As a recruiter or hiring manager, bringing a financial analyst on board is more than just filling a vacancy—it's about choosing a strategic partner for your organization’s financial health. Financial analysts play a crucial role in interpreting data and providing insights that drive business decisions. Despite their importance, many organizations struggle to identify the right candidate who not only fits the technical requirements but also aligns with the company's culture and strategic goals.

In this article, we guide you through everything you need to know about hiring a financial analyst. From understanding the intricacies of their role to crafting an effective job description and leveraging skills assessment tools, we've got you covered. You can learn more about skills tests that are useful in assessing financial analysts at our Financial Analyst Test page.

Table of contents

Why Hire a Financial Analyst?

Hiring a financial analyst can help your company make smarter financial decisions. They can analyze your current financial data, identify trends, and provide insights to improve profitability. For example, a financial analyst might uncover ways to reduce costs or increase revenue streams.

Consider bringing on a financial analyst if you're facing challenges like:

- Difficulty in budgeting or forecasting

- Inconsistent financial reporting

- Need for better investment strategies

Before committing to a full-time hire, assess if your financial needs are ongoing or project-based. For short-term projects or to test the waters, you might start with a financial analyst skills assessment or consider hiring a consultant. If you have constant financial analysis needs, a full-time analyst could be the right choice.

What Does a Financial Analyst Do?

A Financial Analyst evaluates financial data and trends to help businesses make well-informed decisions. They play a significant role in planning investments, assessing risk, and advising on financial strategies.

Day-to-day tasks of a Financial Analyst include:

- Analyzing financial data and creating detailed reports.

- Providing insights on past and current financial performance.

- Developing financial models to forecast future revenues and expenditures.

- Assisting with budget preparation and financial planning.

To learn more about the skills required for this role, you can explore the skills required for a Financial Analyst.

Financial Analyst Hiring Process

The Financial Analyst hiring process typically spans 4-8 weeks. Here's a quick overview of the timeline and steps involved:

- Job posting: Create and publish a detailed Financial Analyst job description on relevant job boards and company website.

- Resume screening: Review incoming applications and shortlist candidates based on qualifications and experience (1-2 weeks).

- Skills assessment: Conduct financial modeling tests or case studies to evaluate technical proficiency (1 week).

- Interviews: Schedule and conduct multiple rounds of interviews, including behavioral and technical questions (2-3 weeks).

- Reference checks: Contact professional references for top candidates (2-3 days).

- Job offer: Extend an offer to the best candidate and negotiate terms (1 week).

The duration may vary depending on factors like the number of applicants and internal processes. In the following sections, we'll dive deeper into each step, providing checklists and resources to streamline your Financial Analyst hiring process.

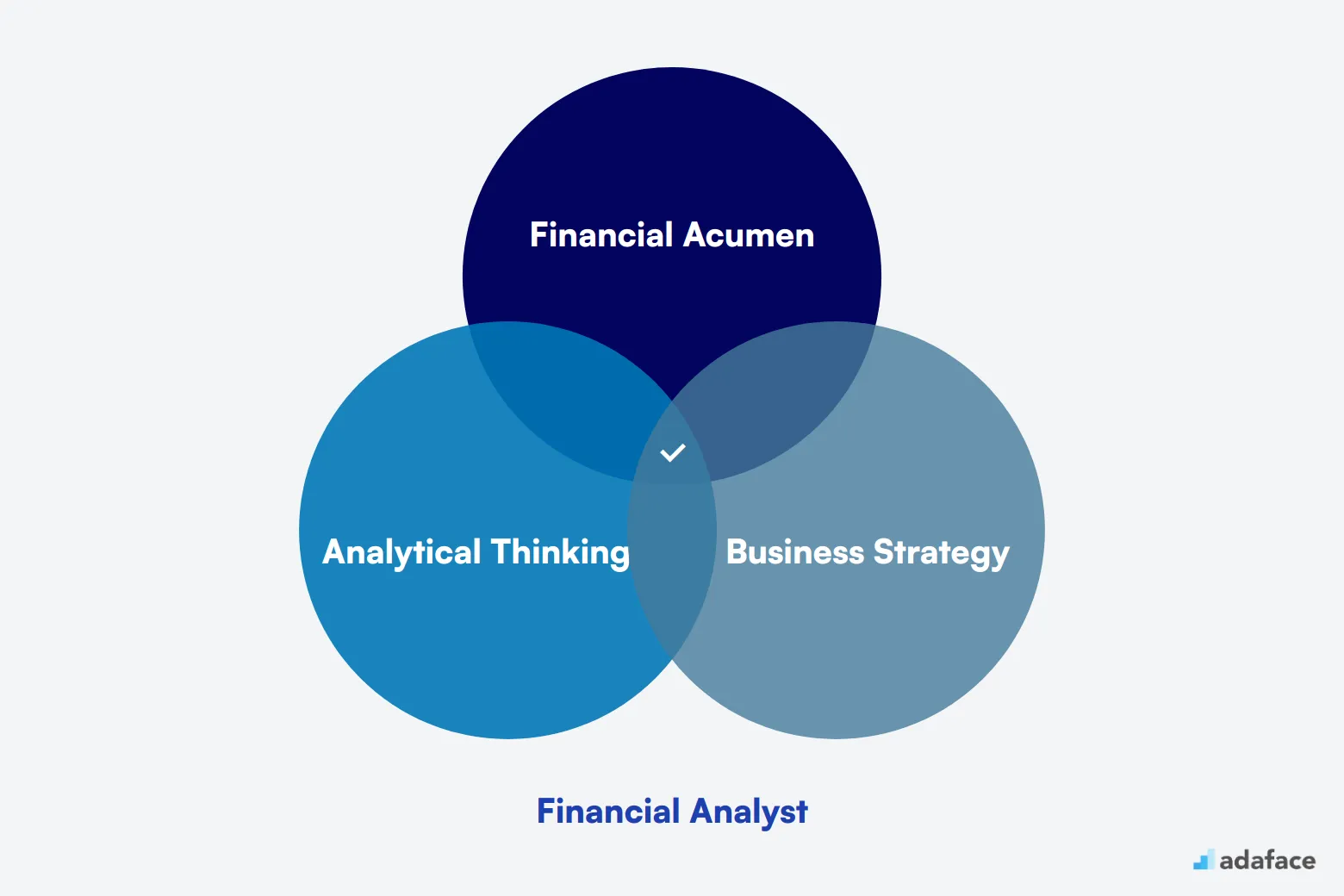

Key Skills and Qualifications for Financial Analysts

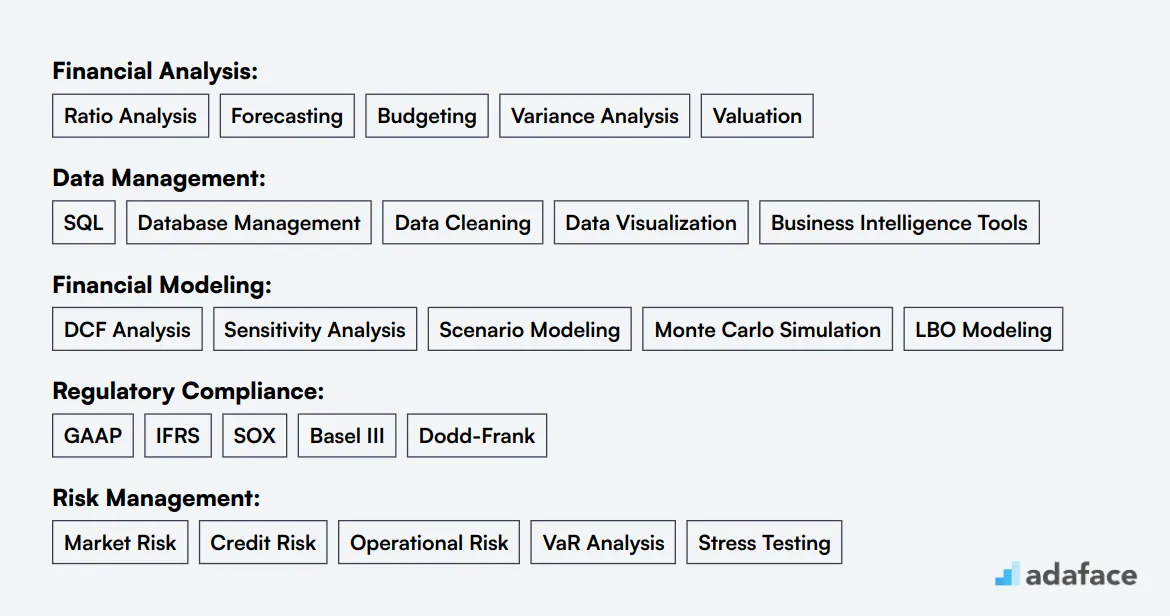

When creating a candidate profile for a Financial Analyst, it's important to distinguish between must-have skills and nice-to-have qualifications. This role requires a mix of technical expertise and soft skills. Here's a guide to help you identify the right blend of abilities for your company's needs.

Required skills typically include a strong foundation in finance and accounting, analytical prowess, and proficiency with financial software. Preferred qualifications often encompass advanced degrees, certifications, or specialized industry experience. Remember, the ideal candidate should not only meet technical requirements but also fit well with your company culture.

To assess these skills effectively, consider using financial analysis tests as part of your hiring process. These can help you objectively evaluate candidates' technical abilities and problem-solving skills in real-world scenarios.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Finance, Accounting, Economics, or related field | Master's degree in Finance or MBA |

| Strong analytical and problem-solving skills | Experience with financial analysis software (e.g., Bloomberg, FactSet) |

| Proficiency in Microsoft Excel and financial modeling | CFA or CPA certification |

| Knowledge of financial statements and accounting principles | Knowledge of statistical analysis and data visualization tools |

| Excellent written and verbal communication skills | Experience in a specific industry or sector |

How to Write an Effective Financial Analyst Job Description

Once you've defined the ideal candidate profile, it's time to craft a compelling job description to attract top financial talent. Here are some key tips to create an impactful Financial Analyst job description:

- Highlight key responsibilities and impact: Clearly outline the role's duties, such as financial modeling, data analysis, and reporting. Emphasize how the analyst's work will contribute to strategic decision-making and company growth.

- Balance technical skills with soft skills: List required technical proficiencies like Excel, SQL, and financial software. Also, emphasize the importance of communication skills, attention to detail, and the ability to work in cross-functional teams.

- Showcase your company's unique selling points: Highlight growth opportunities, company culture, and exciting projects. Mention any unique perks or benefits that set your organization apart in the competitive finance job market.

Best Platforms to Find Financial Analysts

Now that you have a detailed job description in hand, it's time to list your vacancy on job platforms to source qualified candidates. Leveraging the right platforms helps in connecting with professionals who fit your specified criteria and meet your organization's needs.

LinkedIn Jobs

Ideal for posting full-time positions and reaching a wide network of professionals. Allows detailed job descriptions and easy application process.

Indeed

Versatile platform for posting various job types. Offers a large candidate pool and tools for screening applicants.

Glassdoor for Employers

Excellent for established companies to showcase their culture alongside job listings. Provides insights into company reviews and salaries.

Besides the common job boards, there are several platforms tailored for hiring financial analysts. These include Upwork for freelance projects, Robert Half for temporary and permanent placements, and eFinancialCareers for specialization in financial services. Dice is ideal if you're looking for tech-savvy analysts, while ZipRecruiter offers AI-powered candidate matching. For certified professionals, the CFA Institute Career Center is a prime choice, while Monster serves well for full-time roles. Don't forget to utilize Adaface's role-specific tests to assess candidates effectively.

Keywords to Look for in Financial Analyst Resumes

Resume screening is a key step in hiring Financial Analysts. It helps you quickly identify candidates with the right skills and experience before moving to interviews.

When manually screening resumes, focus on key terms like 'financial modeling', 'data analysis', and 'Excel proficiency'. Look for specific financial analysis skills such as forecasting, budgeting, and valuation. Pay attention to educational background, certifications, and relevant work experience.

AI tools can streamline the screening process. You can use ChatGPT or Claude by providing them with a list of desired keywords and your job description. These tools can quickly scan multiple resumes and provide summaries based on your criteria.

Here's a sample prompt for AI resume screening:

TASK: Screen resumes for Financial Analyst role

INPUT: Resumes

OUTPUT: For each resume, provide:

- Name

- Matching keywords

- Score (out of 10)

- Recommendation

- Shortlist (Yes/No/Maybe)

KEYWORDS:

- Financial Analysis (Forecasting, Budgeting, Valuation)

- Excel (Financial Modeling, Pivot Tables)

- Accounting Principles (GAAP, Financial Statements)

- Data Analysis (SQL, Power BI)

- Communication Skills

You can customize this prompt based on your specific Financial Analyst job requirements.

Which skills tests should you use to assess Financial Analysts?

When hiring a financial analyst, skills tests offer a straightforward way to gauge a candidate's proficiency and suitability for the role. These tests provide insights beyond resumes and interviews, ensuring that the candidate possesses the required skill set. Here are our top recommendations for assessing financial analysts.

The Financial Analyst Test is tailored to evaluate candidates' analytical and technical skills required for financial analysis roles. This test helps identify candidates who can effectively interpret and analyze financial data.

For assessing a candidate's understanding of accounting principles, the Financial Accounting Test is recommended. This test ensures that the candidate has a solid grasp of accounting practices essential for accurate financial reporting.

Excel proficiency is indispensable for financial analysts. The Excel Test evaluates a candidate's ability to use Excel tools to organize data, create reports, and perform calculations effectively.

The Business Intelligence Analyst Test allows you to evaluate candidates' abilities to transform data into useful business insights, a skill crucial for making data-driven decisions in finance.

If your organization relies on Hyperion software, the Hyperion Financial Management Test is pivotal to assess candidates' proficiency with this platform, ensuring they can manage your organization's financial planning and analysis seamlessly.

Case Study Assignments to Evaluate Financial Analysts

Case study assignments can be effective for assessing Financial Analyst candidates, but they come with drawbacks. They're often time-consuming, may lead to lower candidate participation, and risk losing qualified applicants who can't commit to lengthy assessments. However, when used judiciously, they can provide valuable insights into a candidate's skills.

Financial Statement Analysis: This case study involves analyzing a company's financial statements to assess its financial health and performance. Candidates are asked to calculate key ratios, identify trends, and make recommendations. This assignment tests the core skills required for financial analysts, including analytical ability and financial acumen.

Investment Recommendation: Candidates are given information about a potential investment opportunity and asked to conduct a thorough analysis. They must evaluate the risks, potential returns, and alignment with investment goals. This case study assesses the candidate's ability to synthesize information and make data-driven recommendations.

Budget Variance Analysis: This assignment involves reviewing a company's budget versus actual performance. Candidates must identify variances, explain potential causes, and suggest corrective actions. It tests their understanding of budgeting processes and their ability to provide actionable insights based on financial data.

Structuring Technical Interviews for Financial Analysts

Once candidates pass the initial skills tests, it's time for technical interviews to assess their hard skills in depth. While skills tests are great for initial screening, technical interviews help identify the best-fit candidates for the role. Let's explore some sample interview questions to use in your Financial Analyst hiring process.

Consider asking: 1) 'Can you explain the three main financial statements and how they're interconnected?' 2) 'Walk me through your process for creating a financial model.' 3) 'How do you approach variance analysis?' 4) 'What methods do you use to forecast revenue?' 5) 'Describe a time when you had to present complex financial data to non-finance stakeholders.' These questions help evaluate candidates' technical knowledge, analytical skills, and communication abilities - all key for success as a Financial Analyst.

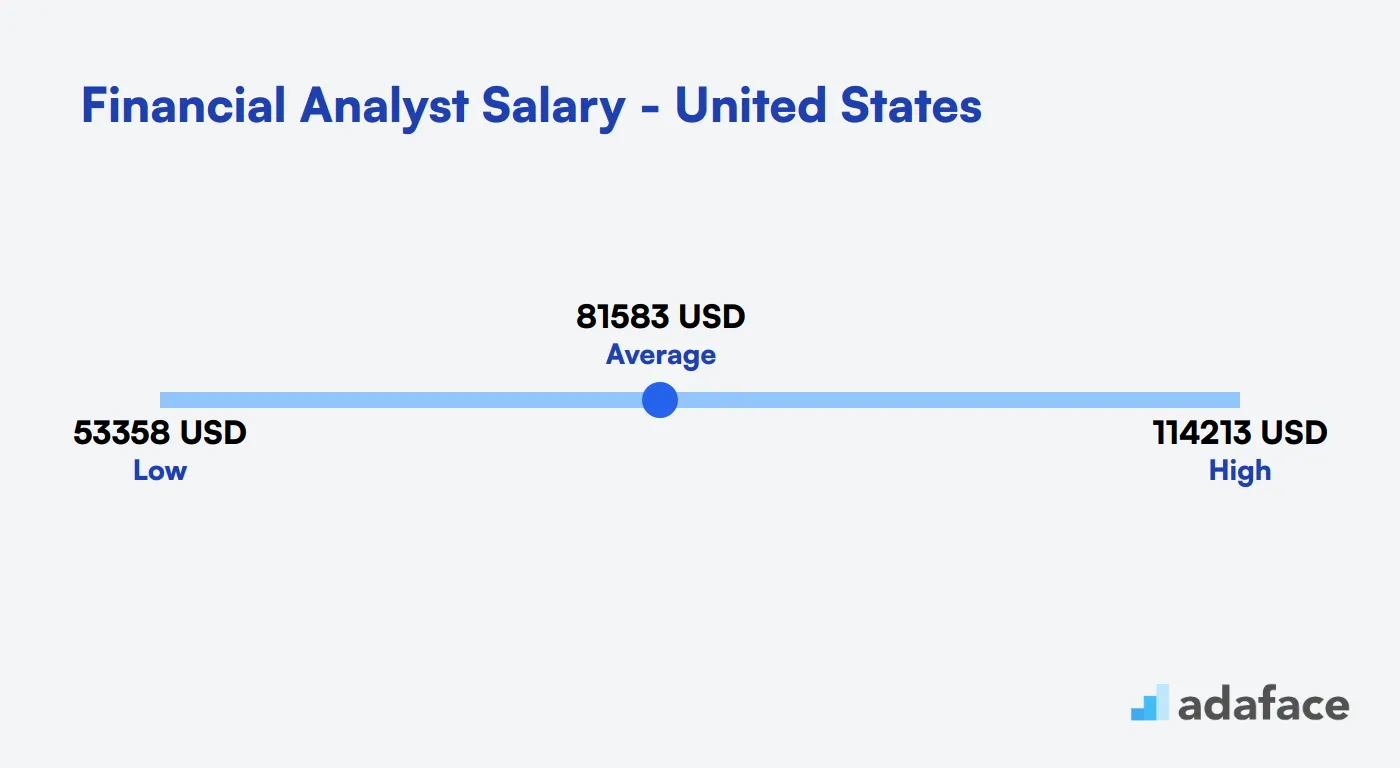

Understanding the Costs of Hiring a Financial Analyst

The cost to hire a Financial Analyst varies significantly based on factors such as location and experience. In the United States, the average salary is around $81,583 per year, with a range typically between $53,359 and $114,213. When budgeting for this role, it's important to consider not only the salary but also potential benefits and overhead costs.

Financial Analyst Salary in the United States

The average salary for a Financial Analyst in the United States is approximately $81,583 per year. Salaries can range from around $53,359 at the lower end to about $114,213 at the higher end, depending on the location and experience of the candidate. Cities like Washington, DC and New York, NY tend to offer higher salaries, with medians of $91,824 and $86,226 respectively.

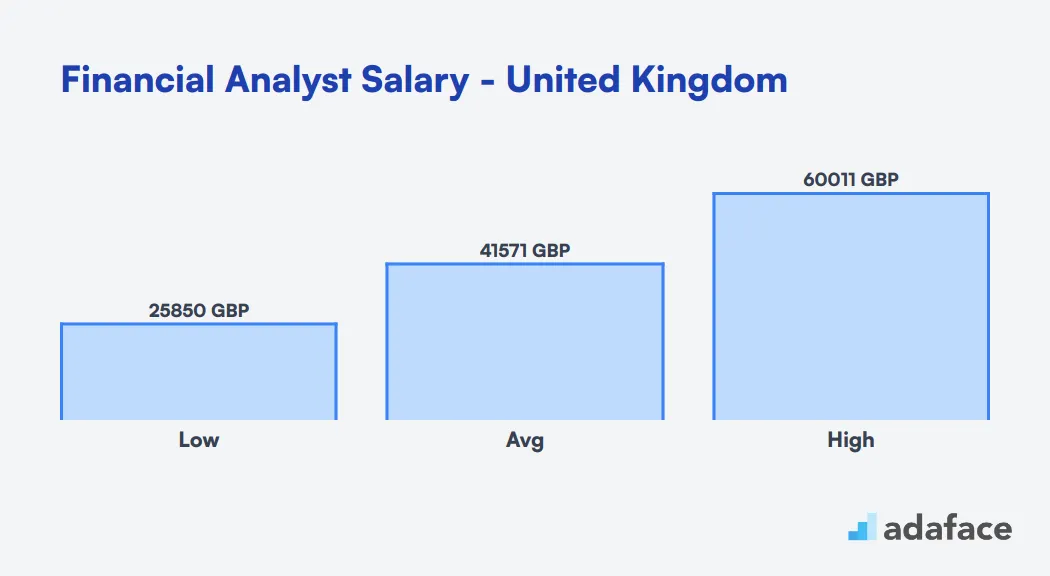

Financial Analyst Salary in the United Kingdom

In the United Kingdom, Financial Analysts can expect competitive salaries. The average annual salary for Financial Analysts in the UK ranges from £35,000 to £65,000, depending on experience, location, and company size.

London-based Financial Analysts typically earn higher salaries, with averages between £45,000 and £75,000 per year. Entry-level positions start around £30,000, while senior roles can exceed £100,000 annually.

What's the difference between a Financial Analyst and an Investment Analyst?

While Financial Analysts and Investment Analysts often sound similar, their roles have distinct areas of focus. This can lead to confusion among recruiters and hiring managers trying to fill these positions.

A Financial Analyst primarily focuses on evaluating a company's performance. Their responsibilities often include budgeting and forecasting, geared toward internal decision-making. Essential tools like Excel and ERP systems are part of their daily toolkit. Typically, they report to a finance manager and have experience ranging from 1-3 years.

Conversely, an Investment Analyst is more involved in identifying and analyzing investment opportunities. They conduct market research and valuations, which influence investment decisions. They use tools like Bloomberg and Reuters and report to a portfolio manager. Investment Analysts generally require 3-5 years of experience and often have a background in finance or economics.

To further understand the skills required for these roles, you may explore the skills required for financial analyst post, which delves into the specifics of each role.

| Financial Analyst | Investment Analyst | |

|---|---|---|

| Primary Focus | Company Performance | Investment Opportunities |

| Education Background | Finance, Business | Finance, Economics |

| Key Responsibilities | Budgeting, Forecasting | Market Research, Valuation |

| Analytical Tools | Excel, ERP Systems | Bloomberg, Reuters |

| Decision Influence | Internal Decisions | Investment Decisions |

| Experience Required | 1-3 Years | 3-5 Years |

| Reports To | Finance Manager | Portfolio Manager |

| Skillsets | Financial Modeling | Investment Analysis |

What are the ranks of Financial Analysts?

Financial Analysts play a crucial role in organizations by assisting with financial planning, analysis, and decision-making. However, many often confuse the various ranks and responsibilities associated with this role. Here's a breakdown of the typical hierarchy in financial analysis roles, which helps distinguish between their duties.

- Junior Financial Analyst: This entry-level position involves assisting higher-level analysts with data collection and analysis. Junior analysts often handle routine tasks such as generating reports and managing spreadsheets, providing a strong foundation for their career in finance.

- Financial Analyst: Once individuals gain experience, they typically move into the role of Financial Analyst. They conduct deeper analyses and prepare reports for management, providing insights into financial performance and forecasts.

- Senior Financial Analyst: Senior Financial Analysts take on more responsibilities, including complex financial modeling and budget analysis. They work closely with management to drive strategic financial decisions and mentor junior analysts.

- Financial Planning & Analysis Manager: This role involves overseeing a team of analysts and managing the overall financial planning and analysis function. They ensure that financial strategies align with business goals. You can read more about the responsibilities of a Financial Analyst Job Description.

- Director of Financial Analysis: At the top of the hierarchy, the Director of Financial Analysis oversees the entire financial analysis department. They guide financial strategy and provide executive leadership with critical financial insights.

Hire Top-Notch Financial Analysts

In this guide, we've explored the significance of hiring financial analysts, their key responsibilities, the hiring process, and the skills needed for the role. We also touched upon crafting effective job descriptions and the best platforms to find suitable candidates, ensuring that you find someone who truly fits your organization's financial needs.

The single most important takeaway from this post is the use of accurate job descriptions and appropriate skills tests to streamline your hiring process. By assessing candidates with the right financial analyst test or utilizing tools from our assessment test library, you can ensure that your chosen financial analyst not only meets but exceeds expectations. This way, you confidently hire analysts who contribute meaningfully to your organization’s financial decisions.

Financial Analyst Test

FAQs

Look for strong analytical skills, proficiency in financial software, relevant certifications, and any previous experience in similar roles. Keywords that indicate analytical, strategic thinking, and attention to detail are essential.

Use skills tests to evaluate their technical competencies. Our Financial Analyst Test can help in assessing analytical and quantitative skills effectively.

While both roles involve evaluating financial data, financial analysts typically focus on internal budget management and corporate finance, whereas investment analysts assess investment opportunities and manage portfolios.

Consider platforms like LinkedIn, specialized financial job boards, and recruitment agencies with a focus on finance sector roles.

Financial modeling is crucial for analysts to create forecasts and budgets. It helps in predicting company performance and making strategic decisions.

Certifications like CFA, CPA, or advanced degrees in finance can be advantageous and indicate a higher level of expertise and commitment to the profession.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources