Financial analysts play a key role in guiding investment decisions and shaping financial strategies. They analyze financial data, study economic trends, and evaluate the performance of stocks, bonds, and other types of investments to provide insights and recommendations.

Financial analyst skills include proficiency in financial modeling, data analysis, and the use of software tools like Excel and financial databases. Additionally, skills such as critical thinking, attention to detail, and effective communication are crucial for success in this role.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Financial Analyst skill tests.

In this post, we will explore 9 essential Financial Analyst skills, 11 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

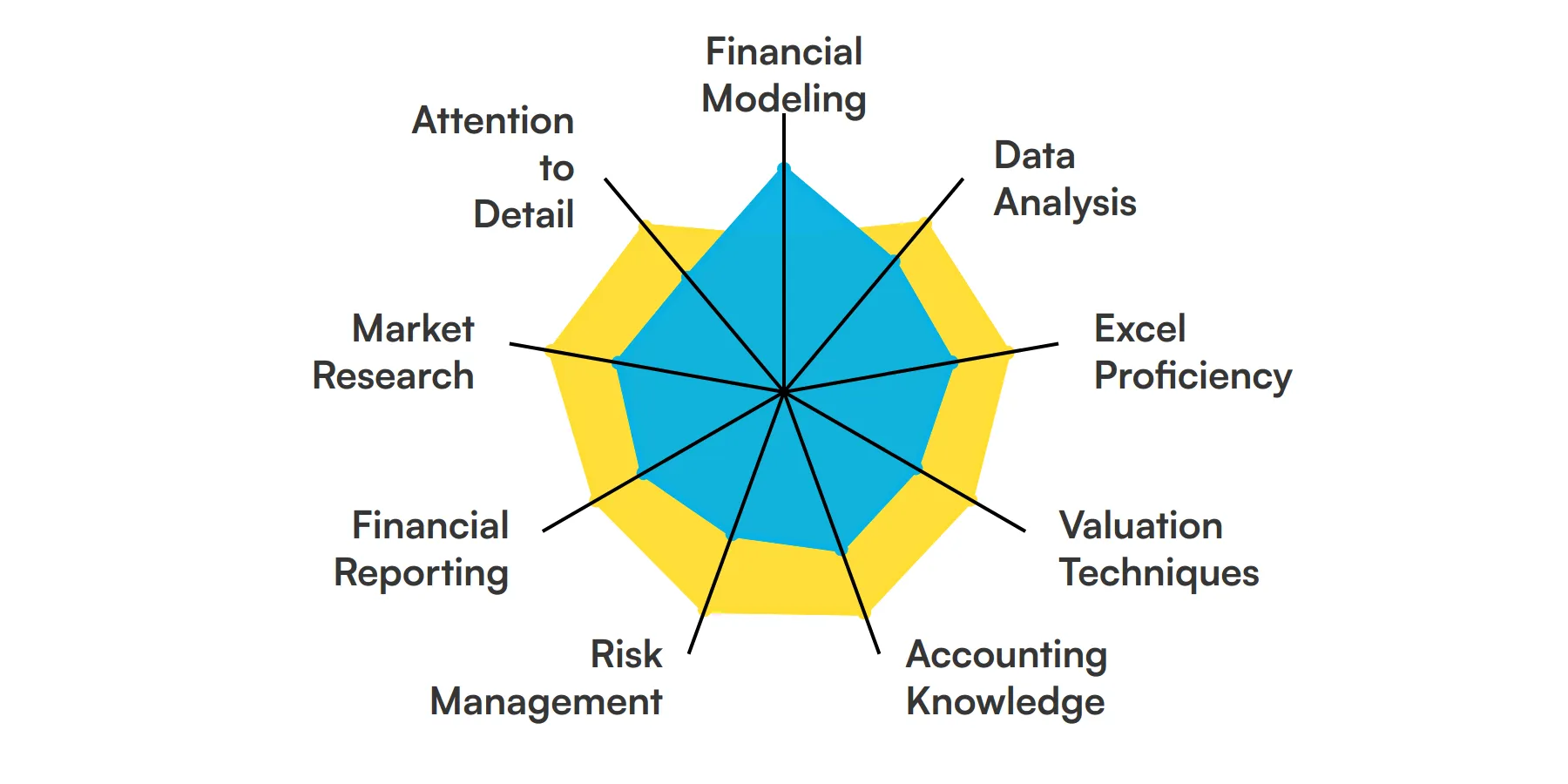

9 fundamental Financial Analyst skills and traits

The best skills for Financial Analysts include Financial Modeling, Data Analysis, Excel Proficiency, Valuation Techniques, Accounting Knowledge, Risk Management, Financial Reporting, Market Research and Attention to Detail.

Let’s dive into the details by examining the 9 essential skills of a Financial Analyst.

Financial Modeling

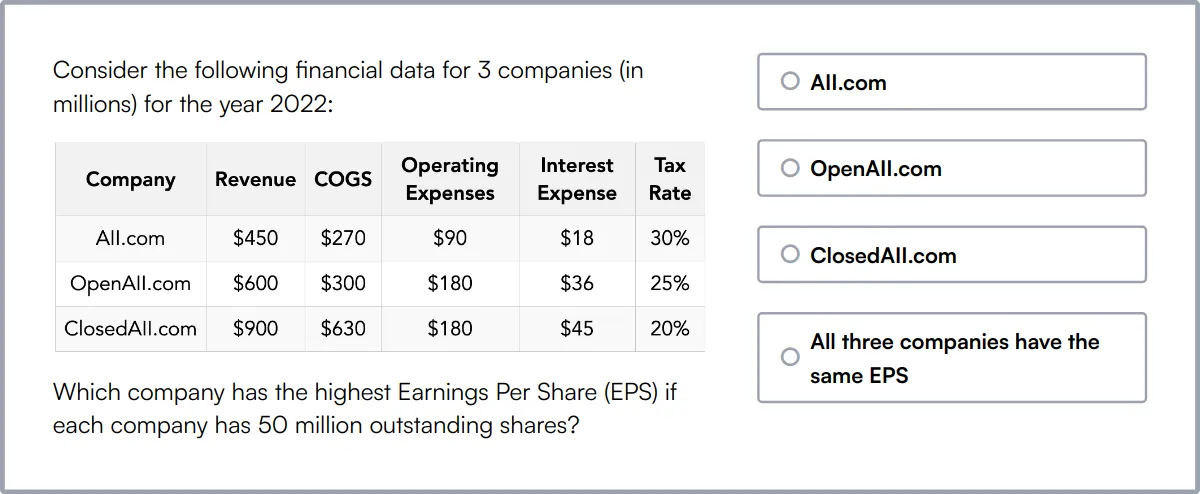

Financial modeling involves creating detailed representations of a company's financial performance. A financial analyst uses this skill to forecast future earnings, assess investment opportunities, and support strategic decision-making.

Check out our guide for a comprehensive list of interview questions.

Data Analysis

Data analysis is the process of inspecting, cleaning, and modeling data to discover useful information. Financial analysts rely on this skill to interpret complex datasets, identify trends, and make data-driven recommendations.

Excel Proficiency

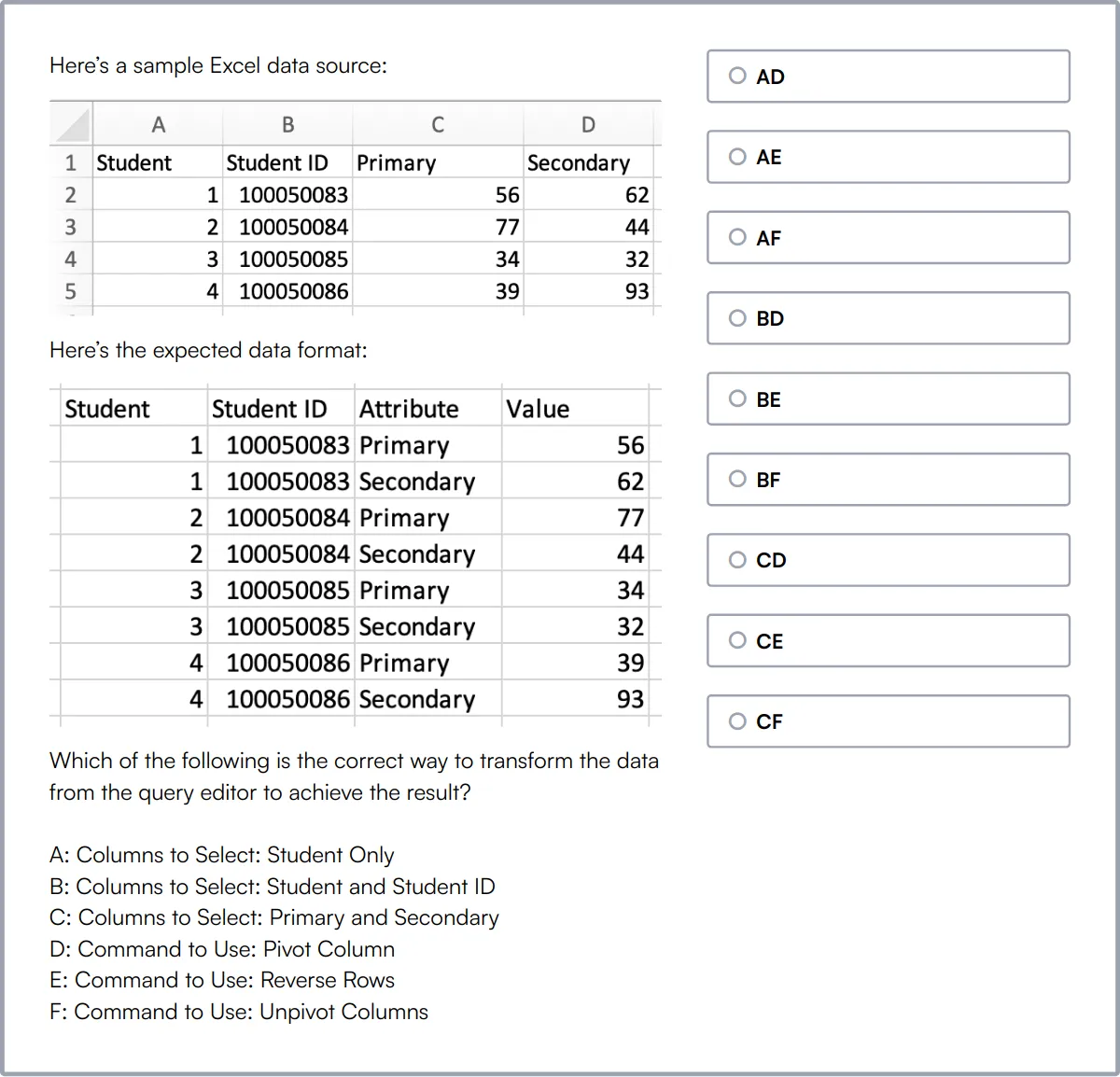

Excel proficiency is crucial for financial analysts as it allows them to organize data, perform calculations, and create financial models. Mastery of Excel functions and tools is essential for efficient data manipulation and analysis.

Valuation Techniques

Valuation techniques are methods used to determine the value of an asset or a company. Financial analysts use these techniques to assess the worth of investments, support mergers and acquisitions, and guide financial planning.

Accounting Knowledge

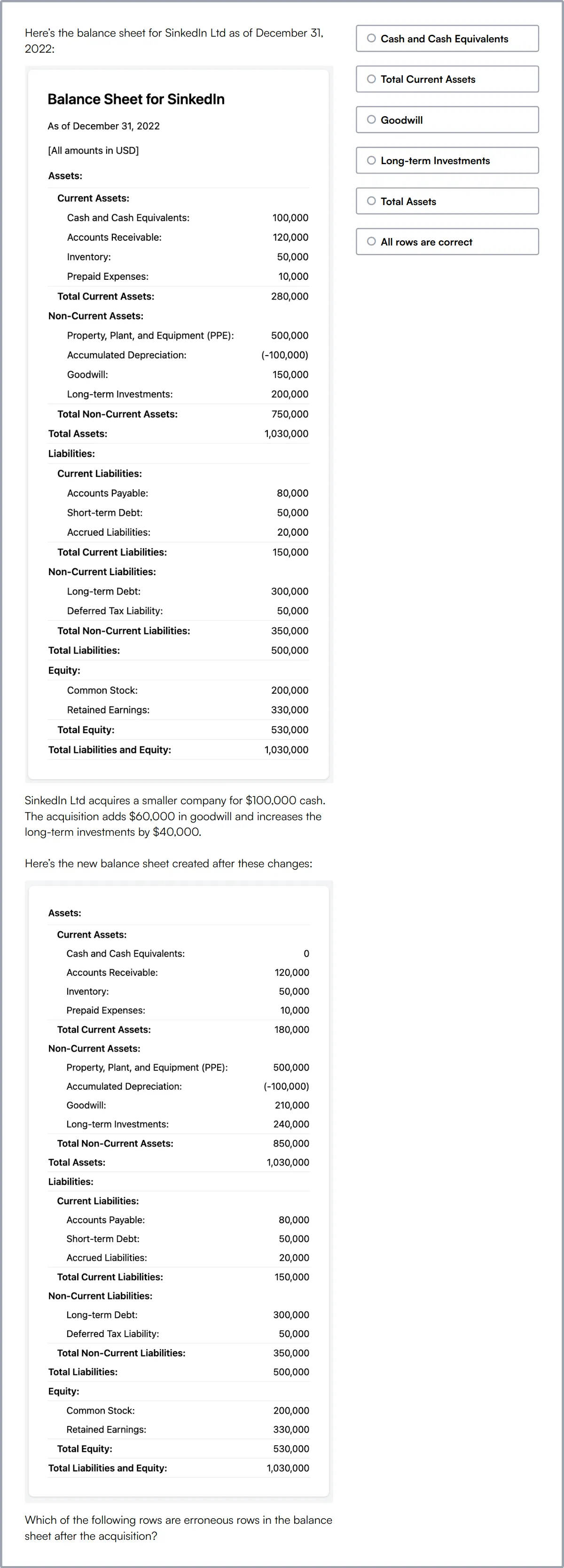

A solid understanding of accounting principles is necessary for financial analysts to interpret financial statements accurately. This skill helps in analyzing a company's financial health and ensuring compliance with financial regulations.

For more insights, check out our guide to writing a Accountant Job Description.

Risk Management

Risk management involves identifying, assessing, and prioritizing risks. Financial analysts use this skill to mitigate potential financial losses and ensure that investment decisions align with the company's risk tolerance.

Financial Reporting

Financial reporting is the process of producing statements that disclose an organization's financial status. Financial analysts must be adept at preparing and interpreting these reports to provide insights to stakeholders.

Market Research

Market research involves gathering and analyzing information about market conditions. Financial analysts use this skill to understand industry trends, evaluate competitive landscapes, and make informed investment decisions.

Attention to Detail

Attention to detail is critical for financial analysts to ensure accuracy in financial models, reports, and data analysis. This skill helps in identifying discrepancies and maintaining the integrity of financial information.

Check out our guide for a comprehensive list of interview questions.

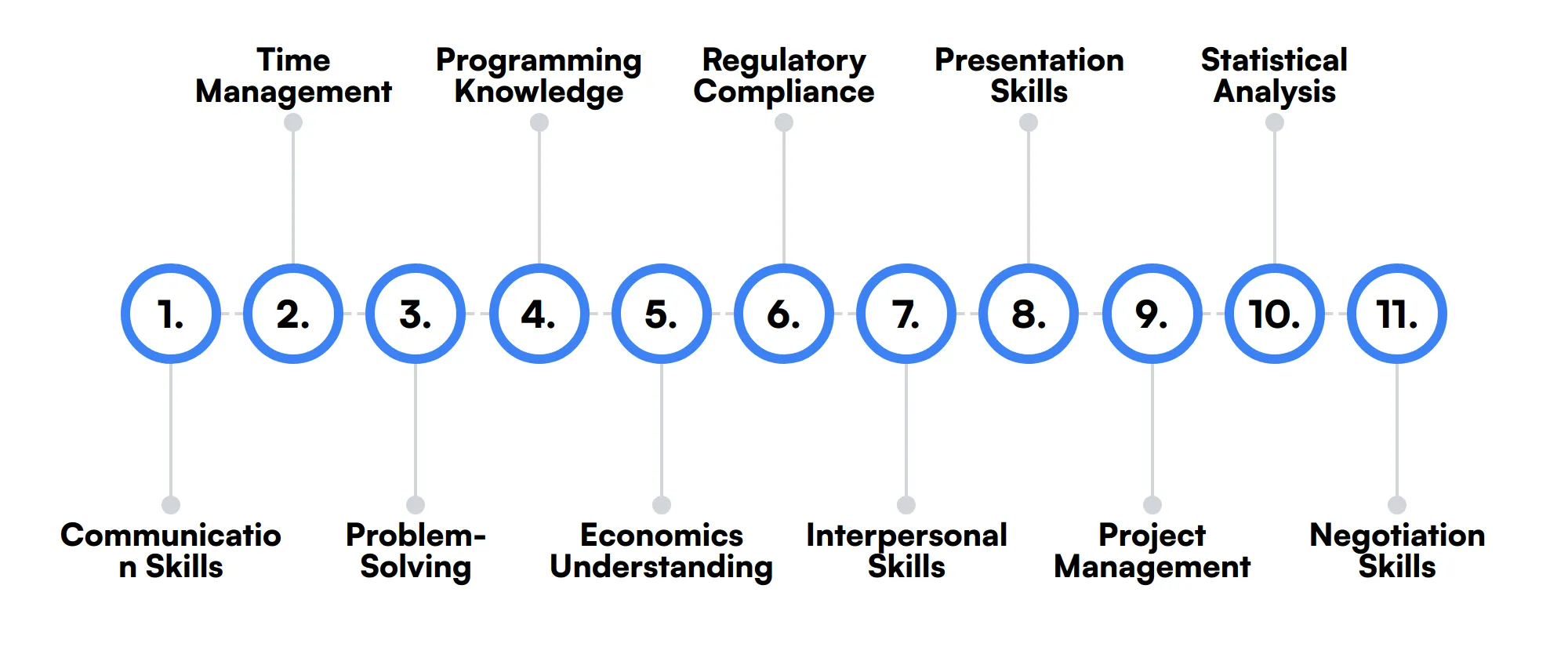

11 secondary Financial Analyst skills and traits

The best skills for Financial Analysts include Communication Skills, Time Management, Problem-Solving, Programming Knowledge, Economics Understanding, Regulatory Compliance, Interpersonal Skills, Presentation Skills, Project Management, Statistical Analysis and Negotiation Skills.

Let’s dive into the details by examining the 11 secondary skills of a Financial Analyst.

Communication Skills

Effective communication skills are important for financial analysts to present their findings clearly to stakeholders. This includes writing reports, creating presentations, and explaining complex financial concepts in an understandable manner.

Time Management

Time management is essential for financial analysts to handle multiple tasks and meet deadlines. This skill ensures that projects are completed efficiently and that analysts can balance various responsibilities.

Problem-Solving

Problem-solving skills enable financial analysts to address challenges and find solutions. This involves critical thinking and the ability to analyze situations from different angles to make sound financial decisions.

Programming Knowledge

Knowledge of programming languages like Python or R can be beneficial for financial analysts. It allows them to automate data analysis processes, perform advanced statistical analysis, and handle large datasets more effectively.

Economics Understanding

A good grasp of economic principles helps financial analysts understand market dynamics and macroeconomic factors. This knowledge is useful for making informed predictions and assessing the impact of economic changes on investments.

Regulatory Compliance

Understanding regulatory requirements is important for financial analysts to ensure that their analyses and recommendations comply with legal standards. This skill helps in avoiding legal pitfalls and maintaining ethical standards.

Interpersonal Skills

Interpersonal skills are valuable for financial analysts to build relationships with colleagues, clients, and stakeholders. This includes teamwork, negotiation, and the ability to work collaboratively in a professional environment.

Presentation Skills

Strong presentation skills enable financial analysts to effectively communicate their findings and recommendations. This involves creating compelling visuals and delivering information in a clear and engaging manner.

Project Management

Project management skills help financial analysts to plan, execute, and oversee projects. This includes setting objectives, managing resources, and ensuring that projects are completed on time and within budget.

Statistical Analysis

Statistical analysis involves using statistical methods to interpret data. Financial analysts use this skill to identify patterns, test hypotheses, and make data-driven decisions that support financial strategies.

Negotiation Skills

Negotiation skills are important for financial analysts when dealing with clients, vendors, or stakeholders. This skill helps in securing favorable terms and agreements that benefit the organization.

How to assess Financial Analyst skills and traits

Assessing the skills and traits of a Financial Analyst can be a challenging task, given the diverse range of competencies required for the role. From financial modeling and data analysis to market research and risk management, a Financial Analyst must possess a well-rounded skill set to excel in their position.

Traditional resumes and interviews often fall short in providing a comprehensive view of a candidate's abilities. Skills-based assessments offer a more reliable method to evaluate a candidate's proficiency in key areas such as Excel proficiency, valuation techniques, and financial reporting.

To streamline the hiring process and ensure you are selecting the best candidates, consider using Adaface assessments. These assessments can lead to a 2x improved quality of hires and an 85% reduction in screening time, making it easier to identify top talent efficiently.

Let’s look at how to assess Financial Analyst skills with these 5 talent assessments.

Financial & Excel Modeling Test

Our Financial & Excel Modeling Test assesses a candidate's proficiency in creating and maintaining financial models using Excel, covering a wide range of financial disciplines.

The test evaluates understanding of financial analysis, planning, forecasting, reporting, valuation, and investment analysis, along with Excel-specific skills like macros and modeling.

Candidates who perform well demonstrate their ability to handle complex financial scenarios and their adeptness in utilizing Excel for financial tasks.

Data Analysis Test

Our Data Analysis Test evaluates a candidate's ability to analyze, interpret, and derive insights from data, crucial for data-driven decision making.

This test covers basics of data modeling, analysis, business analysis fundamentals, and practical use of SQL for data queries.

Successful candidates will show proficiency in handling data operations, interpreting complex datasets, and using data visualization tools effectively.

Excel Test

The Excel Test is designed to evaluate a candidate's expertise in navigating and utilizing Excel to manage and analyze large datasets.

It assesses the use of basic to advanced Excel formulas, data analysis techniques like PivotTables, and data visualization through charts and graphs.

High scorers on this test are adept at Excel automation with macros, enhancing productivity and accuracy in data handling.

Financial Analyst Test

Our Financial Analyst Test measures a candidate's ability to understand and apply financial and accounting principles in real-world scenarios.

The test focuses on financial statements, budgeting and forecasting, financial ratios, and investment analysis, along with Excel skills.

Candidates excelling in this test demonstrate a strong grasp of financial analysis and the practical application of financial theories.

Financial Accounting Online Test

The Financial Accounting Online Test evaluates a candidate's knowledge in financial accounting, ensuring they can handle tasks related to financial reporting and compliance.

This test examines proficiency in financial statements, accounting principles, double-entry bookkeeping, and financial ratios.

Top performers are able to effectively interpret financial data, apply accounting standards, and communicate financial information to stakeholders.

Summary: The 9 key Financial Analyst skills and how to test for them

| Financial Analyst skill | How to assess them |

|---|---|

| 1. Financial Modeling | Evaluate candidate's ability to create and interpret financial simulations. |

| 2. Data Analysis | Assess ability to extract insights from complex datasets. |

| 3. Excel Proficiency | Test proficiency with advanced Excel functions and formulas. |

| 4. Valuation Techniques | Check understanding of different asset valuation methods. |

| 5. Accounting Knowledge | Verify grasp of accounting principles and practices. |

| 6. Risk Management | Review experience in identifying and mitigating financial risks. |

| 7. Financial Reporting | Examine skills in preparing accurate financial statements. |

| 8. Market Research | Assess ability to gather and analyze market data effectively. |

| 9. Attention to Detail | Observe accuracy in handling data and financial details. |

Financial Analyst Online Aptitude Test

Financial Analyst skills FAQs

What is financial modeling and why is it important for a Financial Analyst?

Financial modeling involves creating a summary of a company's expenses and earnings in a spreadsheet. It helps analysts forecast future financial performance and make informed business decisions.

How can recruiters assess Excel proficiency in candidates?

Recruiters can assess Excel proficiency by giving candidates practical tests that involve complex functions, pivot tables, and data visualization tasks.

What are some key valuation techniques a Financial Analyst should know?

Key valuation techniques include Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and Precedent Transactions.

Why is attention to detail important in financial reporting?

Attention to detail ensures accuracy in financial reports, which is critical for compliance, decision-making, and maintaining stakeholder trust.

How can data analysis skills be evaluated during the hiring process?

Data analysis skills can be evaluated through case studies, data interpretation tests, and asking candidates to explain their analytical process.

What role does communication play in a Financial Analyst's job?

Communication skills are essential for presenting findings, explaining complex financial concepts, and collaborating with team members and stakeholders.

How important is programming knowledge for a Financial Analyst?

Programming knowledge, especially in languages like Python or R, can enhance data analysis capabilities and automate repetitive tasks.

What are effective ways to assess a candidate's problem-solving skills?

Effective ways include presenting real-world financial scenarios, asking situational questions, and evaluating their approach to resolving issues.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources