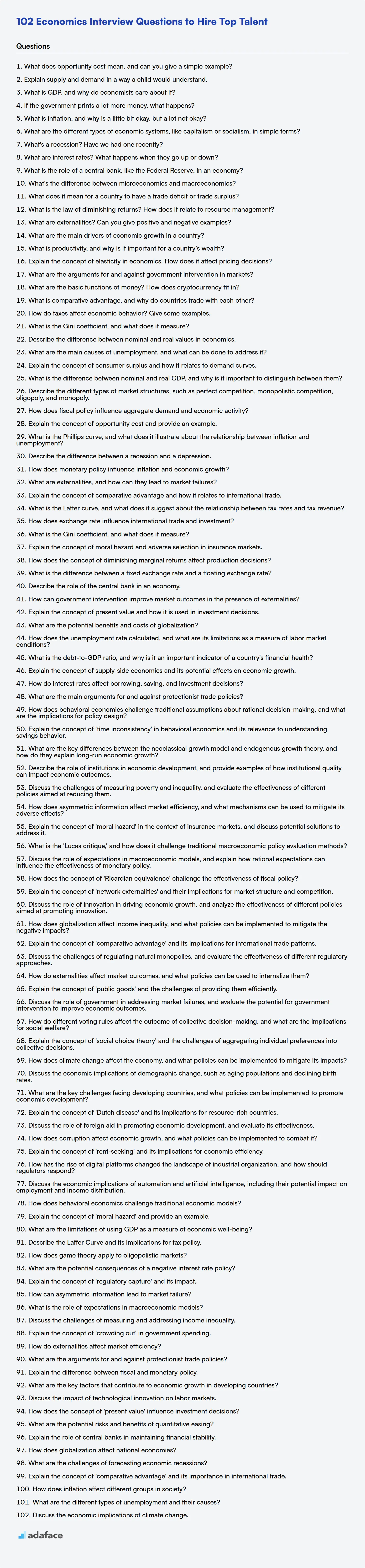

Are you on the hunt for top-notch economics professionals but struggling to gauge their understanding of key economic principles? This curated list of economics interview questions is designed to assist recruiters and hiring managers in identifying candidates who genuinely grasp economics.

This blog post provides a range of economics interview questions, spanning from basic to expert levels, including multiple-choice questions for quick assessments. The questions will test candidates on microeconomics, macroeconomics, econometrics, and various other applied economics topics.

By using these questions, you can assess candidates thoroughly and skill-based hiring by testing their economics knowledge before interviews using our Economics Test.

Table of contents

Basic Economics interview questions

1.

2. Explain supply and demand in a way a child would understand.

Imagine you have a lot of cookies (supply), and your friends want to eat them (demand). If you have only a few cookies, everyone wants one really badly, so they might offer you a toy or even do a chore to get one! That's high demand and prices (the toy or chore) go up.

But, if you suddenly bake a HUGE batch of cookies, everyone can have as many as they want. Now, not as many people are desperate for a cookie. The demand is lower, so you don't need to ask for as much in return (lower prices). So, supply and demand is all about how much of something there is and how badly people want it!

3. What is GDP, and why do economists care about it?

GDP, or Gross Domestic Product, is the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period (usually a year). Economists care about GDP because it's a key indicator of a country's economic health. A rising GDP generally indicates a growing economy with more jobs and higher incomes, while a falling GDP can signal a recession.

Economists use GDP to:

- Track economic growth over time.

- Compare the size and performance of different economies.

- Inform policy decisions related to fiscal and monetary policy.

- Analyze business cycles.

4. If the government prints a lot more money, what happens?

If the government prints significantly more money, it typically leads to inflation. With more money in circulation and the same amount of goods and services available, the value of each unit of currency decreases. This means prices for goods and services rise as more money is needed to purchase them.

In extreme cases, excessive money printing can lead to hyperinflation, where inflation rates become extremely high and rapid, eroding the purchasing power of money very quickly. It can also distort investment and savings decisions, as people try to spend money quickly before it loses value. However, if the economy is operating far below capacity (e.g., during a severe recession) and there's little demand, printing more money might stimulate growth without causing much inflation, but this is less common.

5. What is inflation, and why is a little bit okay, but a lot not okay?

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. A little bit of inflation (around 2% annually) is generally considered healthy for an economy because it encourages spending and investment, as people anticipate that prices will be higher in the future. This can stimulate economic growth and prevent deflation, which can be much more damaging.

However, a lot of inflation (hyperinflation) is not okay because it erodes purchasing power rapidly, creates uncertainty, discourages savings and investment, and can lead to economic instability. When inflation is high, businesses find it difficult to plan for the future, and consumers lose confidence in the value of their money. It can also lead to social unrest and economic collapse if left unchecked.

6. What are the different types of economic systems, like capitalism or socialism, in simple terms?

Economic systems are basically the rules a society uses to decide what to produce, how to produce it, and who gets it. Capitalism emphasizes private ownership and free markets. People and businesses own the resources and make decisions based on supply and demand with minimal government intervention.

Socialism, on the other hand, prioritizes social ownership and control of resources. This can range from the government owning major industries to worker cooperatives making decisions. The goal is often to distribute wealth and resources more equally.

7. What's a recession? Have we had one recently?

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. It's a period when the economy shrinks instead of grows.

Whether we've had a recession recently depends on the specific time frame being considered. Economic data is often revised, and official declarations of recessions are made by organizations like the National Bureau of Economic Research (NBER) with some lag. A common rule of thumb is two consecutive quarters of negative GDP growth, but NBER considers a wider range of indicators.

8. What are interest rates? What happens when they go up or down?

Interest rates represent the cost of borrowing money or the return on lending it. They are typically expressed as an annual percentage of the principal amount. When interest rates go up, borrowing becomes more expensive, which tends to reduce spending and investment, potentially slowing down economic growth. Conversely, when interest rates go down, borrowing becomes cheaper, which can encourage spending and investment, potentially stimulating economic growth.

Lower interest rates can lead to increased inflation as demand rises, while higher rates can help curb inflation by reducing demand. Central banks often adjust interest rates to manage inflation and maintain economic stability. These adjustments also impact exchange rates, savings, and overall financial market conditions.

9. What is the role of a central bank, like the Federal Reserve, in an economy?

The central bank, such as the Federal Reserve in the U.S., plays a critical role in managing a nation's economy. Its primary functions revolve around controlling the money supply and credit conditions to promote economic stability and sustainable growth.

Specifically, the Fed influences interest rates, manages inflation, regulates banks, and acts as a lender of last resort to financial institutions. By adjusting monetary policy, the central bank aims to achieve full employment, stable prices, and moderate long-term interest rates.

10. What's the difference between microeconomics and macroeconomics?

Microeconomics studies the behavior of individual economic agents like households and firms. It focuses on topics such as supply and demand, pricing strategies, and market structures. Essentially, it's about how individuals and companies make decisions within the economy.

Macroeconomics, on the other hand, examines the economy as a whole. It analyzes aggregate variables like GDP, inflation, unemployment, and monetary and fiscal policy. Macroeconomics seeks to understand how the entire economy functions and how governments can intervene to achieve economic goals like growth and stability.

11. What does it mean for a country to have a trade deficit or trade surplus?

A trade deficit occurs when a country imports more goods and services than it exports. This means that more money is flowing out of the country to pay for imports than is coming in from selling exports. Conversely, a trade surplus exists when a country exports more goods and services than it imports. In this case, more money is flowing into the country from exports than is leaving to pay for imports.

12. What is the law of diminishing returns? How does it relate to resource management?

The law of diminishing returns states that at some point, increasing the amount of one input while holding other inputs constant, will lead to a smaller increase in output. In simpler terms, adding more and more of one resource eventually yields less and less benefit.

In resource management, it highlights the importance of optimizing resource allocation. Simply throwing more of one resource at a problem won't always solve it. It relates to resource management because efficient allocation of resources, considering all inputs, is crucial for maximizing output. For example, adding more developers to a software project may initially speed things up, but beyond a certain point, communication overhead and coordination issues can actually slow down the project. Therefore, it's important to consider the diminishing returns of each resource and allocate them effectively.

13. What are externalities? Can you give positive and negative examples?

Externalities are costs or benefits that affect a party who did not choose to incur that cost or benefit. They are side effects of an activity that aren't reflected in the cost of the goods or services involved.

Examples include:

- Negative Externality: Pollution from a factory. The factory produces goods (benefit to them), but the pollution affects the health and environment of nearby residents (cost to them).

- Positive Externality: A beekeeper's bees pollinating a neighboring farmer's crops. The beekeeper benefits from honey production, and the farmer benefits from increased crop yields. Another example is education, which benefits the individual but also society as a whole through a more informed and productive citizenry.

14. What are the main drivers of economic growth in a country?

The main drivers of economic growth include increases in labor productivity, capital accumulation, and technological advancement. More productive workers, more capital per worker (like machinery and infrastructure), and new technologies all contribute to a higher output of goods and services. A country's institutions, such as property rights and rule of law, are also vital. They foster a stable and predictable environment for investment and innovation.

Other important factors include natural resources, human capital (education and skills), and entrepreneurship. While natural resources can provide an initial boost, sustained growth relies more on improvements in productivity and innovation. Investing in education and fostering an environment that encourages entrepreneurship are also critical.

15. What is productivity, and why is it important for a country’s wealth?

Productivity is a measure of output per unit of input. It essentially tells us how efficiently resources (like labor, capital, and raw materials) are being used to produce goods and services. Higher productivity means more output can be generated with the same amount of input, or the same output can be generated with less input.

Productivity is crucial for a country's wealth because it directly impacts its standard of living. When a country's workforce and resources are highly productive, it can produce more goods and services, leading to economic growth. This growth translates into higher incomes, more job opportunities, and increased wealth for its citizens. Furthermore, higher productivity allows businesses to be more competitive in the global market, attracting investment and further boosting economic development.

16. Explain the concept of elasticity in economics. How does it affect pricing decisions?

Elasticity in economics refers to the degree to which changes in price affect the quantity demanded or supplied. If a product's demand is elastic, a small change in price leads to a significant change in quantity demanded. Conversely, if demand is inelastic, price changes have little impact on quantity demanded.

Elasticity significantly influences pricing decisions. For elastic goods, businesses must be cautious about price increases, as they could lose many customers. Lowering prices might substantially increase sales. For inelastic goods, businesses have more pricing power; they can raise prices without significantly reducing demand. Understanding a product's elasticity helps companies optimize pricing strategies to maximize revenue.

17. What are the arguments for and against government intervention in markets?

Arguments for government intervention in markets include correcting market failures like externalities (e.g., pollution), providing public goods (e.g., national defense), ensuring fairness and equity (e.g., minimum wage laws), and stabilizing the economy during recessions (e.g., fiscal stimulus). Intervention can also address information asymmetry, where one party has more knowledge than the other, potentially leading to exploitation.

Arguments against government intervention emphasize potential inefficiencies and unintended consequences. Intervention can distort market signals, leading to misallocation of resources. Regulations can increase costs for businesses, hindering innovation and economic growth. Government intervention might also create opportunities for corruption or rent-seeking. Moreover, the government may lack the necessary information or expertise to effectively intervene, leading to policy failures.

18. What are the basic functions of money? How does cryptocurrency fit in?

Money serves three basic functions: a medium of exchange, a unit of account, and a store of value. As a medium of exchange, money facilitates transactions by eliminating the need for barter. As a unit of account, it provides a common way to measure the value of goods and services. As a store of value, money allows people to save purchasing power for the future.

Cryptocurrencies aim to fulfill these functions but with varying degrees of success. While some cryptocurrencies like Bitcoin have gained acceptance as a medium of exchange (though volatility remains a challenge), their value fluctuations often hinder their effectiveness as a stable unit of account and reliable store of value. Other cryptocurrencies, especially stablecoins, are designed to address the store of value issue by pegging their value to a more stable asset like the US dollar. Their adoption for day-to-day transactions is growing but still limited compared to traditional currencies.

19. What is comparative advantage, and why do countries trade with each other?

Comparative advantage is an economic theory that states a country should specialize in producing and exporting goods or services that it can produce at a lower opportunity cost than other countries. Opportunity cost refers to what a country sacrifices to produce a specific good, essentially the value of the next best alternative. Even if a country has an absolute advantage (can produce everything more efficiently), it benefits from specializing in what it's relatively better at.

Countries trade because it allows them to consume beyond their production possibilities frontier. By specializing in goods where they have a comparative advantage and trading for others, countries can access a wider variety of goods and services at lower costs than if they tried to produce everything domestically. This leads to increased efficiency, higher overall output, and potentially greater economic growth for all participating countries. For example, a country with abundant natural resources might specialize in resource extraction, while another with skilled labor might focus on manufacturing, and both benefit from trading with each other.

20. How do taxes affect economic behavior? Give some examples.

Taxes significantly influence economic behavior by altering incentives. Higher income taxes can discourage work effort or encourage tax avoidance strategies. Similarly, taxes on capital gains can reduce investment, while taxes on consumption (like sales tax) can decrease spending on certain goods and services.

For example, a high tax on cigarettes aims to reduce smoking. Businesses might relocate to areas with lower corporate taxes. Individuals may choose to invest in tax-advantaged retirement accounts rather than taxable investments. These responses demonstrate how taxes shape decisions related to labor supply, investment, and consumption.

21. What is the Gini coefficient, and what does it measure?

The Gini coefficient is a statistical measure of income or wealth inequality within a population. It ranges from 0 to 1, where 0 represents perfect equality (everyone has the same income or wealth) and 1 represents perfect inequality (one person has all the income or wealth, and everyone else has none).

In essence, the Gini coefficient quantifies the gap between a perfectly equal distribution and the actual distribution. A higher Gini coefficient indicates greater inequality, while a lower Gini coefficient suggests a more equitable distribution.

22. Describe the difference between nominal and real values in economics.

Nominal values are expressed in current prices, meaning they are not adjusted for inflation. They represent the actual monetary value at the time of the transaction or measurement. Real values, on the other hand, are adjusted for inflation, providing a more accurate measure of purchasing power and economic activity over time.

For example, nominal GDP reflects the total value of goods and services produced in a country at current prices, while real GDP reflects the total value adjusted for inflation, showing the actual increase in production. The difference highlights that nominal values can be misleading if inflation is significant.

23. What are the main causes of unemployment, and what can be done to address it?

Unemployment stems from various factors. Cyclical unemployment arises from economic downturns where demand for goods and services falls, leading to layoffs. Structural unemployment occurs when there's a mismatch between workers' skills and available jobs, often due to technological advancements or industry shifts. Frictional unemployment is a natural part of the labor market as people transition between jobs. Other factors include seasonal employment and government policies.

Addressing unemployment requires a multi-pronged approach. Stimulating economic growth through fiscal and monetary policies can reduce cyclical unemployment. Investing in education and training programs can help workers acquire skills needed for in-demand jobs, tackling structural unemployment. Improving job search assistance and reducing barriers to employment can minimize frictional unemployment. Targeted support for industries and regions affected by economic changes can also be beneficial.

24. What does opportunity cost mean, and can you give a simple example?

Opportunity cost represents the potential benefits you miss out on when choosing one alternative over another. It's the value of the next best alternative that is foregone.

For example, if you spend $20 on a video game, the opportunity cost is what else you could have bought with that $20, like a book, food, or saving it for something else. Choosing the video game means you lose the chance to have those other things.

25. Explain supply and demand in a way a child would understand.

Imagine you have a lot of candy to sell (that's the supply), and your friends really want to buy it (that's the demand). If you have only a few candies, but everyone wants one, you can charge more money because the demand is high, and the supply is low. That's why rare toys are expensive!

But, if you have tons of candy, and only a few friends want to buy it, you have to lower the price to get people to buy it because the demand is low, and the supply is high. So, supply is how much of something you have, and demand is how much people want it. The balance between them decides how much something costs.

26. What is GDP, and why do economists care about it?

GDP, or Gross Domestic Product, is the total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period. It serves as a broad measure of a country's economic activity.

Economists care about GDP because it provides a snapshot of the overall health and size of an economy. Changes in GDP growth rates are used to track economic cycles, predict future economic performance, and make policy decisions. A rising GDP generally indicates economic growth and prosperity, while a declining GDP may signal a recession. It's also a key metric for comparing the economic performance of different countries.

27. If the government prints a lot more money, what happens?

If the government prints significantly more money, the most likely outcome is inflation. More money in circulation without a corresponding increase in goods and services means each unit of currency is worth less. This leads to a general increase in prices across the economy.

In extreme cases, excessive money printing can lead to hyperinflation, where the value of money plummets rapidly, and prices skyrocket uncontrollably. This can destabilize the economy and erode people's savings. The effect might be lagged, meaning it is not instantaneous. There may be short term boosts in employment and spending. Longer term effects related to inflation will dominate.

28. What is inflation, and why is a little bit okay, but a lot not okay?

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. A little bit of inflation (around 2%) is generally considered healthy for an economy. It encourages spending and investment, as people anticipate prices will be higher in the future. This can stimulate economic growth and employment.

However, high inflation is problematic. It erodes purchasing power rapidly, making it difficult for individuals and businesses to plan for the future. It can lead to uncertainty, instability, and a decline in the overall standard of living. Very high inflation, known as hyperinflation, can devastate an economy, making money practically worthless.

29. What are the different types of economic systems, like capitalism or socialism, in simple terms?

Economic systems organize how a society produces and distributes goods and services. Capitalism prioritizes private ownership, free markets, and competition. Prices are determined by supply and demand, and individuals and companies make their own economic decisions with minimal government intervention. The goal is profit.

Socialism, on the other hand, emphasizes social ownership and control of the means of production. This can range from complete government ownership to worker cooperatives. The goal is to distribute wealth and resources more equitably and provide social services.

30. What's a recession? Have we had one recently?

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. It's a period when the economy shrinks instead of grows.

Whether we've had one recently is a matter of debate and depends on the specific criteria used. For instance, in some countries, there have been periods of economic contraction that may or may not have been officially classified as recessions, depending on the depth and duration of the decline. To get a definitive answer, it is best to look at official data and announcements from governmental economic agencies for the specific region in question.

31. What are interest rates? What happens when they go up or down?

Interest rates represent the cost of borrowing money or the return on lending money, expressed as a percentage. They are a key tool used by central banks to manage inflation and stimulate or cool down the economy.

When interest rates go up, borrowing becomes more expensive, which can lead to decreased spending and investment, potentially slowing down economic growth and curbing inflation. Conversely, when interest rates go down, borrowing becomes cheaper, encouraging spending and investment, which can stimulate economic growth but potentially lead to higher inflation.

32. What is the role of a central bank, like the Federal Reserve, in an economy?

The central bank, like the Federal Reserve (the Fed) in the U.S., plays a crucial role in maintaining the stability and health of a nation's economy. Its primary functions include conducting monetary policy, supervising and regulating banks, and maintaining the stability of the financial system. Monetary policy involves managing the money supply and interest rates to influence inflation, employment, and economic growth.

The Fed uses tools like the federal funds rate (the rate at which banks lend to each other overnight), the discount rate (the rate at which banks can borrow directly from the Fed), and reserve requirements (the amount of money banks must keep in reserve) to influence economic activity. The Fed also acts as a lender of last resort to banks during times of financial crisis, helping to prevent widespread bank failures and economic collapse. By overseeing banks and implementing regulations, it ensures the safety and soundness of the financial system and protects consumers.

33. What's the difference between microeconomics and macroeconomics?

Microeconomics studies the behavior of individual economic agents (consumers, firms, and markets) and how their decisions influence the allocation of scarce resources. It focuses on things like supply and demand, pricing strategies, and consumer behavior at a granular level.

Macroeconomics, on the other hand, examines the economy as a whole. It deals with aggregate variables such as national income, unemployment, inflation, and economic growth. Macroeconomics tries to understand the big picture of a national or even global economy.

34. What does it mean for a country to have a trade deficit or trade surplus?

A trade deficit occurs when a country imports more goods and services than it exports. This means the value of imports exceeds the value of exports. Conversely, a trade surplus happens when a country exports more goods and services than it imports, resulting in the value of exports being greater than the value of imports.

35. What is the law of diminishing returns? How does it relate to resource management?

The law of diminishing returns states that at some point, adding an additional factor of production results in smaller increases in output. In simpler terms, after a certain point, you get less bang for your buck. For example, adding more fertilizer to a field will increase crop yield, but at some point, adding even more fertilizer will have a much smaller impact or even decrease the yield.

In resource management, this law highlights the need for optimization. If you continue to increase a particular input without considering diminishing returns, you'll eventually reach a point where the cost of the input outweighs the benefit. This is applicable to various resources, including manpower, capital, and natural resources. Effective resource management involves finding the optimal balance to maximize output while minimizing waste and inefficiency due to diminishing returns.

36. What are externalities? Can you give positive and negative examples?

Externalities are costs or benefits that affect a party who did not choose to incur that cost or benefit. They are consequences of an economic activity experienced by unrelated third parties.

Examples:

- Negative Externality: A factory polluting a river, affecting the health and livelihood of people downstream. Another is noise pollution from an airport near residential areas.

- Positive Externality: A beekeeper whose bees pollinate a neighboring farmer's crops, increasing the farmer's yield. Another is education; a more educated populace can lead to lower crime rates and increased civic engagement.

37. What are the main drivers of economic growth in a country?

The main drivers of economic growth in a country are complex and interconnected, but key factors include:

- Capital Accumulation: Investment in physical capital (machinery, infrastructure) and human capital (education, skills). More and better equipment and a skilled workforce boost productivity.

- Technological Progress: Innovations, research and development, and adoption of new technologies are crucial for increasing output per unit of input. This is often the most important long-run driver.

- Labor Force Growth: An increase in the size and quality of the labor force contributes to higher production. Favorable demographics can be a significant advantage.

- Natural Resources: Abundant and accessible natural resources (minerals, energy, fertile land) can provide a significant initial boost, though it is not always necessary for sustained growth.

- Institutional Quality: Strong institutions, including secure property rights, rule of law, efficient governance, and stable financial systems, are essential for fostering investment, innovation, and trade.

38. What is productivity, and why is it important for a country’s wealth?

Productivity is a measure of output per unit of input. It essentially tells us how efficiently resources are being used. Inputs can be things like labor, capital, and raw materials, while output refers to the goods or services produced. Higher productivity means you can produce more goods and services with the same amount of resources, or the same amount of goods and services with fewer resources.

Productivity is crucial for a country's wealth because it drives economic growth and higher living standards. When a country's productivity increases, it can produce more goods and services, leading to increased profits, higher wages, and lower prices. This, in turn, creates more jobs, increases investment, and boosts overall economic prosperity. A nation's ability to improve its citizens’ standard of living depends almost entirely on its ability to raise its output per worker. In simple terms, greater productivity makes a nation wealthier.

39. Explain the concept of elasticity in economics. How does it affect pricing decisions?

Elasticity in economics measures the responsiveness of one variable to a change in another. For example, price elasticity of demand measures how much the quantity demanded of a good changes when its price changes. If demand is elastic, a small price change leads to a large change in quantity demanded; if it's inelastic, quantity demanded changes little. Other types of elasticity include income elasticity of demand and cross-price elasticity of demand.

Elasticity significantly affects pricing decisions. If demand is elastic, lowering prices can increase revenue because the increase in quantity sold outweighs the lower price per unit. Conversely, if demand is inelastic, raising prices can increase revenue because the decrease in quantity sold is smaller than the higher price per unit. Understanding elasticity helps businesses optimize pricing strategies to maximize profits.

40. What are the arguments for and against government intervention in markets?

Arguments for government intervention in markets include correcting market failures such as externalities (pollution), providing public goods (national defense), reducing information asymmetry, and promoting equity/fairness (redistributing wealth). Intervention can also stabilize the economy during recessions through fiscal and monetary policy.

Arguments against government intervention focus on potential inefficiencies. Government intervention can lead to unintended consequences, distort prices, create deadweight loss, and stifle innovation. Regulations can be costly to implement and enforce, and government actors may be subject to political influence or corruption, leading to suboptimal outcomes. Some argue that markets are generally efficient and self-correcting, so intervention is rarely justified.

41. What are the basic functions of money? How does cryptocurrency fit in?

Money traditionally serves three basic functions: a medium of exchange, a unit of account, and a store of value. As a medium of exchange, money facilitates transactions, eliminating the need for barter. As a unit of account, it provides a common measure for valuing goods and services. As a store of value, it allows people to save purchasing power for the future.

Cryptocurrencies attempt to fulfill these functions, but with varying degrees of success. While some cryptocurrencies are used as a medium of exchange (though often with limited adoption and high transaction fees), their price volatility makes them a less reliable unit of account and store of value compared to traditional currencies. Some newer cryptocurrencies, often called stablecoins, are designed to maintain a stable value, aiming to better serve as a store of value and unit of account, typically by being pegged to a fiat currency or other assets.

42. What is comparative advantage, and why do countries trade with each other?

Comparative advantage refers to a country's ability to produce a particular good or service at a lower opportunity cost than other countries. This means they sacrifice less of other goods when producing that specific item. Countries trade because they can specialize in producing goods and services where they have a comparative advantage, leading to increased overall production and consumption.

By specializing and trading, countries can access a wider variety of goods and services at lower costs than if they tried to produce everything themselves. This boosts economic growth, improves living standards, and fosters global cooperation.

43. How do taxes affect economic behavior? Give some examples.

Taxes influence economic behavior by altering relative prices and incentives. When taxes increase the cost of a good or service, demand typically decreases. Conversely, subsidies (negative taxes) can encourage consumption or production.

For example, higher income taxes may disincentivize work effort, leading individuals to work less or seek income in other ways. Excise taxes on cigarettes discourage smoking. Investment tax credits encourage businesses to invest in new equipment. Capital gains taxes affect the timing and volume of asset sales. Property taxes affect the demand for housing.

44. What is the Gini coefficient, and what does it measure?

The Gini coefficient is a statistical measure of income inequality within a population. It ranges from 0 to 1, where 0 represents perfect equality (everyone has the same income) and 1 represents perfect inequality (one person has all the income).

It essentially measures the area between the Lorenz curve (which plots the cumulative proportion of total income earned by the cumulative proportion of the population) and the line of perfect equality (a 45-degree line). A higher Gini coefficient indicates greater income inequality, while a lower Gini coefficient indicates more equal income distribution.

45. Describe the difference between nominal and real values in economics.

Nominal values are economic values expressed in current prices. They don't account for inflation. If nominal GDP increases, it could be due to increased production or simply due to rising prices.

Real values, on the other hand, are adjusted for inflation. They reflect the actual quantity of goods and services produced. Real GDP provides a more accurate measure of economic growth by removing the impact of price changes. For example, if a country's nominal GDP grew by 5% but inflation was 3%, the real GDP growth would be approximately 2%.

46. What are the main causes of unemployment, and what can be done to address it?

Unemployment stems from various causes, including cyclical downturns in the economy (recessions), structural shifts due to technological advancements or changes in industry demand, frictional unemployment as people transition between jobs, and seasonal variations in certain industries. Insufficient aggregate demand, skills gaps between available jobs and the workforce's capabilities, and labor market rigidities (e.g., restrictive regulations) also contribute.

Addressing unemployment requires a multi-faceted approach. Governments can implement expansionary fiscal and monetary policies to stimulate economic growth and job creation. Investing in education and training programs helps to bridge skills gaps. Reducing labor market rigidities, while protecting worker rights, can improve labor market flexibility. Furthermore, supporting entrepreneurship and innovation can foster new businesses and employment opportunities. Strengthening social safety nets can provide support to the unemployed while they seek new employment.

Intermediate Economics interview questions

1. Explain the concept of consumer surplus and how it relates to demand curves.

Consumer surplus is the difference between what a consumer is willing to pay for a good or service and what they actually pay. It represents the economic benefit or welfare consumers receive because they can purchase something for less than its perceived value.

Consumer surplus is graphically illustrated as the area below the demand curve and above the market price. The demand curve shows the maximum price consumers are willing to pay for each quantity, while the market price is the actual price they pay. The gap between these two represents consumer surplus. A higher demand indicates a greater willingness to pay, potentially leading to a larger consumer surplus if the market price is lower than what consumers are willing to pay.

2. What is the difference between nominal and real GDP, and why is it important to distinguish between them?

Nominal GDP is the total value of goods and services produced in an economy, calculated using current prices. Real GDP, on the other hand, adjusts nominal GDP for inflation, providing a more accurate measure of economic output by reflecting changes in the volume of production rather than price levels.

Distinguishing between nominal and real GDP is crucial because nominal GDP can be misleading. An increase in nominal GDP might simply reflect rising prices (inflation) rather than actual economic growth. Real GDP provides a more accurate picture of whether the economy is actually expanding or contracting, making it a more reliable indicator for policymakers and economists.

3. Describe the different types of market structures, such as perfect competition, monopolistic competition, oligopoly, and monopoly.

Market structures describe the competitive environment in which firms operate. Perfect competition features many small firms selling identical products with no barriers to entry; prices are determined by supply and demand. Monopolistic competition also involves many firms, but they sell differentiated products, allowing for some price control and non-price competition like advertising. Oligopoly is characterized by a few dominant firms that have significant market power and are interdependent in their pricing and output decisions; barriers to entry are high. Finally, a monopoly exists when there is only one firm selling a unique product with no close substitutes and significant barriers to entry, allowing the monopolist to control price and output.

4. How does fiscal policy influence aggregate demand and economic activity?

Fiscal policy influences aggregate demand primarily through government spending and taxation. Increased government spending directly increases aggregate demand. Tax cuts boost disposable income, which leads to increased consumer spending and investment, indirectly increasing aggregate demand. Conversely, decreased government spending or tax increases reduce aggregate demand. This shift in aggregate demand consequently affects economic activity, impacting output, employment, and inflation.

5. Explain the concept of opportunity cost and provide an example.

Opportunity cost represents the potential benefits you miss out on when choosing one alternative over another. It's the value of the next best alternative foregone. It's an important concept in economics for decision-making under scarcity.

For example, imagine you have $20 and can either buy a book or go to the movies. If you choose to buy the book, the opportunity cost is the enjoyment and experience you would have gained from going to the movies. Conversely, if you choose to go to the movies, the opportunity cost is the knowledge and enjoyment you would have gained from reading the book.

6. What is the Phillips curve, and what does it illustrate about the relationship between inflation and unemployment?

The Phillips curve is an economic model that illustrates an inverse relationship between inflation and unemployment. Generally, it suggests that lower unemployment is associated with higher inflation, and vice versa. This is because as unemployment falls, wages may rise due to increased demand for labor, which can then lead to businesses increasing prices to cover the higher costs, resulting in inflation.

However, the Phillips curve relationship is not always stable or reliable. In the long run, many economists believe there is no trade-off between inflation and unemployment, and the curve is vertical at the natural rate of unemployment. Factors like supply shocks and changes in inflation expectations can also shift the Phillips curve, making the relationship complex and sometimes unpredictable.

7. Describe the difference between a recession and a depression.

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. It's a normal part of the business cycle. A depression, on the other hand, is a more severe and prolonged downturn in economic activity.

Key differences include the magnitude and duration of the economic decline. Depressions involve larger declines in GDP, higher unemployment rates, and a longer period of economic hardship compared to recessions. While recessions are relatively common, depressions are rare.

8. How does monetary policy influence inflation and economic growth?

Monetary policy influences inflation and economic growth primarily by adjusting interest rates and controlling the money supply. Lowering interest rates encourages borrowing and spending, stimulating economic growth but potentially leading to higher inflation if demand outpaces supply. Conversely, raising interest rates reduces borrowing and spending, curbing inflation but potentially slowing down economic growth.

Central banks use tools like the policy rate (e.g., the federal funds rate in the US), reserve requirements, and open market operations (buying or selling government bonds) to implement monetary policy. By managing these instruments, central banks aim to maintain price stability (controlling inflation) while promoting sustainable economic growth and full employment.

9. What are externalities, and how can they lead to market failures?

Externalities are costs or benefits that affect a party who did not choose to incur that cost or benefit. They occur when the production or consumption of a good or service impacts a third party not directly involved in the transaction.

Externalities can lead to market failures because the market price of a good or service does not reflect the true social cost or benefit. This misallocation of resources results in either overproduction (negative externalities like pollution) or underproduction (positive externalities like education) relative to the socially optimal level. Because the market only considers private costs and benefits, it fails to account for the external effects on society.

10. Explain the concept of comparative advantage and how it relates to international trade.

Comparative advantage is an economic theory that explains how countries can benefit from international trade even if one country is more efficient at producing all goods and services than another. It focuses on the opportunity cost of production. A country has a comparative advantage in producing a good if it can produce that good at a lower opportunity cost than another country. Opportunity cost is what you give up to produce something else.

International trade based on comparative advantage allows countries to specialize in producing goods and services where they have a lower opportunity cost. By exporting these goods and importing goods where they have a higher opportunity cost, all participating countries can consume beyond their own production possibilities. This leads to increased overall economic efficiency and welfare for everyone involved. For example, Country A might be able to produce both wheat and textiles more efficiently than Country B, but if Country A has a significantly lower opportunity cost of producing wheat, and Country B has a lower opportunity cost of producing textiles, both countries benefit by specializing and trading.

11. What is the Laffer curve, and what does it suggest about the relationship between tax rates and tax revenue?

The Laffer Curve is a theoretical representation of the relationship between tax rates and the resulting government tax revenue. It suggests that increasing tax rates beyond a certain point can actually decrease tax revenue. This is because excessively high tax rates can discourage economic activity, such as investment and labor, leading to a smaller tax base. People may choose to work less, invest less, or even engage in tax avoidance strategies.

The curve implies that there's an optimal tax rate that maximizes government revenue. Tax rates below this point generate less revenue than possible, while rates above this point stifle economic activity so much that revenue decreases. The exact optimal tax rate is debated and varies depending on the specific economy and circumstances.

12. How does exchange rate influence international trade and investment?

Exchange rates significantly impact international trade and investment. A weaker domestic currency makes exports cheaper for foreign buyers, boosting export volumes, and imports more expensive, potentially reducing import volumes. This can improve a country's trade balance. Conversely, a stronger domestic currency makes exports more expensive and imports cheaper, potentially worsening the trade balance.

For investment, exchange rates affect the returns on international investments. Currency fluctuations can erode or enhance investment gains when profits are converted back to the investor's home currency. Furthermore, exchange rate volatility can increase the risk associated with international investments, potentially deterring foreign direct investment (FDI) and portfolio investment.

13. What is the Gini coefficient, and what does it measure?

The Gini coefficient is a statistical measure of distribution, often used to measure income inequality. It ranges from 0 to 1, where 0 represents perfect equality (everyone has the same income) and 1 represents perfect inequality (one person has all the income).

It's calculated based on the Lorenz curve, which plots the cumulative percentage of total income received against the cumulative percentage of recipients. The Gini coefficient is the ratio of the area between the line of perfect equality and the Lorenz curve to the total area under the line of perfect equality. A higher Gini coefficient indicates greater inequality.

14. Explain the concept of moral hazard and adverse selection in insurance markets.

Moral hazard arises when insured individuals take on more risk because they are protected from the full consequences of their actions. For example, someone with car insurance might drive more recklessly because they know the insurance will cover damages. Adverse selection occurs when individuals with a higher risk of needing insurance are more likely to purchase it than those with lower risk. This happens when insurers can't perfectly assess individual risk, leading to a pool of insured individuals that is riskier than the general population. This can drive up premiums, further discouraging low-risk individuals from buying insurance, worsening the problem.

In essence, moral hazard is about behavior after obtaining insurance, while adverse selection is about who chooses to obtain insurance before any claims are made. Insurers use techniques like deductibles, co-pays, and risk assessments to mitigate these problems.

15. How does the concept of diminishing marginal returns affect production decisions?

Diminishing marginal returns states that at some point, increasing one input (e.g., labor) while holding others constant (e.g., capital) will lead to smaller and smaller increases in output. This significantly impacts production decisions. Businesses must carefully consider whether the additional output from hiring more workers, buying more materials, or investing in new equipment is worth the cost.

Because of diminishing returns, optimal production involves finding the right balance of inputs. Adding too much of one input, without adjusting others, can lead to inefficiencies and reduced profitability. Producers therefore aim to identify the point where the marginal cost of an input equals its marginal revenue product. Understanding and managing diminishing marginal returns is crucial for cost-effective production and maximizing profits.

16. What is the difference between a fixed exchange rate and a floating exchange rate?

A fixed exchange rate is when a country's central bank or government sets and maintains the exchange rate against another currency, a basket of currencies, or a commodity like gold. The rate is typically held constant, and the central bank intervenes in the foreign exchange market to maintain the pegged value, buying or selling its own currency as needed.

In contrast, a floating exchange rate is determined by the supply and demand forces in the foreign exchange market. The value of the currency fluctuates freely based on market conditions, such as economic performance, interest rates, and investor sentiment. There is generally no official intervention to control the exchange rate, though central banks might intervene occasionally to smooth out excessive volatility.

17. Describe the role of the central bank in an economy.

The central bank plays a crucial role in managing a nation's economy. Its primary responsibilities typically include controlling the money supply, setting interest rates, and supervising commercial banks. By adjusting these levers, the central bank aims to maintain price stability (controlling inflation), promote full employment, and foster sustainable economic growth.

Furthermore, the central bank often acts as a lender of last resort to banks facing liquidity crises, helping to prevent systemic failures in the financial system. It may also regulate and oversee the banking sector to ensure its stability and protect depositors. Its actions have broad impacts on businesses, consumers, and the overall economic health of the country.

18. How can government intervention improve market outcomes in the presence of externalities?

Government intervention can improve market outcomes when externalities are present by internalizing the external costs or benefits. This means making the party responsible for the externality bear the costs (or reap the rewards) of their actions. Several tools are available:

- Taxes and Subsidies: Taxes can discourage activities that generate negative externalities (e.g., carbon tax), while subsidies can encourage activities that generate positive externalities (e.g., subsidies for renewable energy).

- Regulation: Setting standards or limits on pollution or requiring specific technologies can directly control negative externalities. For positive externalities, regulations might mandate certain behaviors, like vaccinations.

- Cap-and-Trade: This system sets a limit (cap) on pollution and allows firms to trade permits to pollute. It creates a market for pollution, incentivizing firms to reduce emissions cost-effectively.

- Direct Provision: In cases of significant positive externalities, the government may directly provide the good or service, such as public education or basic research.

19. Explain the concept of present value and how it is used in investment decisions.

Present value (PV) is the current worth of a future sum of money or stream of cash flows, given a specified rate of return. It's used to determine how much a future amount of money is worth today. The basic premise is that money today is worth more than the same amount of money in the future due to its potential earning capacity.

In investment decisions, PV helps compare the profitability of different investment opportunities. By calculating the PV of expected future cash flows from each investment, investors can determine which investment offers the highest return relative to its initial cost. If the present value of expected cash flows exceeds the initial investment, the investment is generally considered worthwhile. If the present value is less than the cost, the investment might not be a good idea. This process helps in making informed decisions about allocating capital.

20. What are the potential benefits and costs of globalization?

Globalization offers numerous potential benefits. These include increased economic growth through expanded markets and trade, lower prices for consumers due to competition, greater cultural exchange and understanding, and faster technological diffusion. Developing countries can benefit from foreign investment and access to new technologies and management practices.

However, globalization also carries potential costs. These include job displacement in developed countries due to outsourcing, increased income inequality, exploitation of labor in developing countries, environmental degradation, and the risk of financial contagion. Furthermore, globalization can lead to cultural homogenization and the erosion of local traditions. Balancing these benefits and costs is a key challenge for policymakers.

21. How does the unemployment rate calculated, and what are its limitations as a measure of labor market conditions?

The unemployment rate is calculated as the percentage of the labor force that is unemployed. The labor force includes people aged 16 and over who are either employed or actively seeking employment. The formula is: (Number of Unemployed / Labor Force) * 100. To be considered unemployed, a person must be actively looking for a job in the past four weeks.

Limitations include that it excludes discouraged workers (those who have stopped looking for work), underemployed workers (those working part-time but wanting full-time work), and doesn't reflect the quality of jobs available (e.g., wages, benefits). It also doesn't capture regional disparities or demographic differences in unemployment.

22. What is the debt-to-GDP ratio, and why is it an important indicator of a country's financial health?

The debt-to-GDP ratio is the ratio of a country's total government debt (public debt) to its gross domestic product (GDP). It's expressed as a percentage. This ratio is crucial because it indicates a country's ability to repay its debts. A lower ratio suggests a stronger ability to pay back debts without significant economic hardship.

A high debt-to-GDP ratio can signal that a country may have difficulty servicing its debt, potentially leading to economic instability, increased borrowing costs, and reduced investor confidence. However, acceptable levels vary depending on factors like interest rates, economic growth, and the government's fiscal policy.

23. Explain the concept of supply-side economics and its potential effects on economic growth.

Supply-side economics posits that economic growth is most effectively fostered by lowering barriers for people to produce (supply) goods and services. This can involve cutting income taxes, capital gains taxes, and corporate taxes, and by deregulation to reduce costs for businesses. The theory suggests that lower taxes incentivize investment, production, and job creation, leading to increased overall economic output. The idea is that tax cuts would encourage businesses to expand, hire more people, and invest more, thereby expanding the economy, growing the 'pie' for everyone.

Potential effects on economic growth are debated. Proponents argue that supply-side policies can lead to increased productivity, innovation, and investment, resulting in higher GDP growth. Critics, however, argue that the benefits disproportionately favor the wealthy, leading to increased income inequality. They also suggest that tax cuts can lead to increased government debt if not accompanied by spending cuts or increased revenues from the stimulated economy. Furthermore, the effectiveness of supply-side policies can depend on factors such as the overall state of the economy, monetary policy, and global economic conditions.

24. How do interest rates affect borrowing, saving, and investment decisions?

Interest rates have a significant impact on borrowing, saving, and investment. Higher interest rates make borrowing more expensive, thus discouraging individuals and businesses from taking out loans for purchases or investments. This leads to reduced spending and investment in the economy. Conversely, higher interest rates incentivize saving, as individuals earn a greater return on their deposits. This can lead to increased savings rates.

Lower interest rates have the opposite effect. Borrowing becomes cheaper, encouraging spending and investment. However, lower interest rates provide less incentive to save, potentially leading to lower savings rates. Investment decisions are influenced as companies may find it more attractive to undertake projects when the cost of borrowing is low. Overall, interest rate adjustments by central banks are a key tool in managing economic activity.

25. What are the main arguments for and against protectionist trade policies?

Arguments for protectionist trade policies often center on safeguarding domestic jobs by shielding industries from foreign competition. It's also argued that protectionism can nurture infant industries, allowing them to mature and become competitive without immediate pressure from established foreign rivals. National security is another justification, protecting industries vital for defense.

However, protectionism leads to higher prices for consumers, as tariffs and quotas restrict the availability of cheaper imports. It can stifle innovation as domestic industries face less competitive pressure to improve. Furthermore, protectionist measures often invite retaliatory actions from other countries, leading to trade wars that harm all involved parties.

Advanced Economics interview questions

1. How does behavioral economics challenge traditional assumptions about rational decision-making, and what are the implications for policy design?

Behavioral economics challenges traditional economics' assumption of perfect rationality. Traditional models assume individuals are always self-interested, have perfect information, and consistently make optimal decisions. Behavioral economics, however, incorporates psychological insights, demonstrating that people are often influenced by cognitive biases, emotions, and social factors. This leads to predictable deviations from rational choice, such as loss aversion (feeling the pain of a loss more strongly than the pleasure of an equivalent gain), framing effects (how information is presented influences decisions), and present bias (overvaluing immediate rewards over future ones).

The implications for policy design are significant. Recognizing these biases allows policymakers to design interventions that 'nudge' individuals towards better choices without restricting freedom of choice. Examples include default options in retirement savings plans (people tend to stick with the default), simplifying complex information to improve understanding, and using social norms to encourage desired behavior. By understanding how people actually behave, rather than how they are assumed to behave, policies can be more effective in achieving their intended goals.

2. Explain the concept of 'time inconsistency' in behavioral economics and its relevance to understanding savings behavior.

Time inconsistency refers to the tendency to value immediate rewards more highly than future rewards, even if the future rewards are objectively larger. This can lead to a disconnect between our intentions (e.g., saving for retirement) and our actions (e.g., spending impulsively). People are more patient when thinking about future choices but become impatient when the decision is immediate.

In the context of savings, time inconsistency explains why people often procrastinate saving, even when they know it's important. The immediate gratification of spending outweighs the future benefit of having more savings. This can manifest as consistently delaying saving decisions, underestimating future expenses, or relying on willpower to save 'later,' which often doesn't happen. Commitment devices, like automatically enrolling in a retirement plan, are often used to combat time inconsistency by making saving the default and reducing the temptation to delay.

3. What are the key differences between the neoclassical growth model and endogenous growth theory, and how do they explain long-run economic growth?

The neoclassical growth model, like the Solow-Swan model, primarily attributes long-run economic growth to exogenous factors, notably technological progress. It posits that economies converge to a steady-state level of output determined by savings rates, population growth, and technology. Diminishing returns to capital imply that increased investment alone cannot sustain long-run growth; only technological advancements can. In contrast, endogenous growth theory explains long-run growth as a result of factors internal to the economic system. It emphasizes the role of human capital, research and development, and knowledge spillovers as drivers of sustained growth. These models suggest that investments in education, innovation, and infrastructure can lead to increasing returns and perpetual growth, unlike the neoclassical model's emphasis on exogenous technological shocks.

4. Describe the role of institutions in economic development, and provide examples of how institutional quality can impact economic outcomes.

Institutions, encompassing formal rules, laws, and organizations, as well as informal norms and customs, play a crucial role in shaping economic development. They establish the 'rules of the game' that govern economic activity, influencing incentives, transaction costs, and property rights. Strong institutions foster economic growth by reducing uncertainty, enforcing contracts, protecting property rights, and promoting competition. Secure property rights, for example, encourage investment and innovation, as individuals and firms are confident that they can reap the rewards of their efforts. Efficient contract enforcement reduces transaction costs and promotes trade. A fair and impartial legal system ensures that businesses and individuals are treated equitably, fostering trust and encouraging investment.

Conversely, weak or corrupt institutions can hinder economic development. High levels of corruption can discourage investment, as businesses fear extortion and arbitrary regulation. Political instability and weak rule of law create uncertainty, making it difficult for businesses to plan for the future. Inadequate protection of property rights can lead to underinvestment and a lack of innovation. For example, countries with weak institutions often experience lower levels of foreign direct investment, slower economic growth, and higher levels of poverty. The presence of corruption also distorts resource allocation, directing funds towards projects that benefit politically connected individuals rather than those that are economically efficient. In many cases, weak governance leads to underdeveloped private sectors, which are essential for innovation and economic growth.

5. Discuss the challenges of measuring poverty and inequality, and evaluate the effectiveness of different policies aimed at reducing them.

Measuring poverty and inequality presents several challenges. Defining a poverty line is subjective and can be absolute (based on basic needs) or relative (compared to the average standard of living). Data collection is often difficult, especially in remote areas or among marginalized populations, leading to underreporting and inaccuracies. Different inequality measures (Gini coefficient, Palma ratio) capture different aspects of income distribution, and the choice of measure can influence the perceived level of inequality. Furthermore, accurately accounting for non-monetary factors like access to healthcare, education, and social services complicates the picture.

Policies aimed at reducing poverty and inequality vary in effectiveness. Social safety nets like unemployment benefits and conditional cash transfers can provide immediate relief but may disincentivize work. Education and job training programs can improve long-term earning potential but require significant investment and may not benefit everyone equally. Progressive taxation and wealth redistribution can reduce income inequality, but excessively high tax rates can stifle economic growth. Addressing systemic discrimination and promoting equal opportunities are crucial but often require long-term societal changes. Ultimately, the effectiveness of any policy depends on its specific design, implementation, and the broader economic and social context.

6. How does asymmetric information affect market efficiency, and what mechanisms can be used to mitigate its adverse effects?

Asymmetric information, where one party in a transaction has more information than the other, undermines market efficiency by leading to adverse selection and moral hazard. Adverse selection occurs before a transaction, where the party with more information selects to participate in the market in a way that disadvantages the other party. Moral hazard arises after a transaction, where one party changes their behavior in a way that is detrimental to the other party because they are shielded from the full consequences of their actions.

Several mechanisms can mitigate these effects. Signaling, where the informed party credibly conveys information (e.g., warranties), helps reduce information gaps. Screening, where the uninformed party induces the informed party to reveal information (e.g., insurance deductibles), also helps. Reputation building, third-party certifications, and government regulation requiring disclosure are other important tools for improving market transparency and efficiency.

7. Explain the concept of 'moral hazard' in the context of insurance markets, and discuss potential solutions to address it.

Moral hazard in insurance occurs when individuals, once insured, alter their behavior in ways that increase the likelihood or severity of a loss, because they no longer bear the full cost of that loss. For example, someone with car insurance might drive more recklessly, knowing that the insurance company will cover the damages in case of an accident. This behavior increases the insurer's costs.

Several strategies can mitigate moral hazard. Deductibles require the insured to pay a portion of the loss, providing an incentive to avoid risky behavior. Co-insurance splits the cost of a loss between the insurer and the insured. Monitoring can involve the insurer tracking the insured's behavior, for instance, using telematics in cars. Experience rating adjusts premiums based on the insured's past claims history, rewarding safe behavior with lower premiums. Furthermore, policy limits restrict the maximum amount an insurer will pay, thus providing some risk exposure for the insured.

8. What is the 'Lucas critique,' and how does it challenge traditional macroeconomic policy evaluation methods?

The Lucas critique, articulated by Robert Lucas, argues that traditional macroeconomic models fail to accurately predict the effects of policy changes because they don't account for the fact that individuals' expectations and behavior will change in response to the new policy. These models often assume fixed relationships based on historical data, without considering that these relationships are contingent on the specific policy regime in place.

Essentially, people learn and adapt. For example, if the government announces a permanent increase in inflation targets, individuals might immediately adjust their wage and price expectations upwards, negating the intended stimulus. Therefore, evaluating policies requires models that explicitly incorporate rational expectations and how policies influence individuals' decision-making processes, rather than relying on static relationships derived from past data.

9. Discuss the role of expectations in macroeconomic models, and explain how rational expectations can influence the effectiveness of monetary policy.

Expectations play a crucial role in macroeconomic models as they influence economic agents' decisions about consumption, investment, and labor supply. These expectations, particularly about future inflation and economic growth, directly impact current economic outcomes. When individuals and firms form expectations about the future, these expectations get embedded in wage and price setting decisions. The more accurately individuals and firms can predict future economic conditions the more they will adjust their current behavior to maximize future well-being.

Rational expectations, where individuals use all available information to form their expectations, can significantly affect monetary policy effectiveness. If economic agents rationally anticipate policy changes (e.g., a decrease in interest rates to stimulate the economy), they may immediately adjust their behavior. For example, if a central bank announces a decrease in the interest rates, with rational expectations economic agents may immediately increase wages and prices to account for anticipated inflation, thereby neutralizing the intended stimulative effect of the lower interest rates. This limits the central bank's ability to influence real economic variables like output and employment, especially in the short run, and increases the risk that monetary policy will only affect nominal variables like inflation.

10. How does the concept of 'Ricardian equivalence' challenge the effectiveness of fiscal policy?

Ricardian equivalence challenges the effectiveness of fiscal policy by suggesting that changes in government spending or taxes don't affect aggregate demand. It argues that consumers, being rational and forward-looking, understand that government borrowing today implies higher taxes in the future to repay the debt. Therefore, instead of spending a tax cut, they'll save it to offset the future tax increase, neutralizing the intended stimulative effect of the fiscal policy. Similarly, increased government spending financed by borrowing is seen as future tax liabilities, leading to reduced private consumption and investment.

In essence, Ricardian equivalence proposes that fiscal policy only alters the timing of taxes, not their ultimate burden. If the assumptions hold, such as perfect capital markets, lump-sum taxes, and rational expectations, then fiscal stimulus through tax cuts or increased government spending will be offset by increased private saving, rendering the fiscal policy ineffective in influencing economic activity.

11. Explain the concept of 'network externalities' and their implications for market structure and competition.

Network externalities occur when the value of a good or service increases as more people use it. This differs from traditional economics where value is often tied to inherent product features alone. Think of social media platforms: their usefulness skyrockets as more people join, creating a larger network of potential connections and content.

The presence of strong network effects often leads to a 'winner-take-all' or 'winner-take-most' market structure. The company that achieves critical mass first gains a significant advantage, making it difficult for competitors to catch up. This reduces competition because new entrants face the uphill battle of attracting users away from an established network, even if their product is technically superior. Consequently, dominant firms may exercise considerable market power.

12. Discuss the role of innovation in driving economic growth, and analyze the effectiveness of different policies aimed at promoting innovation.

Innovation is a key engine of economic growth. By introducing new products, processes, and business models, innovation increases productivity, creates new markets, and drives competitiveness. This leads to higher living standards and job creation. Innovation allows businesses to do more with less, fostering efficiency and unlocking new possibilities for economic expansion.

Policies to promote innovation include funding research and development (R&D) through grants and tax incentives. Strengthening intellectual property rights (patents, copyrights) encourages investment in innovation. Investing in education and skills development builds a workforce capable of generating and adopting new technologies. Creating a regulatory environment that fosters competition and reduces barriers to entry is also crucial. Direct government funding of R&D can spur breakthroughs, but can also risk inefficient allocation. Strong IP protection encourages innovation, but can limit diffusion and increase costs. Tax incentives are generally effective, but need careful design to avoid abuse. Ultimately, a balanced approach is needed, combining direct support, enabling regulation, and investments in human capital.

13. How does globalization affect income inequality, and what policies can be implemented to mitigate the negative impacts?

Globalization's impact on income inequality is complex and debated. Some argue it increases inequality by benefiting skilled workers and capital owners in developed countries, while driving down wages for unskilled workers in those countries and exploiting labor in developing nations. Others contend that it reduces global inequality by lifting people out of poverty in developing countries through increased trade and investment. However, inequality can rise within those developing countries as some benefit more than others.

Policies to mitigate negative impacts include: investing in education and skills training to equip workers for higher-paying jobs in a globalized economy; strengthening social safety nets like unemployment insurance and welfare programs; progressive taxation to redistribute wealth; promoting fair trade practices that protect workers' rights and environmental standards; and investing in infrastructure to support economic development in disadvantaged regions. Strengthening labor laws and collective bargaining can also help ensure that workers receive a fair share of the benefits from globalization.

14. Explain the concept of 'comparative advantage' and its implications for international trade patterns.

Comparative advantage explains how countries benefit from specializing in producing goods and services they can produce at a lower opportunity cost than other countries. Opportunity cost is what you give up to produce something else. Even if a country is more efficient at producing everything (absolute advantage), it still benefits from specializing in and exporting goods where its comparative advantage is greatest, and importing goods where its comparative advantage is least.

This leads to international trade patterns where countries export goods and services they can produce relatively cheaply (lower opportunity cost) and import goods and services that are relatively more expensive to produce domestically. This specialization and trade increases overall global production and consumption, making all participating countries potentially better off. Tariffs and other trade barriers distort these patterns and reduce the benefits of trade.

15. Discuss the challenges of regulating natural monopolies, and evaluate the effectiveness of different regulatory approaches.

Regulating natural monopolies poses several challenges. A primary issue is determining a 'fair' price that balances consumer affordability with the firm's need to cover costs and invest in infrastructure. Setting prices too low can lead to underinvestment and degraded service quality, while setting them too high defeats the purpose of regulation by allowing excessive profits. Another challenge is information asymmetry. Regulators often lack complete information about the firm's cost structure, making it difficult to accurately assess the appropriate price level. Finally, regulatory capture, where the regulated firm unduly influences the regulatory agency, can lead to policies that benefit the firm at the expense of consumers.

Several regulatory approaches exist. Price-cap regulation, which sets a maximum price that the firm can charge, incentivizes efficiency improvements but may not adequately reflect changing costs. Rate-of-return regulation, which allows the firm to earn a specified rate of return on its invested capital, reduces the incentive for efficiency but ensures cost recovery. Incentive regulation mechanisms, such as yardstick competition (comparing performance to similar firms), aim to improve efficiency. The effectiveness of each approach depends on the specific characteristics of the industry and the regulatory environment. No single approach is universally optimal, and a combination of approaches may be necessary to address the challenges effectively.

16. How do externalities affect market outcomes, and what policies can be used to internalize them?