Hiring the right accountant is a critical task for any business. As a recruiter or hiring manager, you're tasked with finding a professional who can manage financial records, ensure compliance, and provide valuable insights for decision-making. Many companies struggle to identify candidates who possess both technical expertise and the soft skills necessary to thrive in their specific business environment.

This comprehensive guide will walk you through the process of hiring an accountant, from understanding the role to structuring effective interviews. We'll cover key aspects such as skills required for accountants, resume screening, and recommended assessment methods to help you make informed hiring decisions.

Table of contents

What Does an Accountant Do?

An accountant plays a key role in managing an organization's financial health. They are responsible for maintaining accurate financial records, preparing financial statements, and ensuring compliance with tax laws and regulations.

The day-to-day tasks of an accountant typically include:

- Recording financial transactions and maintaining ledgers

- Preparing and analyzing financial reports

- Managing accounts payable and receivable

- Conducting internal audits

- Assisting with budgeting and forecasting

- Providing financial advice to management

- Ensuring compliance with accounting standards and tax regulations

Accountant Hiring Process: A Step-by-Step Guide

The accountant hiring process typically spans 4-8 weeks, depending on your organization's efficiency. Here's a brief overview of the key steps:

- Create and post a detailed accountant job description

- Review resumes and applications (1-2 weeks)

- Conduct initial screening calls (3-5 days)

- Administer accounting skills assessments (3-5 days)

- Conduct in-depth interviews (1-2 weeks)

- Perform reference checks (2-3 days)

- Extend job offer and negotiate (3-5 days)

Each step plays a critical role in finding the right accountant for your team. In the following sections, we'll dive deeper into these stages, providing you with practical tips and resources to streamline your hiring process.

Skills and qualifications to look for in an Accountant

When hiring an accountant, it’s easy to blur the lines between required and preferred qualifications. Each company’s needs can differ, making it tricky to craft a candidate profile that fits just right. For instance, a CPA might be a non-negotiable for some, while others may prioritize experience with specific accounting software.

Clearly defining what’s needed and what’s nice to have ensures you attract candidates who can truly contribute to your team's success. This approach also prevents recruiting pitfalls, like being swayed by impressive resumes that lack core skills. For more guidance on aligning candidate skills with job roles, explore our skill mapping resource.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Accounting, Finance, or related field | Master's degree in Accounting or Finance |

| Certified Public Accountant (CPA) designation | Experience with financial reporting and analysis |

| Minimum of 3 years of accounting experience | Knowledge of tax regulations and compliance |

| Proficiency in accounting software such as QuickBooks or SAP | Experience in a corporate accounting environment |

| Strong understanding of Generally Accepted Accounting Principles (GAAP) | Proven track record in managing cross-functional teams |

How to write an Accountant job description?

Once you have a candidate profile ready, the next step is to capture that information in the job description to attract the right candidates. A well-crafted job description can make all the difference in finding the ideal accountant for your organization.

- Highlight key responsibilities and impact: Be clear about the day-to-day tasks your accountant will handle, such as managing financial records, preparing tax returns, or conducting audits. Articulating how these responsibilities contribute to the overall success of the company will attract candidates who are looking to make a significant impact.

- Balance technical skills with soft skills: While technical expertise in areas like GAAP, tax regulations, and accounting software is important, don't forget to emphasize soft skills. Attributes like attention to detail, communication, and problem-solving are equally critical for an accountant's success in a collaborative workplace.

- Showcase unique selling points: What makes your company special? Whether it's a great team culture, opportunities for professional development, or innovative projects, showcasing these aspects in the job description can help you stand out from competitors and appeal to top talent. For detailed duties and qualifications, refer to the accountant job description page.

Top Platforms to Hire Accountants

Now that you have a well-crafted job description, it's time to list your accounting position on job boards to attract qualified candidates. Choosing the right platforms can make a big difference in finding the perfect accountant for your team.

Indeed

Indeed is a highly popular job board that excels at connecting employers with full-time employees across various industries, including accounting.

FlexJobs

FlexJobs specializes in remote, part-time, and flexible job listings, making it ideal for hiring accountants seeking non-traditional work arrangements.

Upwork

Upwork is a freelance marketplace that allows recruiters to connect with independent accounting professionals for temporary or project-based work.

Beyond these popular sites, there are several other platforms tailored for specific hiring needs. These include Remote.co for remote accountants, PeoplePerHour for freelance professionals, and Glassdoor for showcasing company culture. Each platform offers unique features to help you find the right accountant for your skills assessment and hiring process.

Keywords to Look for in Accountant Resumes

Resume screening is a necessary step in the hiring process to ensure you focus your time and interviews on candidates who genuinely fit the role. With numerous applicants, identifying the right match can save you both time and resources.

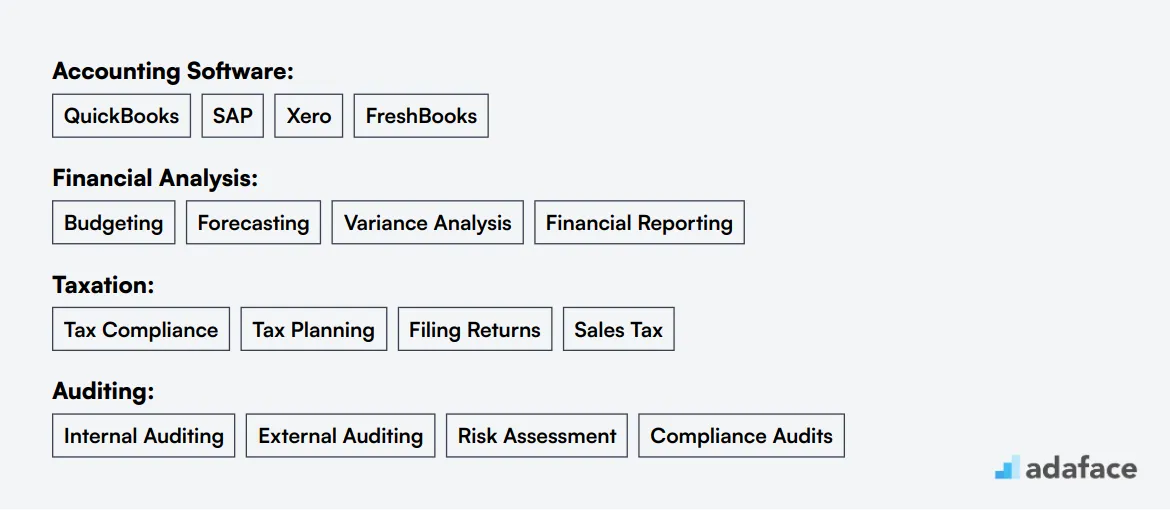

To manually screen resumes, start by looking for primary and secondary keywords related to the accountant role. Essential keywords might include qualifications like a Bachelor's degree in Accounting, CPA designation, and accounting software proficiency such as QuickBooks or SAP. This initial scan helps you remove candidates who don't meet these basic criteria, narrowing down your pool for more in-depth evaluation.

Alternatively, leverage AI language models to facilitate the screening process. These tools can analyze resumes based on the keywords you provide, identifying candidates with the right mix of skills and experience. AI can assess several resumes quickly, providing insights to guide your selection process.

Here's an example AI prompt for resume screening:

TASK: Screen resumes to match job description for accountant role

INPUT: Resumes

OUTPUT: For each resume, provide following information:

- Email id

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (detailed recommendation of whether to shortlist this candidate or not)

- Shortlist (Yes, No or Maybe)

RULES:

- If you are unsure about a candidate's fit, put the candidate as Maybe instead of No

- Keep recommendation crisp and to the point

KEYWORDS DATA:

- Accounting Software (QuickBooks, SAP, Xero)

- Financial Analysis (Budgeting, Forecasting, Financial Reporting)

- Taxation (Tax Compliance, Tax Planning, Filing Returns)

Recommended skills tests for assessing Accountants

Skills tests are a great way to evaluate accountants objectively. They help you assess candidates' practical knowledge and abilities, ensuring you make informed hiring decisions. Here are five key tests we recommend for assessing accountants:

Accounting Test: This accounting test evaluates candidates' understanding of core accounting principles. It covers areas like financial statements, bookkeeping, and general ledger management, which are fundamental for any accounting role.

Financial Accounting Test: Use this financial accounting test to assess candidates' knowledge of advanced accounting concepts. It includes topics like GAAP, financial reporting, and complex transactions analysis.

Excel Test: Proficiency in Excel is a must for accountants. An Excel skills test helps you evaluate candidates' ability to work with spreadsheets, formulas, and financial modeling tools.

QuickBooks Test: Many businesses use QuickBooks for accounting. A QuickBooks test can help you identify candidates who are familiar with this popular accounting software.

Financial Analyst Test: For roles requiring advanced financial analysis, consider using a financial analyst test. This assesses skills in financial modeling, valuation, and investment analysis.

Structuring the Interview Stage for Hiring Accountants

After candidates pass the initial skills tests, it's time for technical interviews to assess their hard skills in depth. While skills tests are great for initial screening, technical interviews are key to finding the best-fit candidates for your accounting role. Let's look at some sample interview questions to help you evaluate potential accountants effectively.

Consider asking questions like: 'Can you explain the difference between cash and accrual accounting?', 'How would you reconcile a bank statement?', 'What's your experience with accounting software?', 'How do you ensure accuracy in financial reports?', and 'Can you walk me through your process for preparing a balance sheet?'. These questions help assess the candidate's accounting knowledge, technical skills, attention to detail, and problem-solving abilities – all crucial for success in an accounting role.

How much does it cost to hire an Accountant?

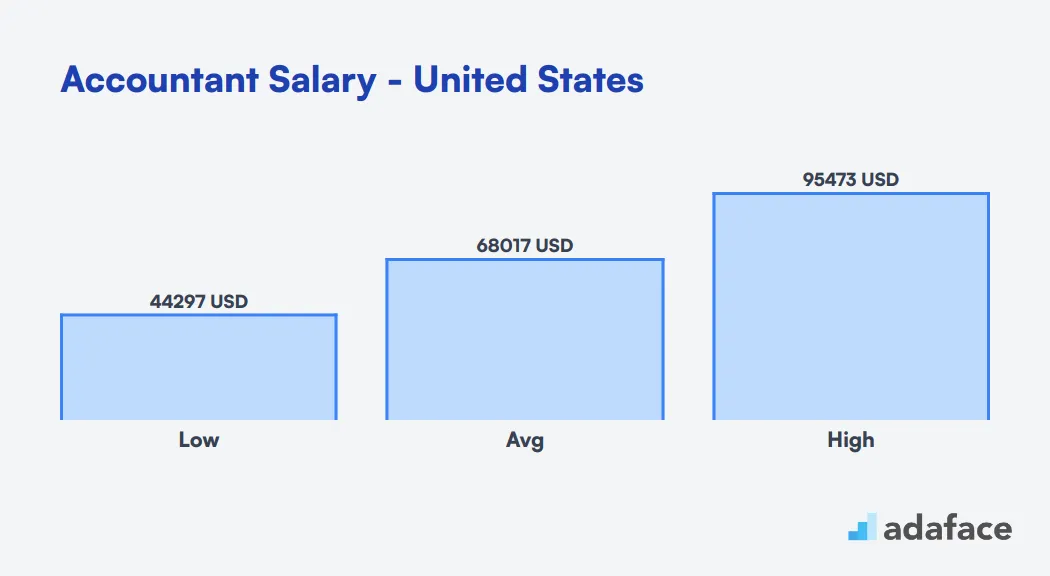

The cost of hiring an accountant varies widely depending on location, experience, and specialization. In the United States, salaries range from $44,298 to $95,473, with a median of $65,033. Meanwhile, in the Philippines, the salary range is between 247,034 PHP and 924,390 PHP, with a median of 477,866 PHP annually. This variation highlights the importance of considering these factors when budgeting for your accounting needs.

Accountant Salary in the United States

The average salary for accountants in the United States ranges from $44,298 to $95,473, with a median of $65,033. This variation depends on factors such as location, experience, and specialization.

Top-paying cities for accountants include New York, NY (mean: $79,993), Seattle, WA (mean: $77,961), and Dallas, TX (mean: $76,442). Entry-level positions typically start at the lower end of the range, while experienced accountants in high-cost areas can command salaries at the upper end.

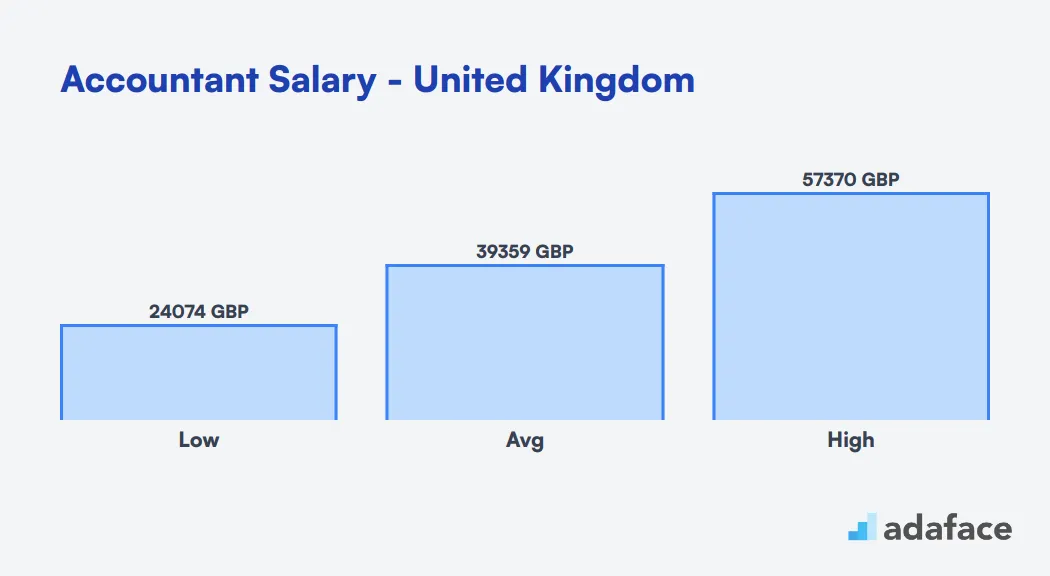

Accountant Salary in the United Kingdom

The average salary for an accountant in the United Kingdom is approximately £40,000 per year. Entry-level positions can start around £25,000, while experienced accountants can earn upwards of £70,000. Factors such as location, sector, and level of expertise can significantly influence these figures.

Accountant Salary in the Philippines

In the Philippines, accountant salaries vary across different cities. Based on data from major cities, the average salary range for accountants is between 247,034 PHP to 924,390 PHP per year. The median salary stands at approximately 477,866 PHP annually.

Among the cities, Angeles offers the highest median salary at 572,740 PHP, followed by Cebu City at 525,346 PHP. Manila, a major business hub, provides a median salary of 509,378 PHP for accountants.

What's the difference between a Financial Accountant and a Management Accountant?

It's easy to confuse Financial Accountants and Management Accountants, especially since both roles deal with numbers and financial data. However, they serve distinct purposes within an organization, making them quite different.

A Financial Accountant is primarily focused on external reporting. They prepare financial statements for external stakeholders like shareholders and investors, complying with standards like GAAP or IFRS. Their work is based on historical data, reflecting the company's past performance.

In contrast, a Management Accountant is concerned with internal reporting for company management. They focus on budgeting, forecasting, and aiding strategic planning. Their reports are not bound by standardized guidelines, allowing more flexibility in focusing on future performance.

Whether you're hiring for a Financial Accountant or a Management Accountant, understanding the unique skills required for each role can streamline your recruitment process. Check out our skills assessment tools to help you identify the right candidate for your needs.

| Financial Accountant | Management Accountant | |

|---|---|---|

| Focus Area | External reporting | Internal reporting |

| Key Responsibilities | Prepare financial statements | Budgeting and forecasting |

| Primary Audience | Shareholders, investors | Internal management |

| Reporting Standards | GAAP or IFRS | Not standardized |

| Time Orientation | Past performance | Future performance |

| Decision Making | Based on historical data | Aid strategic planning |

| Degree Requirement | Accounting or Finance | Accounting, Finance, or Business |

| Typical Tools | Financial software | Budgeting software |

What are the ranks of Accountants?

Accountants are often confused with other financial roles, leading to misunderstandings about their ranks and responsibilities. Understanding the hierarchy can clarify the specific functions each role serves within an organization.

- Junior Accountant: This is typically an entry-level position responsible for basic accounting tasks such as data entry, reconciling accounts, and assisting in the preparation of financial statements. Junior accountants usually report to senior accountants or managers.

- Staff Accountant: Staff accountants possess more experience and handle more complex accounting duties such as preparing tax returns and conducting audits. They often collaborate with junior accountants and provide guidance as needed.

- Senior Accountant: This role involves supervising the accounting team, reviewing financial reports, and ensuring compliance with regulations. Senior accountants often mentor junior staff and serve as a point of contact for external auditors.

- Accounting Manager: An accounting manager oversees the entire accounting department, ensuring that all financial practices align with company policies. They also report directly to senior management regarding financial performance.

- Controller: The controller is responsible for maintaining accurate financial records and preparing financial statements. They oversee the accounting department and ensure compliance with financial regulations.

- Chief Financial Officer (CFO): The CFO is a top executive responsible for the company’s financial strategy and overall financial health. This position involves high-level decision-making and strategic planning to drive the organization’s success.

Hire the Right Accountants for Your Team

We've covered the key aspects of hiring accountants, from understanding their roles to crafting effective job descriptions. We've also explored the hiring process, essential skills to look for, and tips for conducting interviews.

The most important takeaway is to use well-crafted job descriptions and skills tests to make your hiring process more accurate. By focusing on these elements, you'll be better equipped to find accountants who not only have the right qualifications but also fit well with your team and company culture.

Accounting Assessment Test

FAQs

When hiring an accountant, look for candidates with a bachelor's degree in accounting or finance, relevant certifications like CPA or CMA, and experience in your industry. Also, consider skills in accounting software, data analysis, and financial reporting.

To assess an accountant's technical skills, use a combination of methods such as accounting skills tests, case studies, and technical interview questions. These can evaluate their knowledge of accounting principles, software proficiency, and problem-solving abilities.

Important soft skills for accountants include attention to detail, communication, analytical thinking, time management, and ethical judgment. These skills help accountants work effectively within teams and communicate financial information to non-financial stakeholders.

Structure the interview process in stages: initial screening, skills assessment, in-depth interviews, and reference checks. Include both behavioral and situational questions to evaluate technical knowledge and soft skills. Consider involving team members who will work closely with the accountant.

Red flags when hiring an accountant include inconsistencies in their work history, inability to explain accounting concepts clearly, lack of attention to detail in their application materials, and reluctance to provide references or discuss past experiences in depth.

To ensure cultural fit, clearly define your company's values and work environment. Use behavioral interview questions to assess alignment, involve team members in the interview process, and consider a trial period or project to observe the candidate's work style and interactions.

Ask a mix of technical and behavioral questions. Technical questions should cover accounting principles, software proficiency, and industry-specific regulations. Behavioral questions can assess problem-solving skills, ethical decision-making, and communication abilities. For ideas, check out our accountant interview questions guide.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources