Accounting Managers are at the heart of a company's financial operations, ensuring that financial statements are accurate and compliance with legal standards is maintained.

Skills necessary for an Accounting Manager include proficiency in accounting software, strong analytical abilities, and effective leadership and communication skills.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Accounting Manager skill tests.

In this post, we will explore 9 essential Accounting Manager skills, 11 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

9 fundamental Accounting Manager skills and traits

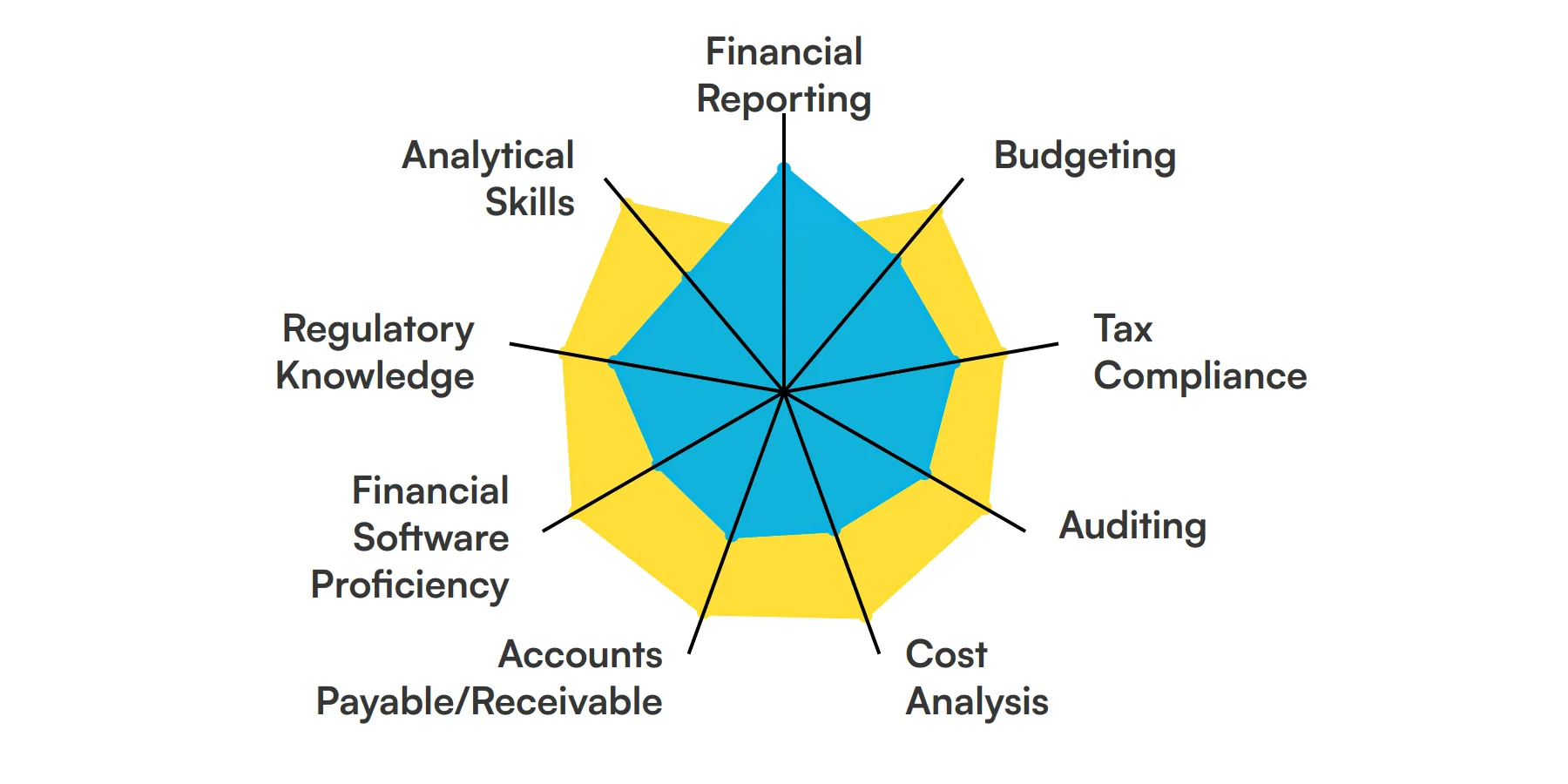

The best skills for Accounting Managers include Financial Reporting, Budgeting, Tax Compliance, Auditing, Cost Analysis, Accounts Payable/Receivable, Financial Software Proficiency, Regulatory Knowledge and Analytical Skills.

Let’s dive into the details by examining the 9 essential skills of a Accounting Manager.

Financial Reporting

An accounting manager must be adept at financial reporting. This involves preparing accurate financial statements and reports that reflect the company's financial status. These reports are crucial for decision-making and regulatory compliance.

For more insights, check out our guide to writing a Accounting Manager Job Description.

Budgeting

Budgeting is a key skill for an accounting manager. It involves planning and overseeing the company's financial resources to ensure they are used effectively. This helps in setting financial goals and tracking performance against those goals.

Tax Compliance

Understanding and ensuring tax compliance is essential. An accounting manager must be familiar with tax laws and regulations to ensure the company meets its tax obligations. This helps in avoiding legal issues and penalties.

Check out our guide for a comprehensive list of interview questions.

Auditing

Auditing skills are necessary for reviewing and verifying the accuracy of financial records. An accounting manager uses these skills to ensure that financial practices comply with internal policies and external regulations.

Cost Analysis

Cost analysis involves evaluating the costs associated with business operations. An accounting manager uses this skill to identify cost-saving opportunities and improve financial efficiency.

Accounts Payable/Receivable

Managing accounts payable and receivable is crucial. This includes overseeing the process of paying bills and collecting payments from clients, ensuring smooth cash flow and financial stability.

Financial Software Proficiency

Proficiency in financial software is a must. An accounting manager uses various accounting software to manage financial data, generate reports, and streamline accounting processes.

Regulatory Knowledge

Staying updated with financial regulations is important. An accounting manager must understand and apply relevant laws and standards to ensure the company's financial practices are compliant.

Analytical Skills

Analytical skills are essential for interpreting financial data. An accounting manager uses these skills to identify trends, make forecasts, and provide insights that support strategic decision-making.

For more insights, check out our guide to writing a Data Analyst Job Description.

11 secondary Accounting Manager skills and traits

The best skills for Accounting Managers include Communication, Problem-Solving, Time Management, Attention to Detail, Negotiation, Project Management, Ethical Judgment, Team Collaboration, Adaptability, Data Analysis and Strategic Planning.

Let’s dive into the details by examining the 11 secondary skills of a Accounting Manager.

Communication

Effective communication is important for an accounting manager. This skill helps in conveying financial information clearly to stakeholders and collaborating with other departments.

Problem-Solving

Problem-solving skills are useful for addressing financial discrepancies and challenges. An accounting manager needs to identify issues and develop solutions to maintain financial integrity.

Time Management

Time management is crucial for meeting deadlines. An accounting manager must prioritize tasks and manage time efficiently to ensure timely financial reporting and compliance.

Attention to Detail

Attention to detail is necessary for accuracy in financial records. An accounting manager must ensure that all financial data is precise to avoid errors and discrepancies.

Negotiation

Negotiation skills can be beneficial in managing vendor contracts and payment terms. An accounting manager may use these skills to secure favorable terms and conditions for the company.

Project Management

Project management skills help in overseeing financial projects. An accounting manager uses these skills to plan, execute, and monitor projects to achieve financial objectives.

Ethical Judgment

Ethical judgment is important for maintaining integrity in financial practices. An accounting manager must adhere to ethical standards and ensure that financial activities are conducted honestly.

Team Collaboration

Collaboration with the finance team and other departments is key. An accounting manager needs to work well with others to ensure cohesive financial management and reporting.

Adaptability

Adaptability is useful in a dynamic financial environment. An accounting manager must be able to adjust to changes in regulations, technology, and business needs.

Data Analysis

Data analysis skills help in making sense of large volumes of financial data. An accounting manager uses these skills to extract meaningful insights and support data-driven decisions.

Strategic Planning

Strategic planning involves setting long-term financial goals. An accounting manager uses this skill to align financial strategies with the company's overall objectives.

How to assess Accounting Manager skills and traits

Assessing the skills and traits of an Accounting Manager is a critical step in ensuring that your finance team is led by someone capable and competent. While the role demands proficiency in financial reporting, budgeting, and tax compliance, it also requires a keen analytical mind and a strong grasp of financial software. Understanding how to evaluate these skills effectively is key to making the right hiring decision.

Traditional methods like reviewing resumes and conducting interviews might provide some insights into a candidate's experience and qualifications. However, they often fall short of revealing the true depth of a candidate's skills in areas like auditing, cost analysis, and regulatory knowledge. This is where practical assessments come into play.

By incorporating skills assessments into your hiring process, you can measure a candidate's abilities directly and objectively. Adaface assessments offer a tailored approach to evaluating the specific competencies needed in an Accounting Manager. From financial software proficiency to analytical skills, our tests cover all necessary areas to ensure a comprehensive evaluation. Using Adaface can lead to a 2x improvement in the quality of your hires and an 85% reduction in screening time, making your hiring process both effective and efficient.

Let’s look at how to assess Accounting Manager skills with these 5 talent assessments.

Financial Accounting Online Test

Our Financial Accounting Online Test evaluates a candidate's proficiency in handling financial statements and accounting principles, crucial for effective financial management and compliance.

The test assesses knowledge in areas such as double-entry bookkeeping, financial ratios, and income and expense recognition, using scenario-based multiple-choice questions that challenge candidates to apply these concepts in practical situations.

Successful candidates demonstrate a strong ability to analyze financial data, apply depreciation and amortization techniques, and manage inventory valuation, reflecting their readiness to handle complex financial tasks.

Aptitude Test for Auditors

Our Aptitude Test for Auditors is designed to measure a candidate's aptitude in auditing, risk assessment, and compliance, key areas for effective auditing practices.

This test covers auditing principles, financial statement analysis, and internal controls, with additional focus on fraud detection and prevention, assessing how well candidates can navigate complex auditing scenarios.

Candidates who excel in this test are adept at ensuring compliance with international auditing standards and accounting regulations, and can effectively communicate audit findings.

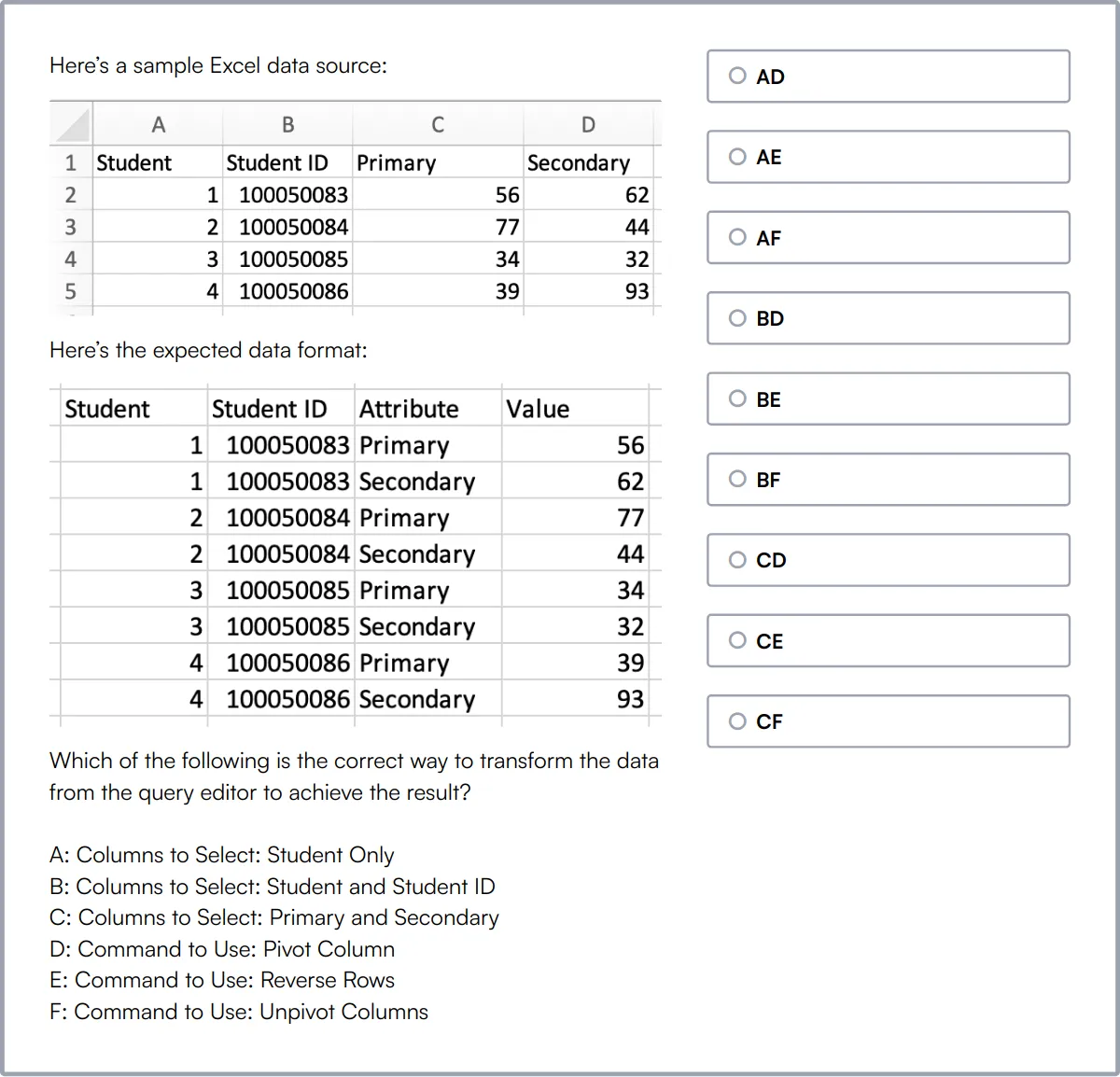

Excel Test

The Excel Test assesses a candidate's ability to efficiently manage and analyze large datasets using Excel, a fundamental tool for data-driven decision making in business environments.

Candidates are tested on their proficiency with advanced formulas like VLOOKUP and HLOOKUP, and their skills in data analysis techniques such as PivotTables and data visualization with charts and graphs.

High-scoring candidates will demonstrate a strong command of Excel's features for data consolidation, error handling, and automation with macros, ensuring they can streamline data management processes effectively.

GDPR Online Test

Our GDPR Online Test evaluates a candidate's understanding of the General Data Protection Regulation (GDPR), assessing their ability to manage and protect data in accordance with legal standards.

The test challenges candidates on their knowledge of data privacy, protection, and security, focusing on compliance with data breach protocols and consent management.

Candidates who perform well on this test are proficient in developing and implementing GDPR compliance policies and ensuring the security and privacy of personal data.

Analytical Skills Test

The Analytical Skills Test measures a candidate's ability to think logically and analyze data, essential skills for problem-solving and decision-making in complex business scenarios.

This test evaluates logical reasoning, data visualization, and critical thinking, requiring candidates to interpret data, identify patterns, and draw logical conclusions from given scenarios.

Candidates excelling in this test show a strong capability in handling spatial reasoning challenges and data interpretation, crucial for roles requiring high-level analytical thinking.

Summary: The 9 key Accounting Manager skills and how to test for them

| Accounting Manager skill | How to assess them |

|---|---|

| 1. Financial Reporting | Evaluate accuracy and clarity in financial statements and reports. |

| 2. Budgeting | Assess ability to plan and allocate financial resources effectively. |

| 3. Tax Compliance | Check knowledge of tax laws and timely filing of returns. |

| 4. Auditing | Review thoroughness in examining financial records and compliance. |

| 5. Cost Analysis | Measure proficiency in evaluating and controlling costs. |

| 6. Accounts Payable/Receivable | Gauge efficiency in managing incoming and outgoing payments. |

| 7. Financial Software Proficiency | Test familiarity with accounting software and tools. |

| 8. Regulatory Knowledge | Verify understanding of financial regulations and standards. |

| 9. Analytical Skills | Assess capability to interpret and analyze financial data. |

Accounting Assessment Test

Accounting Manager skills FAQs

What are the key financial reporting skills needed for an Accounting Manager?

Accounting Managers should be adept at creating accurate financial statements, understanding complex accounting standards, and analyzing financial data to report on the company's financial health.

How can recruiters assess a candidate's expertise in budgeting and forecasting?

Recruiters can evaluate a candidate's budgeting skills by discussing past experiences where they managed budgets, asking for examples of budget strategies they've implemented, and possibly conducting a practical test involving budget preparation.

What role does tax compliance play in the responsibilities of an Accounting Manager?

Tax compliance is critical as Accounting Managers ensure that all company financial practices are in line with current laws and regulations to avoid legal issues and penalties.

Why is proficiency in financial software important for an Accounting Manager?

Proficiency in financial software helps Accounting Managers streamline accounting processes, enhance data accuracy, and provide timely financial insights through automated tools and systems.

How do analytical skills impact the effectiveness of an Accounting Manager?

Analytical skills enable Accounting Managers to interpret complex financial data, forecast future trends, and make informed decisions that align with the company's financial goals.

What are some methods to evaluate an Accounting Manager's communication skills during an interview?

To assess communication skills, recruiters can focus on how clearly the candidate explains complex financial concepts, their ability to present financial information to non-financial stakeholders, and their previous experiences in team and cross-departmental communications.

How important is ethical judgment for an Accounting Manager?

Ethical judgment is key as Accounting Managers handle sensitive financial information and must make decisions that uphold the integrity and trustworthiness of the financial department.

What strategies can be used to test a candidate's adaptability in an Accounting Manager role?

Recruiters can ask about times the candidate has adapted to significant changes in accounting regulations or technology, or discuss hypothetical scenarios that require quick adaptation to new financial practices.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources