In the competitive world of finance, hiring the right talent for financial modeling roles is critical for business success. Asking the right interview questions can help you identify candidates with the skills and knowledge needed to excel in these positions.

This blog post provides a comprehensive list of financial modeling interview questions, categorized by experience level and topic. From basic concepts to advanced techniques, we cover a wide range of questions to help you evaluate candidates at different stages of their careers.

By using these questions, you can gain valuable insights into a candidate's financial modeling abilities and make informed hiring decisions. Consider pairing these interview questions with a pre-employment financial modeling assessment to get a more complete picture of a candidate's skills.

Table of contents

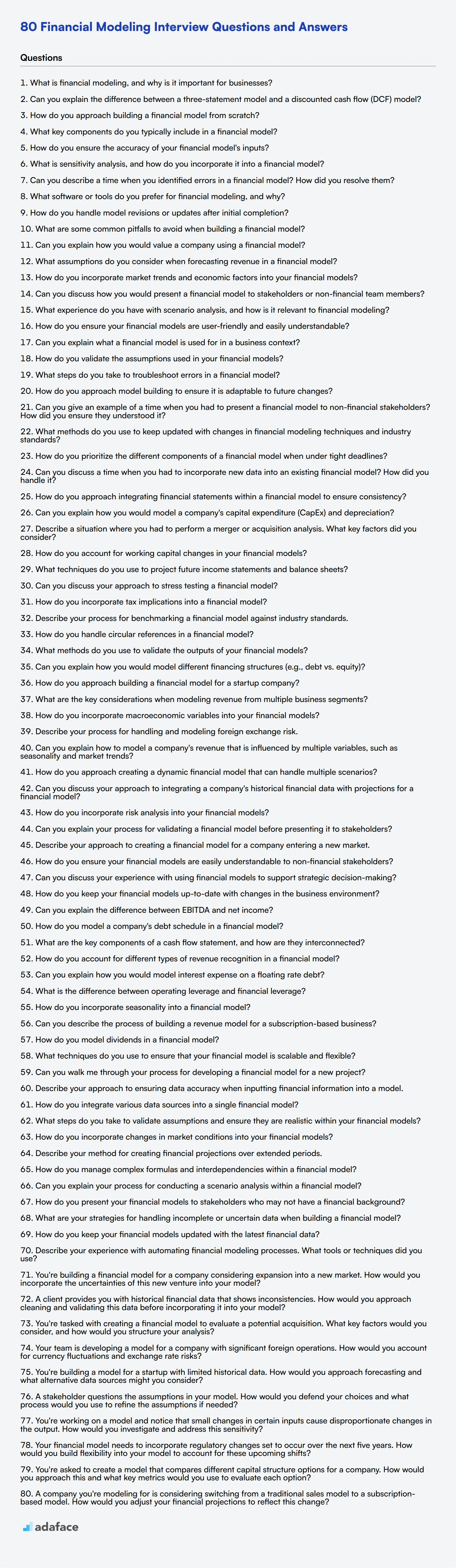

16 basic Financial Modeling interview questions and answers to assess candidates

To ensure your candidates possess the essential skills and knowledge for financial modeling, utilize this list of interview questions. These inquiries will help you assess their understanding and ability to apply fundamental concepts effectively. For more insights on specific roles, check out our detailed job descriptions for various financial positions.

- What is financial modeling, and why is it important for businesses?

- Can you explain the difference between a three-statement model and a discounted cash flow (DCF) model?

- How do you approach building a financial model from scratch?

- What key components do you typically include in a financial model?

- How do you ensure the accuracy of your financial model's inputs?

- What is sensitivity analysis, and how do you incorporate it into a financial model?

- Can you describe a time when you identified errors in a financial model? How did you resolve them?

- What software or tools do you prefer for financial modeling, and why?

- How do you handle model revisions or updates after initial completion?

- What are some common pitfalls to avoid when building a financial model?

- Can you explain how you would value a company using a financial model?

- What assumptions do you consider when forecasting revenue in a financial model?

- How do you incorporate market trends and economic factors into your financial models?

- Can you discuss how you would present a financial model to stakeholders or non-financial team members?

- What experience do you have with scenario analysis, and how is it relevant to financial modeling?

- How do you ensure your financial models are user-friendly and easily understandable?

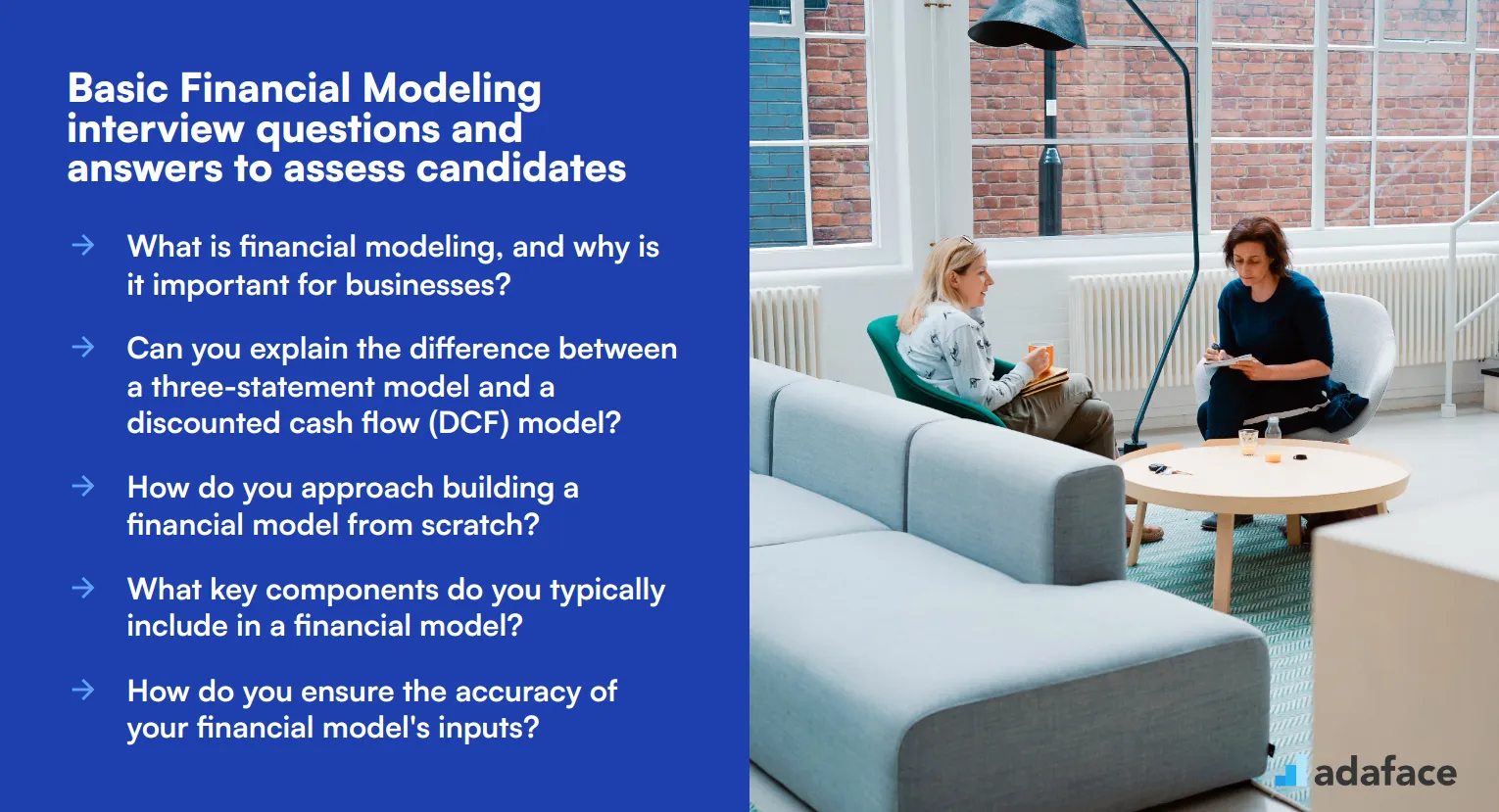

8 Financial Modeling interview questions and answers to evaluate junior analysts

To evaluate junior analysts for financial modeling roles effectively, use this curated list of interview questions. These questions are designed to help you identify candidates with the right skills and analytical thinking required for success in your organization.

1. Can you explain what a financial model is used for in a business context?

A financial model is used to represent the financial performance of a business, project, or investment. It helps businesses forecast future financial performance by simulating the impact of various variables and scenarios.

An ideal candidate should highlight that financial models are crucial for decision-making processes, such as budgeting, forecasting, valuation, and risk management. Look for examples where the candidate successfully applied financial modeling to solve real business problems.

2. How do you validate the assumptions used in your financial models?

Validating assumptions in a financial model involves comparing them against historical data, industry benchmarks, and market trends. It's essential to ensure that assumptions are realistic and based on reliable sources.

Candidates should demonstrate an understanding of the importance of validation and provide examples of how they have adjusted assumptions based on external data or feedback. Look for a methodical approach to validation and a readiness to revise assumptions as new information becomes available.

3. What steps do you take to troubleshoot errors in a financial model?

Troubleshooting errors in a financial model typically involves a systematic review of formulas, inputs, and outputs. This may include checking for consistency, verifying calculations, and using error-checking tools available in spreadsheet software.

Strong candidates will provide a clear process they follow, such as reviewing assumptions, using built-in audit tools, and cross-referencing with external data. They should also discuss their ability to maintain documentation and version control to facilitate error resolution.

4. How do you approach model building to ensure it is adaptable to future changes?

To ensure a financial model is adaptable to future changes, it's crucial to design it with flexibility in mind. This includes using dynamic inputs, scenario analysis, and modular structures that allow easy updates.

A good response will include specific techniques such as creating separate sheets for assumptions, using named ranges, and incorporating sensitivity analysis. Look for candidates who emphasize the importance of clear documentation and user-friendly design.

5. Can you give an example of a time when you had to present a financial model to non-financial stakeholders? How did you ensure they understood it?

Presenting a financial model to non-financial stakeholders requires simplifying complex data and focusing on key insights. Visual aids like charts, graphs, and summaries can help convey the main points effectively.

Candidates should describe a specific instance where they tailored their presentation to the audience's level of understanding, possibly by avoiding jargon and emphasizing the business implications of the model's results. Look for clear communication skills and the ability to translate technical details into actionable insights.

6. What methods do you use to keep updated with changes in financial modeling techniques and industry standards?

Staying updated with changes in financial modeling techniques and industry standards involves continuous learning through professional development courses, industry journals, webinars, and networking with peers.

An ideal response will include specific resources and activities the candidate engages in, such as attending conferences or subscribing to relevant publications. Look for a proactive approach to self-improvement and a commitment to staying current with best practices.

7. How do you prioritize the different components of a financial model when under tight deadlines?

Prioritizing components of a financial model under tight deadlines involves focusing on the most critical elements that will drive decision-making. This typically means ensuring the accuracy of key assumptions and core financial statements first.

Candidates should provide examples of how they have managed tight deadlines in the past, highlighting their ability to identify and prioritize essential tasks. Look for organizational skills and the ability to maintain quality under pressure.

8. Can you discuss a time when you had to incorporate new data into an existing financial model? How did you handle it?

Incorporating new data into an existing financial model involves updating inputs and assumptions while ensuring consistency throughout the model. It's important to document changes and validate the updated model to ensure accuracy.

Candidates should discuss a specific example where they successfully integrated new data, outlining the steps they took to update the model and communicate changes to stakeholders. Look for attention to detail and a systematic approach to data integration.

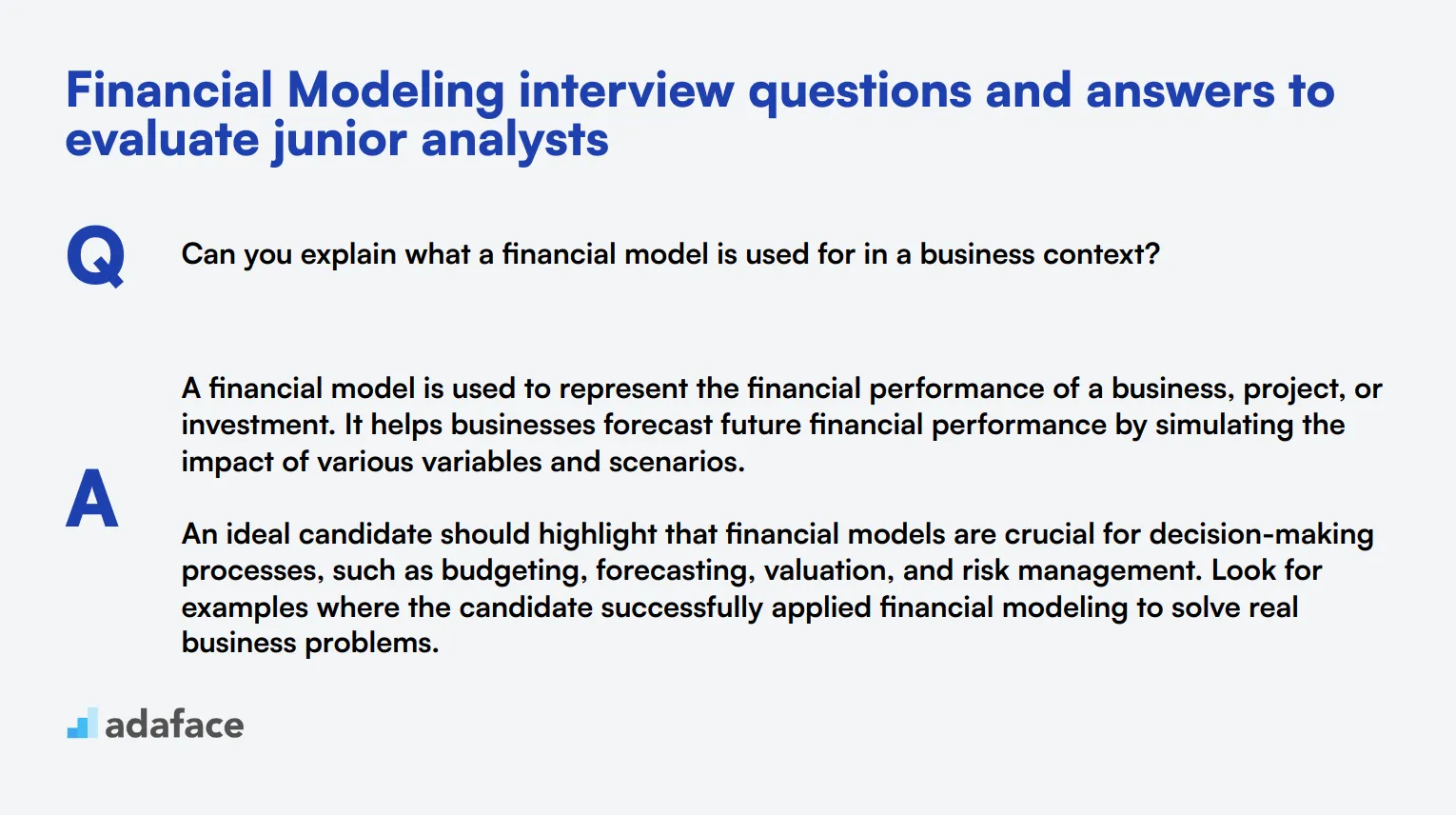

15 intermediate Financial Modeling interview questions and answers to ask mid-tier analysts

To ensure your mid-tier analysts possess the necessary skills for effective financial modeling, consider using these 15 intermediate interview questions. This list will help you evaluate candidates' technical expertise and practical knowledge, ensuring they are well-equipped to handle complex financial tasks. For more insights on financial analyst roles, visit our job description.

- How do you approach integrating financial statements within a financial model to ensure consistency?

- Can you explain how you would model a company's capital expenditure (CapEx) and depreciation?

- Describe a situation where you had to perform a merger or acquisition analysis. What key factors did you consider?

- How do you account for working capital changes in your financial models?

- What techniques do you use to project future income statements and balance sheets?

- Can you discuss your approach to stress testing a financial model?

- How do you incorporate tax implications into a financial model?

- Describe your process for benchmarking a financial model against industry standards.

- How do you handle circular references in a financial model?

- What methods do you use to validate the outputs of your financial models?

- Can you explain how you would model different financing structures (e.g., debt vs. equity)?

- How do you approach building a financial model for a startup company?

- What are the key considerations when modeling revenue from multiple business segments?

- How do you incorporate macroeconomic variables into your financial models?

- Describe your process for handling and modeling foreign exchange risk.

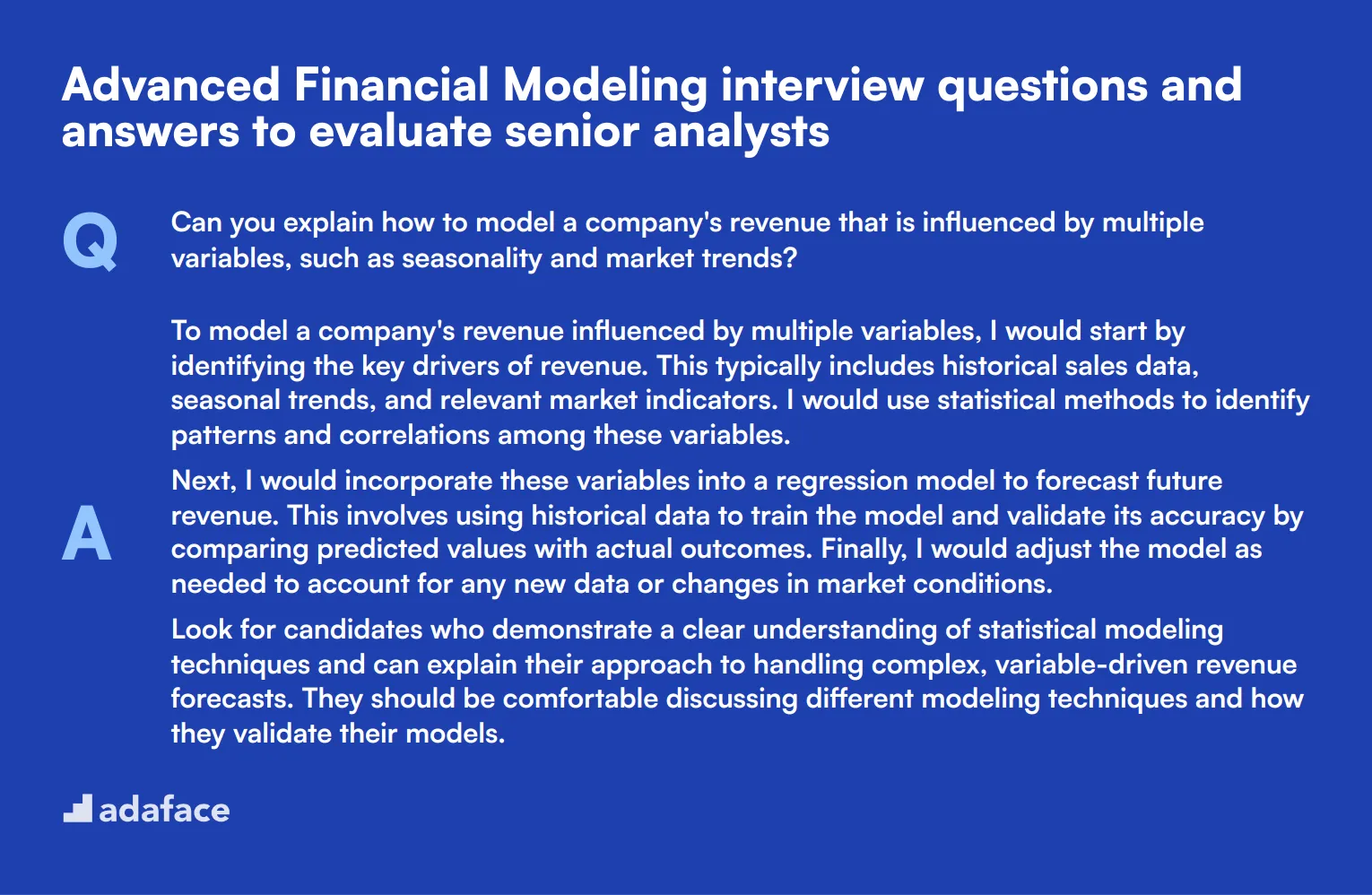

9 advanced Financial Modeling interview questions and answers to evaluate senior analysts

When it comes to evaluating senior financial analysts, you need more than just the basics. These advanced financial modeling interview questions will help you gauge their depth of knowledge, critical thinking, and problem-solving skills, ensuring you find the best fit for your team.

1. Can you explain how to model a company's revenue that is influenced by multiple variables, such as seasonality and market trends?

To model a company's revenue influenced by multiple variables, I would start by identifying the key drivers of revenue. This typically includes historical sales data, seasonal trends, and relevant market indicators. I would use statistical methods to identify patterns and correlations among these variables.

Next, I would incorporate these variables into a regression model to forecast future revenue. This involves using historical data to train the model and validate its accuracy by comparing predicted values with actual outcomes. Finally, I would adjust the model as needed to account for any new data or changes in market conditions.

Look for candidates who demonstrate a clear understanding of statistical modeling techniques and can explain their approach to handling complex, variable-driven revenue forecasts. They should be comfortable discussing different modeling techniques and how they validate their models.

2. How do you approach creating a dynamic financial model that can handle multiple scenarios?

Creating a dynamic financial model involves building flexibility into the model to accommodate various scenarios. I start by identifying the key assumptions and variables that can change, such as revenue growth rates, costs, and market conditions. These variables are then set up as input cells that can be easily adjusted.

I use scenario analysis tools such as data tables or scenario managers to test different assumptions and their impact on the financial outcomes. This allows stakeholders to see a range of possible outcomes based on different scenarios, making the model robust and adaptable.

An ideal candidate should showcase their ability to build flexible models that can handle multiple scenarios seamlessly. They should emphasize their experience with scenario analysis and how they ensure the model remains accurate and manageable.

3. Can you discuss your approach to integrating a company's historical financial data with projections for a financial model?

Integrating historical financial data with projections requires a systematic approach. First, I gather and clean the historical data to ensure it is accurate and complete. This involves reconciling any discrepancies and normalizing the data for consistency.

Next, I use the historical data to identify trends and patterns that can inform future projections. For example, I might calculate historical growth rates, margins, and other key metrics to establish baselines. These baselines are then used to project future performance, adjusted for any anticipated changes in the business or market.

Recruiters should look for candidates who can clearly articulate their process for data integration and projection. They should demonstrate attention to detail in data preparation and a solid methodology for making informed projections based on historical data.

4. How do you incorporate risk analysis into your financial models?

Incorporating risk analysis into financial models involves identifying potential risks and quantifying their impact. I start by listing all potential risks, such as market volatility, regulatory changes, and operational challenges. Each risk is then assessed for its likelihood and potential impact on the financial outcomes.

I use techniques like sensitivity analysis and Monte Carlo simulations to model the impact of these risks. Sensitivity analysis helps identify which variables have the most significant effect on the financial model, while Monte Carlo simulations provide a range of possible outcomes based on different risk scenarios.

Candidates should be able to explain their risk assessment and modeling techniques clearly. Look for those with experience in using advanced risk analysis tools and who can provide concrete examples of how they have applied these methods in past projects.

5. Can you explain your process for validating a financial model before presenting it to stakeholders?

Validating a financial model involves several steps to ensure its accuracy and reliability. First, I perform a thorough review of all inputs and assumptions to confirm they are reasonable and well-supported. This includes cross-checking data sources and verifying calculations.

Next, I conduct a sensitivity analysis to identify how changes in key assumptions affect the model's outputs. This helps ensure the model is robust and highlights any areas that may require further scrutiny. I also test the model's logic by inputting different scenarios and checking for consistency in the results.

An excellent candidate should detail their validation steps and emphasize their attention to accuracy and thorough testing. They should also discuss how they communicate any limitations or uncertainties in the model to stakeholders, ensuring transparency.

6. Describe your approach to creating a financial model for a company entering a new market.

When creating a financial model for a company entering a new market, I start by conducting comprehensive market research. This includes analyzing market size, growth potential, competitive landscape, and regulatory environment. I gather data on comparable companies and industries to inform my assumptions.

I then build the model by incorporating initial investment costs, revenue projections, and expense estimates specific to the new market. Factors like entry strategies, marketing costs, and local economic conditions are considered. I also include scenarios to account for different market entry strategies and potential risks.

Look for candidates who demonstrate a thorough and methodical approach to market analysis and modeling. They should be able to discuss how they adapt their models to new and unfamiliar markets and how they validate their assumptions with research and data.

7. How do you ensure your financial models are easily understandable to non-financial stakeholders?

Ensuring financial models are easily understandable to non-financial stakeholders involves simplifying complex information and presenting it clearly. I start by using intuitive layouts and clear labels for all inputs, calculations, and outputs. I also use charts and graphs to visually represent key data and trends.

I include detailed documentation and explanations for all assumptions and methodologies used in the model. This helps non-financial stakeholders understand the basis for the projections and how different variables affect the outcomes. I also prepare summary reports that highlight the most critical insights and recommendations.

An ideal candidate should exhibit strong communication skills and the ability to translate complex financial data into actionable insights for non-financial stakeholders. They should provide examples of how they have successfully communicated financial models in past experiences.

8. Can you discuss your experience with using financial models to support strategic decision-making?

Using financial models to support strategic decision-making involves providing data-driven insights that inform business strategy. In my experience, I have used financial models to evaluate investment opportunities, assess the financial viability of new projects, and analyze potential mergers and acquisitions.

I start by building models that incorporate all relevant financial metrics and scenarios. These models help identify the potential risks and returns associated with different strategic options. I also use the models to perform sensitivity analysis and stress testing to understand how different variables impact the overall strategy.

Candidates should demonstrate their ability to use financial models as strategic tools. They should discuss specific examples of how their models have influenced key business decisions and how they communicate their findings to senior management.

9. How do you keep your financial models up-to-date with changes in the business environment?

Keeping financial models up-to-date requires regular monitoring and updates based on new data and changes in the business environment. I set up processes to periodically review and update key assumptions and inputs. This includes tracking relevant market indicators, industry trends, and internal business metrics.

I also maintain a log of changes and updates made to the model, ensuring transparency and consistency. Whenever significant changes occur, such as new regulatory requirements or shifts in market conditions, I promptly update the model and revalidate its outputs.

Look for candidates who demonstrate a proactive approach to maintaining their models. They should emphasize their commitment to accuracy and their ability to adapt to new information quickly. Discuss their strategies for ensuring continuous improvement and relevance of their financial models.

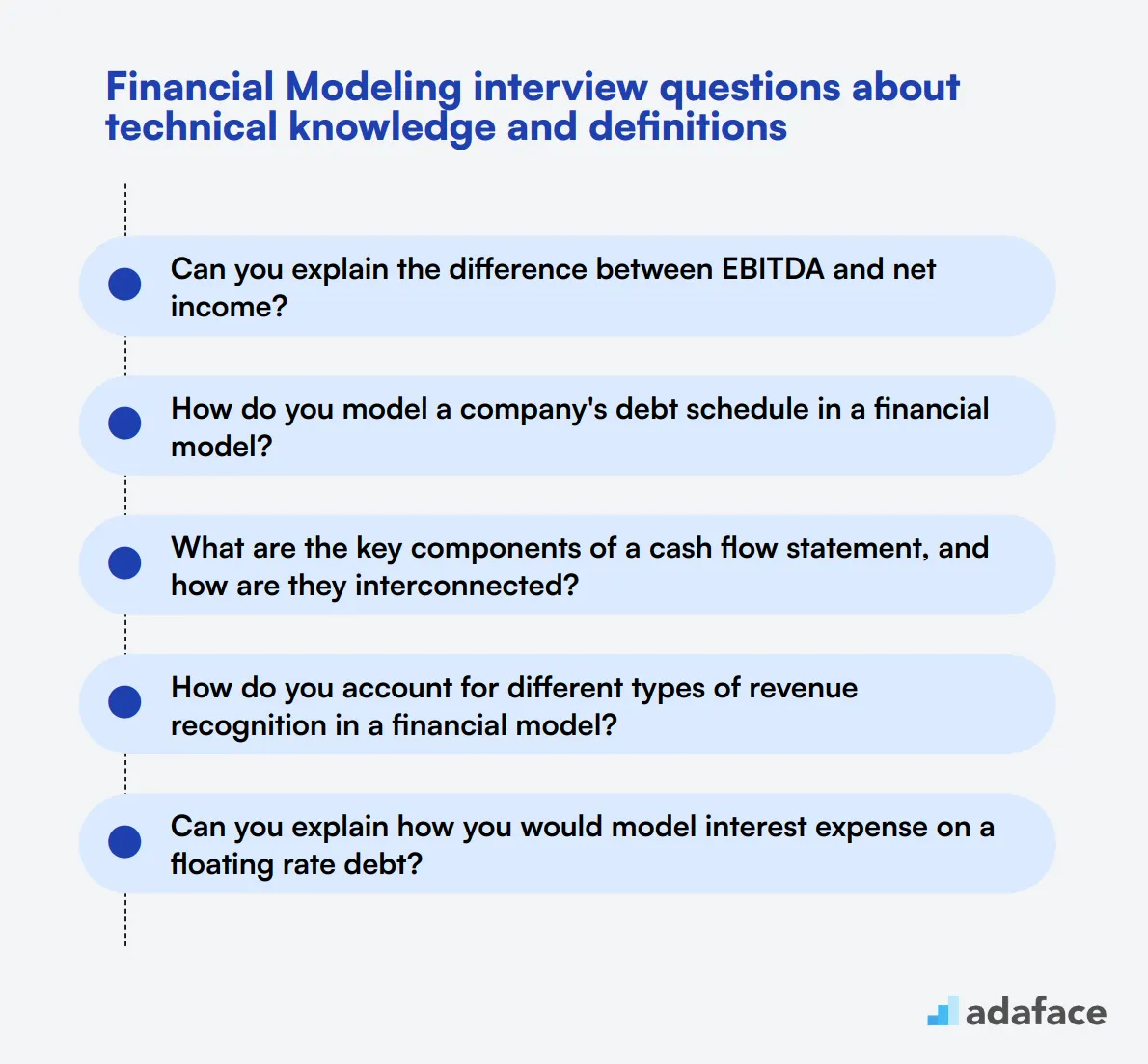

10 Financial Modeling interview questions about technical knowledge and definitions

To determine whether your applicants possess the necessary technical knowledge for financial modeling, ask them some of these technical interview questions. This list will help you evaluate their grasp of essential concepts and ensure they have the expertise required for the role.

- Can you explain the difference between EBITDA and net income?

- How do you model a company's debt schedule in a financial model?

- What are the key components of a cash flow statement, and how are they interconnected?

- How do you account for different types of revenue recognition in a financial model?

- Can you explain how you would model interest expense on a floating rate debt?

- What is the difference between operating leverage and financial leverage?

- How do you incorporate seasonality into a financial model?

- Can you describe the process of building a revenue model for a subscription-based business?

- How do you model dividends in a financial model?

- What techniques do you use to ensure that your financial model is scalable and flexible?

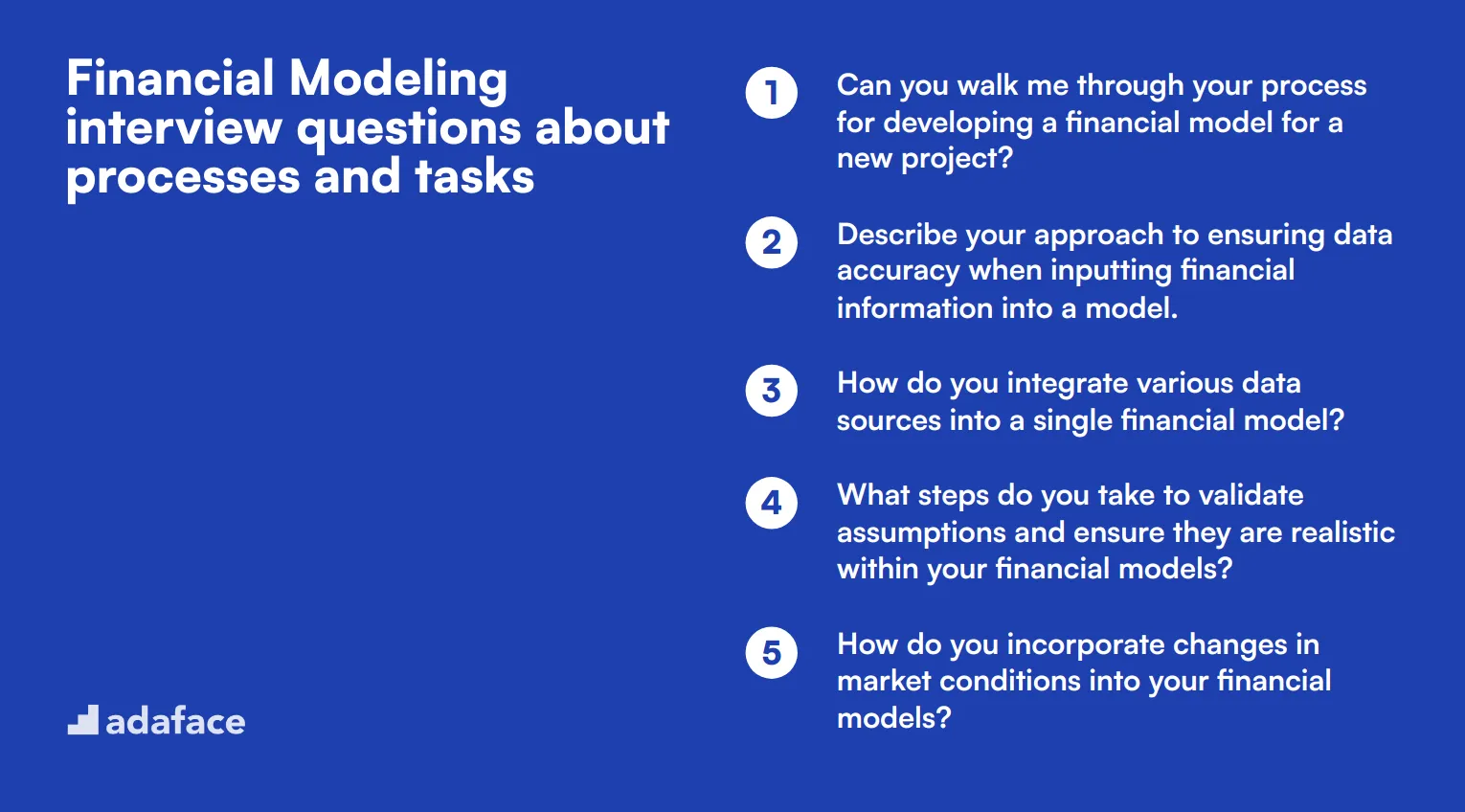

12 Financial Modeling interview questions about processes and tasks

To identify whether your candidates possess the necessary skills to handle the complexities of financial modeling, consider using these interview questions about processes and tasks. By asking these questions, you can gauge their hands-on experience and ability to manage the intricate details of financial modeling effectively. For a detailed overview of financial analyst responsibilities, refer to our job description guide.

- Can you walk me through your process for developing a financial model for a new project?

- Describe your approach to ensuring data accuracy when inputting financial information into a model.

- How do you integrate various data sources into a single financial model?

- What steps do you take to validate assumptions and ensure they are realistic within your financial models?

- How do you incorporate changes in market conditions into your financial models?

- Describe your method for creating financial projections over extended periods.

- How do you manage complex formulas and interdependencies within a financial model?

- Can you explain your process for conducting a scenario analysis within a financial model?

- How do you present your financial models to stakeholders who may not have a financial background?

- What are your strategies for handling incomplete or uncertain data when building a financial model?

- How do you keep your financial models updated with the latest financial data?

- Describe your experience with automating financial modeling processes. What tools or techniques did you use?

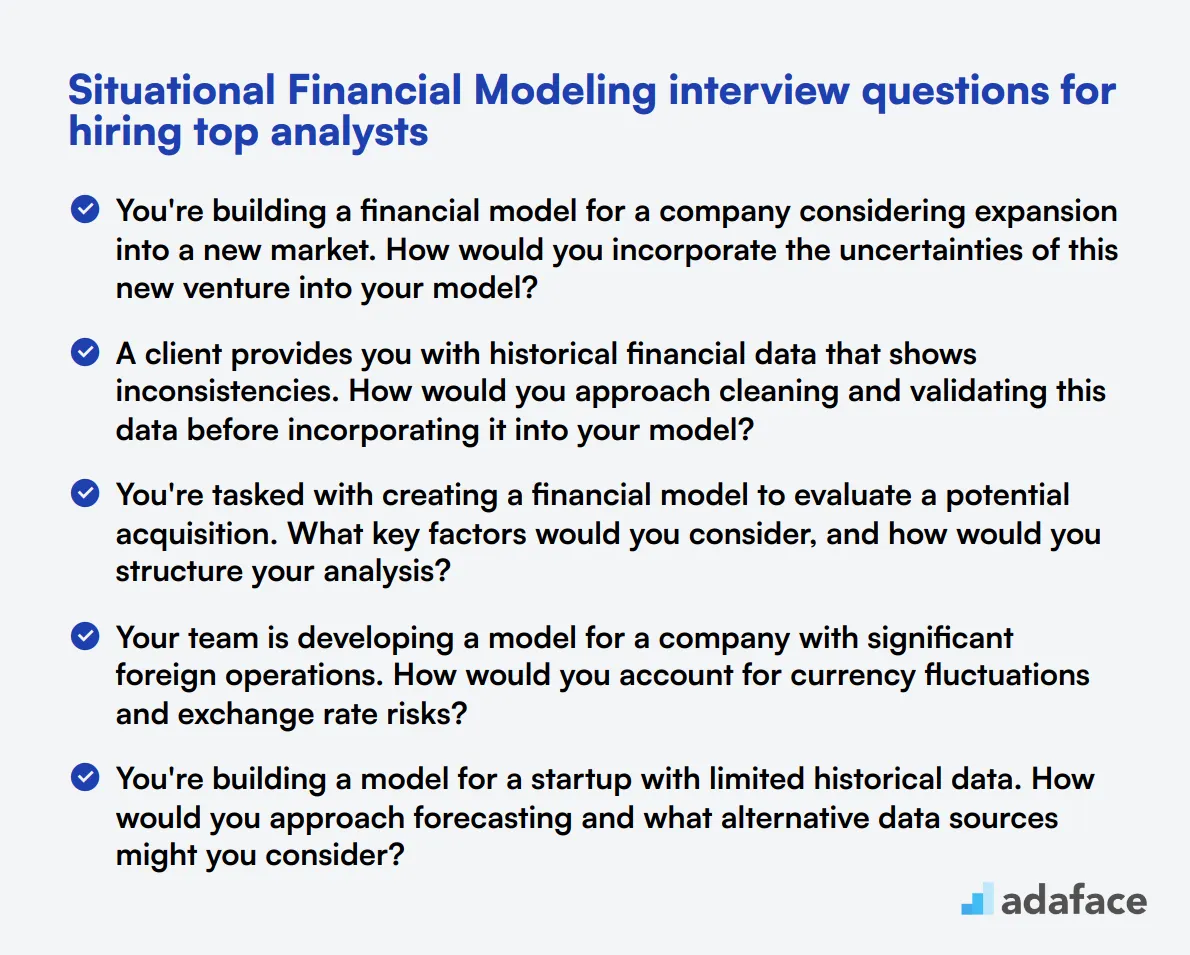

10 situational Financial Modeling interview questions for hiring top analysts

To assess a candidate's real-world financial modeling skills, situational questions are invaluable. These questions help evaluate how applicants apply their knowledge to practical scenarios, providing insight into their problem-solving abilities and decision-making processes. Use these questions to gauge a candidate's capacity to handle complex financial situations effectively.

- You're building a financial model for a company considering expansion into a new market. How would you incorporate the uncertainties of this new venture into your model?

- A client provides you with historical financial data that shows inconsistencies. How would you approach cleaning and validating this data before incorporating it into your model?

- You're tasked with creating a financial model to evaluate a potential acquisition. What key factors would you consider, and how would you structure your analysis?

- Your team is developing a model for a company with significant foreign operations. How would you account for currency fluctuations and exchange rate risks?

- You're building a model for a startup with limited historical data. How would you approach forecasting and what alternative data sources might you consider?

- A stakeholder questions the assumptions in your model. How would you defend your choices and what process would you use to refine the assumptions if needed?

- You're working on a model and notice that small changes in certain inputs cause disproportionate changes in the output. How would you investigate and address this sensitivity?

- Your financial model needs to incorporate regulatory changes set to occur over the next five years. How would you build flexibility into your model to account for these upcoming shifts?

- You're asked to create a model that compares different capital structure options for a company. How would you approach this and what key metrics would you use to evaluate each option?

- A company you're modeling for is considering switching from a traditional sales model to a subscription-based model. How would you adjust your financial projections to reflect this change?

Which Financial Modeling skills should you evaluate during the interview phase?

Assessing a candidate's financial modeling skills during an interview is essential, but one interview cannot cover everything. There are core skills that you should focus on to gauge their proficiency and potential. Here are the key financial modeling skills you should evaluate during the interview phase.

Excel Proficiency

You can utilize an Excel skills assessment test that includes relevant MCQs to filter out candidates with the necessary proficiency. Learn more about the Excel test.

Additionally, you can ask targeted questions during the interview to gauge their hands-on experience with Excel.

Can you explain how you would use pivot tables in Excel to analyze financial data?

Look for candidates who can clearly articulate the process of creating and using pivot tables to summarize and analyze large datasets in Excel.

Financial Statement Analysis

You can use a Financial Accounting test with specific MCQs to assess a candidate's ability to analyze financial statements. Learn more about the Financial Accounting test.

During the interview, ask specific questions to understand their approach to financial statement analysis.

How do you interpret the cash flow statement and what key indicators do you look for?

Candidates should demonstrate their understanding of cash flow components and explain how they use these indicators to assess liquidity and financial stability.

Forecasting and Projections

To evaluate this skill, you can ask questions that focus on their methodology and approach to creating financial forecasts.

Can you describe a time when you created a financial forecast and how you validated its accuracy?

Look for candidates who can explain their approach to gathering data, making assumptions, and the techniques used to validate their forecasts.

3 tips for using Financial Modeling interview questions.

Before you start putting what you've learned into practice, here are our top tips for using Financial Modeling interview questions effectively.

1. Leverage skills tests before interviews.

Using skill tests before interviews helps you filter candidates with the right foundational knowledge, saving valuable interview time.

Consider using specific tests like the Financial Modeling Test or the Excel Test to evaluate critical competencies.

These tests streamline the selection process, ensuring only qualified candidates proceed to the interview stage.

2. Compile relevant interview questions.

Time during an interview is limited. Prioritize questions that assess essential skills and subskills to maximize the effectiveness of the evaluation.

Using other relevant interview questions can provide a comprehensive assessment. Consider questions from domains like financial accounting or analytical skills.

3. Ask follow-up questions.

Initial questions often aren't enough to gauge a candidate's depth. Follow-up questions help uncover true understanding and experience.

For example, after asking about a candidate's experience with three-statement models, a good follow-up question could be: 'Can you explain how you would handle an unexpected revenue drop in your model?' This helps assess their problem-solving skills and practical application.

Hire top Financial Modeling talent with skills tests and interviews

To hire candidates with strong Financial Modeling skills, you need to evaluate them accurately. The most effective way to do this is by using skills tests. These tests provide an objective measure of a candidate's abilities in Financial Modeling.

After using skills tests to shortlist the best applicants, you can invite them for interviews. To streamline your hiring process and find the right talent, sign up for our assessment platform. It offers a range of tools to help you make informed hiring decisions for Financial Modeling roles.

Financial & Excel Modeling Test

Download Financial Modeling interview questions template in multiple formats

Financial Modeling Interview Questions FAQs

Look for strong Excel skills, understanding of financial statements, and basic accounting knowledge.

Ask them to describe or demonstrate building a financial model from scratch, including assumptions, inputs, and outputs.

Focus on basic concepts such as Excel functions, financial statement analysis, and simple modeling tasks.

Ask about specific scenarios where they had to solve complex problems or make critical decisions based on their models.

Ask questions about specific financial modeling techniques, formulas, and industry-specific knowledge.

Focus on model structuring, data validation, scenario analysis, and presentation of financial information.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources