Hiring an Accounting Specialist can be a game-changer for your company's financial operations. These professionals bring precision, expertise, and efficiency to your accounting processes. However, many recruiters stumble when it comes to identifying the right candidate who can truly elevate their financial team. The key lies in understanding the nuances of the role and aligning them with your organization's specific needs.

This comprehensive guide will walk you through the process of hiring an Accounting Specialist, from defining the role to making the final selection. We'll cover essential skills, effective job descriptions, and proven assessment techniques. To get started, check out our Accounting Skills Test to evaluate potential candidates objectively.

Table of contents

Key Skills and Qualifications for an Accounting Specialist

Hiring an Accounting Specialist can be tricky, especially when determining the right mix of skills and qualifications. It's important to recognize that what is required for one organization may be seen as a preference for another. By clearly distinguishing between the two, you can create an effective candidate profile tailored to your company's needs.

When building the ideal profile, consider these required skills: a Bachelor's degree in Accounting or Finance, CPA certification (or in progress), at least three years of relevant experience, proficiency in accounting software like QuickBooks, and strong knowledge of GAAP. Additionally, the preferred qualifications may include a Master's degree, industry-specific experience, familiarity with data analytics tools, and project management skills.

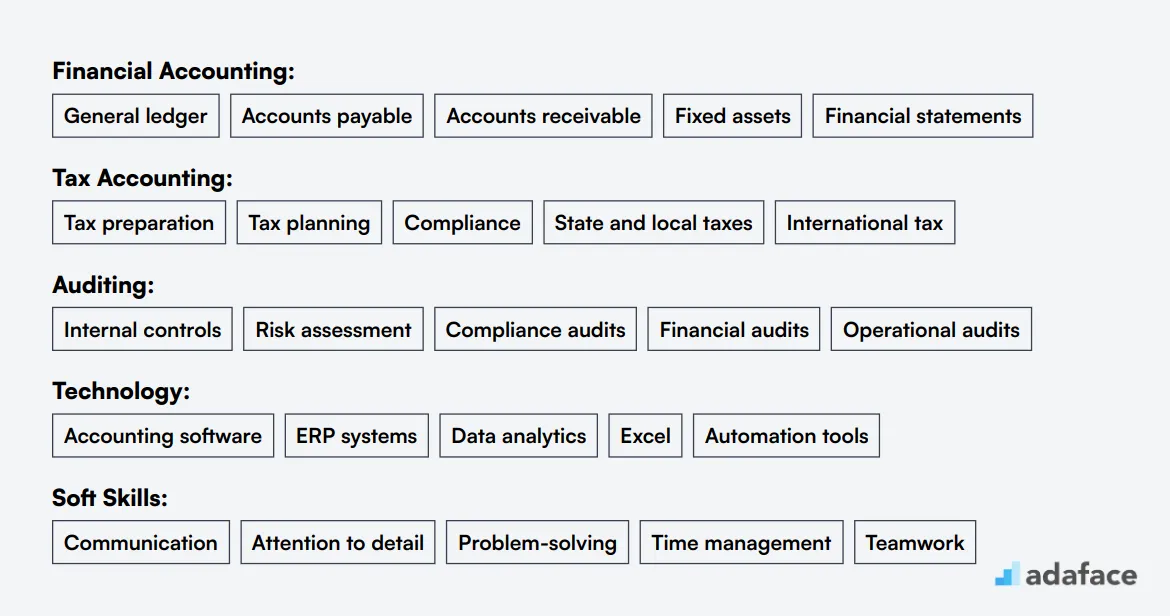

A solid grasp of skills in Financial Accounting, Tax Accounting, Auditing, Technology, and essential soft skills will set a strong foundation for any candidate. For more insight into assessing these skills, take a look at our skills assessment tools.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Accounting, Finance, or related field | Master's degree in Accounting or MBA |

| CPA certification or actively pursuing it | Experience in a specific industry (e.g., manufacturing, healthcare) |

| Minimum of 3 years of experience in accounting or auditing | Knowledge of data analytics tools |

| Proficiency in accounting software (e.g., QuickBooks, SAP) | Familiarity with ERP systems |

| Strong knowledge of GAAP and financial reporting standards | Project management skills |

How to Write an Effective Accounting Specialist Job Description

Once you've defined the ideal candidate profile for your Accounting Specialist role, the next step is crafting a compelling job description to attract top talent. A well-written Accounting Specialist job description can make all the difference in attracting qualified candidates. Here are some key tips to consider:

- Clearly outline the main responsibilities and expected impact of the role

- Balance technical requirements (e.g., proficiency in accounting software) with soft skills (like attention to detail and communication)

- Highlight any unique aspects of your company or the role that might appeal to candidates

- Include information about growth opportunities and company culture to attract long-term fits

Top Platforms to Hire Accounting Specialists

Once you have a well-defined job description for an Accounting Specialist, the next step is to list it on various job platforms to source potential candidates. Utilizing job listing sites can significantly broaden your reach, helping you connect with qualified professionals who fit your needs.

Indeed Accounting Specialist Jobs

Ideal for a wide range of accounting specialist positions across various industries and company sizes. Offers a large pool of candidates and easy-to-use search filters.

LinkedIn Accounting Specialist Jobs

Best for finding experienced accounting specialists with established professional networks. Allows for direct outreach and viewing of candidate profiles and recommendations.

Robert Half Accounting and Finance

Specialized in finance and accounting recruitment. Offers personalized service and access to pre-screened candidates, ideal for companies seeking high-quality, vetted accounting specialists.

Here are three platforms to consider: Indeed Accounting Specialist Jobs offers a vast pool of candidates across various industries, while LinkedIn Accounting Specialist Jobs is perfect for tapping into professional networks. For a more tailored approach, Robert Half Accounting and Finance provides personalized services with access to pre-screened candidates.

In addition to these platforms, you can also explore specialized boards such as Accountingfly, which focuses on accounting professionals, and Upwork for freelance opportunities. If you're looking for CPAs, check out the AICPA, while Dice can help you find tech-savvy accounting specialists. For diverse candidates, consider CareerBuilder, and for temporary staffing needs, Accountemps is an excellent choice.

Keywords to Look for in Accounting Specialist Resumes

Resume screening is a key step in finding the right Accounting Specialist. It helps you quickly identify candidates with the most relevant skills and experience before moving to interviews.

When manually screening resumes, focus on key terms related to accounting skills, software proficiency, and certifications. Look for mentions of financial accounting, tax preparation, auditing experience, and familiarity with accounting software like QuickBooks or SAP.

To streamline the process, consider using AI-powered tools for initial resume screening. These tools can quickly scan large numbers of resumes and highlight candidates that best match your criteria based on predefined keywords and qualifications.

Here's a sample prompt for AI-based resume screening:

TASK: Screen resumes for Accounting Specialist role

INPUT: Resumes

OUTPUT: For each resume, provide:

- Name

- Matching keywords

- Score (out of 10)

- Shortlist recommendation (Yes/No/Maybe)

KEYWORDS:

- Financial accounting (GAAP, financial statements)

- Tax accounting (tax preparation, compliance)

- Auditing (internal controls, risk assessment)

- Software (QuickBooks, SAP, Excel)

- Certifications (CPA, CMA)

- Education (Bachelor's in Accounting or Finance)

Recommended skills tests to assess Accounting Specialists

To ensure you hire the right Accounting Specialist, skills tests are an effective way to evaluate a candidate's abilities beyond their resume. By using targeted skills assessments, you can pinpoint the right fit for your organization from the pool of applicants.

The Accounting Test is tailored to assess candidates' understanding of core accounting principles and practices. This test helps in evaluating their capability to handle daily accounting tasks that are crucial for your business operations. Explore the Accounting Test.

For those candidates who need to demonstrate a strong grasp of financial regulations and procedures, the Financial Accounting Test is the perfect choice. This assessment delves into financial reporting standards, ensuring your candidate can manage your organization's financial health. Learn more about Financial Accounting Test.

Given the importance of data analysis in accounting roles, the Excel Test is a great tool to gauge an applicant's proficiency in using Excel for data management, analysis, and reporting. This test ensures that your candidate can handle complex data sets and produce meaningful insights. Get insights into the Excel Test.

The Attention to Detail Test is indispensable for roles that require meticulousness and accuracy. This assessment will help you identify candidates who thrive on precision and can maintain high standards in their work. Discover more about the Attention to Detail Test.

Lastly, the QuickBooks Test is specialized for applicants who need to manage finances using QuickBooks software. This test ensures that your potential hires can seamlessly integrate into your existing financial processes. Check out the QuickBooks Test.

How much does it cost to hire an Accounting Specialist?

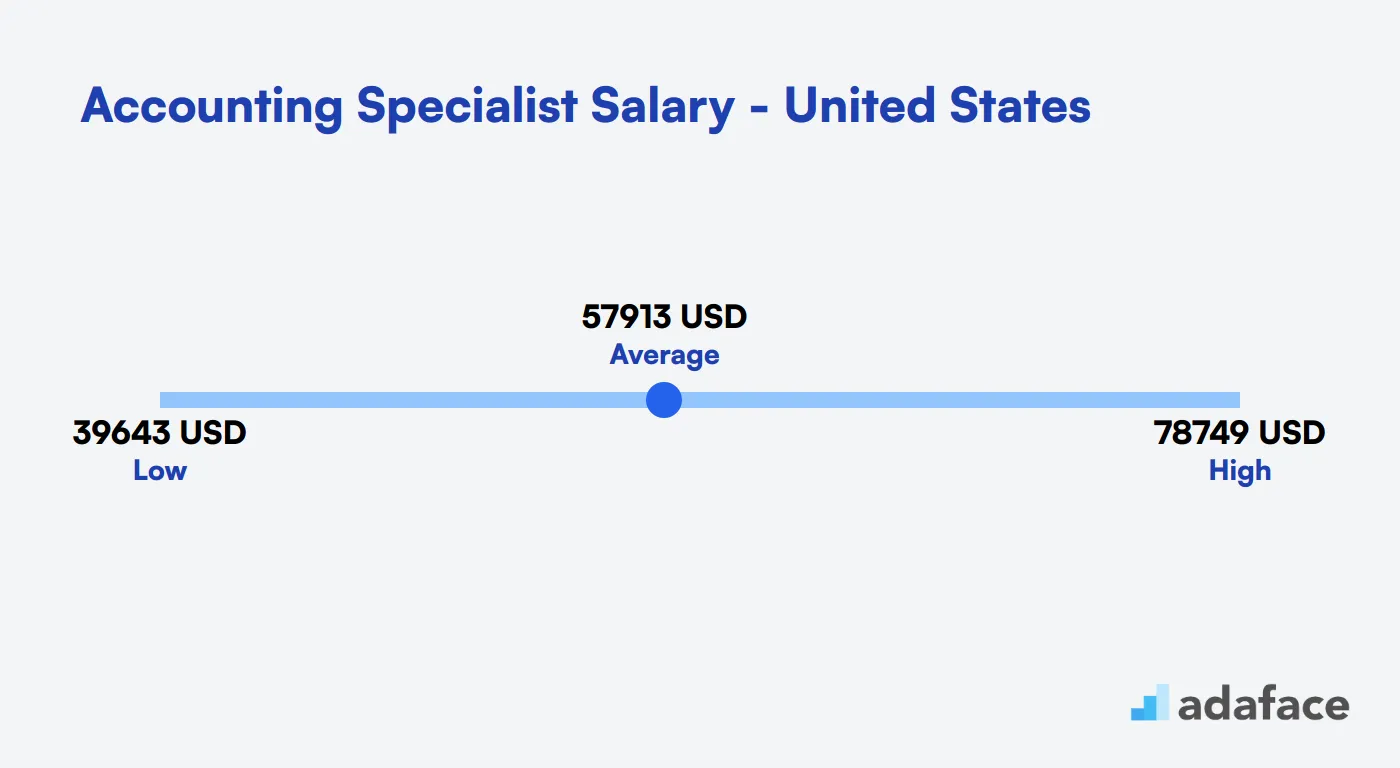

The cost of hiring an Accounting Specialist can vary widely based on location, experience, and industry. In the United States, salaries typically range from $39,644 to $78,749, with a median around $55,874. Across other countries, like Australia and Canada, average figures can be AUD 118,198 and $60,956 CAD respectively. Remember, regions with a higher cost of living or high demand might see salaries at the upper end of these ranges.

Accounting Specialist Salary in the United States

The average salary for Accounting Specialists in the United States ranges from $39,644 to $78,749, with a median of $55,874. Salaries can vary based on factors like location, experience, and company size.

Top-paying cities include Houston, TX (mean: $94,004), Omaha, NE (mean: $92,051), and Tampa, FL (mean: $91,108). Entry-level positions typically start lower, while experienced specialists in high-cost areas can earn significantly more.

Accounting Specialist Salary in Australia

The average salary for an Accounting Specialist in Australia is AUD 118,198 per year. Salaries typically range from AUD 85,116 to AUD 155,339, depending on the region and experience level. For instance, specialists in Sydney can earn between AUD 92,503 and AUD 171,542, while those in Canberra may see figures ranging from AUD 82,404 to AUD 118,147. Melbourne salaries generally fall between AUD 74,282 and AUD 146,950.

Accounting Specialist Salary in Canada

The salary for Accounting Specialists in Canada varies significantly by location. On average, a specialist can expect to earn around $60,956 CAD, with salaries ranging from a low of $43,189 CAD to a high of $81,004 CAD depending on the province and city.

What's the difference between an Accounts Payable Specialist and an Accounts Receivable Specialist?

Many people often confuse Accounts Payable Specialists with Accounts Receivable Specialists due to their similar-sounding titles and roles within the accounting department. However, these two positions have distinct responsibilities and focus on different aspects of a company's financial operations.

Accounts Payable Specialists primarily handle outgoing payments. They process invoices, manage vendor payments, and ensure the company's financial obligations are met on time. Their key skills include attention to detail and strong organizational abilities.

On the other hand, Accounts Receivable Specialists manage incoming payments. They're responsible for customer invoicing, payment collection, and maintaining healthy cash flow. These professionals need excellent communication and negotiation skills to handle customer inquiries and resolve payment disputes.

The tools used by these specialists also differ. Accounts Payable Specialists typically work with software like SAP, QuickBooks, and Excel, while Accounts Receivable Specialists might use Salesforce, Excel, and NetSuite. Both roles require a background in accounting or finance, but Accounts Receivable Specialists may also benefit from economics knowledge.

When it comes to performance metrics, Accounts Payable Specialists are evaluated on payment accuracy and timeliness, while Accounts Receivable Specialists are judged on collection efficiency and aged receivables. Understanding these differences is key for recruiters to find the right fit for each role.

| Accounts Payable Specialist | Accounts Receivable Specialist | |

|---|---|---|

| Primary Focus | Handling outgoing payments | Managing incoming payments |

| Key Responsibilities | Invoice processing, vendor payment | Customer invoicing, payment collection |

| Required Skills | Attention to detail, organization | Communication, negotiation |

| Typical Tools Used | SAP, QuickBooks, Excel | Salesforce, Excel, NetSuite |

| Educational Background | Accounting, Finance, Business | Accounting, Finance, Economics |

| Reporting | Reports to Accounts Payable Manager | Reports to Accounts Receivable Manager |

| Performance Metrics | Payment accuracy, on-time payments | Collection efficiency, aged receivables |

| Common Challenges | Invoice discrepancies, payment delays | Late payments, customer disputes |

What are the ranks of Accounting Specialists?

Many people often confuse the nuances between different accounting roles. While the titles might sound similar, each position has its unique set of responsibilities and hierarchy. Understanding these differences can help in making informed hiring decisions.

- Accounting Clerk: They are entry-level professionals responsible for basic accounting tasks such as data entry, maintenance of accounting records, and assisting with financial reports. Their role is foundational in ensuring accurate and up-to-date financial data.

- Accounts Payable/Receivable Specialist: These specialists handle specific functions related to managing the organization's outgoing and incoming payments. This role requires familiarity with accounting software and often collaborates closely with vendors and customers.

- Junior Accountant: A step above clerks and specialists, junior accountants perform a range of accounting activities including preparing journal entries, assisting in audits, and analyzing financial data. They may also contribute to financial statement preparation.

- Senior Accountant: Senior accountants take on more complex tasks such as managing financial reporting, tax preparation, and internal audits. They often supervise junior team members and are integral in strategic financial planning.

- Accounting Manager: As leaders of the accounting team, accounting managers oversee daily operations, ensure compliance with financial regulations, and develop organizational budgets. They serve as a bridge between the accounting department and upper management. You can find a detailed accounting manager job description to understand their role better.

Hire the Right Accounting Specialists for Your Needs

In this guide, we discussed the key skills and qualifications necessary for an Accounting Specialist, how to craft an effective job description, and the best platforms for hiring. We also covered essential resume keywords and recommended skills tests to ensure you identify top-tier candidates.

If there's one key takeaway, it's to focus on creating accurate job descriptions and using skills tests to streamline your hiring process. Consider employing accounting tests to assess candidates efficiently and ensure you're selecting the right fit for your team.

Accounting Assessment Test

FAQs

Key skills for an Accounting Specialist include proficiency in financial software, attention to detail, analytical thinking, knowledge of accounting principles, and strong communication abilities. Technical skills in areas like Excel and financial reporting are also crucial.

To assess technical skills, use a combination of methods such as financial accounting tests, case studies, and practical assignments. These can help evaluate a candidate's proficiency in accounting software, financial analysis, and problem-solving abilities.

An effective job description should include key responsibilities, required qualifications, desired skills, and information about your company culture. Be specific about the types of financial tasks they'll handle and any specialized knowledge required. You can refer to our Accounting Specialist job description template for guidance.

Look for Accounting Specialists on professional networking sites, accounting job boards, and through referrals from your finance team. Partnering with accounting professional associations or universities with strong accounting programs can also be effective. Consider using remote hiring tools to expand your talent pool.

To ensure a good fit, clearly communicate your company's values and work culture during the interview process. Use behavioral interview questions to assess how candidates have handled situations in the past. Consider incorporating a trial period or project to see how they perform in real-world scenarios.

Ask a mix of technical and behavioral questions. Some examples include: 'How do you ensure accuracy in your work?', 'Describe a time when you identified and corrected a significant accounting error', and 'How do you stay updated with changes in accounting standards?' For more ideas, check our Accounting Specialist interview questions guide.

The hiring process for an Accounting Specialist typically takes 4-6 weeks, including job posting, resume screening, interviews, skills assessments, and reference checks. However, this can vary based on your company's specific needs and the availability of qualified candidates.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources