Budget analysts are fundamental in helping organizations manage their finances. They ensure that financial resources are used efficiently and effectively.

Key skills for a budget analyst include proficiency in financial analysis, budget planning, and cost control, along with strong analytical and communication abilities.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Budget Analyst skill tests.

In this post, we will explore 8 essential Budget Analyst skills, 9 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

8 fundamental Budget Analyst skills and traits

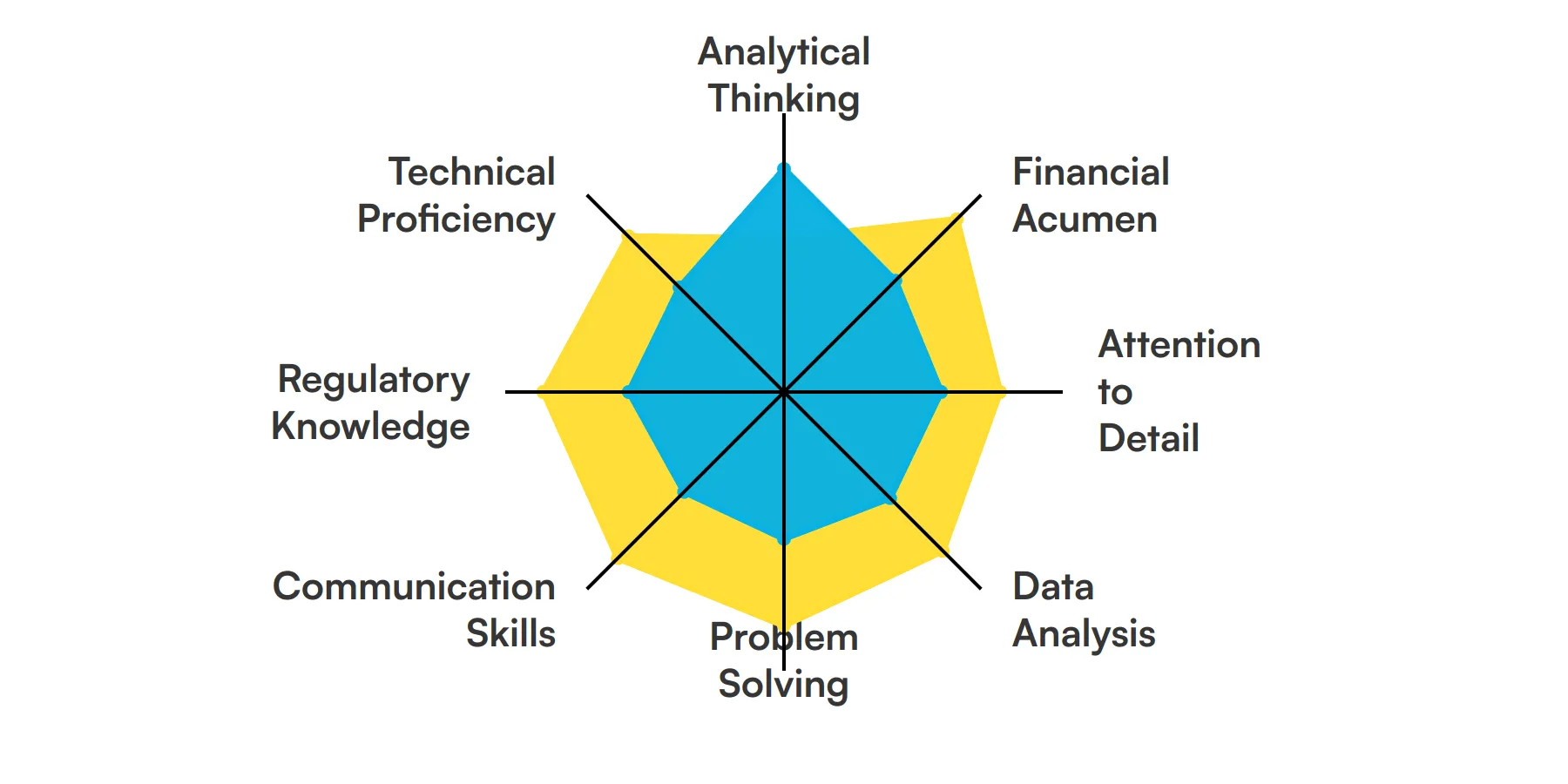

The best skills for Budget Analysts include Analytical Thinking, Financial Acumen, Attention to Detail, Data Analysis, Problem Solving, Communication Skills, Regulatory Knowledge and Technical Proficiency.

Let’s dive into the details by examining the 8 essential skills of a Budget Analyst.

Analytical Thinking

Analytical thinking is fundamental for a Budget Analyst as it involves interpreting complex financial data to make informed decisions. This skill helps in identifying trends, forecasting financial outcomes, and providing actionable insights to optimize budget allocations.

Check out our guide for a comprehensive list of interview questions.

Financial Acumen

A Budget Analyst must possess strong financial acumen to understand and manage the organization's financial resources effectively. This includes knowledge of financial principles, budgeting processes, and accounting standards to ensure accurate financial planning and compliance.

Attention to Detail

Precision is key in budget analysis. Attention to detail ensures that all financial documents and reports are accurate and errors are minimized. This skill is crucial when reviewing large datasets and financial statements to maintain the integrity of financial information.

Data Analysis

Data analysis enables a Budget Analyst to transform raw data into meaningful information. This skill involves using statistical tools and software to conduct analyses that support budget planning and performance evaluation.

For more insights, check out our guide to writing a Data Analyst Job Description.

Problem Solving

Problem solving is essential when unexpected financial discrepancies arise. A Budget Analyst uses this skill to devise effective solutions that align with the organization's financial goals and regulatory requirements.

Communication Skills

Effective communication is crucial for a Budget Analyst to convey complex financial information in a clear and understandable manner. This skill is vital when collaborating with stakeholders and presenting budget proposals and reports.

Regulatory Knowledge

Understanding financial regulations and compliance is necessary for a Budget Analyst to ensure that all budgeting practices adhere to legal standards. This knowledge prevents financial risks and legal challenges for the organization.

Technical Proficiency

Technical proficiency in financial software and tools is indispensable for a Budget Analyst. This skill allows for efficient handling of financial data, budget modeling, and automation of repetitive tasks.

9 secondary Budget Analyst skills and traits

The best skills for Budget Analysts include Project Management, Negotiation, Strategic Planning, Risk Management, Adaptability, Collaboration, Ethical Judgment, Continuous Learning and Time Management.

Let’s dive into the details by examining the 9 secondary skills of a Budget Analyst.

Project Management

Managing multiple budgeting projects efficiently helps a Budget Analyst meet deadlines and manage resources effectively.

Negotiation

Negotiation skills are useful when finalizing budget allocations with department heads and vendors to maximize resource utilization.

Strategic Planning

Strategic planning assists a Budget Analyst in aligning financial goals with organizational objectives, ensuring long-term sustainability.

Risk Management

Identifying and mitigating financial risks is crucial for maintaining the fiscal health of the organization.

Adaptability

The ability to adapt to changing financial environments and regulations ensures a Budget Analyst remains effective in dynamic conditions.

Collaboration

Working collaboratively with other departments ensures that the budgeting process is inclusive and considers all organizational needs.

Ethical Judgment

Maintaining high ethical standards is important for a Budget Analyst to foster trust and integrity in financial reporting.

Continuous Learning

The financial field is ever-evolving, and continuous learning helps a Budget Analyst stay updated with the latest trends and technologies.

Time Management

Effective time management is necessary to handle the frequent deadlines and pressures associated with budget cycles.

How to assess Budget Analyst skills and traits

Assessing the skills and traits of a Budget Analyst is a nuanced process that requires more than just a glance at a resume. While educational background and work experience are informative, they don't fully reveal a candidate's proficiency in essential areas such as analytical thinking, financial acumen, or attention to detail.

To truly understand whether a candidate will thrive in a budget analyst role, employers must evaluate both hard skills like data analysis and technical proficiency, and soft skills including communication and problem-solving abilities. This holistic approach ensures that the analyst can not only manage numbers but also interpret them in a way that is beneficial for the company.

One effective method to assess these competencies is through tailored assessments that measure real-world skills. Adaface assessments offer a practical solution by providing tests specifically designed to evaluate the key skills of budget analysts. These assessments help streamline the hiring process, leading to a significant reduction in screening time and a noticeable improvement in the quality of hires.

Let’s look at how to assess Budget Analyst skills with these 6 talent assessments.

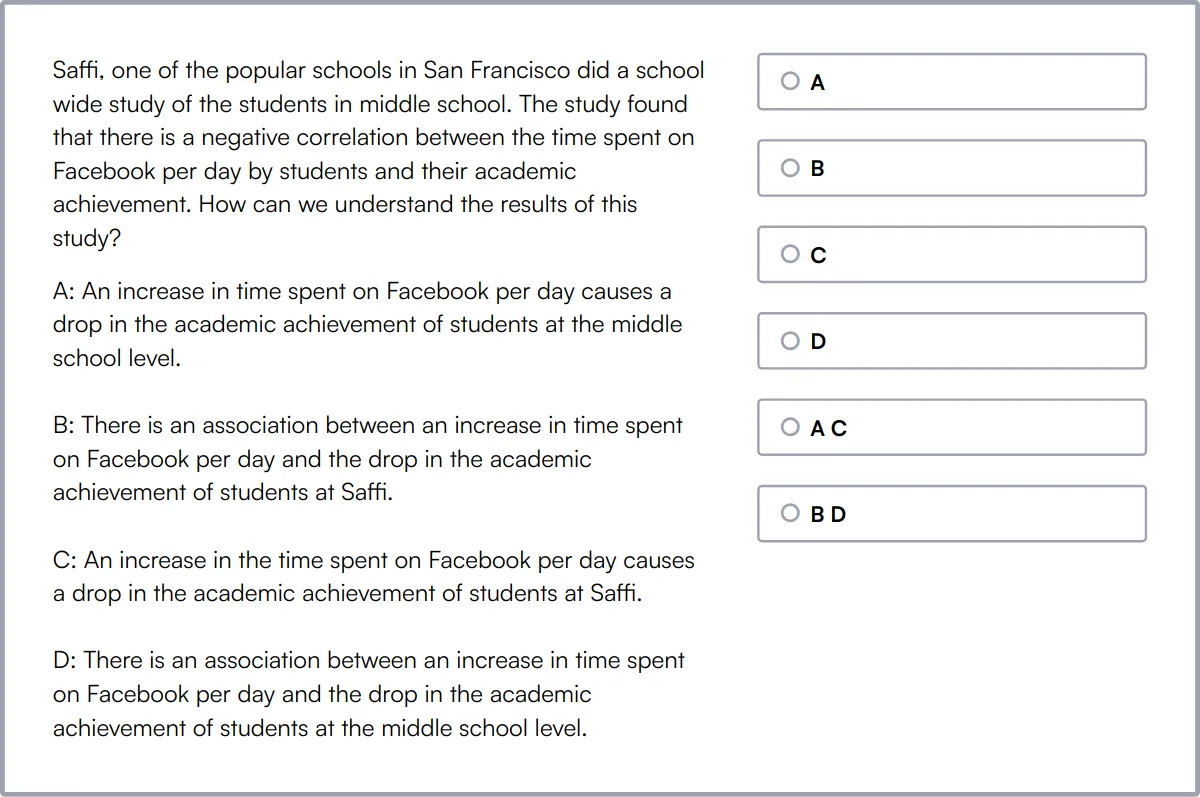

Analytical Skills Test

The Analytical Skills Test evaluates a candidate's ability to comprehend scenarios, identify key information, apply logic, find patterns and draw conclusions.

The test assesses their understanding of Logical Reasoning, Data Visualization, Data Sufficiency, Verbal Reasoning, Numerical Reasoning, Critical Thinking, and Problem Solving.

Successful candidates demonstrate strong logical reasoning, data interpretation, and critical thinking skills, making them adept at solving complex problems and making data-driven decisions.

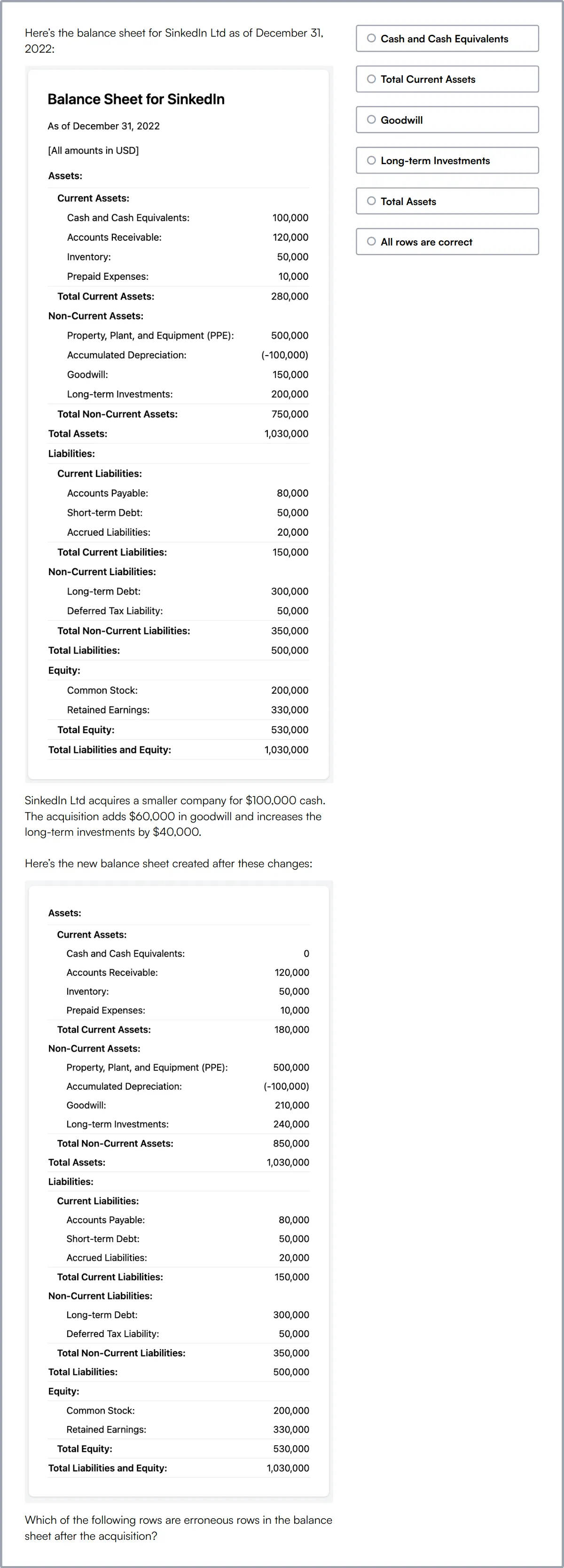

Financial Accounting Online Test

The Financial Accounting Test uses scenario-based multiple-choice questions to evaluate a candidate's knowledge and skills related to financial statements and reporting, accounting principles and concepts, budgeting and forecasting, tax compliance and planning, auditing and internal controls, financial analysis and decision-making, and financial software and tools.

The test assesses their understanding of Financial Statements, Accounting Principles, Double-Entry Bookkeeping, Assets and Liabilities, Income and Expense Recognition, Financial Ratios, Cash Flow Statement, Inventory Valuation, Depreciation and Amortization, and Financial Analysis.

Candidates who excel in this test show proficiency in interpreting and analyzing financial data, applying accounting standards, and effectively communicating financial information to stakeholders.

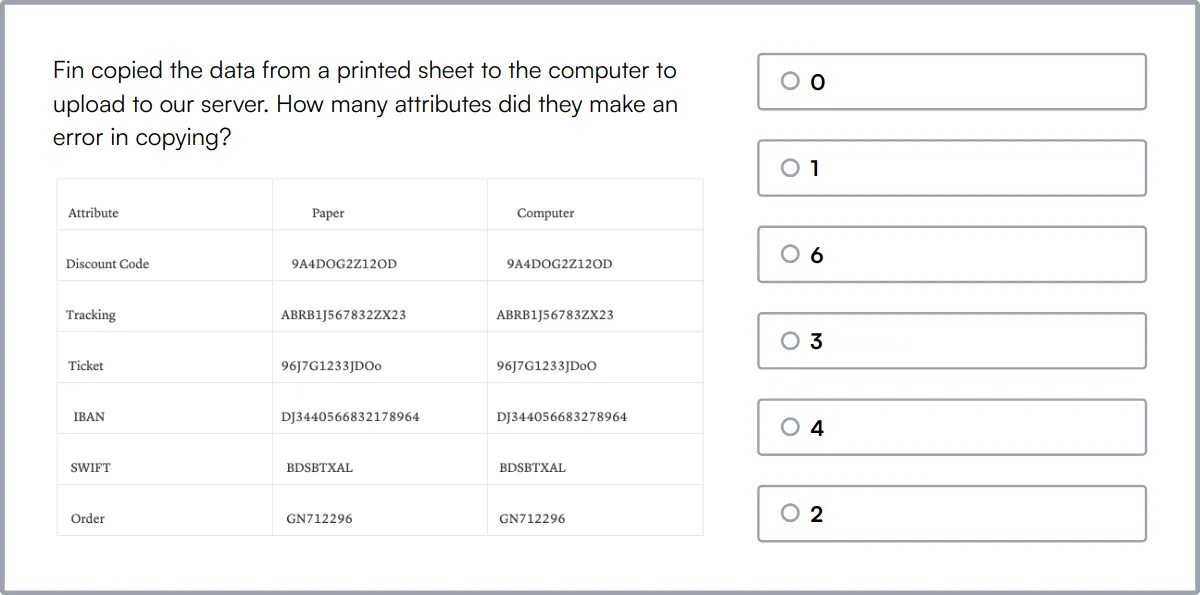

Attention To Detail Test

The Attention to Detail Test evaluates a candidate's ability to focus on the task and their willingness to be thorough for detail-oriented work.

The test assesses their skills in Following Instructions, Verifying Data, Checking Consistency, Proof-reading, Identifying Mistakes, and Detecting Typos.

High-scoring candidates demonstrate meticulous attention to detail, ensuring high-quality work and accuracy in data processing.

Data Analysis Test

The Data Analysis Test assesses a candidate's ability to handle, modify, analyze, and interpret data.

The test evaluates their skills in Data Modelling, Data Analysis, Business Analysis Fundamentals, Data Interpretation, SQL, Data Operations, Data Investigations, and Popular Data Tools.

Candidates who perform well in this test are proficient in analyzing data to find outcomes, detect anomalies, extract insights, and visualize data using charts and graphs.

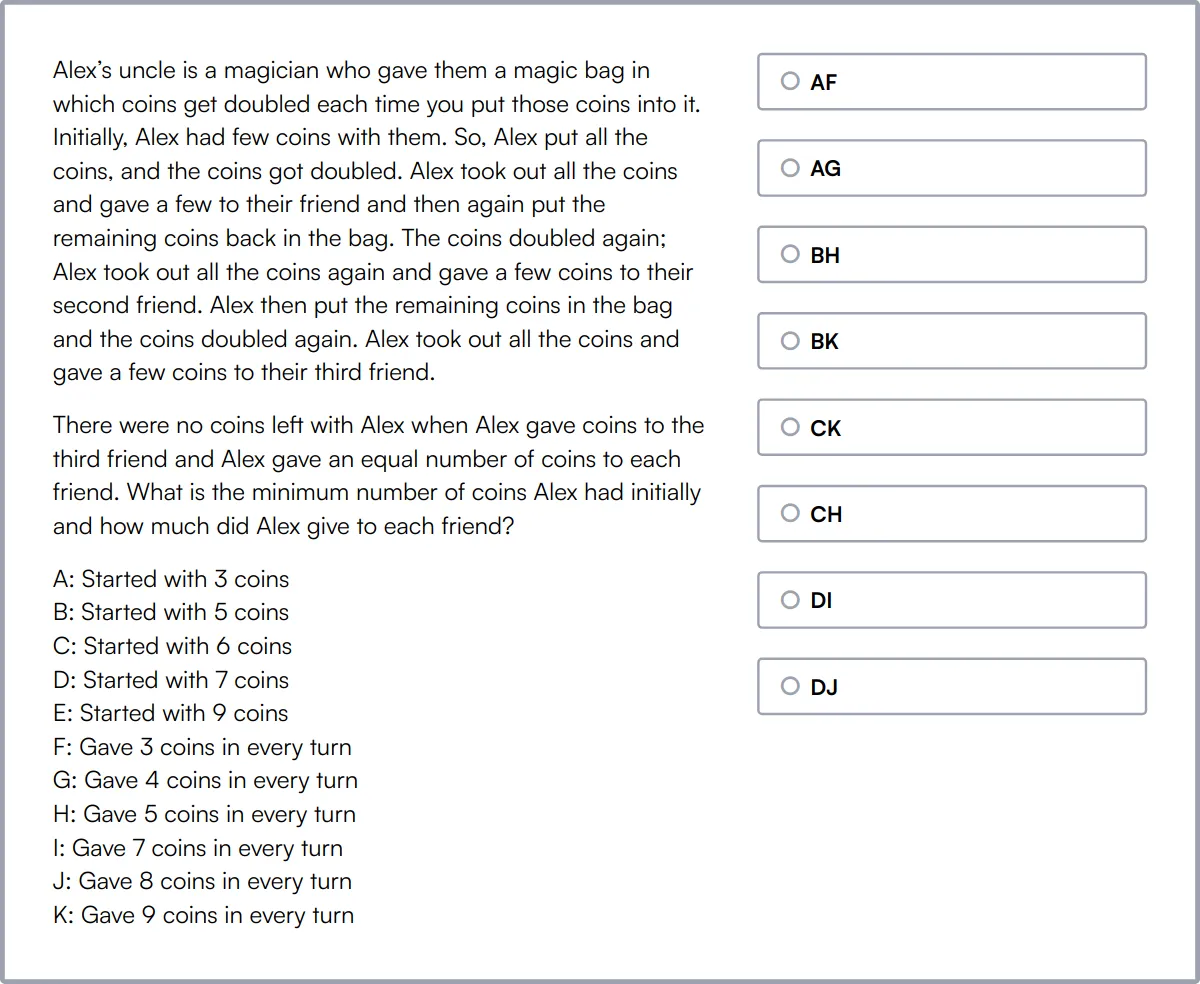

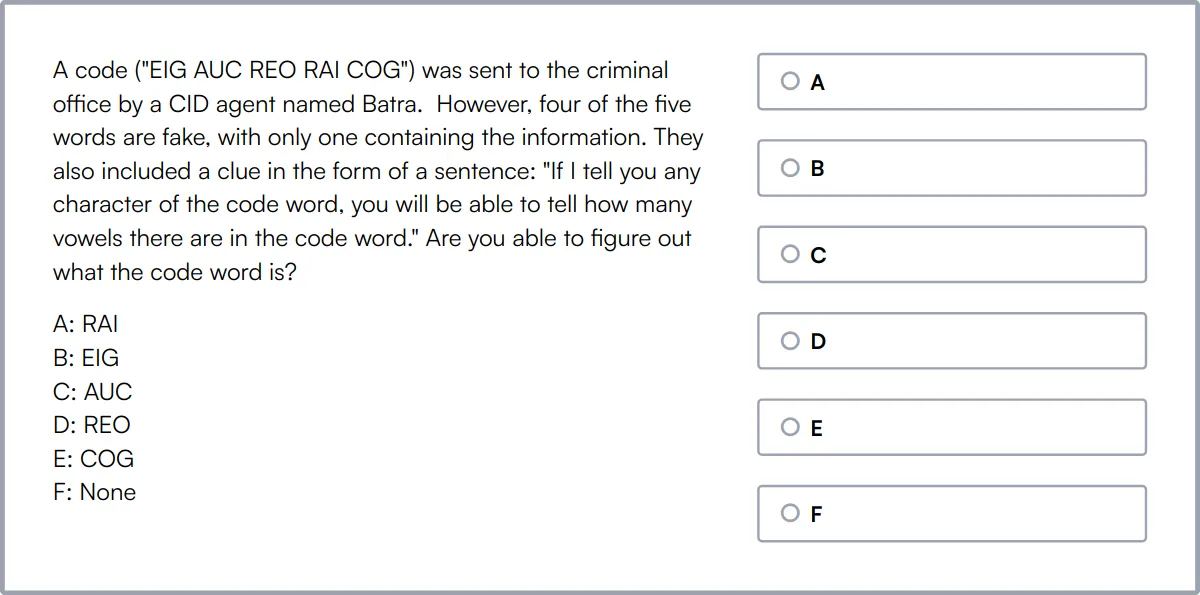

Problem Solving Test

The Problem Solving Test evaluates a candidate's ability to understand instructions, analyze data, and respond to complex problems or situations.

The test assesses their skills in Abstract Reasoning, Critical Thinking, Deductive Reasoning, Inductive Reasoning, Pattern Matching, and Spatial Reasoning.

Successful candidates demonstrate strong problem-solving abilities, learning agility, and coachability, making them capable of tackling challenging tasks.

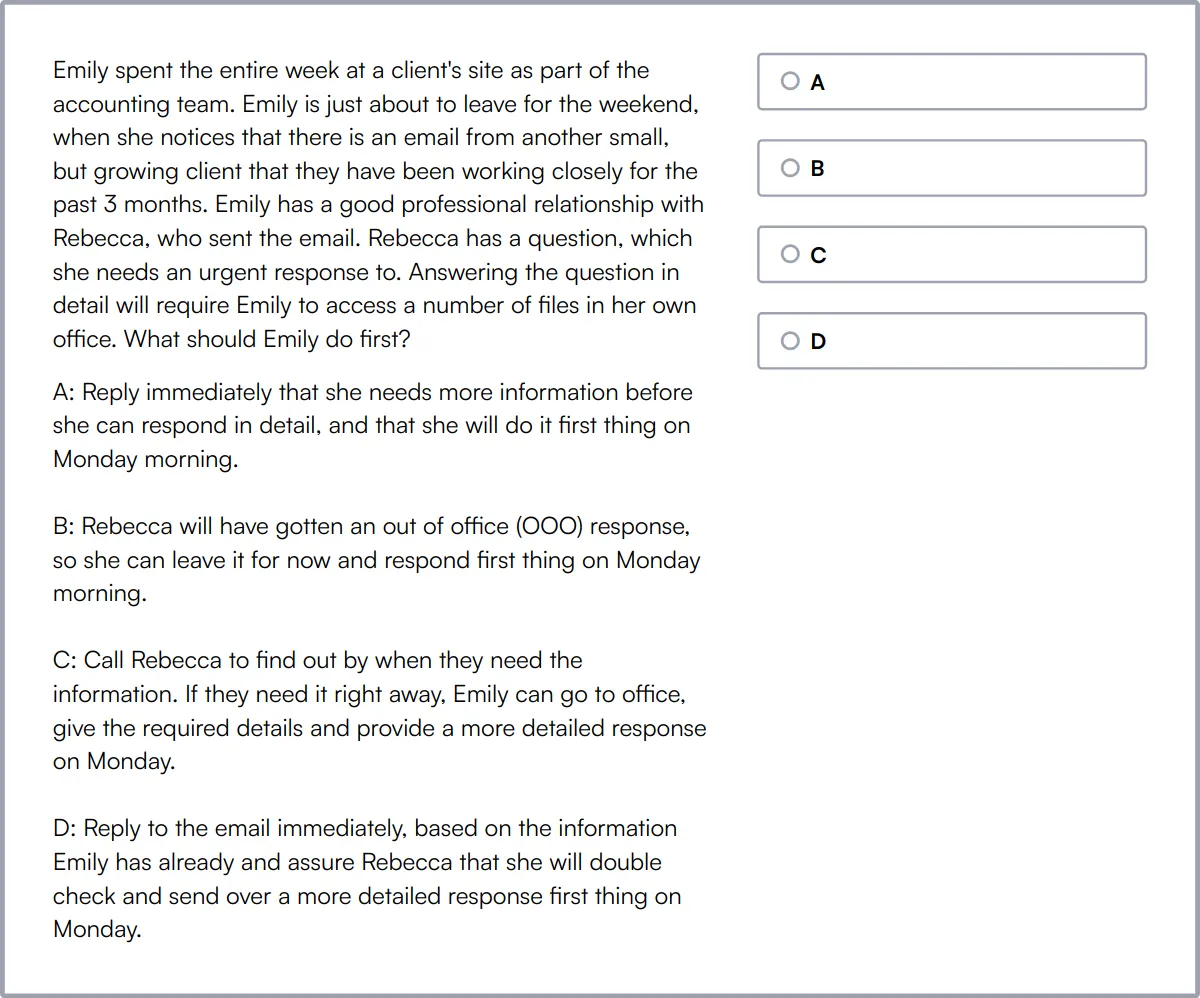

Communication Skills Test

The Communication Test evaluates candidates' communication skills, including verbal and written communication, active listening, and interpersonal skills.

The test assesses their abilities in Communication Skills, Situational Judgement, Attention to Detail, Critical Thinking, and Verbal Reasoning.

Candidates who excel in this test are proficient in effectively communicating with customers, colleagues, and stakeholders in various professional scenarios.

Summary: The 8 key Budget Analyst skills and how to test for them

| Budget Analyst skill | How to assess them |

|---|---|

| 1. Analytical Thinking | Evaluate how a candidate interprets and processes complex information. |

| 2. Financial Acumen | Assess understanding and application of financial principles and reports. |

| 3. Attention to Detail | Observe accuracy in handling data and spotting minute discrepancies. |

| 4. Data Analysis | Check ability to extract insights from large datasets. |

| 5. Problem Solving | Test how effectively a candidate approaches and resolves issues. |

| 6. Communication Skills | Review clarity, effectiveness, and adaptability in verbal and written communication. |

| 7. Regulatory Knowledge | Verify familiarity with and application of relevant legal standards. |

| 8. Technical Proficiency | Gauge competence with necessary software and technical tools. |

Financial Analyst Test

Budget Analyst skills FAQs

What are the key analytical skills required for a budget analyst?

Budget analysts need strong analytical skills to evaluate budget proposals, review financial reports, and monitor spending. They must be able to analyze data to make informed decisions and provide accurate financial forecasts.

How important is financial acumen in a budget analyst role?

Financial acumen is critical for budget analysts as it enables them to understand complex financial documents, assess financial health, and ensure compliance with financial regulations and standards.

What role does attention to detail play in budget analysis?

Attention to detail is paramount in budget analysis to prevent errors in financial reports, ensure accurate budget proposals, and maintain compliance with financial guidelines and regulations.

How can problem-solving skills be assessed in potential budget analyst candidates?

Assess problem-solving skills by presenting candidates with real-world budgeting scenarios that require them to identify issues, analyze information, and propose viable solutions.

Why are communication skills essential for budget analysts?

Communication skills are key for budget analysts to effectively convey budget proposals, justify expenditures, and collaborate with stakeholders to align financial goals and strategies.

What technical skills should a budget analyst possess?

Budget analysts should be proficient in financial software, spreadsheets, and databases. Familiarity with data analysis tools and financial modeling software is also beneficial.

How does strategic planning influence a budget analyst’s role?

Strategic planning is important for budget analysts to help organizations plan long-term financial goals, allocate resources efficiently, and anticipate future financial needs and challenges.

What is the significance of ethical judgment in budget analysis?

Ethical judgment ensures that budget analysts maintain integrity, transparency, and accountability in managing and allocating financial resources, crucial for upholding public trust and organizational standards.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources