In the competitive world of finance and accounting, hiring the right intern can be a game-changer for your team. Accounting interns bring fresh perspectives and can help manage workload, but finding the right fit isn't as straightforward as it seems. Often, companies miss the mark by not clearly defining the skills they need or by not knowing where to look for the best candidates. It's crucial to focus on the specific competencies an intern should possess and to ensure a proper evaluation process to maximize the intern's potential within your organization.

This article aims to guide you through everything you need to know about hiring an accounting intern. We cover the necessary skills and qualifications to look for, crafting an effective job description, and the best platforms to find talented candidates. You'll also learn how to evaluate resumes, conduct skills tests, design case study assignments, and structure interviews. Discover more about these topics in our detailed guides, such as our article on accounting interview questions.

Table of contents

Why Hire an Accounting Intern?

Hiring an accounting intern can help address specific financial challenges in your organization. For example, if you're struggling with bookkeeping backlogs or need assistance with data entry for financial reports, an intern can provide valuable support.

Consider hiring an intern to:

- Assist with accounts payable and receivable processes

- Help prepare financial statements and reports

- Support audit preparation and documentation

When deciding between a full-time hire or an intern, assess your long-term needs. If you require ongoing support and have the resources to train and mentor, a full-time accountant might be more suitable. Otherwise, an accounting intern can be a cost-effective solution for temporary or project-based work.

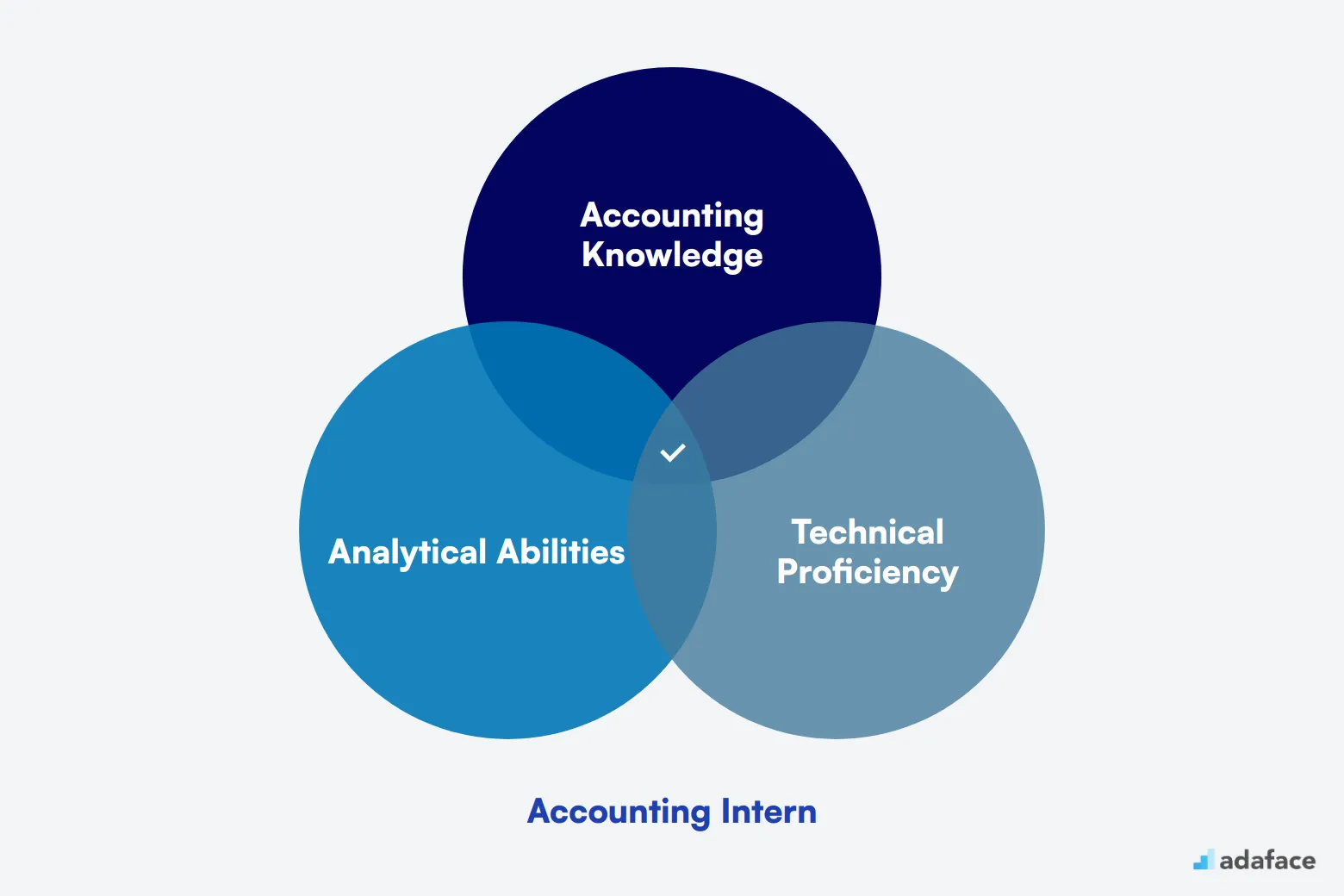

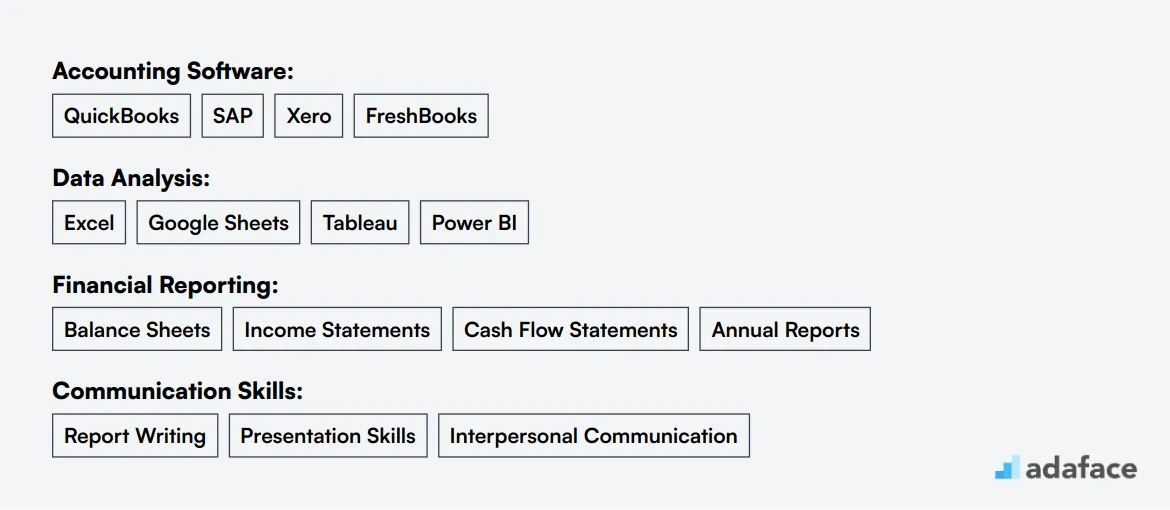

Skills and Qualifications to Look for in an Accounting Intern

When hiring an accounting intern, it's important to understand that what's required for one firm might just be a nice-to-have at another. While some basic accounting knowledge is non-negotiable, different companies may weigh technical skills or prior experience differently. The key is to draw a clear line between what's mandatory and what would simply boost a candidate's profile.

For accounting interns, a bachelor's degree in accounting or a related field is commonly required, along with proficiency in Microsoft Excel and other MS Office applications. Additionally, strong analytical and problem-solving skills are crucial, as is attention to detail and accuracy in work. A basic understanding of accounting principles and financial reporting can set a solid foundation.

In terms of preferred skills, experience with accounting software like QuickBooks or SAP can be beneficial. Prior internship or work experience in an accounting role is advantageous, as are familiarity with data analysis techniques and strong organizational skills. Being able to work independently, as well as part of a team, is also highly regarded. You can learn more about screening candidates to ensure that you identify the right skills early in the hiring process.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Accounting or related field | Experience with accounting software such as QuickBooks or SAP |

| Proficiency in Microsoft Excel and other MS Office applications | Prior internship or work experience in an accounting role |

| Strong analytical and problem-solving skills | Familiarity with data analysis techniques |

| Attention to detail and accuracy in work | Strong organizational and time management skills |

| Basic understanding of accounting principles and financial reporting | Ability to work independently as well as part of a team |

How to write an Accounting Intern job description?

Once you have a candidate profile ready, the next step is to capture that information in the job description to attract the right candidates. A well-crafted job description helps set the tone for your recruitment process.

- Highlight key responsibilities and impact: Clearly define the day-to-day tasks the accounting intern will undertake. Mention how their contributions will support the finance team and influence the overall business performance.

- Balance technical skills with soft skills: While necessary qualifications such as coursework in accounting and familiarity with financial software are important, don't forget to emphasize soft skills like attention to detail and communication. These qualities are crucial for effective collaboration within the team.

- Showcase your company’s unique selling points: Describe what makes your company and the internship opportunity special. Whether it's a chance to learn from experienced professionals or the prospect of working on impactful projects, these details can attract motivated candidates.

Best platforms to hire Accounting Interns

Now that you have a job description ready, it's time to explore job listing sites to source potential candidates. Utilizing various platforms can help you reach a larger audience and attract the right talent for your accounting internship positions.

LinkedIn Jobs

Ideal for posting full-time accounting intern positions. Offers wide reach and professional networking capabilities.

Indeed

Versatile platform suitable for all types of accounting internships. High visibility and easy application process.

Glassdoor Jobs

Excellent for corporate accounting internships. Provides company reviews and salary information alongside job listings.

Some effective platforms include LinkedIn Jobs, which offers professional networking capabilities and is ideal for full-time positions, and Indeed, known for its versatility and high visibility. Additionally, Glassdoor Jobs is excellent for corporate internships, giving insights into company reviews and salaries.

Beyond these, there are several other platforms worth considering. WayUp connects you with college students and recent graduates, while Monster and ZipRecruiter cater to a diverse range of candidates. For university-specific outreach, Handshake is a great option, while SimplyHired and CareerBuilder focus on small to medium-sized and large-scale hiring, respectively.

How to Screen Accounting Intern Resumes

Resume screening is a crucial step in hiring an accounting intern, as it helps filter candidates who meet the basic requirements before moving on to interviews. It saves time and effort by allowing you to focus on the most potential applicants from the onset.

When manually screening resumes, focus on identifying key skills and qualifications that match the job description. Key terms to look for in an accounting intern's resume include: "Bachelor's degree in Accounting", "Microsoft Excel proficiency", and "analytical skills". This helps in quickly narrowing down candidates who meet the foundational requirements.

Using AI language models (LLMs) like Adaface can streamline your screening process. You can prompt the AI with the desired keywords and let it filter resumes based on these criteria. This not only speeds up the process but also ensures consistency in screening across all candidates.

Here’s a sample AI prompt you could use:

TASK: Screen resumes for accounting intern role

INPUT: Resumes

OUTPUT: For each resume, provide the following:

- Email ID

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (whether to shortlist or not)

- Shortlist (Yes, No, Maybe)

RULES:

- If unsure about a candidate's fit, label as Maybe

- Keep recommendations concise.

KEYWORDS DATA:

- Accounting Knowledge (SAP, QuickBooks)

- Analytical Abilities (Excel, Data Analysis)

- Technical Proficiency (Financial Reporting, MS Office)

Recommended Skills Tests to Screen Accounting Interns

When hiring accounting interns, it's important to assess their skills accurately to ensure a good fit for your team. Skills tests offer a reliable way to evaluate candidates' proficiency quickly. Here are our top recommendations to help you make informed decisions:

Accounting Test: This test evaluates the candidate's basic accounting knowledge, covering topics such as financial statements, ledgers, and bookkeeping principles. It's an essential tool to ensure that your intern has a strong foundation in accounting.

Financial Accounting Test: Assess an intern's understanding of key financial accounting concepts with this test, which includes topics like financial reporting and analysis. This helps in gauging their capability to handle real-world financial data.

Excel Test: Excel proficiency is crucial for accounting. This test measures a candidate's ability to use Excel for tasks such as data organization and financial analysis, which are integral parts of an accounting role.

QuickBooks Test: If your organization uses QuickBooks, this test will assess the candidate's ability to navigate and utilize this software. It ensures that they can manage accounts, track expenses, and generate financial reports effectively.

Attention to Detail Test: Accuracy is paramount in accounting. This test helps determine a candidate's meticulousness, ensuring that they can maintain precision while handling numbers and financial documentation.

Case Study Assignments for Hiring Accounting Interns

Case study assignments can be valuable tools for assessing accounting intern candidates. However, they come with drawbacks such as lengthy completion times, lower candidate participation rates, and the risk of losing qualified applicants. Despite these challenges, well-designed case studies can provide insights into a candidate's practical skills and problem-solving abilities.

Financial Statement Analysis: This case study involves analyzing a company's financial statements and identifying key trends or issues. Candidates are asked to interpret financial data, calculate ratios, and provide recommendations. This assignment tests the intern's ability to apply accounting principles in a real-world context.

Budgeting and Forecasting: In this scenario, interns are given a set of financial data and asked to create a budget or financial forecast for a hypothetical company. This case study assesses the candidate's skills in financial planning, Excel proficiency, and attention to detail.

Accounts Reconciliation: This assignment involves reconciling discrepancies in financial records. Interns are presented with bank statements, ledger entries, and other financial documents, and must identify and resolve any inconsistencies. This case study evaluates the candidate's accuracy, problem-solving skills, and understanding of basic accounting processes.

Structuring the Interview Stage for Accounting Intern Candidates

After candidates pass the initial skills tests, it's crucial to conduct technical interviews to assess their hard skills in depth. While skills tests are great for initial screening, technical interviews help identify the best-fit candidates for the role. Let's explore some sample interview questions to evaluate accounting intern applicants effectively.

Consider asking questions like: 'Can you explain the difference between accrual and cash basis accounting?', 'How would you reconcile a bank statement?', 'What financial ratios are important for assessing a company's performance?', 'How do you ensure accuracy in your work?', and 'Can you walk me through the process of creating a balance sheet?' These questions help assess the candidate's understanding of accounting principles, attention to detail, and practical skills necessary for the internship role.

Cost of Hiring an Accounting Intern

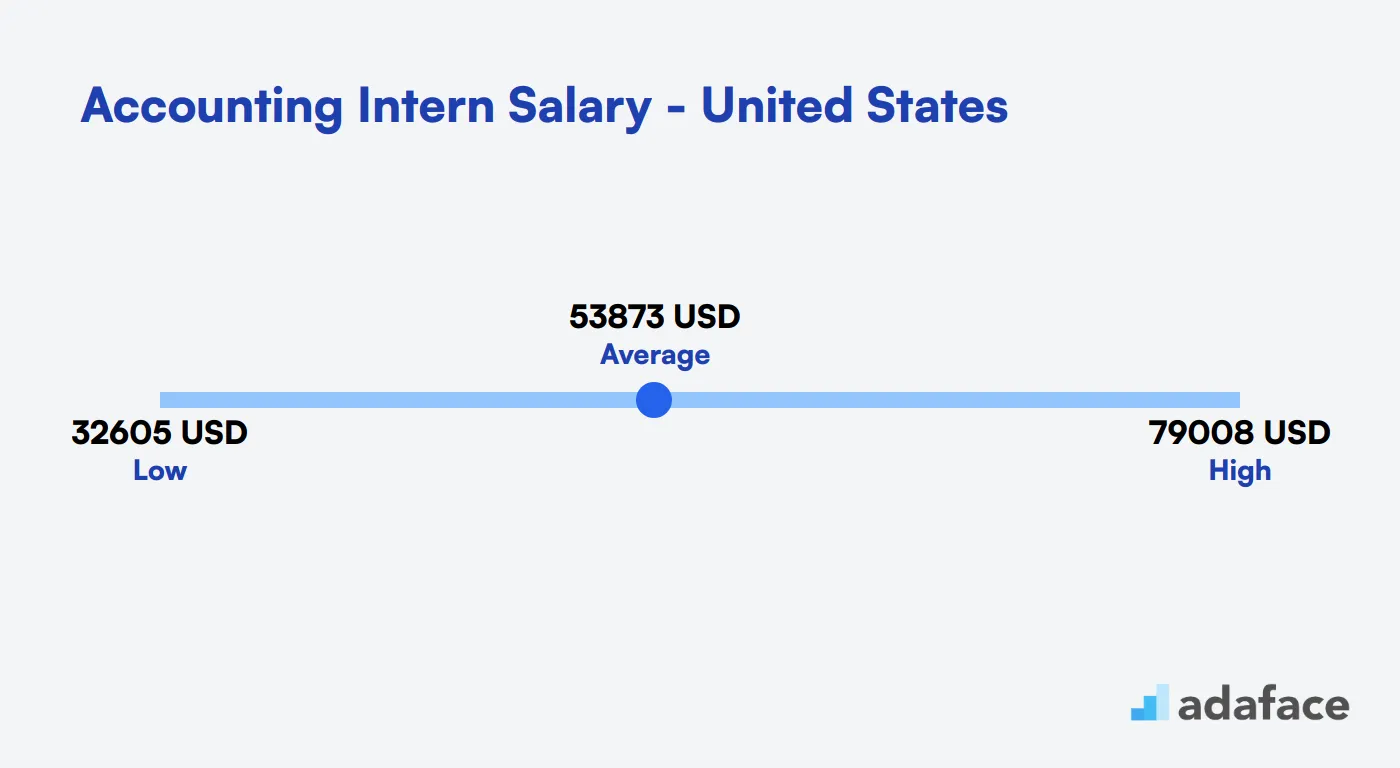

The cost of hiring an Accounting Intern varies widely depending on location, company size, and the intern's qualifications. In the United States, the average salary range for Accounting Interns is $32,605 to $79,008 per year, with a median of $50,755.

Keep in mind that costs may be higher in major cities. For example, New York offers salaries between $62,794 and $120,096, while smaller markets like Wilmington, DE range from $52,409 to $87,568. It's important to research local market rates to set competitive compensation packages.

Accounting Intern Salary in the United States

The average salary for Accounting Interns in the United States ranges from $32,605 to $79,008 per year, with a median of $50,755. This variation depends on factors like location, company size, and the intern's qualifications.

Major cities tend to offer higher salaries. For example, in New York, NY, the salary range is $62,794 to $120,096, while in Chicago, IL, it's $58,143 to $107,262. Smaller markets like Wilmington, DE, offer a range of $52,409 to $87,568.

Accounting Intern Salary in Australia

The average salary for Accounting Interns in Australia ranges from AUD 47,414 to AUD 63,018 per year, with a median of AUD 54,662. In Sydney, interns can expect to earn between AUD 41,495 and AUD 81,261, while in Melbourne, the range is typically AUD 45,390 to AUD 61,150.

These figures can vary based on factors such as the size of the company, the intern's qualifications, and the specific responsibilities of the role. It's worth noting that many internships in Australia are paid, providing valuable experience and financial support for students and recent graduates.

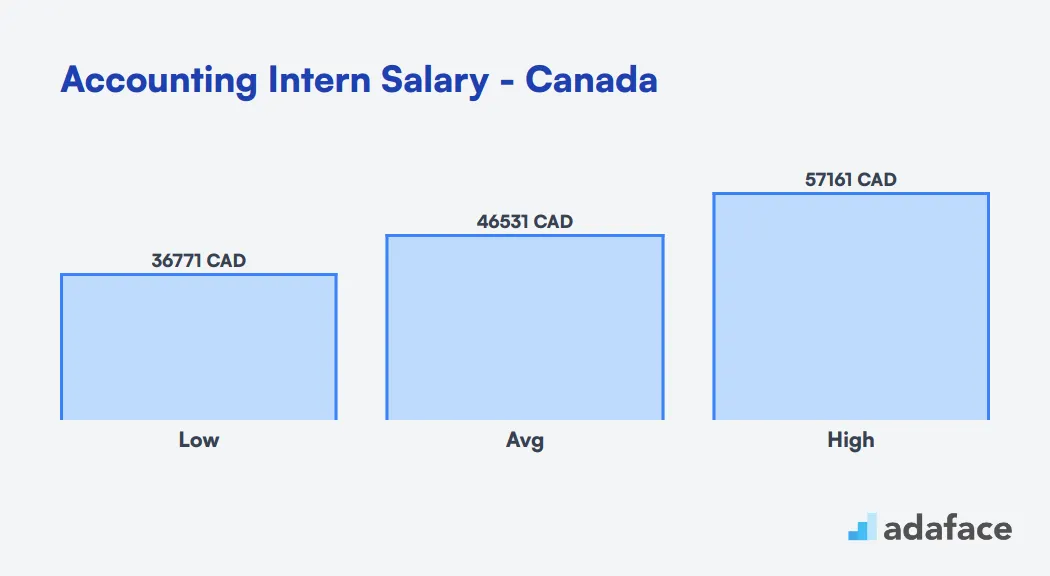

Accounting Intern Salary Canada

In Canada, the salary for an Accounting Intern typically ranges from CAD 36,772 to CAD 57,162 per year, with the median sitting at around CAD 45,847. This can vary based on location and industry, with cities like Vancouver, BC and Toronto, ON often offering higher compensation. It's important for recruiters to consider these variances when setting expectations and making offers.

What's the difference between an Accounting Intern and a Finance Intern?

Many people confuse accounting interns with finance interns due to their overlapping fields. However, these roles have distinct focuses and skill sets that set them apart in the financial world.

Accounting interns primarily deal with financial record-keeping and reporting. They typically work in accounting or audit departments, honing skills in bookkeeping, auditing, and tax preparation. These interns often use software like QuickBooks, SAP, and Oracle, and their projects usually involve financial statements, tax returns, and audits.

On the other hand, finance interns focus on financial analysis and planning. They're often found in corporate finance or investment banking departments, developing skills in financial modeling, forecasting, and investment analysis. These interns are proficient in Excel, Bloomberg, and FactSet, and their projects may include valuation models, merger analysis, and investor presentations.

The career paths for these interns also differ. Accounting interns typically aim for roles like CPA, Auditor, or Tax Accountant, while finance interns often aspire to become Financial Analysts, Investment Bankers, or Portfolio Managers. This difference is reflected in the certifications they pursue - CPAs for accounting and CFAs for finance.

When hiring for these positions, it's crucial to assess candidates' skills accurately. Accounting interns should have a strong grasp of GAAP, IFRS, and tax codes, while finance interns need to understand SEC regulations and financial markets. By recognizing these differences, recruiters can better match candidates to the right internship opportunities.

| Accounting Intern | Finance Intern | |

|---|---|---|

| Primary Focus | Financial record-keeping and reporting | Financial analysis and planning |

| Key Skills | Bookkeeping, auditing, tax preparation | Financial modeling, forecasting, investment analysis |

| Software Proficiency | QuickBooks, SAP, Oracle | Excel, Bloomberg, FactSet |

| Typical Department | Accounting or Audit | Corporate Finance or Investment Banking |

| Career Path | CPA, Auditor, Tax Accountant | Financial Analyst, Investment Banker, Portfolio Manager |

| Regulatory Knowledge | GAAP, IFRS, tax codes | SEC regulations, financial markets |

| Typical Projects | Financial statements, tax returns, audits | Valuation models, merger analysis, investor presentations |

| Certifications Pursued | CPA (Certified Public Accountant) | CFA (Chartered Financial Analyst) |

What are the ranks of Accounting Interns?

Many people often confuse accounting interns with entry-level accountants or other finance roles. However, there's a clear progression in the accounting internship hierarchy that helps students and recent graduates gain valuable experience.

- Junior Accounting Intern: This is typically the starting point for students in their early years of college. They assist with basic bookkeeping tasks, data entry, and simple financial record-keeping.

- Accounting Intern: As students progress in their studies, they may take on more responsibility. These interns often work on preparing financial statements, assisting with audits, and performing more complex calculations.

- Senior Accounting Intern: Usually reserved for final-year students or recent graduates, senior interns may lead small projects, mentor junior interns, and take on tasks similar to those of entry-level accountants.

- Graduate Accounting Intern: Some firms offer extended internships for recent graduates. These positions often serve as a bridge to full-time employment and involve more advanced accounting tasks and responsibilities.

Understanding these ranks can help both interns and employers set clear expectations and create a structured learning path. It's important to note that not all companies use these exact titles, but the general progression of responsibilities is common across many accounting internships.

Hire the Right Accounting Interns for Your Team

Throughout this guide, we've explored the essential steps in hiring an accounting intern, from understanding why hiring them is beneficial, to identifying the skills and qualifications you should look for, writing effective job descriptions, and choosing the best platforms for recruitment. We've also shared insights into resume screening, recommended skills tests, interview structuring, and cost considerations.

To maximize your chances of finding the ideal candidate, focus on creating well-defined job descriptions and utilizing targeted skills tests. By doing so, you'll enhance your hiring process and increase the likelihood of recruiting a top-notch intern who meets your needs. Consider using accounting test to assess your candidates' skills accurately and ensure they are the best fit for your team.

Accounting Assessment Test

FAQs

Look for skills such as attention to detail, basic accounting knowledge, proficiency in Excel, analytical thinking, and effective communication.

Include the role's responsibilities, required skills, and qualifications. Clearly outline the learning opportunities and any potential for full-time employment.

Consider using platforms like LinkedIn, university career centers, and specialized job boards. You can also explore remote hiring options on websites like Adaface Remote Hiring.

Check for relevant coursework, internships, and any practical experience. Look for consistency in their academic history and any extracurricular activities that demonstrate responsibility.

Use skills tests like the Accounting Test or Excel Test to evaluate candidates' proficiency.

Include behavioral questions, situational questions, and a discussion of any relevant projects or case studies. Use questions from our guide on accounting intern interview questions.

Accounting interns focus on accounting tasks like bookkeeping and financial statement preparation, while finance interns are more involved in financial analysis and investment strategies.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources