Hiring an Accounting Manager is crucial for businesses aiming to maintain financial accuracy and insight. As a recruiter or hiring manager, you can't underestimate the importance of this role, which involves not only handling financial reporting and analysis but also implementing accounting policies and procedures. Unfortunately, many companies may not fully grasp the diverse skills and specific qualifications an Accounting Manager should possess, often focusing solely on technical expertise without considering leadership and strategic capabilities.

In this blog post, we'll explore the various facets of hiring an Accounting Manager, from defining their roles and responsibilities to understanding the step-by-step hiring process. We'll also cover how to write a compelling job description and where to source top-tier candidates. For more insights on the skills required, you can check our detailed skills assessment tools.

Table of contents

Why Hire an Accounting Manager?

An Accounting Manager can be a game-changer for businesses facing financial challenges. They can streamline processes, ensure regulatory compliance, and improve financial reporting accuracy. For instance, if your company is struggling with cash flow management or needs to implement cost-cutting measures, an Accounting Manager could develop strategies to address these issues.

Consider hiring an Accounting Manager when:

- Your financial operations have become too complex for a bookkeeper

- You need someone to lead and mentor a growing accounting team

- Your business is expanding and requires more sophisticated financial planning

Before committing to a full-time hire, assess if your current financial challenges warrant a permanent position. For short-term projects or periodic financial overhauls, working with a consultant might be more cost-effective. However, if you need ongoing financial leadership and strategy, a full-time Accounting Manager could be the right choice for your business.

What Does an Accounting Manager Do?

An Accounting Manager oversees the financial operations of an organization, ensuring accurate financial reporting and compliance with relevant laws and regulations. They play a key role in managing accounting staff, developing budgets, and implementing financial strategies.

Day-to-day tasks of an Accounting Manager include:

- Supervising and reviewing the work of accounting staff to ensure accuracy and adherence to organizational policies.

- Developing and maintaining financial systems and procedures that enhance accuracy and efficiency.

- Preparing financial statements, budgets, and forecasts to provide insight into the company’s financial state.

- Coordinating audits and collaborating with external auditors to ensure compliance with accounting standards.

- Providing management with reports and analyses to aid in strategic decision-making and financial planning. For a deeper understanding of the skills needed, you can explore skills required for an accounting manager.

Accounting Manager Hiring Process

The hiring process for an Accounting Manager typically spans 1-2 months. Here's a quick overview of the timeline and steps involved:

- Create and post a detailed job description on relevant platforms

- Review resumes (expect initial applications within 3-4 days)

- Conduct skill assessments or case studies (about 1 week)

- Interview shortlisted candidates

- Make an offer to the best candidate

Each step requires careful consideration to ensure you find the right fit for your organization. In the following sections, we'll dive deeper into these stages, providing checklists and helpful resources for a successful hiring process.

Essential Skills and Qualifications for an Accounting Manager

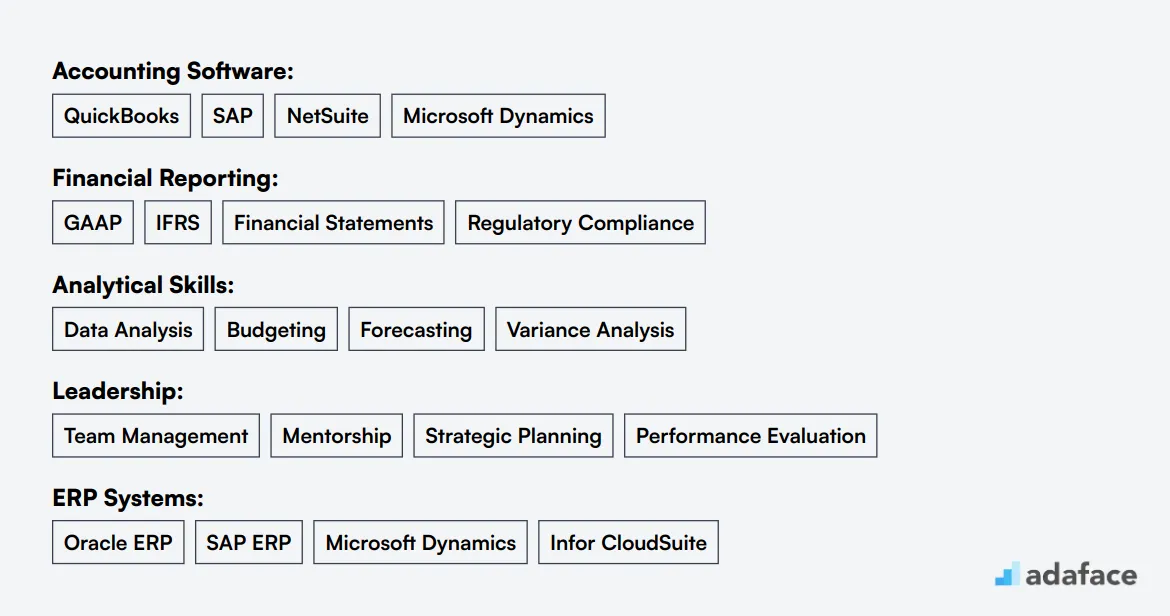

Hiring an Accounting Manager requires a clear understanding of both the required and preferred skills for the role. It's common for recruiters to conflate the two, mistaking strong preferences for must-haves, which can lead to a limited candidate pool. To simplify this process, it’s important to differentiate what is essential versus what can enhance a candidate's profile.

Typically, an Accounting Manager should possess a Bachelor's degree in Accounting or Finance, along with a minimum of 5 years of relevant experience. Proficiency in accounting software like QuickBooks or SAP, as well as a solid understanding of Generally Accepted Accounting Principles (GAAP), are also critical. Furthermore, analytical and problem-solving skills play a key role in their effectiveness.

On the other hand, preferred qualifications can set apart candidates in a competitive field. Certifications such as a Certified Public Accountant (CPA) or a Master’s degree can be advantageous. Experience with financial analysis, budgeting, and enterprise resource planning (ERP) systems can also enhance a candidate's fit for your organization.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Accounting, Finance, or a related field | Certified Public Accountant (CPA) or equivalent certification |

| Minimum of 5 years of accounting experience | Master's degree in Accounting or Finance |

| Proficiency in accounting software such as QuickBooks or SAP | Experience in financial analysis and budgeting |

| Strong understanding of Generally Accepted Accounting Principles (GAAP) | Experience with enterprise resource planning (ERP) systems |

| Excellent analytical and problem-solving skills | Proven success in managing a team |

How to write an Accounting Manager job description?

Once you've identified the ideal candidate profile, the next step is to craft an engaging job description to attract the right talent. A well-written job description serves as a powerful tool in recruiting the right Accounting Manager.

Here are a few tips to get you started:

- Define key responsibilities and impact: Clearly outline the specific tasks and outcomes expected from the Accounting Manager. Highlight how their role will contribute to the financial health and strategic goals of your organization. For a detailed breakdown of responsibilities, refer to this Accounting Manager job description.

- Balance technical skills with industry expertise: List necessary qualifications such as a CPA or CMA certification alongside industry experience in financial reporting and analysis. Don't forget to mention important soft skills, like leadership and communication, to ensure you attract well-rounded candidates.

- Showcase your company's unique aspects: Distinguish your company by emphasizing unique projects, opportunities for growth, or a dynamic team environment. These details can set your job listing apart and entice top talent to apply.

Top Platforms to Source Accounting Manager Candidates

Now that you have a well-crafted job description, it's time to post it on job listing sites to attract potential candidates. The right platform can significantly impact the quality and quantity of applicants you receive. Let's explore some of the best options for finding your next Accounting Manager.

LinkedIn Jobs

Ideal for finding full-time Accounting Manager positions in established companies. Offers extensive networking opportunities and detailed company profiles.

Indeed

A comprehensive job board for all types of Accounting Manager roles. Offers a wide range of positions from various companies and industries.

Glassdoor Jobs

Useful for full-time positions with added benefits of company reviews and salary information. Helps in making informed decisions about potential employers.

Beyond these popular sites, there are specialized platforms like Robert Half and Accounting Principals for finance-specific roles. For remote positions, FlexJobs is an excellent choice, while Upwork caters to freelance arrangements. Dice can be useful for tech-savvy accounting roles, and general job boards like CareerBuilder and Monster round out the options for a broad reach.

How to screen Accounting Manager resumes?

Screening resumes is a key step in the hiring process for an Accounting Manager role. It helps filter out candidates who do not meet the required qualifications and saves time by focusing on those who truly possess the skills you're looking for.

When manually screening resumes, focus on key keywords that align with the role's requirements. Look for terms such as Bachelor's degree in Accounting, GAAP, QuickBooks, or SAP. These indicate a candidate's foundational knowledge and experience in important areas. Also, prioritize candidates with a strong background in analytical and problem-solving skills.

Incorporating AI tools like language models can further streamline resume screening. By inputting the necessary keywords and qualifications into an AI, you can quickly identify resumes that match your criteria. This approach can significantly cut down on the manual work involved and increase accuracy in selecting potential candidates.

Here's a handy AI prompt to assist in screening resumes for the Accounting Manager role:

TASK: Screen resumes to match job description for Accounting Manager role

INPUT: Resumes

OUTPUT: For each resume, provide the following information:

- Email id

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (detailed recommendation of whether to shortlist this candidate or not)

- Shortlist (Yes, No, or Maybe)

RULES:

- If unsure about a candidate's fit, put the candidate as Maybe instead of No

- Keep recommendation crisp and to the point.

KEYWORDS DATA:

- Accounting Expertise (GAAP, Financial Reporting)

- Leadership (Team Management, Strategic Planning)

- Analytical Problem Solving (Data Analysis, Budgeting)

Recommended Skills Tests to Screen Accounting Managers

For hiring an Accounting Manager, using skills tests ensures that candidates possess the necessary expertise to handle the role's responsibilities. These tests help recruiters and hiring managers identify candidates with the right blend of technical and analytical skills. Here are our top recommendations:

Accounting Test: This test provides an accurate measure of a candidate's accounting knowledge and their ability to apply it effectively in real-world scenarios. It ensures that the candidate can handle key accounting tasks with confidence.

Financial Accounting Test: Use this test to evaluate the candidate's understanding of financial accounting principles. It is tailored to assess their capability to manage the financial records and reports essential for strategic decision-making.

Excel Test: Excel proficiency is a must-have for any Accounting Manager. This test gauges a candidate's skill in using Excel for data analysis, financial modeling, and reporting, crucial for maintaining accuracy in financial operations.

Financial Modeling Test: This test assesses the candidate's proficiency in building financial models, which are critical for forecasting and budgeting. It evaluates analytical skills and the ability to translate data into actionable insights.

Attention to Detail Test: An Accounting Manager must exhibit a high level of precision in their work. This test checks the candidate's ability to notice discrepancies and ensure accuracy in financial documents and processes.

How to structure the interview stage for hiring Accounting Managers

Once candidates have successfully cleared the skills tests, the next step is to bring them into technical interviews where their hard skills can be thoroughly evaluated. Skills tests are effective at filtering out unfit candidates, but technical interviews are critical for finding the best candidates suited for the accounting manager role. This is where you'll have the opportunity to ask sample interview questions that reveal their depth of knowledge and practical experience.

Consider asking questions like: How do you handle tight deadlines while ensuring accuracy in financial reports? This assesses time management and accuracy. What accounting software are you most comfortable using and why? evaluates their familiarity with tools. Describe a time you identified a significant error in a financial statement and how you corrected it, which tests problem-solving abilities. How do you ensure compliance with financial regulations? gauges their understanding of legal requirements. Additionally, you might ask about conflict resolution experiences to determine their leadership skills. For more accounting manager interview questions, understanding the candidate's mindset is key.

How Much Does It Cost to Hire an Accounting Manager?

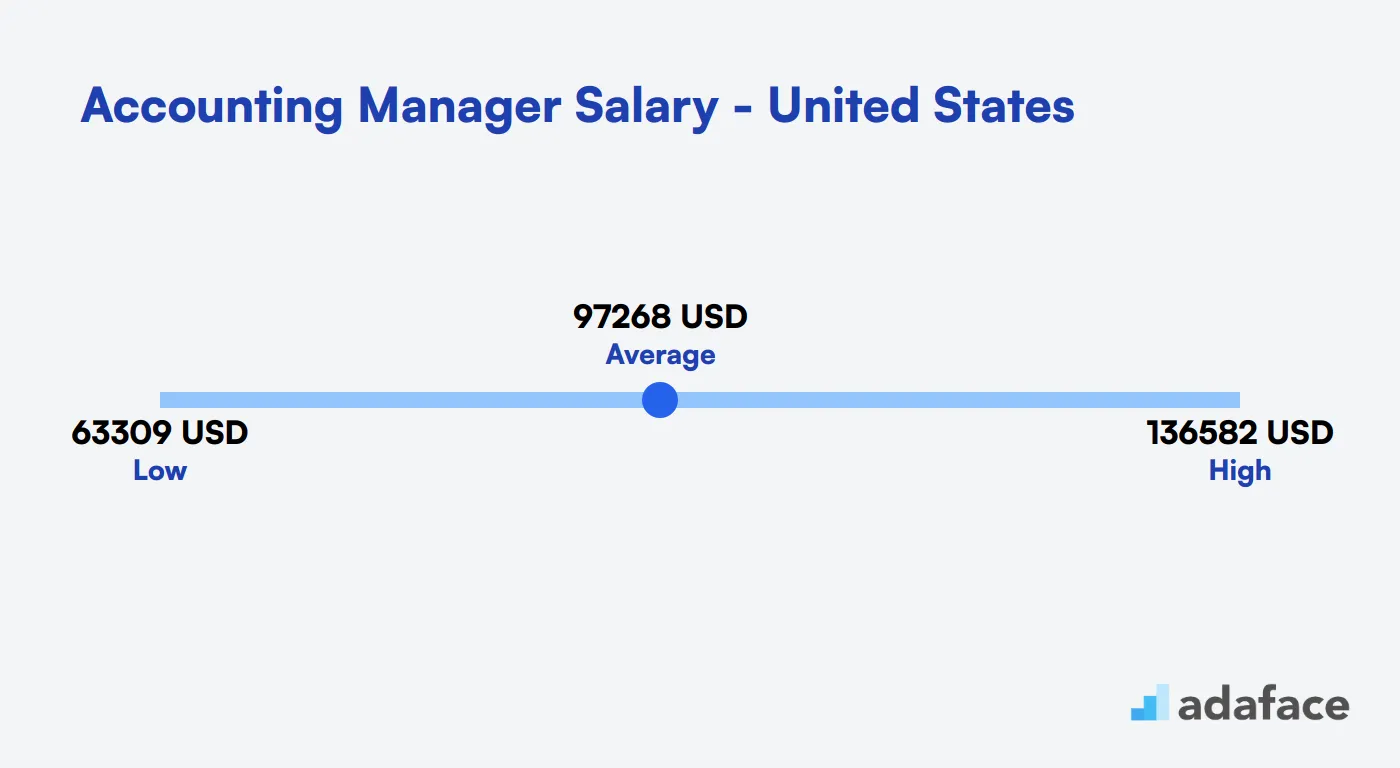

The cost of hiring an Accounting Manager varies widely based on location, experience, and company size. In the United States, the average salary for this role is around $97,268 per year. However, the range can extend from $63,310 to $136,583, depending on factors like city and industry.

Keep in mind that the total cost of hiring includes more than just the base salary. You'll need to factor in benefits, taxes, recruitment expenses, and potentially relocation costs. It's wise to budget for about 1.25 to 1.4 times the base salary to cover these additional expenses.

Accounting Manager Salary United States

The average salary for an Accounting Manager in the United States is $97,268. Depending on location, experience, and specific responsibilities, salaries can range from $63,310 to $136,583. For example, in San Francisco, CA, salaries typically fall between $83,708 and $164,998, while in El Paso, TX, they range from $45,718 to $106,686.

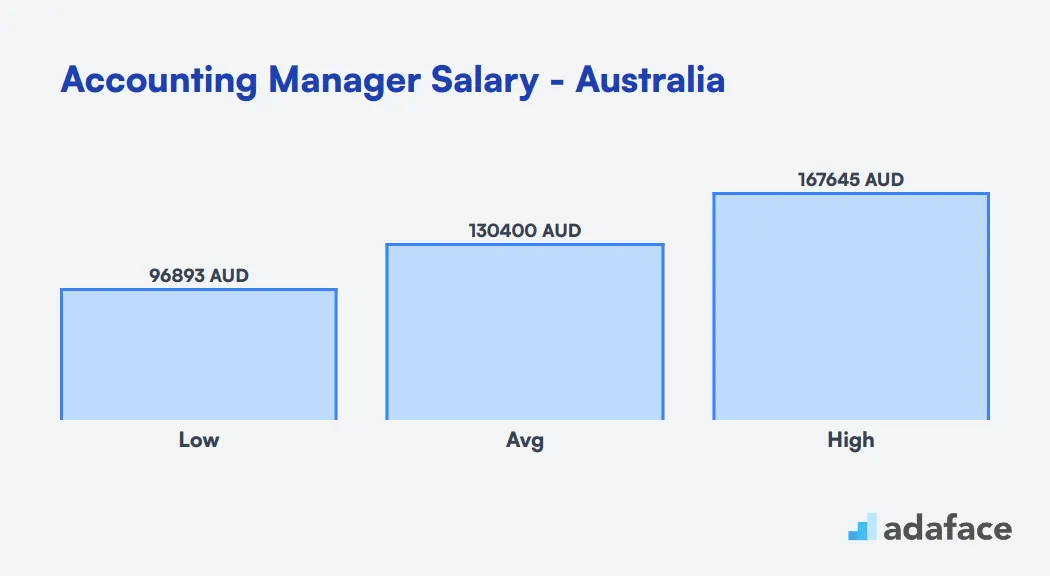

Accounting Manager Salary in Australia

In Australia, Accounting Managers earn a competitive salary. The median annual salary is AUD 127,450, with a range typically falling between AUD 96,893 and AUD 167,645.

Salaries can vary based on location, with East Perth, WA offering the highest median at AUD 147,501, while Fremantle, WA has the lowest median at AUD 112,572. Factors such as experience, company size, and industry also influence compensation.

Accounting Manager Salary in Canada

The average salary for an Accounting Manager in Canada is approximately CAD 93,188 per year. Salaries can range from CAD 64,981 to CAD 125,175 depending on location and level of experience. Major cities like Toronto and Vancouver typically offer higher salaries, reflecting the cost of living and demand for skilled professionals.

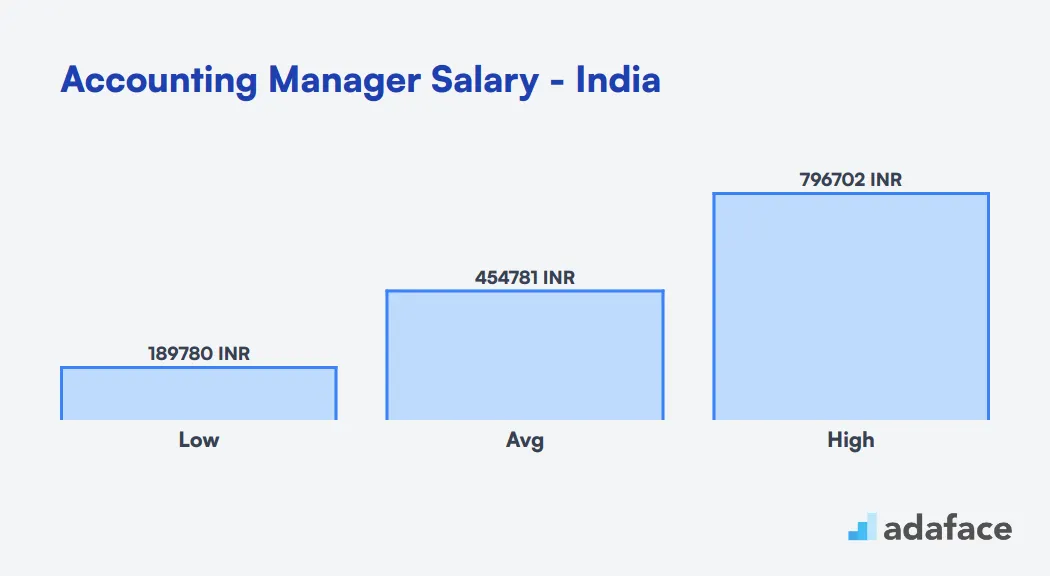

Accounting Manager Salary in India

The average salary for Accounting Managers in India ranges from ₹189,780 to ₹796,702 per year, with a median of ₹388,842. However, salaries vary significantly based on location, with Vadodara offering the highest median at ₹1,447,996, followed by Ahmedabad at ₹1,069,927. Bengaluru and Chennai tend to offer lower salaries, with medians of ₹620,240 and ₹436,653 respectively.

What's the difference between a Financial Accounting Manager and a Managerial Accounting Manager?

Though both the Financial Accounting Manager and Managerial Accounting Manager roles are vital in the finance department, they serve distinct purposes that can cause confusion. Financial Accounting Managers primarily focus on external financial reporting, while Managerial Accounting Managers are concerned with internal decision-making support.

Financial Accounting Managers cater to shareholders, creditors, and regulators by preparing financial statements in compliance with GAAP. They focus on historical financial data and must be proficient in ERP systems and financial reporting tools. Their tasks involve quarterly and annual reporting, ensuring adherence to SEC regulations, GAAP, and IFRS.

On the flip side, Managerial Accounting Managers support company management and department heads. They are responsible for budgeting, forecasting, and cost analysis using forward-looking projections and operational data. Proficiency in BI tools and data analytics software is crucial for them. Reporting can be monthly, weekly, or as needed, with a focus on internal policies and industry-specific regulations.

For more detailed insights on the skills required for a Financial Accounting Manager, you can explore this blog post.

| Financial Accounting Manager | Managerial Accounting Manager | |

|---|---|---|

| Focus | External financial reporting | Internal decision-making support |

| Primary users | Shareholders, creditors, regulators | Company management, department heads |

| Reporting frequency | Quarterly and annual | Monthly, weekly, or as needed |

| Key responsibilities | Financial statements, GAAP compliance | Budgeting, forecasting, cost analysis |

| Data emphasis | Historical financial data | Forward-looking projections, operational data |

| Software proficiency | ERP systems, financial reporting tools | BI tools, data analytics software |

| Regulatory knowledge | SEC regulations, GAAP, IFRS | Industry-specific regulations, internal policies |

| Key skills | Financial analysis, auditing, compliance | Cost accounting, strategic planning, data analysis |

What are the ranks of Accounting Managers?

In the corporate world, accounting positions often come with distinct titles that reflect levels of responsibility and expertise. It's easy to confuse one position with another, especially when roles overlap or when titles vary across different organizations. Understanding the hierarchy of accounting management roles can help you identify the right fit for your team.

- Junior Accounting Manager: Typically an entry-level management role, a Junior Accounting Manager oversees day-to-day accounting operations and reports to more senior managers. This role is ideal for those who have a few years of experience and are looking to step into management.

- Accounting Manager: An Accounting Manager handles more complex accounting issues, such as financial reporting and internal controls. They often manage a team of accountants and work closely with senior management to ensure the financial health of the organization. For more details on what this role entails, you can refer to the Accounting Manager job description.

- Senior Accounting Manager: With significant experience and expertise, a Senior Accounting Manager takes on strategic financial planning and decision-making. They play a crucial role in shaping the financial strategies of the company and often report directly to the CFO or Controller.

- Director of Accounting: This is a high-level executive role responsible for the overall accounting function within a company. Directors of Accounting develop strategies to streamline accounting processes and influence financial policy.

Hire the Best Accounting Managers for Your Team

We've covered the key aspects of hiring an Accounting Manager, from understanding their role to crafting job descriptions and conducting interviews. The hiring process can be complex, but with the right approach, you can find the perfect candidate for your organization.

If there's one takeaway from this guide, it's the importance of using well-crafted job descriptions and skills assessments to make your hiring process more accurate. Consider using accounting skills tests to evaluate candidates objectively and ensure they have the necessary expertise for the role.

Accounting Assessment Test

FAQs

Look for candidates with strong analytical skills, leadership abilities, and experience in financial management and reporting. They should also possess excellent communication skills and a strategic mindset.

An effective job description should clearly outline the role’s responsibilities, qualifications required, and the skills desired. It should also specify any necessary certifications or experiences, such as proficiency in accounting software or a CPA license.

You can find qualified candidates on professional networking platforms like LinkedIn, job boards, or through recruitment agencies specializing in accounting roles. Additionally, consider using industry-specific platforms for a greater reach.

Common questions include inquiries about their experience with financial reporting, how they handle tight deadlines, and their approach to implementing accounting standards. You can find more examples in our accounting manager interview questions.

Consider using skills assessment tests that focus on accounting principles, financial analysis, and software proficiency. These tools help evaluate a candidate’s technical abilities and problem-solving skills.

A Financial Accounting Manager focuses on external reporting, compliance, and preparing financial statements. In contrast, a Managerial Accounting Manager concentrates on internal budgeting, forecasting, and strategic planning to aid managerial decision-making.

To ensure a smooth process, structure interviews to cover technical skills, leadership qualities, and strategic thinking. Prepare questions that assess both their technical expertise and managerial capabilities, and involve key stakeholders in the interview process.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources