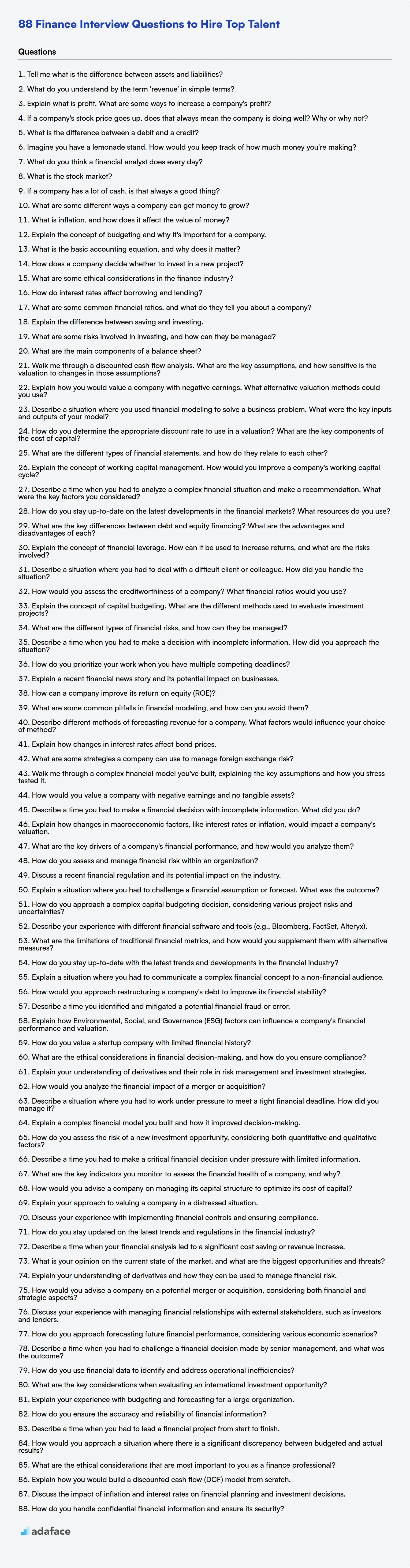

Finance interviews can be stressful, both for the interviewer and the candidate. Finance roles demand a unique blend of technical expertise and analytical which makes assessing candidates a challenge.

This blog post provides a detailed collection of finance interview questions categorized by skill level, ranging from basic to expert, including multiple-choice questions. We aim to equip you with questions to evaluate candidates.

Use these questions to identify promising candidates, and for a more data-driven approach, consider using Adaface's financial analyst test to evaluate skills before the interview.

Table of contents

Basic Finance interview questions

1. Tell me what is the difference between assets and liabilities?

Assets are what a company owns that has future economic value. They represent resources that can generate revenue or reduce expenses. Examples include cash, accounts receivable, inventory, and equipment.

Liabilities, on the other hand, are what a company owes to others. They represent obligations to transfer assets or provide services to another entity in the future. Examples include accounts payable, salaries payable, and loans.

2. What do you understand by the term 'revenue' in simple terms?

Revenue, in simple terms, is the total amount of money a company or business earns from its operations, primarily from selling goods or services to customers. It represents the top line of the income statement and is calculated before any expenses or costs are deducted. Think of it as the total sales income before subtracting costs to arrive at a profit figure.

3. Explain what is profit. What are some ways to increase a company's profit?

Profit is the financial gain a company makes after deducting all expenses, including the cost of goods sold, operating expenses, interest, and taxes, from its total revenue. In simpler terms, it's what's left over after paying all the bills.

To increase profit, a company can focus on either increasing revenue or decreasing expenses. Some common strategies include:

- Increasing Sales: Implement marketing campaigns, improve customer service, expand into new markets, or introduce new products/services.

- Reducing Costs: Negotiate better deals with suppliers, streamline operations, automate tasks, reduce waste, or optimize energy consumption.

- Pricing Strategies: Increase prices (carefully considering demand), offer discounts to boost sales volume, or bundle products/services.

- Improving Efficiency: Implement lean manufacturing principles, optimize supply chain management, or invest in employee training.

4. If a company's stock price goes up, does that always mean the company is doing well? Why or why not?

No, a company's stock price increasing doesn't always mean the company is doing well. While it often correlates with positive performance or future expectations, it's influenced by many factors beyond the company's fundamental health. Market sentiment, overall economic conditions, investor speculation, and news events (even unrelated ones) can significantly impact the price.

For example, hype around a new technology or a short squeeze can drive a stock price up temporarily, even if the company's underlying financials haven't improved. Conversely, a broad market downturn can depress a stock price regardless of how well the company is actually performing. Therefore, it's important to look at a variety of metrics, not just the stock price, to assess a company's true performance.

5. What is the difference between a debit and a credit?

The terms debit and credit have different meanings depending on the context. In banking, a debit decreases your account balance, while a credit increases it. For example, a purchase made with your debit card results in a debit to your account. A deposit into your account is a credit.

In accounting, debit and credit are entries used to record transactions. They adhere to the fundamental accounting equation: Assets = Liabilities + Equity. A debit increases asset and expense accounts while decreasing liability, owner's equity, and revenue accounts. Conversely, a credit increases liability, owner's equity, and revenue accounts while decreasing asset and expense accounts. Debits are always on the left, and credits are on the right.

6. Imagine you have a lemonade stand. How would you keep track of how much money you're making?

I'd keep track of my lemonade stand earnings using a simple system. I'd start with a cash box or jar to hold the money. Each time I sell a cup of lemonade, I'd immediately put the money from the sale into the cash box. To track income, I would use a notebook or a simple spreadsheet on a phone/tablet. For each sale, I'd record the date, time, and amount of money received. At the end of the day (or whenever I want to check my progress), I'd count the money in the cash box and compare it to the total amount recorded in my notebook/spreadsheet. This helps ensure I am accounting for all sales and have a clear view of my earnings.

7. What do you think a financial analyst does every day?

A financial analyst's day typically involves a mix of data gathering, analysis, and reporting. They might spend time collecting financial data from various sources, building financial models to forecast future performance, and analyzing trends to identify investment opportunities or risks. This often includes tasks like:

- Analyzing financial statements (income statement, balance sheet, cash flow statement).

- Creating financial models (e.g., discounted cash flow, comparable company analysis).

- Preparing presentations and reports summarizing findings and recommendations.

- Monitoring market trends and economic indicators.

- Communicating with internal stakeholders (e.g., portfolio managers, investment bankers) or external clients.

8. What is the stock market?

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. These shares, also known as stocks or equities, represent ownership in a company.

It functions as a platform for companies to raise capital by issuing shares to the public, and it allows investors to participate in the potential growth and profits of those companies. Stock prices are determined by supply and demand, reflecting investor sentiment and expectations about a company's future performance.

9. If a company has a lot of cash, is that always a good thing?

Having a lot of cash isn't always a good thing. While it provides a buffer for downturns and opportunities for investment, excessive cash can signal a lack of innovation, strategic direction, or efficient capital allocation. It might indicate the company is not reinvesting in itself (R&D, expansion, etc.) or returning value to shareholders (dividends, buybacks).

Large cash reserves can also make a company an attractive takeover target or lead to pressure to make rash acquisitions. Moreover, inflation can erode the real value of idle cash over time. The ideal cash balance is one that balances safety and opportunity with efficient capital management.

10. What are some different ways a company can get money to grow?

Companies can obtain funding for growth through various methods. Some common approaches include: taking out loans from banks or other financial institutions, seeking venture capital or private equity investments, issuing bonds, or offering equity through an initial public offering (IPO) or secondary offerings. They can also use internally generated funds, also known as retained earnings.

Another way is through strategic partnerships where another company invests in the growth of the company to gain access to markets, products, or technology. Government grants and subsidies can also be sources of funds for specific projects or industries. Finally, crowdfunding has emerged as a viable option, especially for startups and smaller businesses.

11. What is inflation, and how does it affect the value of money?

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. It's typically expressed as a percentage increase over a period of time.

Inflation erodes the value of money because each unit of currency buys fewer goods and services than it did previously. For example, if the inflation rate is 5%, an item that cost $1 last year would cost $1.05 this year. This means the real value or purchasing power of a dollar has decreased.

12. Explain the concept of budgeting and why it's important for a company.

Budgeting is the process of creating a detailed financial plan for a specific period, typically a year. It involves estimating revenues, expenses, and cash flows to determine how resources will be allocated and managed.

Budgeting is crucial for companies because it provides a roadmap for achieving financial goals, enabling better decision-making, resource allocation, and performance monitoring. It helps control costs, identify potential problems early on, and ensures alignment between financial objectives and overall business strategy. Effectively, it guides a company to optimal financial performance and sustainability.

13. What is the basic accounting equation, and why does it matter?

The basic accounting equation is Assets = Liabilities + Equity. This equation represents the fundamental relationship between what a company owns (assets), what it owes to others (liabilities), and the owners' stake in the company (equity).

It matters because it's the foundation of the double-entry bookkeeping system. Every transaction affects at least two accounts to keep the equation in balance. This ensures the accuracy and reliability of financial statements, providing a clear picture of a company's financial position and performance. Imbalances in the equation signal potential errors or fraud.

14. How does a company decide whether to invest in a new project?

Companies evaluate new projects by assessing potential returns against risks and costs. This often involves a combination of quantitative and qualitative analyses.

Key considerations include:

- Financial metrics: ROI (Return on Investment), NPV (Net Present Value), IRR (Internal Rate of Return), payback period, and profitability index are calculated and compared against hurdle rates or benchmarks.

- Strategic alignment: Does the project align with the company's overall strategic goals and objectives?

- Market analysis: Assessment of market size, growth potential, competitive landscape, and customer demand.

- Risk assessment: Identification and evaluation of potential risks (e.g., technical, market, financial, regulatory) and mitigation strategies.

- Qualitative factors: Impact on brand reputation, competitive advantage, employee morale, and social responsibility. A weighted scoring model can be used to prioritize projects, incorporating both quantitative and qualitative factors.

15. What are some ethical considerations in the finance industry?

Ethical considerations in finance are paramount. They include maintaining integrity and objectivity in financial advice, avoiding conflicts of interest by fully disclosing any relationships or affiliations that might influence decisions, and ensuring confidentiality of client information. Insider trading is a serious breach of ethics, as is manipulating markets for personal gain.

Furthermore, financial professionals have a responsibility to provide fair and transparent pricing, avoid predatory lending practices, and act in the best interests of their clients. Upholding ethical standards builds trust and is crucial for the stability and reputation of the financial industry.

16. How do interest rates affect borrowing and lending?

Interest rates are a key factor affecting borrowing and lending. Higher interest rates make borrowing more expensive, as borrowers have to pay back more than the principal amount. This discourages borrowing for both consumers (e.g., mortgages, car loans) and businesses (e.g., investments in new equipment, expansions). Consequently, higher rates tend to reduce overall demand in the economy. On the lending side, higher interest rates make saving and investing more attractive, as lenders/savers receive a higher return on their money. This incentivizes people to save more and lend more.

Conversely, lower interest rates make borrowing cheaper, encouraging spending and investment. Lower rates also decrease the incentive to save, as the returns are lower, leading to potentially more spending. Central banks often manipulate interest rates to influence economic activity, lowering rates to stimulate growth during recessions and raising rates to curb inflation during periods of rapid economic expansion.

17. What are some common financial ratios, and what do they tell you about a company?

Common financial ratios provide insights into a company's performance and financial health. Some key ratios include:

- Liquidity Ratios:

- Current Ratio (Current Assets / Current Liabilities): Measures a company's ability to pay short-term obligations.

- Quick Ratio ( (Current Assets - Inventory) / Current Liabilities): Similar to the current ratio but excludes inventory.

- Profitability Ratios:

- Gross Profit Margin ((Revenue - Cost of Goods Sold) / Revenue): Indicates the percentage of revenue remaining after accounting for the cost of goods sold.

- Net Profit Margin (Net Income / Revenue): Shows the percentage of revenue remaining after all expenses.

- Solvency Ratios:

- Debt-to-Equity Ratio (Total Debt / Shareholders' Equity): Assesses the company's financial leverage.

- Efficiency Ratios:

- Inventory Turnover (Cost of Goods Sold / Average Inventory): Measures how efficiently a company manages its inventory.

These ratios are used to evaluate a company's liquidity, profitability, solvency, and efficiency. By analyzing these ratios, investors and analysts can gain a better understanding of a company's financial strength and overall performance, and to evaluate trends over time. They are usually compared to industry averages, or against the companies previous historical performance.

18. Explain the difference between saving and investing.

Saving is typically setting aside money for short-term goals or emergencies, with a focus on safety and accessibility. The primary goal is to preserve capital, even if it means earning minimal returns. Common savings vehicles include savings accounts, money market accounts, and certificates of deposit (CDs). The returns are typically low but the risk is also low and the money is easily accessible.

Investing, on the other hand, involves using money to purchase assets with the expectation of generating future income or appreciation in value. This usually entails taking on more risk in the hope of achieving higher returns over a longer period. Examples of investments include stocks, bonds, mutual funds, and real estate. Investments carry the risk of loss but potentially offer greater growth.

19. What are some risks involved in investing, and how can they be managed?

Investing inherently involves risks, and understanding them is crucial for effective management. Some key risks include: Market Risk (overall market decline), Inflation Risk (loss of purchasing power), Interest Rate Risk (changes in interest rates impacting bond values), Credit Risk (borrower defaulting), and Liquidity Risk (difficulty selling an investment quickly).

Risk management strategies include diversification (spreading investments across different asset classes), asset allocation (adjusting portfolio based on risk tolerance), using stop-loss orders, and conducting thorough due diligence before investing. Regularly reviewing and rebalancing your portfolio is also a vital part of managing risk effectively.

20. What are the main components of a balance sheet?

The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns (e.g., cash, accounts receivable, inventory, property, plant, and equipment). Liabilities represent what a company owes to others (e.g., accounts payable, salaries payable, loans). Equity represents the owners' stake in the company; it's the residual value of assets minus liabilities.

Intermediate Finance interview questions

1. Walk me through a discounted cash flow analysis. What are the key assumptions, and how sensitive is the valuation to changes in those assumptions?

A discounted cash flow (DCF) analysis values a company based on the present value of its expected future free cash flows (FCF). First, you project the company's FCF for a specific period, usually 5-10 years, based on revenue growth, operating margins, tax rates, and investments in working capital and fixed assets. After the projection period, you estimate a terminal value, which represents the value of all future cash flows beyond the projection period. Common methods for calculating terminal value include the Gordon Growth Model (assuming a constant growth rate) or an exit multiple approach. The projected FCFs and the terminal value are then discounted back to their present values using the weighted average cost of capital (WACC), which represents the company's cost of capital. The sum of the present values of the FCFs and terminal value gives you the estimated enterprise value, from which you subtract net debt to arrive at the equity value. Key assumptions include revenue growth rate, operating margin, terminal growth rate (or exit multiple), and WACC.

The valuation is highly sensitive to changes in these assumptions. Small changes in the revenue growth rate or operating margin can significantly impact the projected FCFs and, therefore, the enterprise value. The terminal value, which often represents a large portion of the total value, is particularly sensitive to the terminal growth rate and the discount rate used in the WACC calculation. A higher growth rate or a lower discount rate will result in a significantly higher terminal value. Sensitivity analysis and scenario planning are crucial to understand the range of possible values and the impact of different assumptions on the valuation. For example, consider a scenario where WACC = 0.10, Terminal_Growth_Rate = 0.02. If we increase Terminal_Growth_Rate to 0.03 it will drastically change the terminal value, which in turn affects the enterprise value. Similarly increasing WACC to 0.11 will drastically reduce the terminal value.

2. Explain how you would value a company with negative earnings. What alternative valuation methods could you use?

When a company has negative earnings, traditional valuation methods like P/E ratios become unreliable. One approach is to focus on revenue-based multiples, such as Price-to-Sales (P/S), especially if the company is expected to become profitable in the future. Another strategy is to use discounted cash flow (DCF) analysis, but it requires carefully projecting future cash flows and ensuring the terminal value calculation accounts for potential future profitability.

Alternative methods include valuing the company's assets (Net Asset Value) if it has significant tangible assets, or using a liquidation valuation to estimate the value if the company were to be shut down and its assets sold. For startups or companies with high growth potential but current losses, venture capital methods (like the Berkus method or scorecard method) or option pricing models might be more appropriate, valuing the potential upside rather than current profitability.

3. Describe a situation where you used financial modeling to solve a business problem. What were the key inputs and outputs of your model?

In my previous role at a subscription box company, we were considering launching a new product line targeting a different demographic. To evaluate the financial viability, I built a financial model to forecast profitability. Key inputs included market size, penetration rate, average order value, customer acquisition cost (CAC), and churn rate. I used historical data from our existing product lines and market research reports to estimate these inputs.

The model's primary outputs were projected revenue, cost of goods sold (COGS), operating expenses, net income, and cash flow over a five-year period. Sensitivity analysis was performed by varying key inputs like CAC and churn to understand the potential range of outcomes. The model ultimately helped leadership decide to delay the new product launch due to projected low profitability under various realistic scenarios, allowing us to focus on optimizing existing product lines instead.

4. How do you determine the appropriate discount rate to use in a valuation? What are the key components of the cost of capital?

The appropriate discount rate reflects the opportunity cost of capital, i.e., the return investors require for undertaking a specific investment given its risk. It's often determined using the Weighted Average Cost of Capital (WACC). Key components are cost of equity, cost of debt, and the relative weights of equity and debt in the company's capital structure.

The Cost of Equity is usually derived using the Capital Asset Pricing Model (CAPM): r_e = R_f + β(R_m - R_f), where R_f is the risk-free rate, β is the asset's beta, and R_m is the expected market return. The Cost of Debt is the yield to maturity on the company's debt, adjusted for taxes (since interest expense is tax deductible). WACC is calculated as: WACC = (E/V)*r_e + (D/V)r_d(1-T), where E is the market value of equity, D is the market value of debt, V is the total market value of capital (E+D), r_e is the cost of equity, r_d is the cost of debt, and T is the corporate tax rate. The risk-free rate is usually the yield on a long-term government bond. Beta measures the stock's volatility relative to the overall market.

5. What are the different types of financial statements, and how do they relate to each other?

The primary financial statements are the income statement, balance sheet, and statement of cash flows. They are interconnected and provide a comprehensive view of a company's financial performance and position.

- The income statement reports a company's financial performance over a period of time, showing revenues, expenses, and ultimately, net income. Net income flows into the retained earnings section of the balance sheet.

- The balance sheet presents a company's assets, liabilities, and equity at a specific point in time. It follows the accounting equation (Assets = Liabilities + Equity). Retained earnings from the income statement increases the equity in the balance sheet.

- The statement of cash flows tracks the movement of cash both into and out of a company over a period of time. The ending cash balance on the statement of cash flows should reconcile with the cash balance reported on the balance sheet.

6. Explain the concept of working capital management. How would you improve a company's working capital cycle?

Working capital management involves strategically managing a company's current assets and liabilities to ensure it has sufficient liquidity to meet its short-term obligations. It focuses on optimizing the levels of inventory, accounts receivable, and accounts payable. Efficient working capital management improves a company's operational efficiency and profitability. It is the difference between current assets and current liabilities.

To improve a company's working capital cycle, several strategies can be employed:

- Reduce Inventory: Implement just-in-time inventory management or improve demand forecasting.

- Accelerate Accounts Receivable: Offer early payment discounts, improve invoicing processes, and implement stricter credit policies.

- Extend Accounts Payable: Negotiate longer payment terms with suppliers.

- Optimize Cash Management: Use cash flow forecasting to predict future cash needs. Negotiate short term loans to bridge the gap, if needed. Implementing a robust Enterprise Resource Planning (ERP) system can also help improve the visibility of the finances.

7. Describe a time when you had to analyze a complex financial situation and make a recommendation. What were the key factors you considered?

In my previous role as a financial analyst, I was tasked with evaluating the potential acquisition of a smaller competitor. The company was struggling financially, but possessed valuable intellectual property. The situation was complex because their financial statements were unreliable, and their revenue projections were overly optimistic.

The key factors I considered were: 1. Due diligence: I conducted thorough due diligence, including independent valuation of the IP and scrubbing their financials to identify true revenue and cost drivers. 2. Market analysis: I analyzed the competitive landscape and potential market share gains. 3. Risk assessment: I identified risks associated with the acquisition, such as integration challenges and potential loss of key personnel. 4. Financial modeling: I built a discounted cash flow model using conservative assumptions to project the potential return on investment. Based on my analysis, I recommended against the acquisition unless the purchase price was significantly reduced to reflect the high level of risk and uncertainty.

8. How do you stay up-to-date on the latest developments in the financial markets? What resources do you use?

I stay updated on financial markets through a variety of resources. I regularly read the Wall Street Journal, Financial Times, and Bloomberg for breaking news and in-depth analysis. I also follow key economic indicators and reports released by organizations like the Federal Reserve and the Bureau of Economic Analysis.

Furthermore, I utilize financial data platforms such as Bloomberg Terminal (when accessible) and Refinitiv to track market movements and company performance. I also follow reputable financial analysts and economists on platforms like LinkedIn and Twitter to gain diverse perspectives and insights into market trends.

9. What are the key differences between debt and equity financing? What are the advantages and disadvantages of each?

Debt financing involves borrowing money that must be repaid with interest. Equity financing involves selling a portion of ownership in the company in exchange for capital. Key differences lie in repayment obligations, impact on ownership, and risk. Debt requires fixed payments, doesn't dilute ownership but can lead to bankruptcy if not managed well. Equity doesn't require repayment, dilutes ownership, and is often more expensive than debt.

Advantages of debt include retaining ownership and tax deductibility of interest. Disadvantages are the obligation to repay and potential for financial distress. Advantages of equity include no repayment obligation and increased financial flexibility. Disadvantages are dilution of ownership and higher cost of capital in the long run.

10. Explain the concept of financial leverage. How can it be used to increase returns, and what are the risks involved?

Financial leverage refers to the use of debt to finance an investment or project. The goal is to amplify returns. For example, a company might borrow money to invest in a project that is expected to generate a higher return than the interest rate on the loan. If the investment is successful, the company can pay off the loan and keep the excess profit, thus increasing the return on equity.

However, leverage also amplifies losses. If the investment performs poorly, the company is still obligated to repay the debt, potentially leading to financial distress or even bankruptcy. The risks include increased interest expense, risk of default, and the possibility of lower profitability if the returns don't exceed the cost of borrowing. High leverage increases a company's financial risk.

11. Describe a situation where you had to deal with a difficult client or colleague. How did you handle the situation?

In a previous role, I had a client who was consistently late providing necessary information for project deliverables, and then became frustrated when deadlines were missed. I addressed this by first acknowledging their frustration and validating their concerns. Then, I proactively set up a revised communication plan, including weekly check-in meetings and clearly outlined deadlines with reminders.

I also took the time to understand the client's workflow and identify potential bottlenecks. By tailoring our process to better suit their needs and maintaining open communication, we were able to improve our working relationship, meet project deadlines, and ultimately achieve a successful outcome. This also included setting boundaries when their requests were outside the scope of the original agreement, directing them to appropriate channels or explaining clearly the change request process.

12. How would you assess the creditworthiness of a company? What financial ratios would you use?

To assess a company's creditworthiness, I would analyze its financial statements to evaluate its ability to meet its debt obligations. Key financial ratios I would use include: Debt-to-Equity ratio (Total Liabilities/Shareholders' Equity) - indicating leverage; Current Ratio (Current Assets/Current Liabilities) and Quick Ratio ((Current Assets - Inventory)/Current Liabilities) - assessing short-term liquidity; Interest Coverage Ratio (EBIT/Interest Expense) - showing the ability to pay interest expenses; and Debt Service Coverage Ratio (DSCR) - measuring the ability to cover total debt service (including principal and interest).

Further assessment would involve examining the company's profitability (e.g., Return on Assets, Return on Equity, Profit Margins), cash flow generation, and overall industry outlook. A company with high leverage, low liquidity, poor profitability, and declining cash flows would be considered a higher credit risk. Also important is understanding the management quality, competitive position and any contingent liabilities.

13. Explain the concept of capital budgeting. What are the different methods used to evaluate investment projects?

Capital budgeting is the process companies use for decision making on capital projects – those projects with a life of a year or more. It helps in planning expenditures and investments, aiming to maximize the profitability of the company. Companies use capital budgeting to evaluate major projects and investments, such as new plants, equipment, or products.

Several methods are used to evaluate investment projects, including:

- Net Present Value (NPV): Calculates the present value of expected cash flows minus the initial investment.

- Internal Rate of Return (IRR): Determines the discount rate that makes the NPV of all cash flows from a particular project equal to zero.

- Payback Period: Measures the time required to recover the initial investment.

- Profitability Index (PI): Calculates the ratio of the present value of future cash flows to the initial investment.

- Accounting Rate of Return (ARR): Calculates the average accounting profit as a percentage of the initial investment.

14. What are the different types of financial risks, and how can they be managed?

Financial risks encompass various categories that can impact an organization's financial health. These include market risk (fluctuations in interest rates, equity prices, and exchange rates), credit risk (the possibility of loss due to a borrower's failure to repay a loan or meet contractual obligations), liquidity risk (the risk of not being able to meet short-term financial obligations), operational risk (risks arising from inadequate or failed internal processes, people, and systems, or from external events), and systemic risk (the risk of a breakdown in the entire financial system).

Managing these risks involves several strategies. Market risk can be mitigated through hedging techniques, diversification, and asset allocation strategies. Credit risk is managed through credit analysis, collateralization, and credit insurance. Liquidity risk can be addressed by maintaining sufficient cash reserves and establishing lines of credit. Operational risk requires robust internal controls, disaster recovery plans, and employee training. Systemic risk is typically addressed through regulatory oversight and international cooperation.

15. Describe a time when you had to make a decision with incomplete information. How did you approach the situation?

In a previous role as a project manager, I was tasked with selecting a new CRM software. The information available on each potential CRM was incomplete, particularly regarding long-term scalability and user adoption rates within our specific company culture. To approach this, I prioritized gathering the most crucial missing information. I did this by:

- Contacting existing users of each CRM (through industry connections and online forums) to get candid feedback.

- Requesting extended trial periods for the top two contenders to run internal tests with a representative group of employees.

- Focusing on the flexibility of each CRM - how easily could it be customized to fit our needs, and what was the vendor's track record for updates and support.

Ultimately, I chose the CRM that, while not perfect on paper, demonstrated the greatest potential for adaptation and positive user feedback during the trial period, mitigating the risks associated with the initial information gaps. It's better to adapt and to be flexible than to rely completely on initially complete information.

16. How do you prioritize your work when you have multiple competing deadlines?

When faced with multiple competing deadlines, I prioritize my work by first assessing the urgency and importance of each task. I use a matrix such as Eisenhower Matrix to categorize tasks into Urgent/Important, Not Urgent/Important, Urgent/Not Important, and Not Urgent/Not Important. Urgent and Important tasks get immediate attention.

Next, I estimate the effort required for each task. Combining urgency, importance, and effort, I create a prioritized list. I communicate clearly with stakeholders about potential delays or the need to renegotiate deadlines, providing realistic expectations and offering alternative solutions if possible.

17. Explain a recent financial news story and its potential impact on businesses.

A recent financial news story is the continued high inflation rates, despite efforts by central banks to curb them through interest rate hikes. This impacts businesses in several ways. Firstly, it increases their operating costs, as raw materials, energy, and labor become more expensive. Secondly, it can dampen consumer demand, as individuals have less disposable income due to higher prices for essential goods and services. This can lead to decreased sales and profitability for businesses.

To mitigate these effects, businesses might consider strategies such as raising prices (potentially impacting sales volume), improving operational efficiency to reduce costs, or focusing on product/service offerings that are less price-sensitive and cater to a higher-income clientele. The specific impact and appropriate response will vary depending on the industry, business model, and geographic location.

18. How can a company improve its return on equity (ROE)?

A company can improve its Return on Equity (ROE) by focusing on three key areas as defined by the DuPont analysis: profitability, asset utilization, and financial leverage.

Specifically, a company can increase its ROE by:

- Improving its net profit margin (increasing revenue or reducing costs).

- Increasing its asset turnover ratio (generating more sales with the same assets).

- Increasing its equity multiplier (using more debt financing, but this increases financial risk). Each of these approaches has its own advantages and risks that a company needs to consider.

19. What are some common pitfalls in financial modeling, and how can you avoid them?

Common pitfalls in financial modeling include overcomplicating the model, relying too heavily on historical data without considering future changes, and making unrealistic assumptions. Circular references and formula errors are also frequent issues. Failing to perform sensitivity analysis or stress testing can lead to a false sense of security. Furthermore, neglecting to document the model's logic and assumptions makes it difficult to understand and maintain.

To avoid these pitfalls, start with a clear and simple model, and gradually add complexity only when necessary. Always validate your assumptions and data sources. Use sensitivity analysis and stress testing to assess the model's robustness. Regularly review your formulas and logic to prevent errors. Implement clear documentation explaining the model's purpose, assumptions, and structure. Finally, get a second pair of eyes on the model to catch any mistakes or oversights.

20. Describe different methods of forecasting revenue for a company. What factors would influence your choice of method?

Several methods exist for forecasting revenue, each with its strengths and weaknesses. Common approaches include: Trend Analysis: Examining historical revenue data to identify patterns and project future sales. Market Research: Analyzing market size, growth rate, and competitive landscape to estimate potential revenue. Sales Pipeline Analysis: Assessing the value and probability of closing deals in the sales pipeline. Econometric Modeling: Using statistical techniques to identify relationships between economic variables and revenue. Bottom-Up Forecasting: Aggregating individual sales forecasts from sales teams or departments.

The choice of method depends on factors such as data availability, forecast horizon, company size and industry, and desired level of accuracy. For example, trend analysis is suitable when historical data is reliable and the market is stable. Market research is appropriate when entering new markets or launching new products. Sales pipeline analysis works well for companies with well-defined sales processes. Econometric modeling is useful when economic factors significantly impact revenue. Simpler methods are preferrable when data is sparse or when accuracy is not critical.

21. Explain how changes in interest rates affect bond prices.

Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. This is because the present value of a bond's future cash flows (coupon payments and principal) is discounted at the prevailing interest rate. If interest rates increase, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. Consequently, the prices of existing bonds must decrease to become competitive.

Conversely, if interest rates decrease, newly issued bonds offer lower yields. Existing bonds with higher yields become more valuable, and their prices increase. The magnitude of the price change depends on the bond's maturity; longer-term bonds are more sensitive to interest rate changes than shorter-term bonds. This sensitivity is known as duration.

22. What are some strategies a company can use to manage foreign exchange risk?

Companies can employ several strategies to manage foreign exchange risk. Some common methods include: Hedging (using financial instruments like futures, forwards, and options to lock in exchange rates), Netting (offsetting payables and receivables in the same currency to reduce the overall exposure), Matching (matching assets and liabilities in the same currency), and Leading and Lagging (accelerating or delaying payments based on anticipated exchange rate movements). Also, companies can pursue Diversification by operating in multiple countries to reduce reliance on a single currency.

Furthermore, a company can adopt Pricing Strategies by adjusting prices to reflect exchange rate fluctuations, or use Currency Clauses in contracts that allow for price adjustments based on exchange rate movements. Another important aspect is Centralized Treasury Management which allows for better coordination and control over foreign exchange exposures. Finally, Natural Hedging is achieved by locating production facilities in countries where the company sells its products, thus creating a natural hedge against currency fluctuations.

Advanced Finance interview questions

1. Walk me through a complex financial model you've built, explaining the key assumptions and how you stress-tested it.

Okay, I built a discounted cash flow (DCF) model to value a renewable energy project. The core of the model projected free cash flow to the firm (FCFF) over a 20-year period, then discounted it back to the present using a weighted average cost of capital (WACC). Key assumptions included: projected energy prices (based on market forecasts and PPA contracts), electricity generation volume (dependent on weather patterns, turbine availability, and degradation), operating expenses (fixed and variable), capital expenditures (initial investment and ongoing maintenance), and the discount rate (WACC). The WACC was calculated using the cost of equity (CAPM), cost of debt (based on the project's debt structure), and target capital structure.

To stress-test the model, I performed sensitivity analysis and scenario analysis. Sensitivity analysis involved changing individual assumptions (e.g., energy prices, discount rate, construction costs) by a range of percentages (e.g., +/- 10%, +/- 20%) to see how they affected the project's net present value (NPV). Scenario analysis involved creating multiple scenarios (e.g., base case, optimistic case, pessimistic case) by changing multiple assumptions simultaneously. For example, the pessimistic scenario might include lower energy prices, higher operating expenses, and a higher discount rate, simulating an unfavorable market environment. I also ran a Monte Carlo simulation to assess the project's risk profile, generating a distribution of NPV outcomes based on randomly varying key assumptions within defined ranges.

2. How would you value a company with negative earnings and no tangible assets?

Valuing a company with negative earnings and no tangible assets is challenging and requires focusing on potential future value rather than current financials. Traditional methods like discounted cash flow (DCF) analysis based on projected revenue growth and eventual profitability become crucial. We'd need to carefully estimate future cash flows, considering factors like market size, growth rate, competitive landscape, and the company's ability to achieve profitability.

Other valuation approaches include using comparable companies (if any exist) that were in a similar situation (e.g., early-stage tech companies) and applying revenue multiples or subscriber-based valuation. Venture capital methods like the Berkus method or risk factor summation method can be used, which factor in the stage of the company and various risk elements. Ultimately, the valuation will be highly dependent on the assumptions made about the company's future prospects and the discount rate applied to reflect the inherent risk.

3. Describe a time you had to make a financial decision with incomplete information. What did you do?

In my previous role, I was tasked with choosing a new marketing automation platform. I had detailed pricing for two vendors, but crucial usage data estimates from our sales team, needed to project long-term costs for scaling, were delayed. I decided to proceed with a short-term pilot program with both vendors, focusing on a smaller segment of our customer base. This allowed me to gather real usage data, get user feedback, and more accurately predict the cost implications of each platform as we scaled up.

Ultimately, the pilot program revealed that one vendor, while initially more expensive, had significantly better customer segmentation capabilities that would reduce costs through more targeted campaigns. Even though the information was incomplete initially, by focusing on gaining information through testing and usage I made a more effective decision.

4. Explain how changes in macroeconomic factors, like interest rates or inflation, would impact a company's valuation.

Changes in macroeconomic factors significantly impact a company's valuation. For instance, rising interest rates increase the cost of borrowing, potentially reducing a company's profitability and future cash flows. This leads to a lower present value of those cash flows, and consequently, a lower valuation. Higher inflation erodes purchasing power, increasing input costs and potentially decreasing consumer demand for a company's products, impacting revenue and profitability. This also often leads to higher interest rates, further compounding the negative effect on valuation.

Conversely, decreasing interest rates can stimulate borrowing and investment, boosting economic activity and potentially increasing a company's revenue and profitability, leading to a higher valuation. Lower inflation can improve profit margins and consumer spending, similarly contributing to a higher valuation. Investors closely monitor these macroeconomic trends and adjust their valuation models accordingly, affecting stock prices and market capitalization.

5. What are the key drivers of a company's financial performance, and how would you analyze them?

Key drivers of a company's financial performance revolve around profitability, efficiency, liquidity, and solvency. Profitability is driven by revenue growth, cost of goods sold, operating expenses, and pricing strategies. Efficiency is how well a company uses its assets, often measured using metrics like inventory turnover, accounts receivable turnover, and asset turnover. Liquidity (ability to meet short-term obligations) is driven by current assets and current liabilities, reflected in ratios like the current ratio and quick ratio. Solvency (ability to meet long-term obligations) is affected by debt levels, equity, and interest coverage ratios.

Analyzing these involves examining financial statements (income statement, balance sheet, cash flow statement) and calculating relevant ratios. Trend analysis, comparing performance over time, and benchmarking against competitors provide valuable insights. For example, a declining gross profit margin might indicate pricing pressures or increasing production costs. Similarly, a high debt-to-equity ratio suggests higher financial risk. DuPont analysis can break down return on equity (ROE) to identify specific areas of strength or weakness.

6. How do you assess and manage financial risk within an organization?

I assess and manage financial risk by first identifying potential risks through environmental scanning, historical data analysis, and expert opinions. This includes market risk (interest rates, exchange rates), credit risk (defaults), operational risk (fraud, errors), and liquidity risk.

Next, I measure and analyze these risks, often using statistical models, scenario analysis, and stress testing. I then develop and implement risk mitigation strategies such as diversification, hedging, insurance, and establishing internal controls. Finally, I continuously monitor and report on risk exposures, adjusting strategies as needed to maintain alignment with the organization's risk appetite and regulatory requirements.

7. Discuss a recent financial regulation and its potential impact on the industry.

One recent financial regulation is the EU's Digital Operational Resilience Act (DORA), aimed at strengthening the cybersecurity of financial entities. DORA requires firms to implement robust IT risk management frameworks, conduct regular testing, and establish incident reporting mechanisms. Its potential impact on the industry is significant. Financial institutions will likely face increased compliance costs as they upgrade their systems and processes to meet DORA's requirements.

Furthermore, DORA could lead to greater standardization of cybersecurity practices across the EU financial sector, potentially reducing systemic risk. However, smaller firms may struggle to comply due to limited resources, and the interpretation of some provisions may lead to uncertainty and inconsistent implementation. Ultimately, DORA's success will depend on effective enforcement and ongoing collaboration between regulators and industry participants.

8. Explain a situation where you had to challenge a financial assumption or forecast. What was the outcome?

In my previous role, we were forecasting a significant increase in user engagement based on a recent marketing campaign. The initial assumption was a linear relationship between ad spend and user activity. However, I noticed that the engagement metrics from the campaign were heavily skewed towards new users, with existing user engagement remaining relatively flat. I challenged this by pointing out that the initial surge was likely a novelty effect and that retention rates for new users acquired through this campaign were significantly lower than our historical average.

To validate this, I analyzed cohort data, tracking new user behavior over a longer period and comparing it to previous campaigns. The data confirmed my suspicion. We revised the forecast to account for the lower retention, resulting in a more realistic and ultimately accurate projection. This prevented us from over-investing in a marketing strategy that wasn't sustainable in the long term. The outcome was a more data-driven budget allocation and a shift towards strategies focused on improving user retention alongside acquisition.

9. How do you approach a complex capital budgeting decision, considering various project risks and uncertainties?

When facing a complex capital budgeting decision with project risks and uncertainties, I'd start by clearly defining the project goals and identifying all feasible alternatives. Then, I would estimate the expected cash flows for each alternative, considering various scenarios (best case, worst case, most likely). To account for risk, I would use techniques like sensitivity analysis (to see how changes in key variables affect the NPV), scenario analysis (to evaluate different potential outcomes), and potentially Monte Carlo simulation (for more complex risk profiles).

Finally, I'd choose the project that offers the highest risk-adjusted return, considering the organization's risk appetite and strategic objectives. I would use techniques like calculating the risk adjusted discount rate or certainty equivalent cash flows to account for risk within the NPV analysis. Post-implementation, I'd monitor the project's performance against the initial projections and make adjustments as necessary.

10. Describe your experience with different financial software and tools (e.g., Bloomberg, FactSet, Alteryx).

I have experience with several financial software and tools. I've used Bloomberg extensively for market data analysis, news monitoring, and running financial models. I am proficient in using the Bloomberg terminal for tasks such as researching companies, analyzing financial statements, and tracking market trends. I've also worked with FactSet, primarily for portfolio analysis, screening companies based on various financial metrics, and creating custom reports. My familiarity extends to retrieving and manipulating data from these platforms using their respective APIs.

While I haven't had direct hands-on experience with Alteryx, I understand its capabilities for data blending and advanced analytics in the financial context. I'm familiar with the concept of using Alteryx to automate data workflows, perform complex calculations, and generate insights from large datasets. I am a quick learner and confident in my ability to adapt to new financial tools.

11. What are the limitations of traditional financial metrics, and how would you supplement them with alternative measures?

Traditional financial metrics like net income, EPS, and ROI, while useful, often provide an incomplete picture of a company's overall health and future prospects. They tend to be backward-looking, focusing on past performance rather than predicting future success. They can also be easily manipulated or 'window-dressed' to present a more favorable image than reality, and often fail to capture intangible assets like brand reputation, customer loyalty, or innovation capabilities. Furthermore, they can be industry-specific and may not allow for easy comparison across different sectors.

To supplement traditional metrics, I would incorporate alternative measures that offer a more holistic view. These include: non-financial KPIs (e.g., customer satisfaction scores, employee engagement, market share), ESG (Environmental, Social, and Governance) factors, which reflect a company's commitment to sustainability and ethical practices, and leading indicators such as website traffic, social media engagement, or new product pipeline strength. Analyzing these alongside traditional financials provides a better assessment of long-term value creation and risk management.

12. How do you stay up-to-date with the latest trends and developments in the financial industry?

I stay updated through a combination of active learning and passive monitoring. Actively, I regularly read publications like The Wall Street Journal, Financial Times, and industry-specific reports from firms like McKinsey and Deloitte. I also follow key influencers and thought leaders on LinkedIn and Twitter, and attend relevant webinars and industry conferences when possible.

Passively, I subscribe to newsletters from financial institutions and technology providers, and I leverage news aggregators and customized Google Alerts to identify relevant articles and announcements. For specific areas, such as fintech or cryptocurrency, I dedicate time to reading white papers and participating in online forums to understand the latest innovations and challenges.

13. Explain a situation where you had to communicate a complex financial concept to a non-financial audience.

I once had to explain discounted cash flow (DCF) to a marketing team to justify a large upfront investment in a new campaign. Instead of using financial jargon, I focused on the core concept: spending money now to make more money later. I explained it like planting a tree: you invest time and resources (the initial spend) and, over time, it grows and bears fruit (future revenue). The ‘discounted’ part was explained as acknowledging that money today is worth more than the same amount of money in the future because of inflation and the possibility of investing it elsewhere. I used simple visuals and avoided accounting terminology, framing the discussion around the expected increase in leads, conversions, and ultimately, sales revenue, clearly demonstrating how the initial investment would pay off over time and why this approach was more strategic than simply cutting costs. This allowed them to understand the reasoning behind the investment and buy into the long-term vision.

14. How would you approach restructuring a company's debt to improve its financial stability?

Restructuring a company's debt involves renegotiating the terms of existing debt obligations to make them more manageable. My approach would begin with a thorough analysis of the company's financial situation, including cash flow projections, asset valuations, and current debt obligations. Based on this analysis, I would explore several options, such as:

- Negotiating with creditors: Seeking lower interest rates, extended repayment periods, or debt forgiveness.

- Debt consolidation: Combining multiple debts into a single loan with more favorable terms.

- Debt-for-equity swap: Offering creditors equity in the company in exchange for reducing or eliminating debt.

- Bankruptcy (as a last resort): Utilizing bankruptcy proceedings to reorganize debt under court supervision. The chosen strategy would depend on the severity of the company's financial distress and the willingness of creditors to cooperate. Throughout the process, clear communication with all stakeholders is crucial.

15. Describe a time you identified and mitigated a potential financial fraud or error.

During my time as a reconciliation analyst, I noticed a recurring discrepancy in our daily transaction reports. Specifically, a particular vendor payment was consistently being recorded twice – once through the automated system and again manually by an employee who wasn't aware of the automation. This effectively doubled the payment amount to the vendor.

To mitigate this, I first brought this to the attention of my supervisor and the employee involved. Then, I investigated the root cause, tracing the transaction flow and identifying the redundant manual entry. I then worked with the IT team to implement a control that would flag any duplicate payments based on vendor ID and amount. I also provided training to the employee on the automated system to prevent future errors. This saved the company a significant amount of money and improved the accuracy of our financial reporting.

16. Explain how Environmental, Social, and Governance (ESG) factors can influence a company's financial performance and valuation.

ESG factors are increasingly recognized as significant drivers of a company's financial performance and valuation. Strong ESG practices can lead to improved operational efficiency through resource optimization and waste reduction, fostering innovation in sustainable products and services, and attracting and retaining top talent. These improvements can directly translate to higher revenues, lower costs, and improved profitability, thereby increasing a company's valuation. Conversely, poor ESG performance can result in reputational damage, regulatory fines, difficulty accessing capital, and decreased investor confidence, all of which negatively impact financial performance and valuation.

Investors are integrating ESG considerations into their investment decisions, leading to a higher demand for companies with strong ESG profiles. This increased demand can drive up the company's stock price and lower its cost of capital. Furthermore, companies that proactively manage their ESG risks and opportunities are better positioned to navigate evolving regulatory landscapes and changing consumer preferences, contributing to long-term financial sustainability and enhanced valuation.

17. How do you value a startup company with limited financial history?

Valuing a startup with limited financial history is challenging and requires a combination of methods. Since traditional methods like discounted cash flow (DCF) are difficult to apply due to the lack of reliable historical data and future projections, alternative approaches are often used.

Common methods include:

- Venture Capital Method: Estimates required future return and uses a target ROI based on stage and risk, working backward to a pre-money valuation.

- Berkus Method: Assigns monetary values to key startup elements such as a sound idea, prototype, management team, strategic relationships, and market penetration.

- Risk Factor Summation Method: Identifies and assesses risks inherent to the startup, adjusting the valuation accordingly.

- Comparable Transactions (Comps): Analyzing valuations of similar startups that have been acquired or received funding.

- Cost-to-Duplicate Method: Estimates the cost of replicating the startup's assets and resources. This method sets a floor for valuation.

- Scorecard Method: Compares the startup to similar funded startups and adjusts the average valuation based on factors such as team strength, market opportunity, and competitive environment.

18. What are the ethical considerations in financial decision-making, and how do you ensure compliance?

Ethical considerations in financial decision-making encompass honesty, fairness, transparency, and avoiding conflicts of interest. Decisions must prioritize stakeholders' well-being (customers, employees, shareholders) over personal gain or short-term profits. Insider trading, fraud, and misleading financial reporting are clear ethical breaches.

Compliance is ensured through a multi-pronged approach: adhering to legal and regulatory requirements (e.g., SEC regulations), implementing internal controls and policies, providing ethics training to employees, establishing whistleblowing mechanisms, and conducting regular audits. Promoting a culture of integrity and ethical behavior is crucial for long-term compliance and trust.

19. Explain your understanding of derivatives and their role in risk management and investment strategies.

Derivatives are financial contracts whose value is derived from an underlying asset, index, or rate. Common examples include futures, options, swaps, and forwards. In risk management, derivatives are used to hedge or mitigate exposure to price fluctuations. For example, a company can use futures contracts to lock in the price of a commodity they need, protecting them from potential price increases. Alternatively, a farmer might use futures to guarantee a price for their crops at harvest time.

In investment strategies, derivatives can be used for speculation, leverage, and arbitrage. Speculators use derivatives to profit from anticipated price movements, while investors can use them to gain leveraged exposure to an asset without having to invest the full amount. Arbitrageurs exploit price discrepancies between different markets or derivative instruments to generate risk-free profits. However, it's important to remember that derivatives can also amplify losses and require careful management.

20. How would you analyze the financial impact of a merger or acquisition?

Analyzing the financial impact of a merger or acquisition involves several key steps. First, I'd assess the target company's financials: revenue, profitability, assets, and liabilities. This includes reviewing their historical performance, financial ratios (like profitability and leverage), and any contingent liabilities. Next, I'd project the combined company's financials, considering synergies (cost savings, revenue enhancements) and potential integration costs. These projections would be based on various assumptions about market conditions, integration success, and operational efficiencies. Finally, I'd use valuation techniques like discounted cash flow (DCF) analysis, precedent transactions, and market multiples to determine the potential value creation (or destruction) from the deal. Sensitivity analysis would be performed to understand the impact of changing assumptions on the overall valuation. The goal is to understand if the deal creates value for shareholders and if the acquisition price is reasonable.

21. Describe a situation where you had to work under pressure to meet a tight financial deadline. How did you manage it?

In my previous role, we were approaching the end of the fiscal year and were significantly behind on revenue targets. To address this, I worked with the sales and marketing teams to identify key deals that could be closed quickly. This involved a lot of late nights, including re-negotiating terms, expediting legal reviews, and providing extra support to the sales team to push deals over the line.

To manage the pressure, I prioritized tasks based on their potential impact and likelihood of success, constantly communicating progress and roadblocks to my manager. I also made sure to take short breaks to avoid burnout, even during the busiest periods. We successfully exceeded our revised target by focusing our efforts and leveraging teamwork.

Expert Finance interview questions

1. Explain a complex financial model you built and how it improved decision-making.

I developed a Monte Carlo simulation model to assess the risk and return profile of a proposed real estate development project. The model incorporated numerous uncertain variables, such as construction costs, rental rates, occupancy rates, and discount rates. Rather than relying on single-point estimates, I used probability distributions to represent the range of possible values for each variable. The simulation ran thousands of iterations, generating a distribution of potential project outcomes, including net present value (NPV), internal rate of return (IRR), and payback period.

This model significantly improved decision-making by providing a more comprehensive understanding of the project's potential risks and rewards. Instead of simply looking at a single 'best-case' or 'worst-case' scenario, the model allowed stakeholders to visualize the entire range of possible outcomes and assess the probability of achieving specific financial targets. This informed decision-making, allowing the company to appropriately price the project, incorporate risk mitigation strategies, and confidently move forward with the investment.

2. How do you assess the risk of a new investment opportunity, considering both quantitative and qualitative factors?

I assess investment risk by combining quantitative and qualitative factors. Quantitatively, I analyze financial statements, looking at metrics like debt-to-equity ratio, cash flow, profitability, and projected returns (ROI, IRR). I also consider market data, volatility, and economic indicators to understand the broader market risk. I use techniques like sensitivity analysis and scenario planning to model different outcomes and potential losses.

Qualitatively, I evaluate the management team's experience and track record, the competitive landscape, the company's business model and its sustainability, regulatory risks, and potential technological disruptions. I also consider brand reputation and customer loyalty. Combining these perspectives provides a holistic risk assessment.

3. Describe a time you had to make a critical financial decision under pressure with limited information.

During a previous role at a small startup, our primary payment processor experienced a major outage right before payroll. We had very little cash reserve and employee morale was already low. I had to decide whether to take out a high-interest emergency loan to cover payroll immediately or delay payroll, communicate transparently with employees, and risk significant attrition.

After quickly analyzing our cash flow projections, potential loan terms, and the potential impact of delayed payments (including legal ramifications and employee morale), I decided to delay payroll by 48 hours. I then crafted a transparent email explaining the situation, outlining a firm payment date, and offering a small bonus to compensate for the inconvenience. While it was a stressful period, open communication and the short delay minimized negative impact, and ultimately avoided a risky loan.

4. What are the key indicators you monitor to assess the financial health of a company, and why?

I focus on several key indicators to assess a company's financial health. Profitability ratios, such as gross profit margin and net profit margin, indicate how efficiently a company generates profit from its revenue. Liquidity ratios, like the current ratio and quick ratio, demonstrate the company's ability to meet its short-term obligations. Solvency ratios, including the debt-to-equity ratio, reveal the company's long-term financial stability and its reliance on debt.

Furthermore, I monitor cash flow from operating activities, as it shows the company's ability to generate cash from its core business. Declining margins, poor liquidity, excessive debt, or negative cash flow are all warning signs. By tracking these indicators over time and comparing them to industry benchmarks, I can gain a comprehensive understanding of a company's financial well-being.

5. How would you advise a company on managing its capital structure to optimize its cost of capital?

To optimize a company's cost of capital through capital structure management, I'd advise a balanced approach focusing on debt and equity. First, analyze the current capital structure, assessing debt-to-equity ratio, interest rates, and investor expectations. Then, identify the optimal mix by considering factors like industry benchmarks, tax implications (interest tax shield), and the company's risk profile. The goal is to minimize the weighted average cost of capital (WACC).

Specifically, evaluate the benefits of increasing debt, such as lower cost due to the tax shield, against the increased financial risk of higher leverage. For equity, analyze different types of equity financing (common vs. preferred) and the associated cost. Regularly monitor key metrics like debt covenants, credit ratings, and investor sentiment to ensure the capital structure remains optimal and aligned with the company's strategic goals. This might involve share buybacks, dividend adjustments, or debt refinancing depending on market conditions.

6. Explain your approach to valuing a company in a distressed situation.

Valuing a distressed company requires a modified approach compared to healthy businesses. A key focus is on liquidation value and going concern value under various restructuring scenarios. Instead of relying heavily on discounted cash flow (DCF) analysis which may be unreliable given the uncertainty, I would prioritize asset-based valuation techniques and adjusted book values, understanding that assets might be worth less in a fire sale. I would also consider comparable transaction analysis, looking at similar distressed companies and their acquisition prices, but focusing on transactions that occurred during economic downturns or industry-specific crises. Finally, scenario planning around different restructuring possibilities (e.g., debt restructuring, asset sales, bankruptcy) is critical, factoring in legal and administrative costs.

Important metrics include understanding the company's cash burn rate, available cash reserves, and the timeline to potential insolvency. Sensitivity analysis is crucial to understand how different assumptions about asset realization rates, restructuring costs, and timelines impact the valuation. Focus is more on downside risk and potential recovery values for creditors and equity holders in different scenarios, as opposed to a single point estimate for the 'fair' value.

7. Discuss your experience with implementing financial controls and ensuring compliance.

My experience with financial controls includes implementing and maintaining systems to ensure accuracy and compliance. I've worked with teams to establish clear processes for expenditure approvals, budget management, and revenue recognition, focusing on segregation of duties and appropriate documentation. A specific example involves working with the finance team to implement a new expense reporting system. This involved defining approval workflows, setting spending limits based on employee roles, and integrating the system with our accounting software. This initiative reduced processing time by 30% and improved compliance with company policy.

Furthermore, I've actively participated in internal and external audits, preparing documentation and addressing auditor inquiries. I have experience working with various compliance frameworks such as SOX. In my previous role, I assisted in documenting and testing key controls related to financial reporting, and I identified and resolved several control weaknesses, ensuring adherence to regulatory requirements.

8. How do you stay updated on the latest trends and regulations in the financial industry?

I stay updated on the latest trends and regulations in the financial industry through a multi-faceted approach. I regularly read publications like the Wall Street Journal, Financial Times, and Bloomberg. I also subscribe to newsletters and alerts from regulatory bodies such as the SEC, FINRA, and relevant international organizations.

Furthermore, I actively participate in industry conferences, webinars, and online forums. This allows me to network with professionals, learn from experts, and engage in discussions about emerging topics and regulatory changes. I also follow key influencers and thought leaders on social media platforms like LinkedIn to stay informed about real-time updates and discussions.

9. Describe a time when your financial analysis led to a significant cost saving or revenue increase.

During my time at Company X, I was tasked with analyzing our marketing spend effectiveness. My analysis revealed that a significant portion of our budget was allocated to a social media platform with a low conversion rate. By identifying this inefficiency, I recommended shifting those funds to a different platform with a proven higher ROI.

This reallocation resulted in a 15% increase in qualified leads and a 10% reduction in marketing costs within the first quarter. The revised strategy significantly improved our customer acquisition cost and positively impacted the company's overall revenue.

10. What is your opinion on the current state of the market, and what are the biggest opportunities and threats?

The current market is characterized by a high degree of volatility and uncertainty, driven by factors such as inflation, rising interest rates, and geopolitical instability. While this presents challenges, it also creates significant opportunities. Companies that can adapt quickly, manage costs effectively, and identify unmet needs are well-positioned to succeed. Specific opportunities lie in areas like automation, cybersecurity, and sustainable energy solutions.

However, the biggest threats include a potential recession, continued supply chain disruptions, and increasing competition. Companies that are overly leveraged or reliant on outdated business models are particularly vulnerable. A key threat lies in the rapid pace of technological change; failing to adopt new technologies or adapt to changing consumer preferences could be a significant disadvantage.

11. Explain your understanding of derivatives and how they can be used to manage financial risk.

Derivatives are financial contracts whose value is derived from an underlying asset, index, or interest rate. Common examples include futures, options, swaps, and forwards. They allow investors to speculate on the future price movements of the underlying asset without actually owning it. A key use is managing financial risk (hedging).

Derivatives help in managing risk by allowing parties to transfer or offset specific risks. For example, a company anticipating a future purchase of raw materials can use futures contracts to lock in a price, mitigating the risk of price increases. Similarly, options can be used to protect against downside risk while still allowing participation in potential upside. Interest rate swaps can convert floating-rate debt to fixed-rate debt, and vice versa, managing interest rate exposure. Overall, derivatives provide tools for tailoring risk profiles to meet specific needs and reducing uncertainty.

12. How would you advise a company on a potential merger or acquisition, considering both financial and strategic aspects?

Advising on a merger or acquisition involves a comprehensive evaluation. From a financial standpoint, I'd analyze the target company's financials (revenue, profitability, assets, liabilities) to determine a fair valuation using methods like discounted cash flow, precedent transactions, and market multiples. Due diligence is crucial to uncover any hidden liabilities or risks. Synergies, such as cost savings and revenue enhancements, should be identified and quantified to justify the deal's premium.

Strategically, I'd assess how the merger aligns with the company's long-term goals and competitive landscape. Does it expand market share, provide access to new technologies or customers, or strengthen its competitive advantage? I'd also analyze the potential integration challenges, cultural differences, and regulatory hurdles. A successful merger requires a well-defined integration plan to ensure a smooth transition and realization of the deal's objectives. Post-merger, monitoring key performance indicators (KPIs) will be essential to track progress against the initial investment thesis.

13. Discuss your experience with managing financial relationships with external stakeholders, such as investors and lenders.

In my previous role, I was responsible for managing financial relationships with various external stakeholders, including investors and lenders. This involved preparing and presenting financial reports, such as quarterly and annual results, to investors, ensuring transparency and addressing their inquiries. I also worked closely with lenders to secure financing for projects, negotiating terms and conditions, and maintaining compliance with loan covenants.

I have experience in building strong relationships with these stakeholders by maintaining open communication, providing timely and accurate information, and proactively addressing any concerns. For example, when a key investor expressed concerns about a specific project's ROI, I prepared a detailed sensitivity analysis to illustrate the potential impact of different market scenarios, which helped to alleviate their concerns and maintain their confidence in our strategy.

14. How do you approach forecasting future financial performance, considering various economic scenarios?

I approach financial forecasting by first establishing a baseline forecast using historical data and current trends. I then develop multiple economic scenarios (e.g., optimistic, pessimistic, and most likely) by considering factors like GDP growth, interest rates, and inflation. For each scenario, I adjust key assumptions driving the baseline forecast (e.g., sales growth, cost of goods sold) and quantify the impact on financial performance using sensitivity analysis.

To refine the accuracy of the forecast under each scenario, I may also use statistical models like time series analysis or regression analysis. Finally, I document all assumptions and methodologies for transparency and regularly update the forecasts as new information becomes available.

15. Describe a time when you had to challenge a financial decision made by senior management, and what was the outcome?