Accounting specialists are fundamental to the financial health of a company. They ensure accurate financial records and compliance with legal standards, which are critical for any business's operational success.

Skills necessary for an accounting specialist include proficiency in accounting software, strong attention to detail, and effective time management. Additionally, interpersonal and communication skills are important as they often collaborate with other departments.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Accounting Specialist skill tests.

In this post, we will explore 9 essential Accounting Specialist skills, 11 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

9 fundamental Accounting Specialist skills and traits

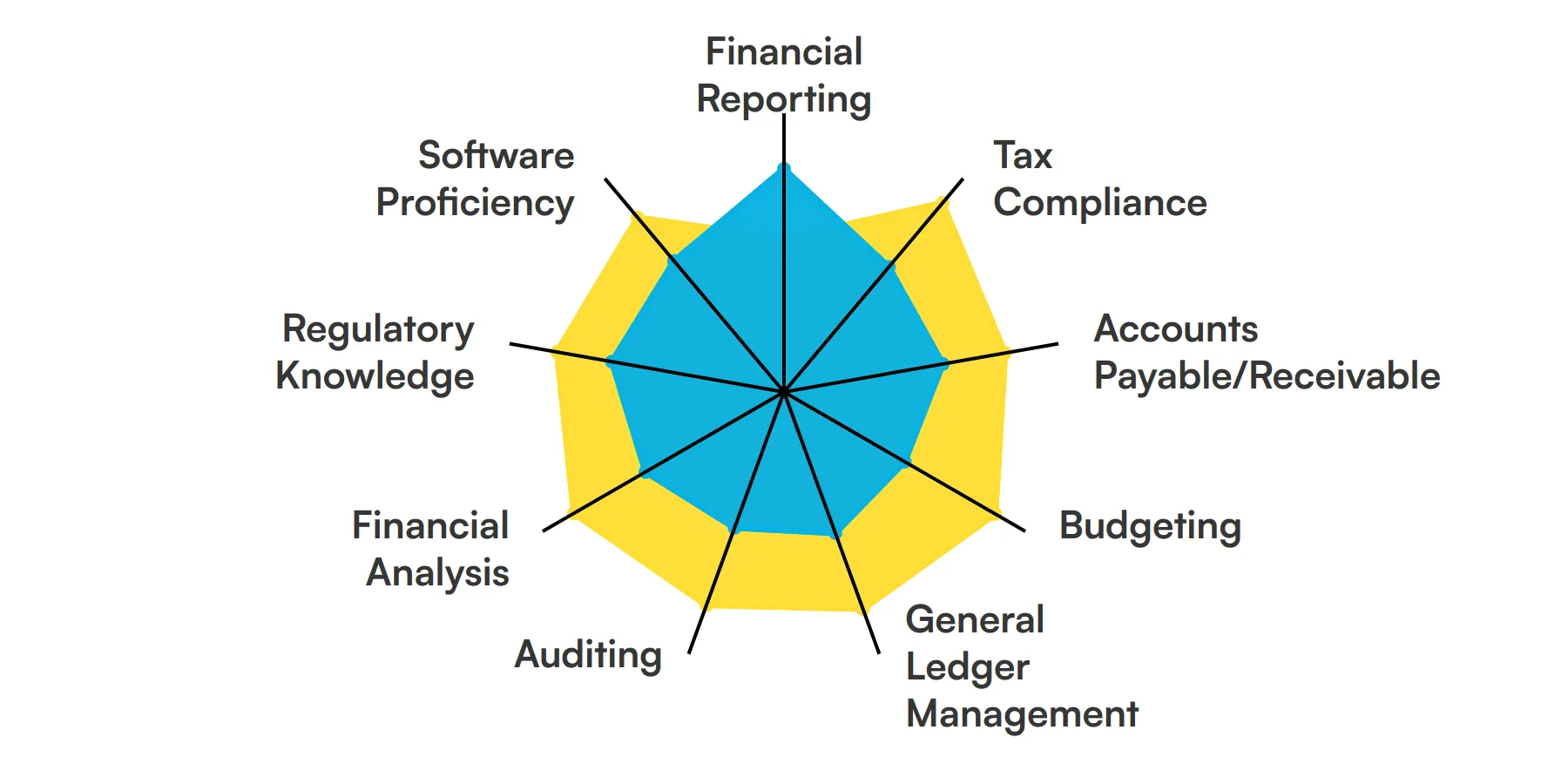

The best skills for Accounting Specialists include Financial Reporting, Tax Compliance, Accounts Payable/Receivable, Budgeting, General Ledger Management, Auditing, Financial Analysis, Regulatory Knowledge and Software Proficiency.

Let’s dive into the details by examining the 9 essential skills of a Accounting Specialist.

Financial Reporting

An accounting specialist must be adept at preparing and analyzing financial statements. This skill ensures that all financial data is accurately represented and compliant with regulatory standards.

For more insights, check out our guide to writing a Financial Analyst Job Description.

Tax Compliance

Understanding and applying tax laws is crucial for an accounting specialist. This involves preparing tax returns and ensuring that the organization adheres to all tax regulations to avoid penalties.

Accounts Payable/Receivable

Managing the inflow and outflow of funds is a key responsibility. This includes processing invoices, tracking payments, and ensuring timely collections to maintain cash flow.

Check out our guide for a comprehensive list of interview questions.

Budgeting

Creating and managing budgets helps in planning and controlling financial resources. An accounting specialist uses this skill to forecast future financial needs and monitor spending.

General Ledger Management

Maintaining the general ledger is fundamental. This involves recording all financial transactions and ensuring the accuracy of financial data for reporting and analysis.

For more insights, check out our guide to writing a Accounting Specialist Job Description.

Auditing

Conducting internal and external audits is essential to verify the accuracy of financial records. This skill helps in identifying discrepancies and ensuring compliance with financial regulations.

Financial Analysis

Analyzing financial data to identify trends and make informed decisions is a critical skill. This involves interpreting financial statements and using data to support strategic planning.

Check out our guide for a comprehensive list of interview questions.

Regulatory Knowledge

Staying updated with financial regulations and standards is necessary. An accounting specialist must ensure that all financial practices comply with current laws and guidelines.

Software Proficiency

Proficiency in accounting software like QuickBooks, SAP, or Oracle is essential. This skill enables efficient management of financial data and streamlines accounting processes.

11 secondary Accounting Specialist skills and traits

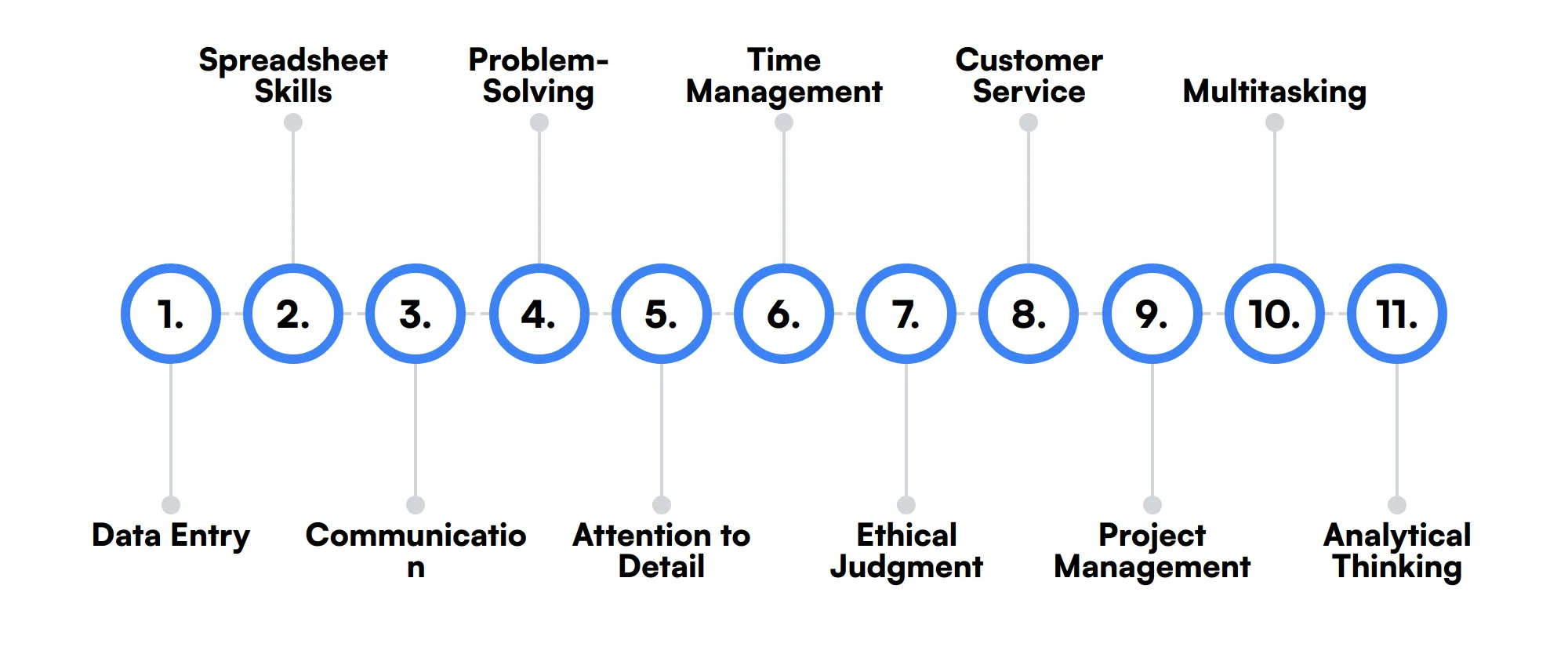

The best skills for Accounting Specialists include Data Entry, Spreadsheet Skills, Communication, Problem-Solving, Attention to Detail, Time Management, Ethical Judgment, Customer Service, Project Management, Multitasking and Analytical Thinking.

Let’s dive into the details by examining the 11 secondary skills of a Accounting Specialist.

Data Entry

Accurate data entry is important for maintaining precise financial records. This skill ensures that all transactions are correctly recorded in the accounting system.

Spreadsheet Skills

Advanced knowledge of spreadsheets, particularly Excel, is useful for organizing and analyzing financial data. This includes creating complex formulas and financial models.

Communication

Effective communication skills are necessary for explaining financial information to non-financial stakeholders. This includes writing reports and presenting financial data clearly.

Problem-Solving

Identifying and resolving financial discrepancies requires strong problem-solving skills. An accounting specialist must be able to troubleshoot issues and find effective solutions.

Attention to Detail

Meticulous attention to detail is crucial for ensuring the accuracy of financial records. This skill helps in identifying errors and maintaining the integrity of financial data.

Time Management

Managing multiple tasks and meeting deadlines is essential in accounting. This skill ensures that all financial activities are completed in a timely manner.

Ethical Judgment

Maintaining high ethical standards is important for an accounting specialist. This involves ensuring transparency and honesty in all financial practices.

Customer Service

Providing excellent customer service is important when dealing with clients or internal stakeholders. This skill helps in building trust and maintaining positive relationships.

Project Management

Managing accounting projects, such as system implementations or financial audits, requires strong project management skills. This includes planning, executing, and monitoring project progress.

Multitasking

Handling various accounting tasks simultaneously is often required. This skill helps in managing workload efficiently and ensuring that all responsibilities are met.

Analytical Thinking

Analyzing financial data to draw meaningful insights is a valuable skill. This involves critical thinking and the ability to interpret complex financial information.

How to assess Accounting Specialist skills and traits

Assessing the skills and traits of an Accounting Specialist can be a challenging task. While resumes and certifications provide a snapshot of a candidate's qualifications, they often fall short in revealing the true depth of their expertise in areas like Financial Reporting, Tax Compliance, and Budgeting. To truly understand a candidate's proficiency, you need to go beyond traditional hiring methods.

Skills-based hiring practices, such as talent assessments, offer a more reliable way to gauge a candidate's competencies. These assessments can help you evaluate their abilities in Accounts Payable/Receivable, General Ledger Management, Auditing, and more. Adaface on-the-job skill tests are designed to help you achieve a 2x improved quality of hires and an 85% reduction in screening time.

By leveraging these assessments, you can ensure that your candidates not only have the necessary technical skills but also possess the regulatory knowledge and software proficiency required for the role. This comprehensive approach will help you identify the best fit for your team, ensuring that your Accounting Specialist can handle the complexities of financial analysis and compliance with ease.

Let’s look at how to assess Accounting Specialist skills with these 4 talent assessments.

Financial Accounting Online Test

The Financial Accounting Online Test evaluates a candidate's proficiency in financial statements, accounting principles, and financial analysis. This test is designed to assess the candidate's ability to interpret and analyze financial data, apply accounting standards, and communicate financial information effectively.

The test covers topics such as financial statements, double-entry bookkeeping, assets and liabilities, income and expense recognition, and financial ratios. Candidates are also tested on their knowledge of cash flow statements, inventory valuation, depreciation and amortization, and financial analysis.

Successful candidates demonstrate a strong understanding of accounting principles and the ability to analyze and interpret financial data. They are proficient in applying accounting standards and regulations and can effectively communicate financial information to stakeholders.

Aptitude Test for Auditors

The Aptitude Test for Auditors assesses a candidate's aptitude for auditing, risk assessment, and compliance. This test evaluates the candidate's understanding of auditing standards, risk management, fraud detection, and internal controls.

The test covers topics such as auditing principles, financial statements analysis, internal controls and risk management, fraud detection and prevention, and international auditing standards. Candidates are also assessed on their knowledge of accounting regulations and laws.

Candidates who perform well on this test demonstrate a strong understanding of auditing principles and the ability to identify risks and control weaknesses. They are proficient in evaluating audit evidence, communicating audit findings, and ensuring compliance with regulations and accounting principles.

Financial Analyst Test

The Financial Analyst Test evaluates a candidate’s ability to understand financial statements, calculate and interpret financial ratios, and predict future results. This test helps identify candidates with strong accounting and compliance backgrounds.

The test covers topics such as accounting principles, bookkeeping fundamentals, financial statements, budgeting and forecasting, and financial ratios. Candidates are also tested on their knowledge of investment analysis, risk management, cost of capital, and capital budgeting.

High-scoring candidates demonstrate expertise in financial analysis and the ability to interpret financial data. They are proficient in budgeting and forecasting, investment analysis, and risk management, making them valuable assets for financial decision-making.

Excel Test

The Excel Test evaluates a candidate's ability to work with large datasets in Excel, navigate multiple spreadsheets, use advanced formulas, and create reports. This test screens for proficiency in sorting/filtering data, analyzing data using PivotTables, and creating dashboards using charts.

The test covers topics such as basic formulas (MATCH, INDEX), math formulas (SUM, MIN, AVG), advanced formulas (IF, VLOOKUP, HLOOKUP), data types, and analyzing data (Pivots, Filters). Candidates are also tested on their ability to visualize data (Charts, graphs), work with dates and times, data validation, and error handling.

Candidates who excel in this test demonstrate strong Excel skills, including the ability to use advanced formulas and create comprehensive reports. They are proficient in data analysis, visualization, and automation with macros, making them effective in handling complex data tasks.

Summary: The 9 key Accounting Specialist skills and how to test for them

| Accounting Specialist skill | How to assess them |

|---|---|

| 1. Financial Reporting | Evaluate accuracy and timeliness in preparing financial statements. |

| 2. Tax Compliance | Review understanding and application of tax laws and regulations. |

| 3. Accounts Payable/Receivable | Assess ability to manage invoices and balance accounts effectively. |

| 4. Budgeting | Test skills in forecasting and maintaining operational budgets. |

| 5. General Ledger Management | Check proficiency in maintaining and reconciling ledger accounts. |

| 6. Auditing | Observe accuracy in reviewing financial documents and processes. |

| 7. Financial Analysis | Gauge capability to analyze financial data and trends. |

| 8. Regulatory Knowledge | Examine familiarity with applicable financial regulations and standards. |

| 9. Software Proficiency | Test proficiency with accounting software and tools. |

SAP FICO Test (Financial Accounting & Controlling)

Accounting Specialist skills FAQs

What skills are most important for an Accounting Specialist?

Key skills include financial reporting, tax compliance, and general ledger management. Proficiency in software and spreadsheet skills are also important, along with strong communication and analytical thinking abilities.

How can recruiters assess problem-solving skills in accounting candidates?

Recruiters can assess problem-solving skills by presenting candidates with hypothetical accounting scenarios that require quick and effective solutions. Observing the approach and solution offered provides insight into the candidate's problem-solving abilities.

What software skills should Accounting Specialists possess?

Accounting Specialists should be proficient in accounting software like QuickBooks, Microsoft Excel, and SAP. Familiarity with database management systems can also be beneficial.

Why is attention to detail important for an Accounting Specialist?

Attention to detail ensures accuracy in financial reports, audits, and tax filings, which are critical for maintaining compliance and making informed business decisions.

How can time management skills be evaluated during the hiring process?

Time management can be evaluated by discussing past work experiences, asking how candidates have handled deadlines, or through practical tests that simulate a typical workday's tasks and deadlines.

What role does ethical judgment play in accounting?

Ethical judgment is crucial in accounting to ensure compliance with laws and regulations, maintain transparency, and uphold the trust placed in financial reporting by stakeholders.

How important is customer service in the Accounting Specialist role?

Customer service is important for maintaining positive relationships with clients and vendors, ensuring timely and accurate communication, and resolving any discrepancies or issues that arise.

Can multitasking be a valuable skill for Accounting Specialists?

Yes, multitasking is valuable as it enables specialists to efficiently handle multiple tasks or projects at once, such as managing accounts payable and receivable simultaneously, which increases productivity.

Assess and hire the best Accounting Specialists with Adaface

Assessing and finding the best Accounting Specialist is quick and easy when you use talent assessments. You can check out our product tour, sign up for our free plan to see talent assessments in action or view the demo here:

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources