As a recruiter or hiring manager, you're tasked with finding a Budget Analyst who can navigate the complex world of financial planning and analysis. Many organizations underestimate the impact a skilled Budget Analyst can have on their financial health and decision-making processes. The right candidate doesn't just crunch numbers; they provide insights that drive strategic financial planning and resource allocation.

This guide will walk you through the process of hiring a top-notch Budget Analyst, from understanding the role to conducting effective interviews. We'll cover essential skills, crafting compelling job descriptions, and utilizing the best screening methods to ensure you find the perfect fit for your organization.

Table of contents

Why Hire a Budget Analyst?

Hiring a budget analyst can help your organization manage finances more effectively. These professionals analyze spending patterns, create financial reports, and recommend ways to improve budget allocation. For example, they might identify areas where costs can be cut or suggest investments that could yield better returns.

Consider hiring a budget analyst if you're facing challenges like:

- Difficulty in tracking expenses across departments

- Inconsistent financial forecasting

- Need for more accurate budget planning

Before committing to a full-time hire, assess your company's specific needs. For smaller projects or short-term financial planning, working with a consultant or using financial assessment tools might be more suitable. As your financial management needs grow more complex, bringing a dedicated budget analyst on board can provide long-term benefits.

What does a Budget Analyst do?

A Budget Analyst plays a key role in an organization's financial planning and management. They analyze budgets, review funding requests, and recommend spending plans to ensure the company's financial health and goal alignment.

The day-to-day responsibilities of a Budget Analyst include:

- Reviewing budget proposals and funding requests

- Analyzing financial data and preparing budget reports

- Forecasting future financial needs

- Monitoring spending to ensure it stays within budget

- Recommending ways to reduce costs and improve efficiency

- Collaborating with department heads to develop budget plans

- Ensuring compliance with financial regulations and policies

Budget Analyst Hiring Process

Hiring a Budget Analyst generally takes about 6 to 8 weeks. Here's a straightforward overview of the steps involved in the process.

- Define the Job: Start with a clear job description tailored to your needs. This helps attract the right candidates.

- Post the Job: Share the job listing on relevant platforms. Expect to receive applications within a few days.

- Resume Screening: Review resumes and shortlist candidates based on qualifications and experience. This step usually takes about a week.

- Skill Testing: Administer job-specific skill assessments. This could include analytical tests or finance-related case studies. Allocate another week for this phase.

- Interviews: Conduct interviews with the shortlisted candidates. This can take roughly 1 to 2 weeks.

- Job Offer: Once you identify the best candidate, proceed to extend the offer. This can take an additional week based on negotiations.

In summary, the overall hiring process for a Budget Analyst spans about 1 to 2 months. By following these steps systematically, you can ensure a smooth hiring experience. We will explore each step in detail to help you streamline your recruitment process.

Key Skills and Qualifications for a Budget Analyst

Creating a candidate profile for a Budget Analyst can be tricky, as the requirements may vary significantly across different organizations. What one company considers a necessity, another may view as a bonus. It's important to clearly distinguish between the skills and qualifications that are required versus those that are preferred.

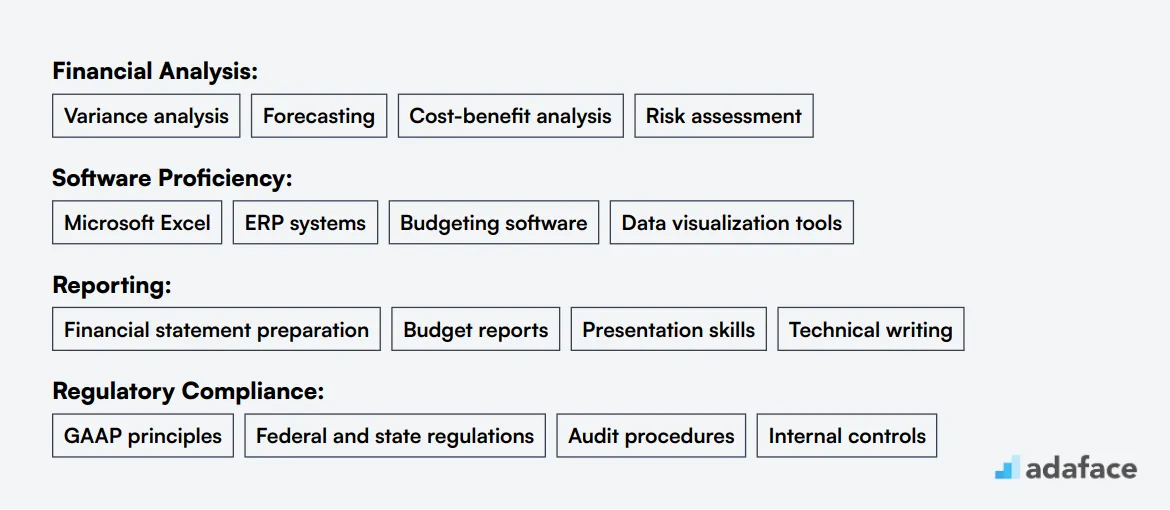

Start with the required skills, which typically include a Bachelor's degree in Finance, Accounting, or Economics, along with several years of relevant experience. Proficiency in Excel for financial modeling, strong analytical abilities, and knowledge of budgeting principles are also key.

Next, consider the preferred qualifications. While a Master's degree can enhance a candidate's profile, familiarity with ERP systems and data visualization tools might give them a competitive edge. Certifications like CPA are beneficial, especially for candidates with experience in government or non-profit sector budgeting.

To further assist in the hiring process, exploring skills assessment tools can help in evaluating candidates' proficiencies effectively.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Finance, Accounting, Economics, or related field | Master's degree in Finance or related field |

| 3+ years of experience in budget analysis or financial planning | Experience with ERP systems (e.g., SAP, Oracle) |

| Proficiency in Excel and financial modeling | Familiarity with data visualization tools (e.g., Tableau, Power BI) |

| Strong analytical and problem-solving skills | Certified Public Accountant (CPA) or similar certification |

| Knowledge of budgeting principles and financial regulations | Experience in government or non-profit sector budgeting |

How to write a Budget Analyst job description?

Once you have crafted a candidate profile, the next step is to translate that information into a compelling job description that attracts the right talent. An effective Budget Analyst job description should highlight the key aspects of the role while also showcasing what makes your organization unique.

• Highlight key responsibilities and impact: Clearly outline the core responsibilities of the Budget Analyst, including financial forecasting, budget preparation, and variance analysis. This will demonstrate the role's importance in achieving the company's financial goals and help attract candidates who are looking for impactful work.

• Balance technical skills with soft skills: While it's important to mention technical skills like proficiency in budgeting software and financial modeling, don't forget to include soft skills such as analytical thinking and communication. A well-rounded candidate will possess both technical expertise and the ability to collaborate effectively with other teams.

• Showcase company and role’s unique selling points: Highlight what sets your company apart, whether it’s a dynamic work environment, opportunities for growth, or innovative projects. Candidates want to know why they should choose your organization over others, so make sure to convey that in your description. For a detailed job description, you might refer to the Budget Analyst job description.

Top Platforms to Hire Budget Analysts

Now that you have a well-crafted job description, it's time to post it on job listing sites to attract qualified budget analyst candidates. The right platform can significantly impact the quality and quantity of applicants you receive. Let's explore some top options for finding your ideal budget analyst.

Dice - Budget Analyst Jobs

Ideal for finding budget analysts with strong technical skills, especially for roles requiring financial software expertise or data analysis capabilities.

Indeed - Budget Analyst Jobs

A broad platform suitable for posting various types of budget analyst positions, from entry-level to senior roles across different industries.

LinkedIn - Budget Analyst Jobs

Excellent for targeting experienced budget analysts and leveraging professional networks for referrals and background checks.

Other notable platforms include CareerBuilder for reaching diverse candidates, Monster for wide-reach postings, Accountemps for temporary staffing needs, and Upwork for freelance budget analysts. Each platform offers unique advantages, so consider your specific requirements when choosing where to post your job listing. Remember to leverage skills assessment tools to evaluate candidates effectively once you start receiving applications.

How to Screen Budget Analyst Resumes

Resume screening is a necessary step in the hiring process, especially when the applicant pool is large. It helps weed out candidates who don't meet basic qualifications, allowing you to focus on those who have the potential to excel as a Budget Analyst.

When manually screening resumes, focus on identifying primary and secondary keywords that align with the job requirements. Look for terms related to budgeting, financial analysis, and financial planning. This initial scan helps eliminate candidates who lack the necessary skills, like proficiency in Excel or experience with ERP systems.

Using AI tools like LLMs can streamline resume screening by automating keyword matching. You can prompt an AI to identify keywords and assess their relevance to the job description. This method is particularly helpful for managing large volumes of applications efficiently.

Here is a handy example of an AI prompt you can use:

TASK: Screen resumes to match job description for Budget Analyst role

INPUT: Resumes

OUTPUT: For each resume, provide the following information:

- Email id

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (detailed recommendation of whether to shortlist this candidate or not)

- Shortlist (Yes, No, or Maybe)

RULES:

- If you are unsure about a candidate's fit, put the candidate as Maybe instead of No

- Keep recommendation crisp and to the point.

KEYWORDS DATA:

- Education (Bachelor's or Master's in Finance, Accounting)

- Experience (budget analysis, ERP systems)

- Skills (Excel, financial modeling)

Recommended skills tests to screen Budget Analysts

When hiring Budget Analysts, using skills tests is a straightforward way to ensure candidates possess the specific abilities needed for the role. Testing can help you quickly identify candidates with the right skills, ensuring better hiring decisions. Here are our top recommendations for assessing Budget Analysts:

Financial Analyst Test: This test evaluates candidates' ability to analyze financial data, which is a key part of a Budget Analyst's role. It assesses understanding of financial statements and their implications on budgeting decisions. Learn more about Financial Analyst Test.

Accounting Test: Budget Analysts need a solid grasp of accounting principles. This test covers essential accounting skills and ensures the candidate can handle financial records accurately. Explore the Accounting Test.

Excel Test: Proficiency with Excel is necessary for data analysis and creating budgets. This test assesses a candidate's ability to use Excel for financial modeling and data manipulation. Discover the Excel Test.

Data Interpretation Test: Budget Analysts often need to interpret complex data sets. This test helps identify candidates who can extract meaningful insights from data, a crucial skill for budgeting tasks. Check out the Data Interpretation Test.

Financial Modeling Test: Assessing financial modeling skills is important as Budget Analysts frequently need to create scenarios and predict financial outcomes. This test evaluates the ability to build and interpret complex financial models. Understand the Financial Modeling Test.

Structuring the Interview Stage for Budget Analyst Candidates

After candidates pass the initial skills assessments, it's time for technical interviews to thoroughly evaluate their hard skills. While screening tests are great for filtering out unqualified applicants, they don't always identify the best fit for the role. Technical interviews allow you to dig deeper into a candidate's expertise and problem-solving abilities.

Here are some sample interview questions for Budget Analyst candidates:

- How do you approach creating a budget forecast?

- Can you explain the difference between financial modeling and budgeting?

- What methods do you use to identify cost-saving opportunities?

- How do you handle conflicting budget priorities from different departments?

- Can you walk me through your process for variance analysis?

- What financial software are you most comfortable using for budget management?

Cost Considerations for Hiring a Budget Analyst

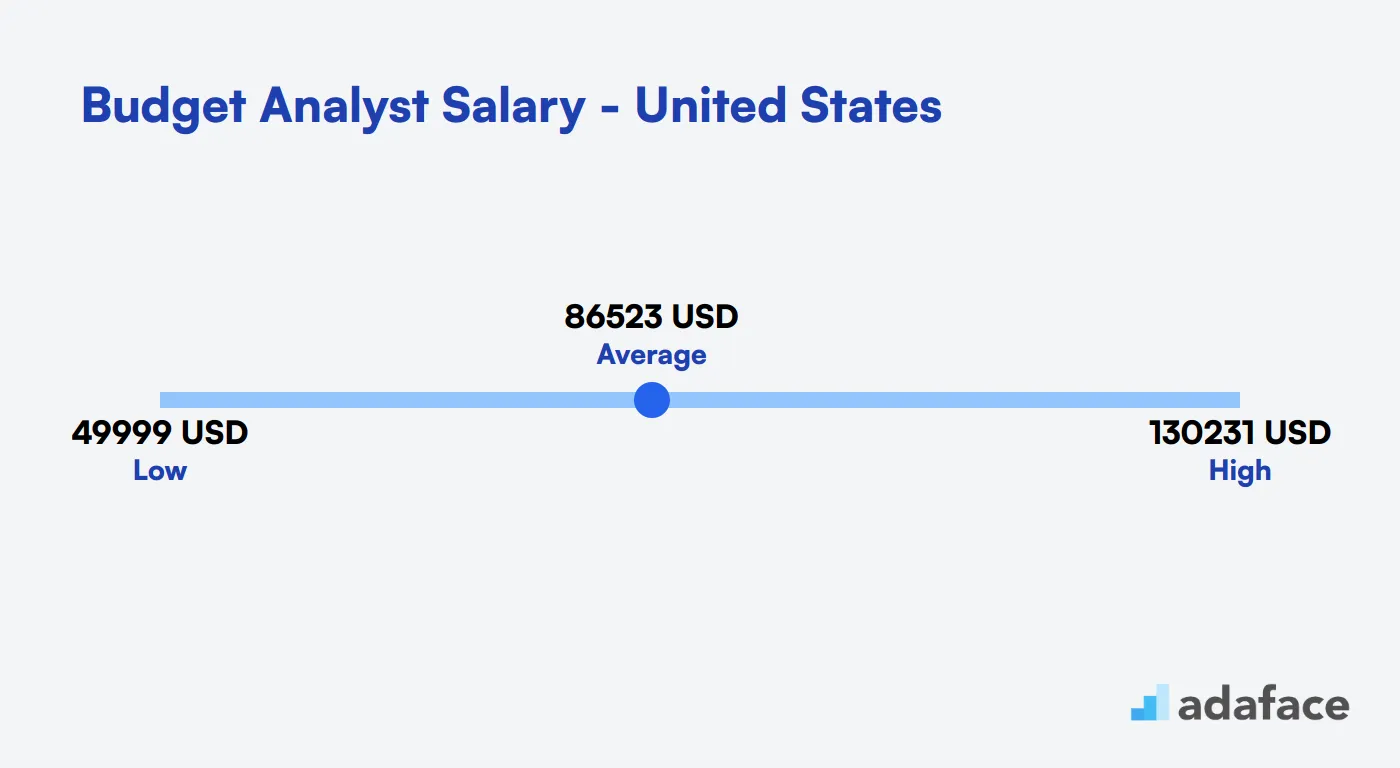

When hiring a Budget Analyst, expect to pay an average salary ranging from $50,000 to $130,000 annually in the United States. Factors such as location, experience, and industry can significantly influence these figures, with median salaries around $80,700 and averages at approximately $86,500.

Budget Analyst salary United States

In the United States, the salary for a Budget Analyst typically ranges from $50,000 to $130,000 annually. The median salary stands at about $80,700, while the average is around $86,500. These figures can vary based on location, experience, and the specific industry sector. Areas like Fort Belvoir, VA and Arlington, VA tend to offer higher salary ranges for this role.

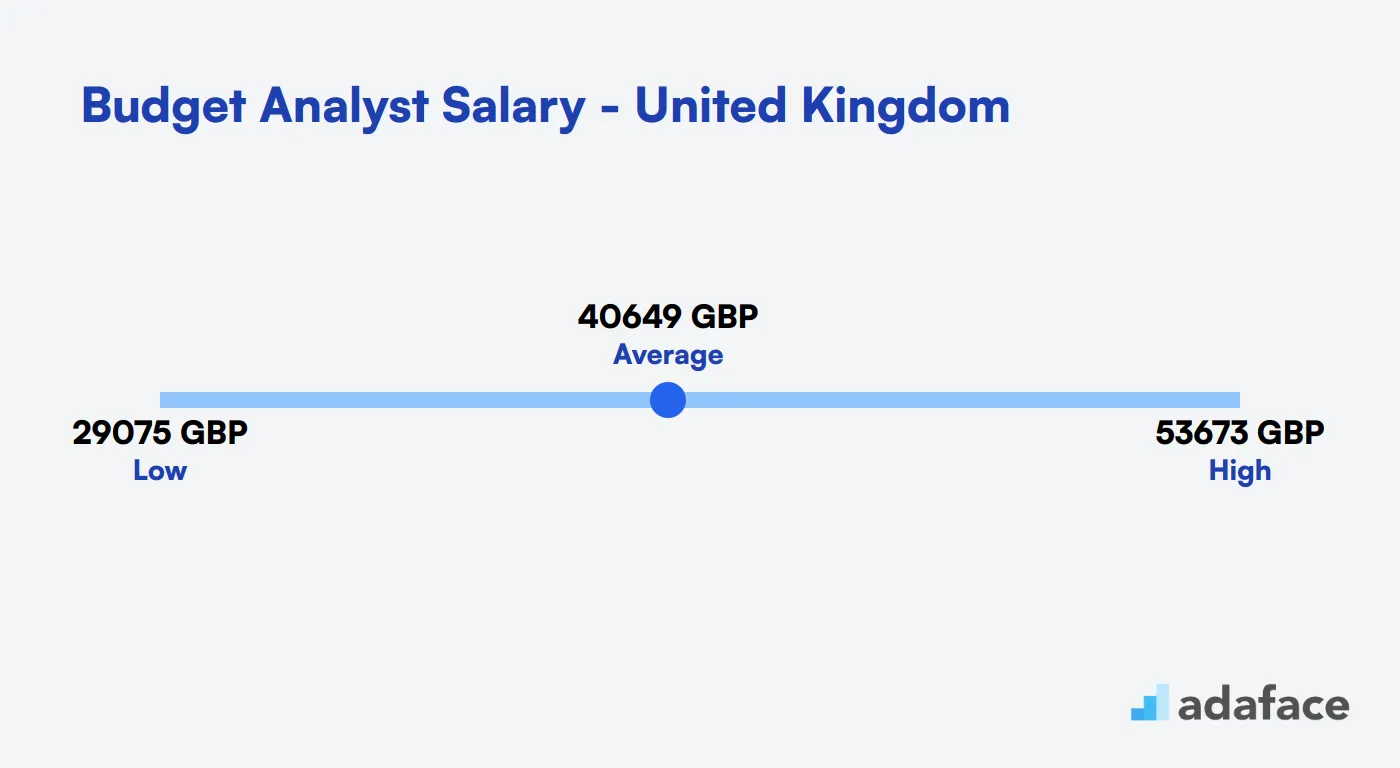

Budget Analyst Salary in the United Kingdom

Budget Analysts in the UK typically earn between £25,000 to £55,000 per year. The average salary is around £35,000, with experienced professionals in senior roles potentially earning up to £70,000 annually.

Salaries can vary based on factors such as location, industry, and experience level. For instance, Budget Analysts working in London or for large corporations often command higher salaries compared to those in smaller cities or organizations.

What's the difference between a Financial Analyst and a Budget Analyst?

People often confuse the roles of Financial Analyst and Budget Analyst due to their overlapping responsibilities in the finance sector. At first glance, both positions seem to deal with numbers and financial data, but they serve distinct purposes within an organization.

A Financial Analyst primarily focuses on investment analysis, utilizing skills in financial modeling and valuation. They typically work in environments like investment banks and corporations, using tools such as Excel and Bloomberg Terminal. Their role involves analyzing financial data to guide investment decisions, often requiring degrees in finance or economics and certifications like CFA or CPA.

In contrast, a Budget Analyst concentrates on budget planning, applying skills related to budgeting and forecasting. They usually find employment in government or non-profit organizations, relying on tools such as SAP and Oracle to prepare budget reports. Their work revolves around resource allocation decisions and often requires degrees in accounting or business management, with certifications such as CMA or CGFM.

| Financial Analyst | Budget Analyst | |

|---|---|---|

| Primary Focus | Investment Analysis | Budget Planning |

| Key Skills | Financial Modeling, Valuation | Budgeting, Forecasting |

| Tools Used | Excel, Bloomberg Terminal | SAP, Oracle |

| Degree Requirement | Finance, Economics | Accounting, Business Management |

| Work Environment | Investment Banks, Corporations | Government, Non-profits |

| Certifications | CFA, CPA | CMA, CGFM |

| Job Role | Analyze Financial Data | Prepare Budget Reports |

| Decision Level | Investment Decisions | Resource Allocation Decisions |

What are the ranks of Budget Analysts?

Understanding the various ranks of budget analysts is important as these roles can often be confused with other financial positions. Different ranks within budget analysis offer distinct responsibilities and opportunities for specialization within the field.

Junior Budget Analyst: This is an entry-level position where individuals assist senior analysts in data collection and analysis. They typically work under supervision and handle tasks such as preparing financial reports and tracking expense patterns.

Budget Analyst: As a mid-level position, budget analysts are responsible for developing budgets and preparing financial plans. They analyze data, provide recommendations, and ensure compliance with financial regulations. Individuals in this role often serve as a bridge between junior analysts and management.

Senior Budget Analyst: Senior budget analysts hold a more experienced role, where they are tasked with overseeing budget preparation and long-term financial planning. They play a key role in strategic decision-making and often lead a team of junior analysts. This role requires a deep understanding of financial principles and the ability to communicate insights to stakeholders.

For more insights on preparing for hiring a budget analyst, you can explore our budget analyst interview questions to better evaluate potential candidates.

Hire the Best Budget Analysts for Your Organization

Throughout this guide, we've covered the key aspects of hiring budget analysts, from understanding their role to crafting job descriptions and conducting interviews. The hiring process for budget analysts requires careful consideration of their analytical skills, financial acumen, and ability to work with complex data.

If there's one takeaway from this post, it's the importance of using well-crafted job descriptions and targeted skills assessments to ensure accurate hiring. Implementing a financial analyst test can help you evaluate candidates' financial knowledge and analytical capabilities, making your hiring process more effective and reliable.

Financial Analyst Test

FAQs

Key skills for a Budget Analyst include financial analysis, proficiency in Excel and budgeting software, attention to detail, strong communication skills, and the ability to interpret complex financial data. Look for candidates with a solid understanding of accounting principles and experience in budget preparation and forecasting.

When screening resumes, focus on candidates with relevant education in finance or accounting, experience in budget analysis or related fields, and specific skills like financial modeling and data analysis. Look for achievements that demonstrate their ability to improve financial processes or contribute to cost savings.

Ask questions that assess their technical skills, problem-solving abilities, and communication skills. Include scenario-based questions about budget variances, forecasting challenges, and presenting financial data to non-financial stakeholders. You can find a comprehensive list of Budget Analyst interview questions on our website.

Utilize skills assessment tools and tests specifically designed for Budget Analysts. These can include Excel tests, financial analysis simulations, and data interpretation exercises. Adaface offers tailored assessment tests that can help evaluate a candidate's technical proficiency.

Be cautious of candidates who lack attention to detail in their application materials, struggle to explain complex financial concepts in simple terms, or have limited experience with budgeting software and tools. Also, watch for those who show little interest in understanding the broader business context of financial decisions.

The hiring process for a Budget Analyst typically takes 4-6 weeks, including resume screening, initial interviews, skills assessments, and final interviews. However, this timeline can vary depending on the organization's needs and the candidate pool's quality.

To attract top talent, offer competitive compensation, highlight opportunities for professional growth, and showcase your company's financial stability and innovative projects. Emphasize the impact the role will have on the organization's success and any unique benefits or work culture aspects that set your company apart.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources