Hiring the right Financial Accounting professionals is crucial for maintaining accurate financial records and ensuring compliance with regulations. By asking targeted interview questions, recruiters and hiring managers can effectively assess candidates' knowledge, skills, and experience in this specialized field.

This blog post provides a comprehensive list of Financial Accounting interview questions tailored for different experience levels, from junior to senior accountants. We've organized the questions into categories, including general, technical, and situational inquiries, to help you thoroughly evaluate candidates' capabilities.

By using these interview questions, you can identify top talent and make informed hiring decisions for your accounting team. Consider complementing your interview process with a Financial Accounting skills assessment to gain a more complete picture of candidates' abilities.

Table of contents

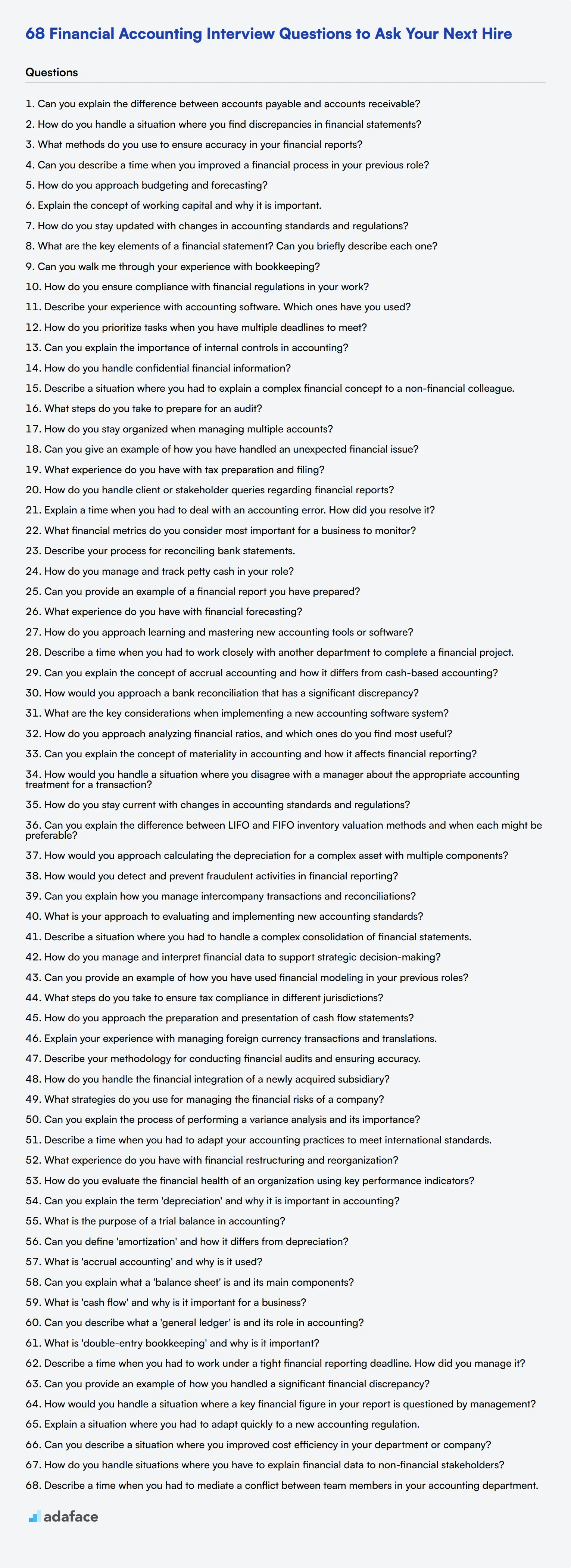

8 general Financial Accounting interview questions and answers to assess applicants

To help you evaluate candidates effectively, we've compiled a list of essential Financial Accounting interview questions. Use these questions to gauge a candidate’s grasp on core accounting principles, financial reporting, and analytical skills during your next interview session.

1. Can you explain the difference between accounts payable and accounts receivable?

Accounts payable represents the money a company owes to its suppliers or vendors for goods and services received, but not yet paid for. It's a liability on the company's balance sheet. On the other hand, accounts receivable is the money owed to the company by its customers for goods or services delivered, but not yet paid for. This is an asset on the company's balance sheet.

When evaluating an answer, look for a clear understanding of these terms and their impact on the company's financial statements. The ideal candidate should also mention how managing these effectively can impact cash flow and working capital.

2. How do you handle a situation where you find discrepancies in financial statements?

When discrepancies are found in financial statements, the first step is to identify the source of the error. This involves scrutinizing the records to trace the mistake, whether it's a data entry error, a miscalculation, or an issue with documentation.

The candidate should mention the importance of cross-referencing with supporting documents and possibly communicating with relevant departments to resolve the discrepancy. An ideal response would also reflect the importance of maintaining a robust internal control system to prevent such errors in the future. For more insights, check out our guide on skills required for financial analysts.

3. What methods do you use to ensure accuracy in your financial reports?

To ensure accuracy in financial reports, it's crucial to follow Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Regular audits and reconciliations are also key practices. Additionally, using accounting software that can automate and validate entries can significantly reduce errors.

Candidates should highlight the importance of maintaining detailed documentation and a systematic approach to double-checking work. They should also mention any specific tools or technologies they use to enhance accuracy and efficiency.

4. Can you describe a time when you improved a financial process in your previous role?

A strong response will include a specific example where the candidate identified a bottleneck or inefficiency in a financial process. They should describe the steps they took to improve the process, whether it was through automation, better resource allocation, or implementing new software.

The ideal candidate should quantify the impact of their improvement, such as time saved or accuracy increased. This demonstrates their ability to not only identify issues but also implement effective solutions.

5. How do you approach budgeting and forecasting?

Budgeting and forecasting require a blend of historical data analysis and future projections. Candidates should explain their process of gathering historical financial data, analyzing trends, and using this information to make informed predictions about future financial performance.

Look for candidates who emphasize the importance of regular review and adjustment of budgets and forecasts to reflect changing circumstances. They should also mention collaboration with other departments to ensure that their financial plans align with the organization's overall goals.

6. Explain the concept of working capital and why it is important.

Working capital is the difference between a company’s current assets and current liabilities. It measures the company’s short-term liquidity and operational efficiency. Positive working capital indicates that a company can cover its short-term liabilities with its short-term assets, which is essential for day-to-day operations.

Candidates should emphasize that managing working capital effectively ensures that the company can meet its obligations and invest in its growth. They might also discuss strategies for optimizing working capital, such as inventory management and accounts receivable/payable management.

7. How do you stay updated with changes in accounting standards and regulations?

Staying updated with changes in accounting standards and regulations involves continuous learning and professional development. Candidates might mention subscribing to industry publications, attending seminars, webinars, or workshops, and being a member of professional bodies such as the AICPA or ACCA.

An ideal response will reflect a proactive approach to learning and a commitment to maintaining compliance with the latest standards. This shows that the candidate values accuracy and regulatory compliance in their work.

8. What are the key elements of a financial statement? Can you briefly describe each one?

The key elements of a financial statement include the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity. The income statement shows the company’s financial performance over a period, including revenues, expenses, and profits. The cash flow statement outlines the cash inflows and outflows from operating, investing, and financing activities.

Look for candidates who can explain each element clearly and concisely, demonstrating their understanding of how these elements reflect the overall financial health of a company. An ideal answer should also mention the importance of these statements for stakeholders.

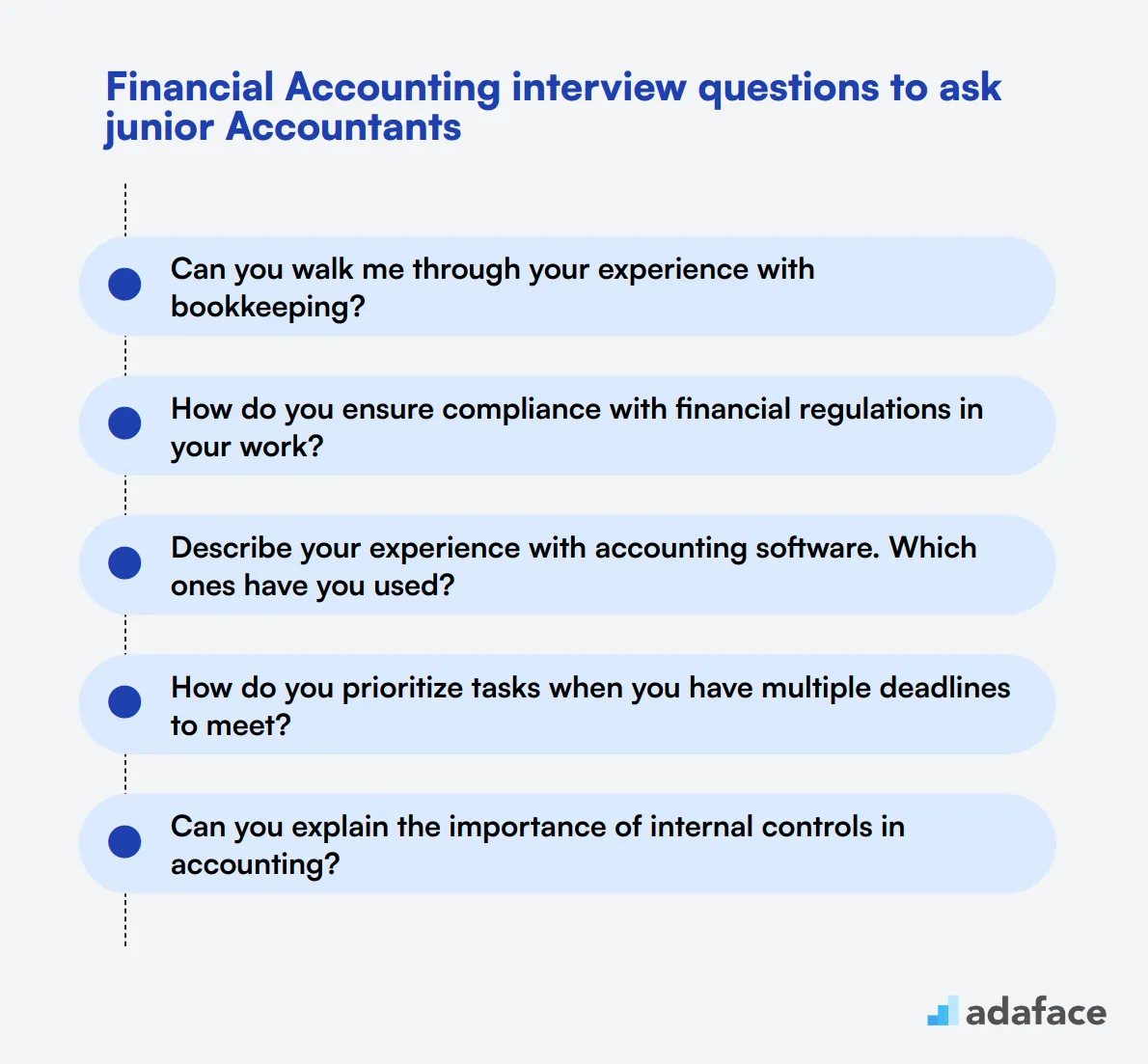

20 Financial Accounting interview questions to ask junior Accountants

To identify the best junior accountants for your team, use this carefully curated list of interview questions. These questions are designed to evaluate both the technical skills and practical experience of candidates, helping you find the right fit for your organization. For more insights into what to look for, check out this accountant job description.

- Can you walk me through your experience with bookkeeping?

- How do you ensure compliance with financial regulations in your work?

- Describe your experience with accounting software. Which ones have you used?

- How do you prioritize tasks when you have multiple deadlines to meet?

- Can you explain the importance of internal controls in accounting?

- How do you handle confidential financial information?

- Describe a situation where you had to explain a complex financial concept to a non-financial colleague.

- What steps do you take to prepare for an audit?

- How do you stay organized when managing multiple accounts?

- Can you give an example of how you have handled an unexpected financial issue?

- What experience do you have with tax preparation and filing?

- How do you handle client or stakeholder queries regarding financial reports?

- Explain a time when you had to deal with an accounting error. How did you resolve it?

- What financial metrics do you consider most important for a business to monitor?

- Describe your process for reconciling bank statements.

- How do you manage and track petty cash in your role?

- Can you provide an example of a financial report you have prepared?

- What experience do you have with financial forecasting?

- How do you approach learning and mastering new accounting tools or software?

- Describe a time when you had to work closely with another department to complete a financial project.

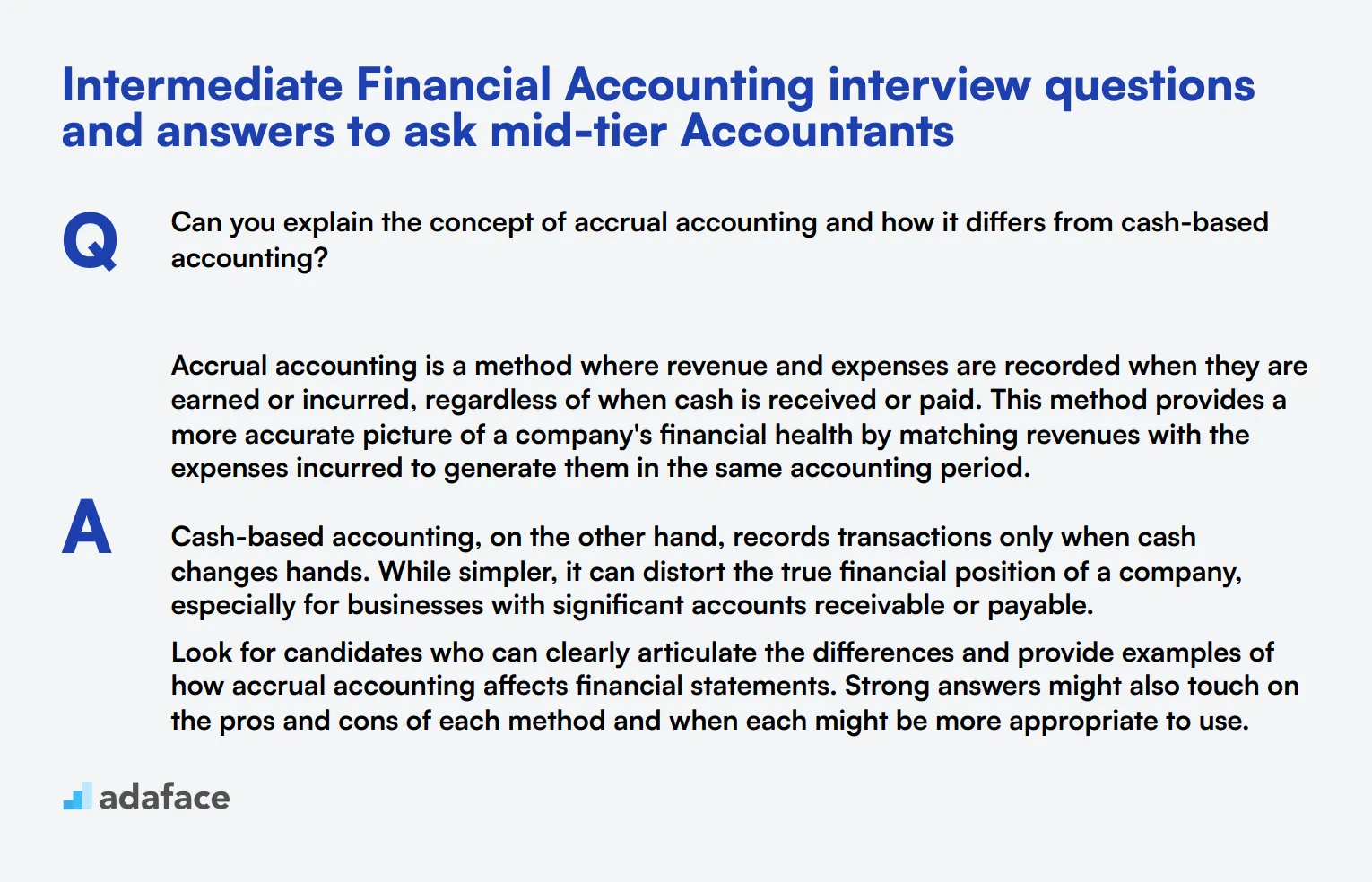

10 intermediate Financial Accounting interview questions and answers to ask mid-tier Accountants

Ready to take your financial accounting interviews up a notch? These 10 intermediate questions are perfect for assessing mid-tier accountants. They'll help you gauge a candidate's depth of knowledge and problem-solving skills, while keeping things interesting. Use these to spark discussions and uncover how well your potential hires can apply their accounting know-how in real-world scenarios.

1. Can you explain the concept of accrual accounting and how it differs from cash-based accounting?

Accrual accounting is a method where revenue and expenses are recorded when they are earned or incurred, regardless of when cash is received or paid. This method provides a more accurate picture of a company's financial health by matching revenues with the expenses incurred to generate them in the same accounting period.

Cash-based accounting, on the other hand, records transactions only when cash changes hands. While simpler, it can distort the true financial position of a company, especially for businesses with significant accounts receivable or payable.

Look for candidates who can clearly articulate the differences and provide examples of how accrual accounting affects financial statements. Strong answers might also touch on the pros and cons of each method and when each might be more appropriate to use.

2. How would you approach a bank reconciliation that has a significant discrepancy?

A strong approach to a bank reconciliation with a significant discrepancy would include the following steps:

- Review all transactions in both the bank statement and the company's records

- Check for timing differences (e.g., outstanding checks or deposits in transit)

- Look for errors in data entry or recording

- Investigate any unusual or unexpected transactions

- Consider the possibility of fraud or unauthorized transactions

If the discrepancy persists, the candidate might suggest reaching out to the bank for clarification or involving other team members or supervisors to review the reconciliation process.

An ideal response should demonstrate attention to detail, systematic problem-solving, and a commitment to accuracy. Look for candidates who emphasize the importance of thorough documentation throughout the reconciliation process and who understand the implications of unresolved discrepancies on financial reporting.

3. What are the key considerations when implementing a new accounting software system?

Key considerations for implementing new accounting software include:

- Assessing the company's specific needs and ensuring the software can meet them

- Evaluating the software's scalability and ability to integrate with existing systems

- Planning for data migration and ensuring data integrity

- Budgeting for both the initial cost and ongoing maintenance

- Training staff and managing change within the organization

- Ensuring the software complies with relevant accounting standards and regulations

Candidates should also mention the importance of having a robust implementation plan, including testing phases and a contingency plan in case of issues during the transition.

Look for answers that demonstrate an understanding of both the technical and human aspects of system implementation. Strong candidates will emphasize the importance of stakeholder buy-in and clear communication throughout the process.

4. How do you approach analyzing financial ratios, and which ones do you find most useful?

When analyzing financial ratios, a systematic approach is crucial. This typically involves:

- Calculating key ratios from financial statements

- Comparing ratios to industry benchmarks and historical company data

- Identifying trends and anomalies

- Interpreting the results in the context of the company's overall financial health and strategy

Some of the most useful ratios include:

- Liquidity ratios (e.g., current ratio, quick ratio)

- Profitability ratios (e.g., gross margin, net profit margin)

- Efficiency ratios (e.g., inventory turnover, accounts receivable turnover)

- Leverage ratios (e.g., debt-to-equity ratio)

- Valuation ratios (e.g., price-to-earnings ratio)

Look for candidates who understand that no single ratio tells the whole story and that context is key. Strong answers will emphasize the importance of using a combination of ratios and considering qualitative factors alongside quantitative analysis. Candidates should also be able to explain how different ratios can provide insights into various aspects of a company's financial performance and position.

5. Can you explain the concept of materiality in accounting and how it affects financial reporting?

Materiality in accounting refers to the significance of an item, error, or misstatement in financial information. An item is considered material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

The concept of materiality affects financial reporting in several ways:

- It guides accountants in deciding which information should be disclosed in financial statements

- It helps auditors determine the scope and extent of their audit procedures

- It influences decisions about whether to adjust for errors or misstatements discovered during the audit process

Look for candidates who understand that materiality is both a quantitative and qualitative concept. They should be able to explain that what's material for one company might not be for another, depending on factors like company size, industry, and specific circumstances. Strong answers might also touch on the professional judgment required in applying materiality concepts and the potential consequences of misjudging materiality.

6. How would you handle a situation where you disagree with a manager about the appropriate accounting treatment for a transaction?

A professional approach to handling disagreements about accounting treatments might include:

- Thoroughly researching the relevant accounting standards and guidelines

- Preparing a clear, fact-based explanation of your position

- Listening to and understanding the manager's perspective

- Discussing the potential impacts of different treatments on the financial statements

- If necessary, seeking input from other experts or higher-level management

The candidate should emphasize the importance of maintaining professional skepticism and integrity while also respecting the chain of command and fostering positive working relationships.

Look for answers that demonstrate strong communication skills, ethical decision-making, and a commitment to accuracy in financial reporting. The ideal candidate should show they can navigate difficult conversations professionally and are willing to stand up for what they believe is correct, while remaining open to other perspectives and willing to admit if they're wrong.

7. How do you stay current with changes in accounting standards and regulations?

Staying current with accounting standards and regulations is crucial for any accountant. Effective strategies might include:

- Regularly reading professional publications and newsletters

- Attending webinars, seminars, and conferences

- Participating in continuing professional education (CPE) courses

- Following relevant regulatory bodies and standard-setting organizations on social media

- Joining professional accounting associations and participating in their events

- Discussing changes and their implications with colleagues and industry peers

Candidates might also mention the importance of understanding not just the changes themselves, but also their practical implications for financial reporting and business operations.

Look for answers that demonstrate a proactive approach to learning and a genuine interest in the field. Strong candidates will emphasize the importance of not just knowing about changes, but also understanding how to apply them in practice. They might also mention specific sources they find particularly useful or recent changes they've had to adapt to in their work.

8. Can you explain the difference between LIFO and FIFO inventory valuation methods and when each might be preferable?

LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) are inventory valuation methods that determine the cost of goods sold and the value of ending inventory:

- FIFO assumes that the oldest inventory items are sold first

- LIFO assumes that the newest inventory items are sold first

FIFO is generally preferable when:

- Inventory is perishable or becomes obsolete quickly

- You want to match physical flow of goods (in most cases)

- You want to report higher profits and higher inventory values on the balance sheet (in times of rising prices)

LIFO might be preferred when:

- The goal is to minimize taxes in periods of rising prices (as it results in higher cost of goods sold and lower taxable income)

- The company wants to match current costs against current revenues

Look for candidates who understand the impact of each method on financial statements and tax liability. Strong answers will also mention that LIFO is not allowed under IFRS, which is important for companies operating internationally. Candidates should be able to discuss the pros and cons of each method and how the choice might affect financial ratios and stakeholder perceptions.

9. How would you approach calculating the depreciation for a complex asset with multiple components?

Calculating depreciation for a complex asset with multiple components, also known as component depreciation, involves:

- Identifying the significant components of the asset

- Determining the useful life of each component

- Allocating the total cost of the asset among its components

- Calculating depreciation separately for each component based on its cost and useful life

- Summing the depreciation of all components to get the total depreciation for the asset

This approach allows for more accurate depreciation as different parts of an asset may have different useful lives. For example, in a building, the structure might have a longer life than the heating system or the roof.

Look for candidates who understand the concept of materiality in deciding which components to depreciate separately. Strong answers might also mention the need to regularly review and adjust component depreciation if circumstances change. Candidates should be able to discuss the advantages of this method (more accurate matching of expenses to revenues) as well as its challenges (increased complexity in record-keeping).

10. How would you detect and prevent fraudulent activities in financial reporting?

Detecting and preventing fraudulent activities in financial reporting involves a multi-faceted approach:

- Implementing strong internal controls and segregation of duties

- Regularly reviewing and reconciling accounts

- Conducting surprise audits

- Using data analytics to identify unusual patterns or transactions

- Fostering a culture of ethics and integrity within the organization

- Providing channels for whistleblowers to report suspicious activities

- Staying alert to common fraud indicators or 'red flags'

Prevention strategies might include:

- Robust hiring practices including background checks

- Regular staff training on fraud awareness and ethical behavior

- Implementing a code of conduct and ensuring it's followed

- Using technology to automate processes and reduce human error or manipulation

Look for candidates who understand that fraud detection and prevention is an ongoing process that requires vigilance and adaptability. Strong answers will emphasize the importance of professional skepticism and the need to stay updated on new fraud schemes and prevention techniques. Candidates should also recognize the role of external auditors in detecting fraud and the importance of cooperating fully with audit processes.

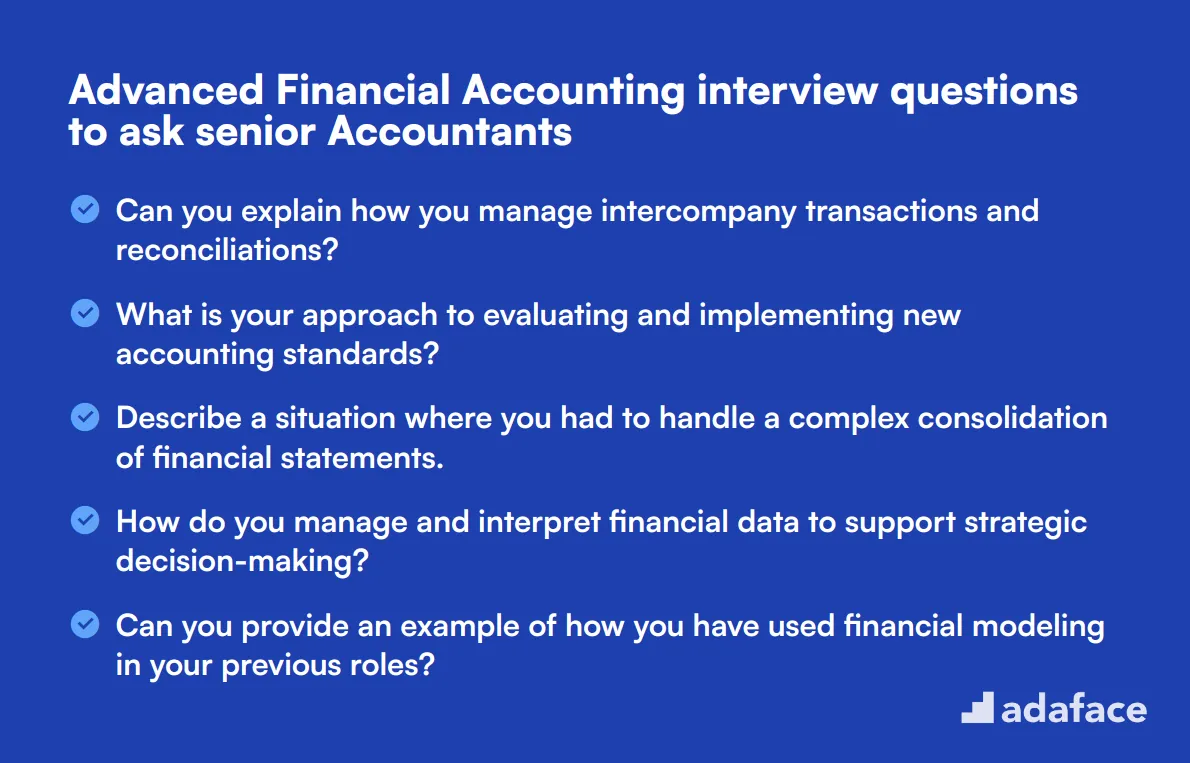

15 advanced Financial Accounting interview questions to ask senior Accountants

To effectively assess the capabilities of senior accountants, consider using these advanced Financial Accounting interview questions. This list is designed to help hiring managers and recruiters identify candidates with the right expertise and problem-solving skills required for complex accounting tasks. For additional insights on the required skills, you can refer to this financial analyst job description.

- Can you explain how you manage intercompany transactions and reconciliations?

- What is your approach to evaluating and implementing new accounting standards?

- Describe a situation where you had to handle a complex consolidation of financial statements.

- How do you manage and interpret financial data to support strategic decision-making?

- Can you provide an example of how you have used financial modeling in your previous roles?

- What steps do you take to ensure tax compliance in different jurisdictions?

- How do you approach the preparation and presentation of cash flow statements?

- Explain your experience with managing foreign currency transactions and translations.

- Describe your methodology for conducting financial audits and ensuring accuracy.

- How do you handle the financial integration of a newly acquired subsidiary?

- What strategies do you use for managing the financial risks of a company?

- Can you explain the process of performing a variance analysis and its importance?

- Describe a time when you had to adapt your accounting practices to meet international standards.

- What experience do you have with financial restructuring and reorganization?

- How do you evaluate the financial health of an organization using key performance indicators?

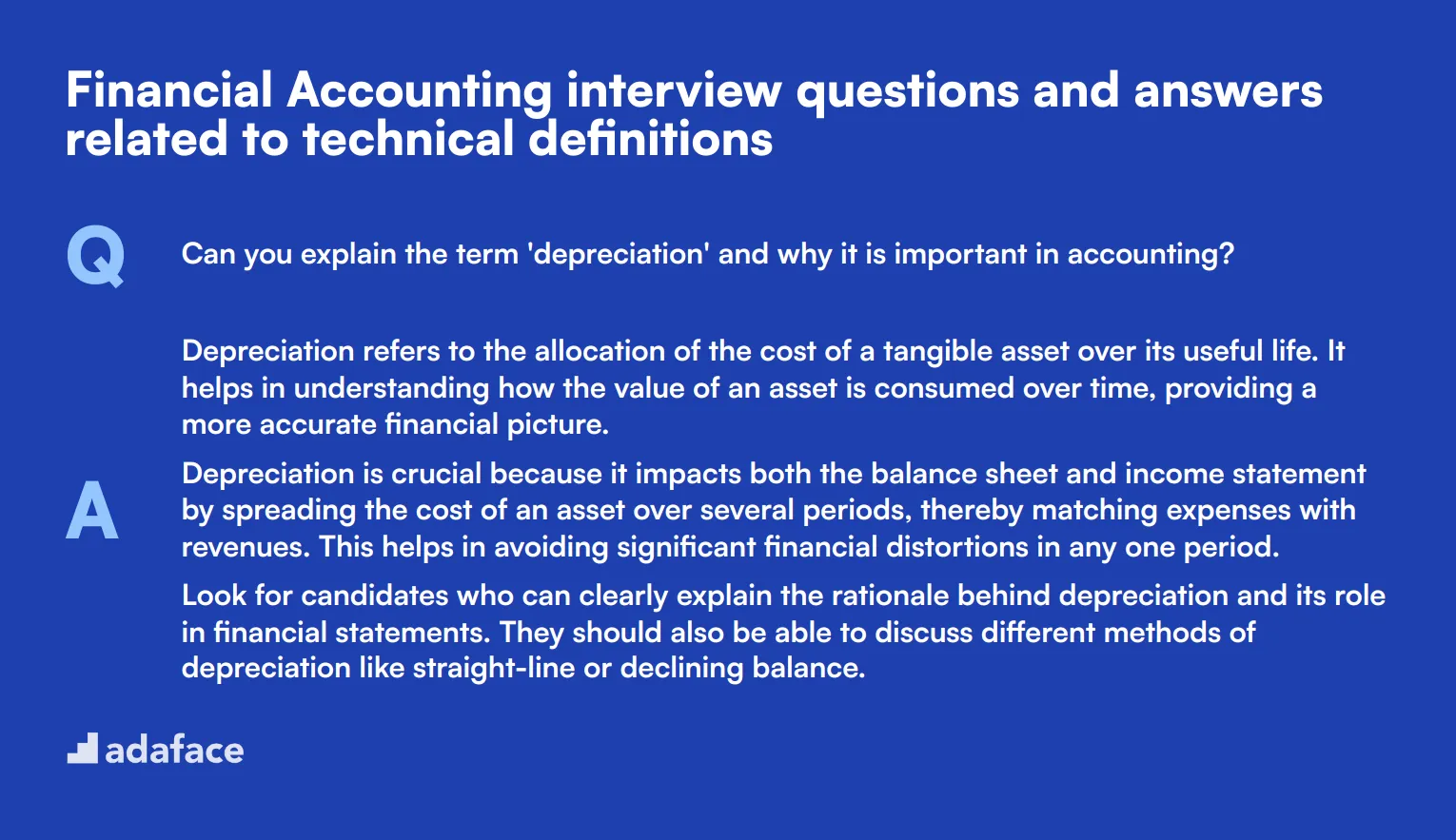

8 Financial Accounting interview questions and answers related to technical definitions

To effectively evaluate whether your candidates have a strong grasp of fundamental financial accounting concepts, use this list of technical definition questions. These questions will help you gauge their understanding of key terms and principles, ensuring they can speak the same language as your finance team.

1. Can you explain the term 'depreciation' and why it is important in accounting?

Depreciation refers to the allocation of the cost of a tangible asset over its useful life. It helps in understanding how the value of an asset is consumed over time, providing a more accurate financial picture.

Depreciation is crucial because it impacts both the balance sheet and income statement by spreading the cost of an asset over several periods, thereby matching expenses with revenues. This helps in avoiding significant financial distortions in any one period.

Look for candidates who can clearly explain the rationale behind depreciation and its role in financial statements. They should also be able to discuss different methods of depreciation like straight-line or declining balance.

2. What is the purpose of a trial balance in accounting?

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. It serves as a checkpoint to ensure that the entries in a company's bookkeeping system are mathematically correct.

The trial balance helps to identify any discrepancies in the accounting records early, making it easier to locate and correct errors before preparing the final financial statements.

An ideal candidate should be able to explain the purpose and importance of a trial balance in maintaining the accuracy of financial records. They should also be aware of common discrepancies and how to address them.

3. Can you define 'amortization' and how it differs from depreciation?

Amortization is the process of gradually writing off the initial cost of an intangible asset over its useful life. Unlike depreciation, which applies to tangible assets, amortization is used for assets like patents, trademarks, and goodwill.

Both amortization and depreciation aim to allocate the cost of an asset over its useful life, but they apply to different types of assets. While depreciation deals with physical assets, amortization deals with intangible ones.

Look for candidates who can clearly distinguish between amortization and depreciation and explain why each is important for accurate financial reporting. This shows their understanding of different asset types and their financial treatment.

4. What is 'accrual accounting' and why is it used?

Accrual accounting is a method where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid. This approach provides a more accurate financial picture by matching income and expenses to the periods in which they are incurred.

Accrual accounting is used because it offers a more realistic view of a company's financial situation, allowing for better financial planning and decision-making.

Candidates should be able to articulate the principles of accrual accounting and its advantages over cash-based accounting. They should also understand its importance in providing a true and fair view of the company's financial health.

5. Can you explain what a 'balance sheet' is and its main components?

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It includes three main components: assets, liabilities, and shareholders' equity.

Assets are resources owned by the company, liabilities are obligations owed, and shareholders' equity represents the residual interest in the assets after deducting liabilities. The balance sheet equation is Assets = Liabilities + Shareholders' Equity.

Look for candidates who can clearly describe the structure and purpose of a balance sheet. They should be able to explain each component and its significance in representing the company's financial health.

6. What is 'cash flow' and why is it important for a business?

Cash flow refers to the movement of money in and out of a business. It is crucial for maintaining the liquidity necessary to meet short-term obligations and invest in new opportunities.

Positive cash flow allows a business to cover expenses, repay debts, and fund growth, while negative cash flow can indicate financial trouble and potential insolvency.

Candidates should be able to explain the importance of cash flow management and distinguish between operating, investing, and financing cash flows. Understanding the nuances of cash flow analysis is critical for effective financial management.

7. Can you describe what a 'general ledger' is and its role in accounting?

A general ledger is a comprehensive record of all financial transactions conducted by a company. It is the central repository for accounting data and includes accounts for assets, liabilities, equity, revenues, and expenses.

The general ledger serves as the foundation for preparing financial statements, ensuring that all financial data is accurately recorded and categorized.

An ideal candidate should demonstrate a clear understanding of the general ledger's role in the accounting process and its importance in ensuring accurate financial reporting. They should also be familiar with how to maintain and reconcile the general ledger.

8. What is 'double-entry bookkeeping' and why is it important?

Double-entry bookkeeping is an accounting system in which every transaction affects at least two accounts, with one debit and one credit entry. This method ensures that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

Double-entry bookkeeping is important because it reduces errors, improves the accuracy of financial records, and provides a complete picture of a company's financial activities.

Look for candidates who can explain the principles of double-entry bookkeeping and its advantages over single-entry systems. They should also be able to discuss its role in maintaining accurate and reliable financial records.

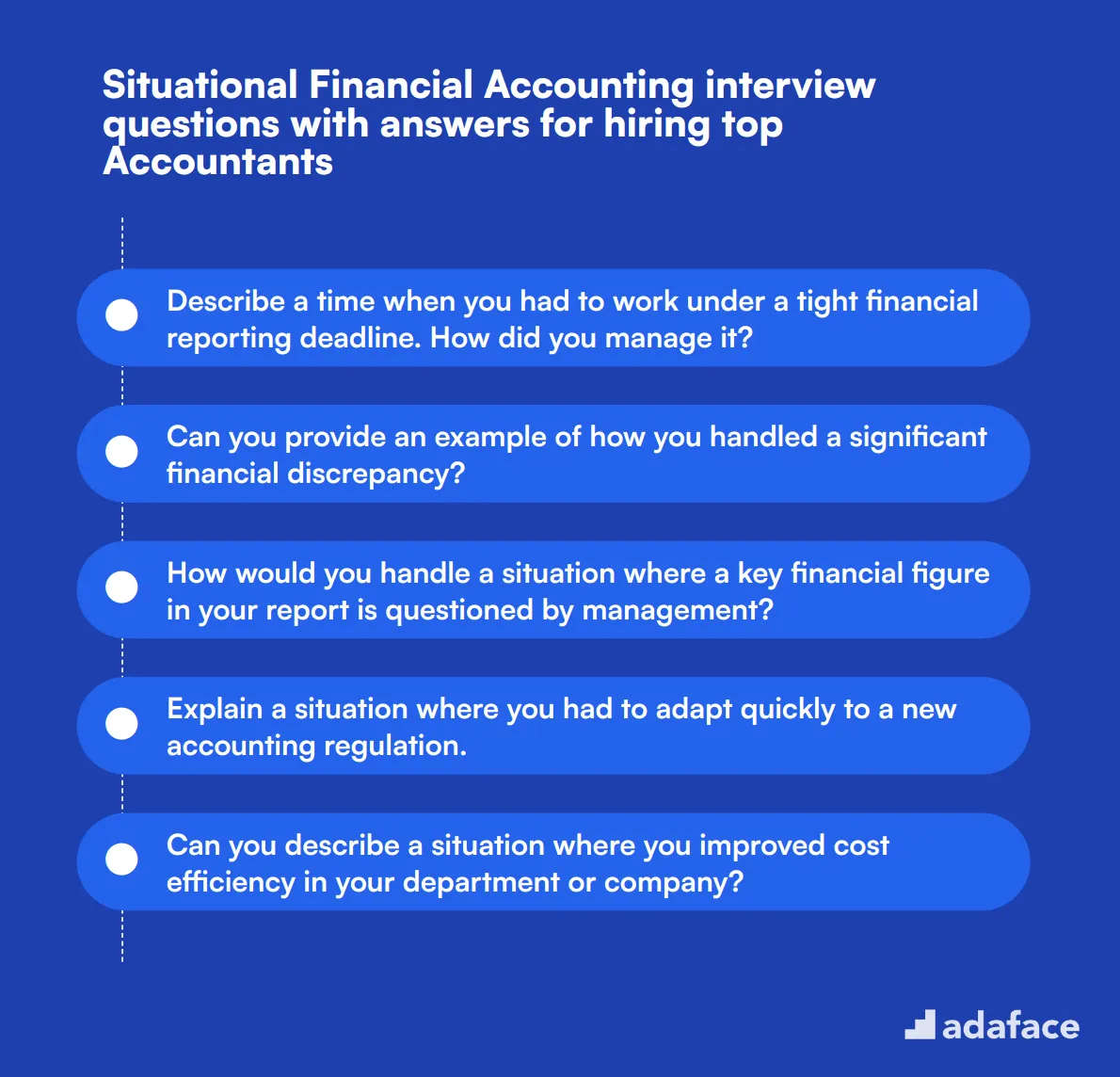

7 situational Financial Accounting interview questions with answers for hiring top Accountants

To ensure you are hiring top-notch accountants who can handle real-world financial challenges, ask them these situational interview questions. These queries are designed to gauge how candidates react to specific scenarios they might encounter on the job. Whether you're hiring for a junior position or a senior role, these questions will help you assess their practical skills and problem-solving abilities.

1. Describe a time when you had to work under a tight financial reporting deadline. How did you manage it?

In my previous role, we had an urgent need to finalize the quarter-end financial statements due to an unexpected audit announcement. I immediately prioritized my tasks and created a detailed timeline to ensure every essential element was covered without compromising accuracy.

I also coordinated closely with my team, delegating tasks based on individual strengths and ensuring constant communication. We managed to complete the report ahead of schedule, which was well-received by the auditors and management.

An ideal candidate should illustrate their ability to work efficiently under pressure, demonstrate effective time management skills, and show how they maintain accuracy and quality even with tight deadlines.

2. Can you provide an example of how you handled a significant financial discrepancy?

In one instance, I discovered a substantial discrepancy during a routine reconciliation process. I started by thoroughly reviewing all related transactions, comparing our internal records with bank statements to pinpoint the source of the discrepancy.

After identifying the error, which was a double entry of a significant payment, I promptly corrected the records and implemented additional checks to prevent similar issues in the future. I also communicated the issue and resolution to the relevant stakeholders to ensure transparency.

What to look for: The candidate should demonstrate keen attention to detail, a systematic approach to problem-solving, and the ability to communicate effectively with stakeholders about financial issues.

3. How would you handle a situation where a key financial figure in your report is questioned by management?

If management questions a key financial figure, I would first review the data and calculations to ensure their accuracy. Then, I would gather all supporting documentation and be prepared to explain the methodology used to arrive at the figure.

I would arrange a meeting with the concerned parties to discuss their concerns and provide a clear, logical explanation backed by data. If there were any errors or misunderstandings, I would address them promptly and update the report as necessary.

Look for candidates who can remain calm under scrutiny, possess strong communication skills, and show a commitment to transparency and accuracy in their reporting.

4. Explain a situation where you had to adapt quickly to a new accounting regulation.

When a new revenue recognition standard was introduced, I had to quickly adapt our accounting processes to comply. I started by thoroughly studying the regulation and attending workshops to understand its implications.

I then updated our accounting policies and procedures, conducted training sessions for the team, and collaborated with other departments to ensure a smooth transition. This proactive approach helped us comply without any disruptions to our financial reporting.

Ideal responses should show the candidate's initiative in staying updated with new regulations, their ability to implement changes effectively, and their commitment to continuous learning.

5. Can you describe a situation where you improved cost efficiency in your department or company?

At my previous job, I identified that we were overspending on office supplies due to a lack of centralized procurement. I proposed a new system where all purchases were tracked and approved through a dedicated software platform.

This change allowed us to negotiate better rates with suppliers, reduce unnecessary purchases, and ultimately save the company a significant amount of money annually. The new system also improved accountability and transparency within the procurement process.

Look for examples where candidates took initiative, used data to drive decisions, and successfully implemented cost-saving measures. Their ability to collaborate and communicate changes effectively is also crucial.

6. How do you handle situations where you have to explain financial data to non-financial stakeholders?

I always start by simplifying complex financial terms into easy-to-understand language. For instance, instead of using jargon, I use analogies or everyday examples that relate to their area of expertise.

I also prepare visual aids like charts and graphs to illustrate key points. During the discussion, I encourage questions to ensure they fully understand the information being presented. This approach has helped build trust and make financial data more accessible to everyone.

The ideal candidate should show empathy, strong communication skills, and the ability to make financial data comprehensible to individuals without a financial background.

7. Describe a time when you had to mediate a conflict between team members in your accounting department.

In one instance, two team members disagreed over the allocation of tasks for a major project. I first listened to both sides to understand their perspectives and concerns. Then, I facilitated a meeting where we discussed the issues openly and collaboratively sought solutions.

We agreed on a fair distribution of tasks considering each individual's strengths and workload. This not only resolved the conflict but also improved team morale and productivity.

Look for responses that demonstrate the candidate's conflict resolution skills, ability to listen and empathize, and their effectiveness in fostering a collaborative team environment.

Which Financial Accounting skills should you evaluate during the interview phase?

While it's impossible to fully assess a candidate's financial accounting skills in one interview, focusing on key areas can provide a reliable gauge of their abilities. Here are the core financial accounting skills you should evaluate during the interview process.

Analytical Skills

Analytical skills are essential in financial accounting as they enable accountants to scrutinize financial data and identify trends, discrepancies, or potential areas for improvement. This skill is vital for ensuring accurate financial reporting and decision-making.

To assess a candidate's analytical skills, you can use an assessment test that includes relevant multiple-choice questions (MCQs). Adaface offers a financial accounting test designed to evaluate analytical proficiency.

Additionally, you can ask targeted interview questions to judge their analytical abilities.

Can you describe a time when you identified a significant discrepancy in a financial report? How did you handle it?

When asking this question, look for responses that demonstrate the candidate's ability to identify issues, analyze data, and implement solutions effectively.

Attention to Detail

Attention to detail is critical in financial accounting because even small errors can lead to significant financial discrepancies. Accountants must be meticulous in their work to ensure accuracy in financial statements and compliance with regulations.

To filter for this skill, consider using an assessment that includes MCQs focused on identifying errors and ensuring accuracy. For instance, Adaface's attention to detail test is a great tool.

You can also ask specific interview questions to evaluate their attention to detail.

Tell me about a time when you caught an error that others had missed. How did you find it, and what was the outcome?

Look for responses that show the candidate's thoroughness and their approach to reviewing financial documents. Their answer should reflect their ability to consistently produce accurate work.

Technical Proficiency

Technical proficiency is important as modern accountants need to be adept with accounting software and tools. This skill ensures they can efficiently manage financial data, conduct analyses, and generate accurate reports.

To gauge a candidate's technical proficiency, you can use an assessment test with MCQs related to common accounting software and tools. Adaface provides an accounting test which covers these technical aspects.

Consider asking interview questions that assess their familiarity and comfort level with accounting software.

Which accounting software are you most proficient in, and can you describe a complex task you have completed using it?

Look for answers that showcase their technical skills and practical experience. The candidate should be able to demonstrate their ability to use software to solve accounting problems effectively.

3 Effective Tips for Conducting Financial Accounting Interviews

Before you put the financial accounting interview questions to use, here are some strategic tips to help refine your interviewing process and ensure you're effectively assessing candidates.

1. Incorporate Skills Assessments Early in the Process

Using skills tests before interviews can significantly streamline the hiring process by ensuring only qualified candidates move forward. Skills assessments help filter out candidates who may look good on paper but don't possess the necessary practical abilities.

For financial accounting roles, consider using assessments such as the Financial Accounting Test or the broader Accounting Test. These tests evaluate critical competencies needed for the role, providing a clear picture of candidate capabilities.

Integrating these tests early in your recruitment process not only saves time during interviews but also enhances the objectivity of your hiring decisions. It allows you to focus interview discussions on in-depth understanding and cultural fit rather than basic skills verification.

2. Curate Your Question List Wisely

Time is limited in interviews, so it’s important to ask focused questions that reveal critical insights about the candidates. Select a mix of questions that cover both the fundamentals and the specifics of financial accounting to ensure a thorough evaluation.

Explore other relevant skillsets that complement financial knowledge. Consider including questions from areas such as data analysis or business intelligence to gauge broader analytical skills.

By blending questions from different yet relevant areas, you can obtain a holistic view of the candidate’s capabilities and how they tackle complex problems.

3. Master the Art of Follow-Up Questions

Relying solely on prepared interview questions isn't enough. Effective follow-up questions dive deeper into the candidate’s responses to reveal critical thinking and problem-solving skills.

For instance, if a candidate explains their approach to a common accounting problem, you might follow up with, 'Can you describe a time when this approach helped you overcome a significant challenge?' This question helps assess practical application of knowledge and adaptability to real-world issues.

Use Financial Accounting interview questions and skills tests to hire talented Accountants

If you are looking to hire someone with strong Financial Accounting skills, it's important to verify that they possess the necessary competencies. The most accurate way to achieve this is through skill tests, such as our Financial Accounting Test.

After utilizing this test, you can effectively shortlist the best applicants and invite them for interviews. To get started, consider signing up at Adaface or explore our test library for more relevant assessments.

Financial Accounting Online Test

Download Financial Accounting interview questions template in multiple formats

Financial Accounting Interview Questions FAQs

Common questions often include topics like financial statements, accounting principles, and examples of handling specific accounting situations.

Ask questions regarding specific accounting software, technical definitions, and practical scenarios they have encountered in previous roles.

Focus on their foundational knowledge of accounting principles, eagerness to learn, and ability to handle basic financial tasks.

Situational questions can reveal how candidates approach real-world accounting problems, their problem-solving skills, and their ability to handle stress.

Senior Accountants should demonstrate advanced knowledge, leadership abilities, and extensive experience in handling complex accounting tasks.

A mix of questions helps to assess both the theoretical knowledge and practical skills of the candidate, ensuring a well-rounded evaluation.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources