Accountants play a key role in managing and interpreting financial data for businesses. They ensure accurate financial reporting and compliance with regulations, which is crucial for informed decision-making and maintaining financial health.

Accounting skills encompass a range of competencies, including proficiency in accounting software, understanding of financial principles, and strong analytical abilities. Additionally, skills like attention to detail and effective communication are important for success in this role.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Accountant skill tests.

In this post, we will explore 9 essential Accountant skills, 11 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

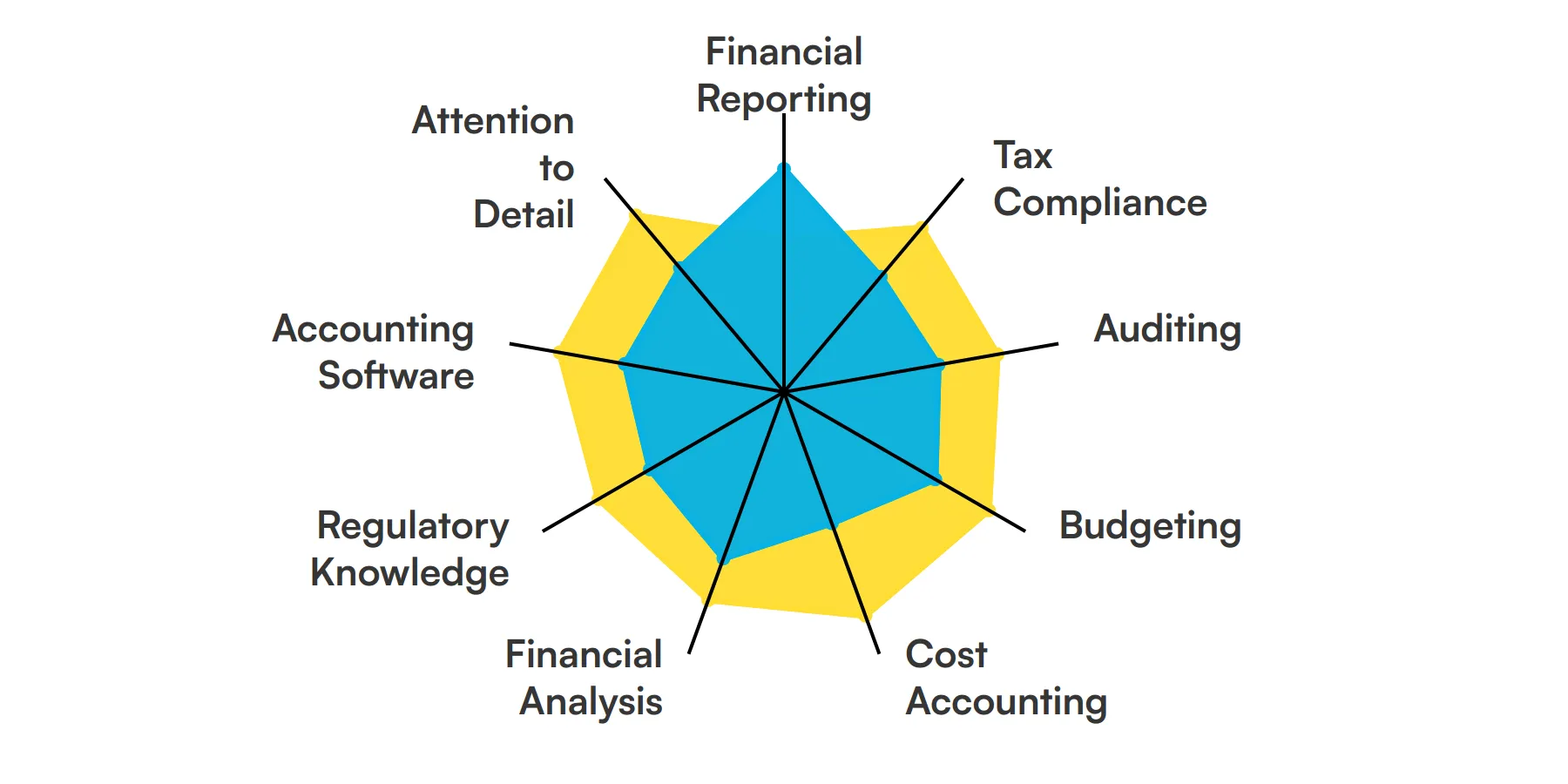

9 fundamental Accountant skills and traits

The best skills for Accountants include Financial Reporting, Tax Compliance, Auditing, Budgeting, Cost Accounting, Financial Analysis, Regulatory Knowledge, Accounting Software and Attention to Detail.

Let’s dive into the details by examining the 9 essential skills of a Accountant.

Financial Reporting

Accountants need to prepare accurate financial statements, including balance sheets, income statements, and cash flow statements. This skill ensures that stakeholders have a clear view of the company's financial health.

For more insights, check out our guide to writing a Financial Analyst Job Description.

Tax Compliance

Understanding and adhering to tax laws is crucial for accountants. They must ensure that the company complies with all tax regulations, files returns on time, and takes advantage of any tax benefits.

Auditing

Auditing involves examining financial records to ensure accuracy and compliance with regulations. Accountants use this skill to identify discrepancies and recommend improvements in financial processes.

Budgeting

Creating and managing budgets helps accountants plan for future financial needs. This skill is essential for forecasting expenses and revenues, ensuring the company stays on track financially.

Check out our guide for a comprehensive list of interview questions.

Cost Accounting

Cost accounting involves tracking and analyzing costs associated with production. Accountants use this skill to determine pricing strategies and improve cost efficiency.

Financial Analysis

Analyzing financial data helps accountants make informed decisions. This skill involves interpreting financial ratios, trends, and metrics to provide insights into the company's performance.

Regulatory Knowledge

Staying updated with financial regulations and standards is crucial. Accountants must understand and apply these rules to ensure compliance and avoid legal issues.

For more insights, check out our guide to writing a Accountant Job Description.

Accounting Software

Proficiency in accounting software like QuickBooks or SAP is essential. These tools help accountants manage financial data efficiently and automate routine tasks.

Attention to Detail

Accuracy is paramount in accounting. This skill ensures that all financial records are precise, reducing the risk of errors that could lead to financial discrepancies.

Check out our guide for a comprehensive list of interview questions.

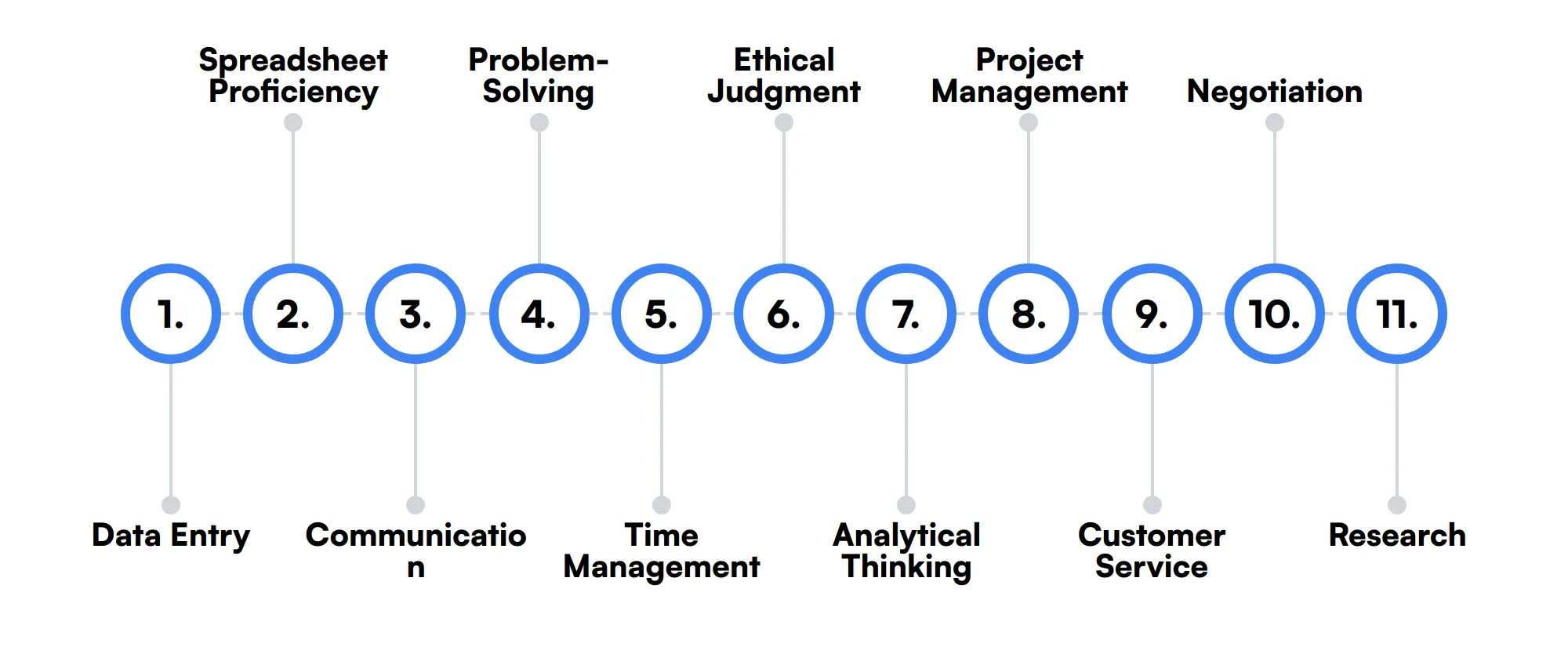

11 secondary Accountant skills and traits

The best skills for Accountants include Data Entry, Spreadsheet Proficiency, Communication, Problem-Solving, Time Management, Ethical Judgment, Analytical Thinking, Project Management, Customer Service, Negotiation and Research.

Let’s dive into the details by examining the 11 secondary skills of a Accountant.

Data Entry

Accurate data entry is fundamental for maintaining reliable financial records. This skill involves inputting financial transactions into accounting systems.

Spreadsheet Proficiency

Knowledge of spreadsheet software like Excel is important for organizing and analyzing financial data. Accountants use spreadsheets for tasks such as budgeting and financial modeling.

Communication

Effective communication skills help accountants explain financial information to non-financial stakeholders. This ensures that everyone understands the financial implications of business decisions.

Problem-Solving

Accountants often encounter financial discrepancies or issues that require resolution. Strong problem-solving skills help them identify the root cause and implement effective solutions.

Time Management

Managing multiple tasks and deadlines is a common challenge for accountants. Good time management skills ensure that all financial activities are completed on schedule.

Ethical Judgment

Maintaining integrity and ethical standards is crucial in accounting. This skill ensures that accountants act in the best interest of the company and comply with legal requirements.

Analytical Thinking

Analytical thinking helps accountants interpret complex financial data and make informed decisions. This skill is essential for identifying trends and making strategic recommendations.

Project Management

Managing financial projects, such as audits or system implementations, requires strong project management skills. Accountants use this skill to ensure projects are completed on time and within budget.

Customer Service

Providing excellent customer service is important for accountants who interact with clients. This skill helps build strong relationships and ensures client satisfaction.

Negotiation

Negotiation skills are useful for accountants involved in contract discussions or vendor management. This skill helps secure favorable terms and conditions for the company.

Research

Conducting research is important for staying updated with industry trends and regulations. Accountants use this skill to gather information that supports financial decision-making.

How to assess Accountant skills and traits

Assessing the skills and traits of an accountant can be a challenging task. While resumes and certifications provide a snapshot of their qualifications, they don't always reflect the candidate's true proficiency in key areas such as financial reporting, tax compliance, and auditing. To truly understand an accountant's capabilities, a more hands-on approach is necessary.

Skills-based hiring practices, like talent assessments, offer a reliable way to evaluate a candidate's competencies. These assessments can cover a wide range of skills, from budgeting and cost accounting to financial analysis and regulatory knowledge. By focusing on practical tasks and real-world scenarios, you can get a clearer picture of how well a candidate will perform in your specific role.

For a streamlined and effective assessment process, consider using Adaface on-the-job skill tests. These tests can help you achieve a 2x improved quality of hires and an 85% reduction in screening time. Whether you need to evaluate proficiency in accounting software or attention to detail, Adaface offers a comprehensive solution tailored to your needs.

Let’s look at how to assess Accountant skills with these 4 talent assessments.

Financial Accounting Online Test

Our Financial Accounting Online Test evaluates a candidate's proficiency in handling financial statements, applying accounting principles, and utilizing financial tools and software.

The test assesses candidates on their ability to interpret financial data, apply accounting standards, and manage financial reporting and analysis.

Successful candidates demonstrate a thorough understanding of financial ratios, cash flow management, and the principles of depreciation and amortization.

Financial Analyst Test

The Financial Analyst Test measures a candidate's expertise in analyzing financial statements, budgeting, and forecasting, as well as their proficiency with Excel.

This test evaluates the candidate's ability to calculate financial ratios, perform investment analysis, and understand risk management and capital budgeting.

Candidates who excel in this test are adept at financial planning and possess strong analytical skills, essential for making informed investment decisions.

Aptitude Test for Auditors

Our Aptitude Test for Auditors assesses a candidate's understanding of auditing standards, risk management, and compliance with financial regulations.

The test challenges candidates on their knowledge of internal controls, fraud detection, and adherence to international auditing standards.

High-scoring candidates will demonstrate a strong capability in evaluating audit evidence and communicating audit findings effectively.

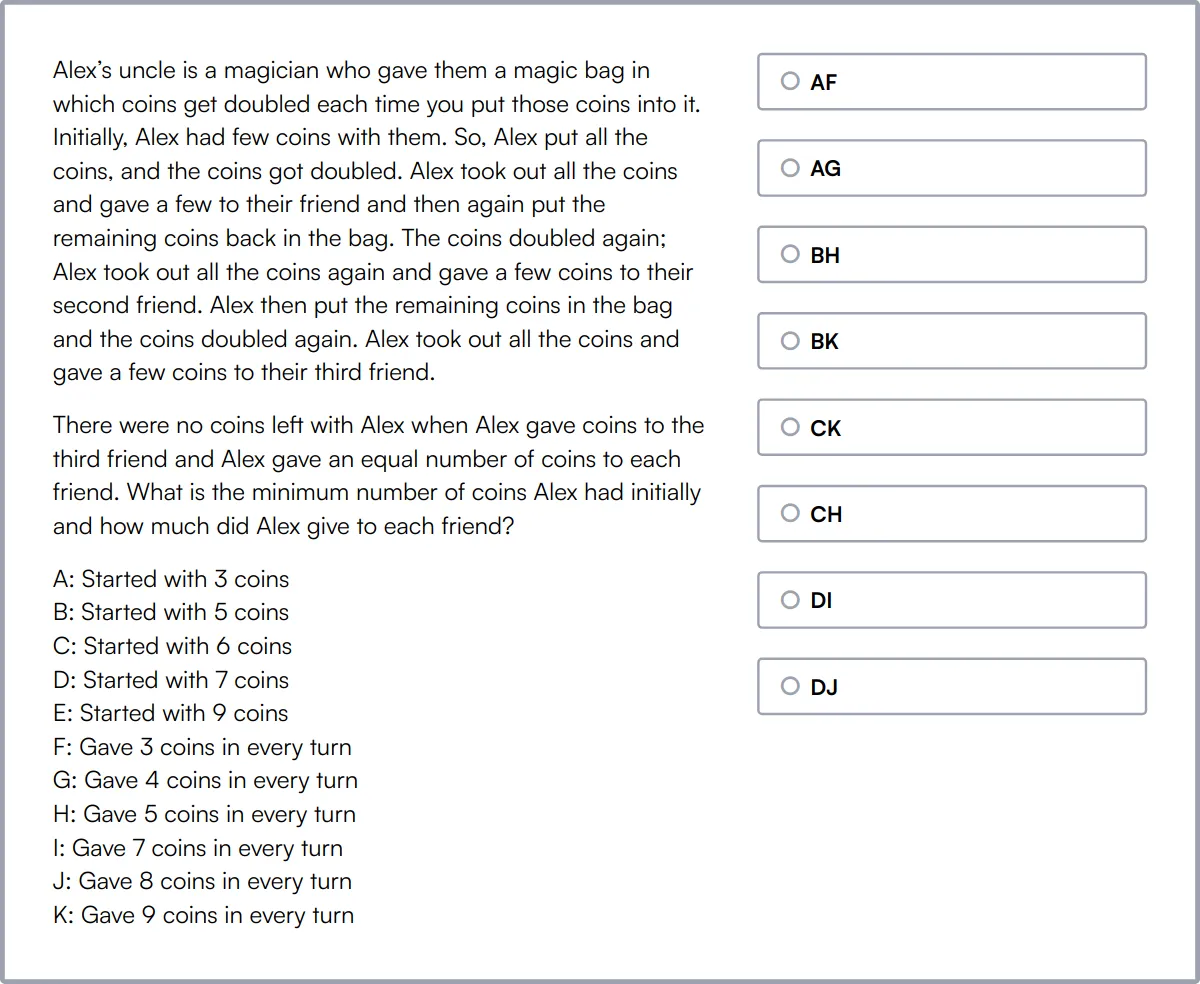

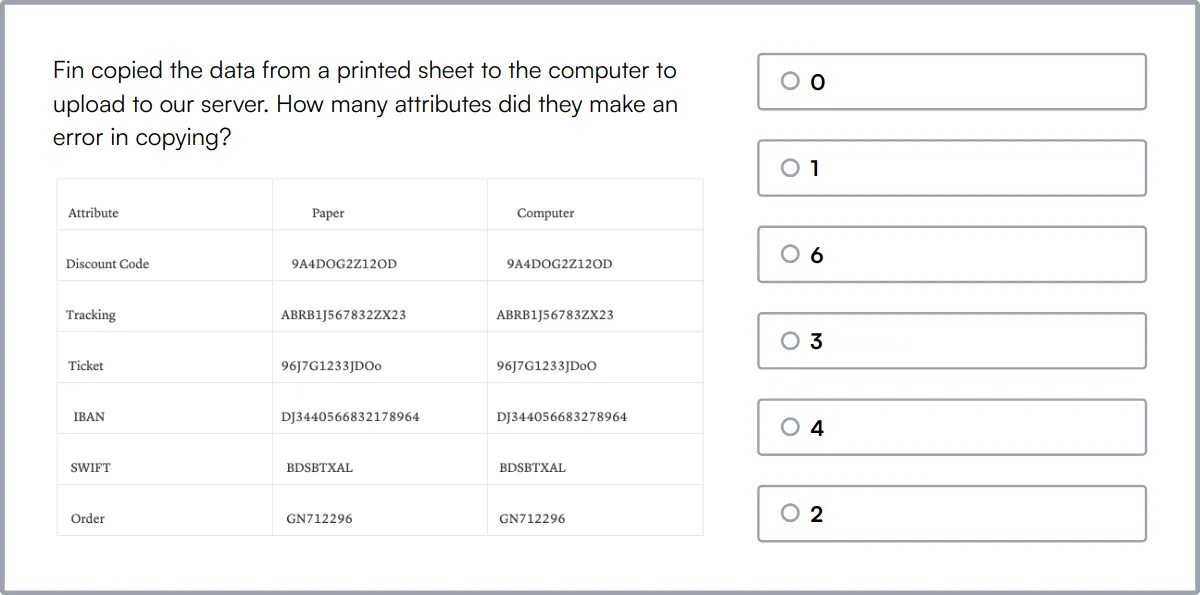

Attention To Detail Test

The Attention To Detail Test evaluates a candidate's ability to meticulously verify data, identify inconsistencies, and proofread documents.

This test measures the candidate's proficiency in following detailed instructions and detecting typographical errors to ensure high-quality output.

Candidates who perform well on this test are likely to produce work that is accurate and free of errors, reflecting a high level of care and attention.

Summary: The 9 key Accountant skills and how to test for them

| Accountant skill | How to assess them |

|---|---|

| 1. Financial Reporting | Evaluate accuracy and clarity in financial statements and reports. |

| 2. Tax Compliance | Check adherence to tax laws and timely filing of returns. |

| 3. Auditing | Assess thoroughness in examining financial records and compliance. |

| 4. Budgeting | Review ability to plan and allocate financial resources effectively. |

| 5. Cost Accounting | Measure proficiency in tracking and managing costs. |

| 6. Financial Analysis | Evaluate skills in interpreting financial data and trends. |

| 7. Regulatory Knowledge | Check understanding of relevant financial regulations and standards. |

| 8. Accounting Software | Assess proficiency in using accounting software tools. |

| 9. Attention to Detail | Evaluate accuracy and precision in financial data handling. |

Accounting Assessment Test

Accountant skills FAQs

What are the key skills to look for in an accountant?

Key skills include Financial Reporting, Tax Compliance, Auditing, Budgeting, Cost Accounting, and Financial Analysis. Proficiency in Accounting Software and Spreadsheet tools is also important.

How can I assess an accountant's Financial Reporting skills?

Review their experience with preparing financial statements, ask for examples of past reports, and test their knowledge of relevant accounting standards.

What methods can be used to evaluate Tax Compliance expertise?

Check their familiarity with current tax laws, request examples of tax returns they have prepared, and consider giving them a tax scenario to solve.

How do I test an accountant's proficiency with Accounting Software?

Ask about the software they have used, request a demonstration of their skills, and consider practical tests using the software your company employs.

Why is Attention to Detail important for accountants?

Attention to Detail ensures accuracy in financial records, helps prevent errors, and is crucial for compliance with regulations.

What are effective ways to assess an accountant's Analytical Thinking?

Present them with complex financial data and ask for their analysis. Evaluate their ability to identify trends, anomalies, and provide actionable insights.

How can I gauge an accountant's Communication skills?

Assess their ability to explain financial concepts clearly, both in writing and verbally. Role-playing scenarios can also be useful.

What role does Ethical Judgment play in accounting?

Ethical Judgment ensures that accountants adhere to legal standards and maintain integrity, which is essential for trust and compliance.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources