The GDPR Online Test evaluates a candidate's understanding of the General Data Protection Regulation (GDPR) and their ability to implement compliance measures.

It assesses knowledge in data privacy, protection, and security, focusing on GDPR compliance, data breach protocols, and consent management. The test uses scenario-based questions to evaluate the candidate's ability to handle data responsibly and securely.

Candidates who excel in this test are well-prepared to manage data protection risks and develop GDPR compliance strategies, ensuring the security and privacy of personal data.

Data Interpretation Assessment Test

Our Data Interpretation Assessment Test focuses on a candidate's ability to analyze and draw insights from complex data sets. It tests skills in interpreting graphs, charts, and tables.

The test evaluates how well candidates can read data, analyze trends, and make logical inferences from visual and textual data sources. It includes multiple-choice questions that simulate real-world data analysis scenarios.

Performing well on this test indicates a candidate's proficiency in data visualization and their ability to make data-driven decisions.

Statistics Test

The Statistics Test assesses a candidate's knowledge in statistics and data analysis. It covers a range of topics from basic statistics fundamentals to more complex concepts like regression and non-parametric statistics.

This test evaluates the candidate's understanding of statistical methods, probability, and data sampling. It challenges them to apply these concepts to real-world data analysis tasks.

Candidates who score well are adept at using statistical techniques to analyze and interpret data, providing valuable insights for business decisions and research.

Summary: The 8 key Risk Analyst skills and how to test for them

| Risk Analyst skill | How to assess them |

|---|---|

| 1. Data Analysis | Evaluate ability to interpret and derive insights from complex datasets. |

| 2. Financial Modeling | Assess proficiency in creating financial forecasts and valuation models. |

| 3. Quantitative Skills | Measure capability to apply mathematical techniques to risk scenarios. |

| 4. Regulatory Knowledge | Check understanding of financial regulations and compliance requirements. |

| 5. Risk Assessment | Determine skill in identifying and evaluating potential risks. |

| 6. Statistical Analysis | Gauge expertise in using statistical methods to analyze data. |

| 7. Market Research | Evaluate ability to gather and analyze market trends and data. |

| 8. Problem-Solving | Assess capability to identify issues and develop effective solutions. |

Financial Analyst Online Aptitude Test

Risk Analyst skills FAQs

What are the key data analysis skills required for a Risk Analyst?

Risk Analysts should be proficient in using tools like Excel, SQL, and Python to analyze large datasets. They should also be able to interpret data trends and patterns to make informed decisions.

How can recruiters assess a candidate's financial modeling skills?

Recruiters can ask candidates to build a financial model during the interview process. Reviewing past work samples or case studies can also provide insight into their financial modeling capabilities.

Why is regulatory knowledge important for a Risk Analyst?

Regulatory knowledge ensures that Risk Analysts can navigate and comply with industry regulations, reducing the risk of legal issues and financial penalties for the organization.

What methods can be used to evaluate a candidate's quantitative skills?

Quantitative skills can be assessed through technical tests, problem-solving exercises, and reviewing academic qualifications in mathematics, statistics, or related fields.

How important is communication in a Risk Analyst role?

Effective communication is crucial for Risk Analysts to convey complex risk assessments and recommendations to stakeholders clearly and concisely.

What tools should a Risk Analyst be proficient in for technical proficiency?

Risk Analysts should be proficient in tools like Excel, SQL, Python, R, and risk management software such as SAS or MATLAB.

How can attention to detail be assessed during the hiring process?

Attention to detail can be evaluated through tasks that require precision, such as data analysis exercises, reviewing reports, or identifying errors in datasets.

What role does market research play in risk assessment?

Market research helps Risk Analysts understand market trends, economic conditions, and industry developments, which are essential for accurate risk assessment and decision-making.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources