Hiring the right credit risk analysts is crucial for financial institutions to manage potential losses and maintain a healthy portfolio. Conducting effective interviews is key to identifying candidates with the necessary skills for risk analysis and decision-making capabilities.

This blog post provides a comprehensive set of credit risk interview questions, ranging from general inquiries to specific scenarios for junior, mid-tier, and top analysts. We cover topics including risk assessment methods, risk management processes, and situational questions to help you evaluate candidates thoroughly.

By using these questions, you can gain deeper insights into candidates' knowledge and problem-solving abilities. Consider complementing your interview process with a financial analyst test to ensure a well-rounded evaluation of potential hires.

Table of contents

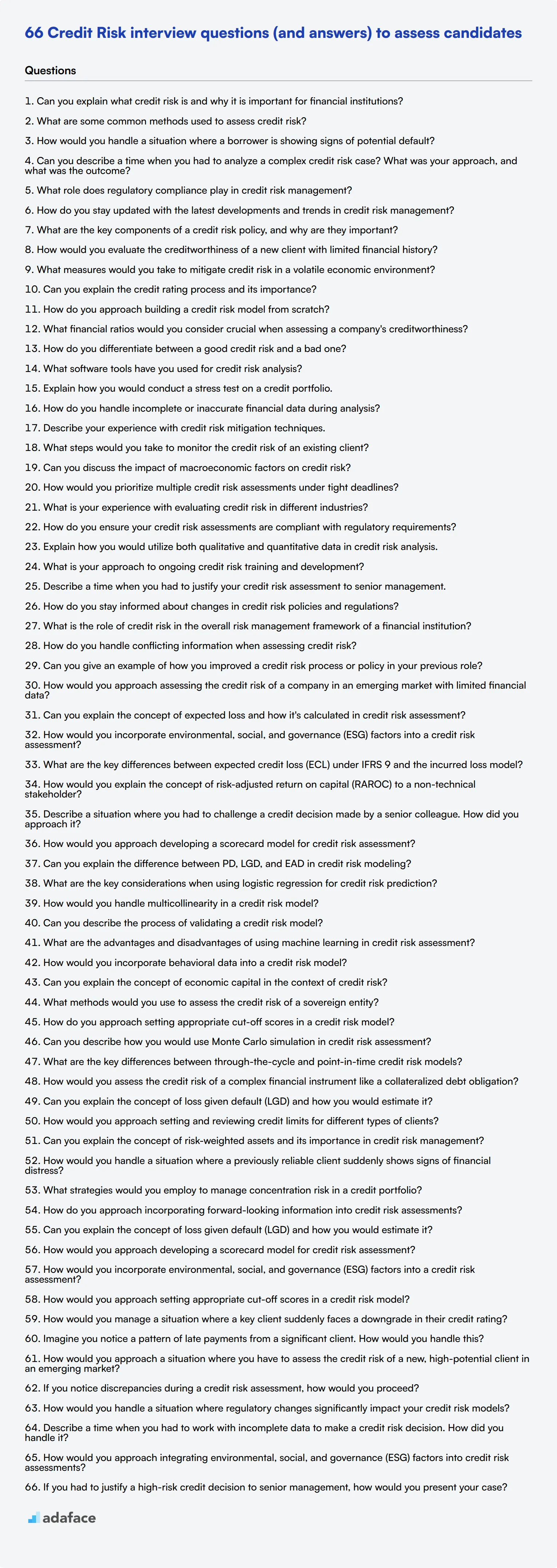

9 general Credit Risk interview questions and answers to assess candidates

To effectively assess the suitability of candidates for credit risk roles, it’s essential to ask the right questions. This list of interview questions is designed to help you evaluate a candidate's understanding of credit risk principles and their practical application in real-world situations.

1. Can you explain what credit risk is and why it is important for financial institutions?

Credit risk refers to the possibility that a borrower will default on their debt obligations, leading to a financial loss for the lender. It is crucial for financial institutions to manage credit risk to maintain their financial stability and ensure profitability.

An ideal candidate should demonstrate a clear understanding of credit risk and discuss its significance in protecting the institution's assets, maintaining liquidity, and complying with regulatory requirements. Look for answers that show awareness of the broader impact of credit risk on the financial system.

2. What are some common methods used to assess credit risk?

Common methods for assessing credit risk include credit scoring models, financial statement analysis, and qualitative assessments of the borrower's industry and management. These methods help in evaluating the borrower's ability to repay the loan and the likelihood of default.

Candidates should be able to explain how these methods are applied and provide examples of their use in previous roles. Look for responses that reflect a comprehensive understanding of different assessment techniques and their effectiveness in various scenarios.

3. How would you handle a situation where a borrower is showing signs of potential default?

If a borrower is showing signs of potential default, the first step is to conduct a thorough review of their financial situation and determine the root cause of the distress. This may involve renegotiating the loan terms, offering restructuring options, or increasing monitoring efforts.

Candidates should discuss their approach to proactive risk management, including communication with the borrower and strategies to mitigate losses. Look for answers that highlight their problem-solving skills and ability to devise effective solutions under pressure.

4. Can you describe a time when you had to analyze a complex credit risk case? What was your approach, and what was the outcome?

In a complex credit risk case, it is important to gather all relevant information, including financial statements, market conditions, and the borrower's credit history. I once dealt with a case where the borrower had multiple revenue streams and fluctuating cash flows. I conducted a detailed financial analysis and used stress testing to evaluate different scenarios.

The outcome was a successful loan restructuring plan that mitigated risk for our institution while providing the borrower with a feasible repayment schedule. Look for candidates who can articulate their analytical process and demonstrate successful outcomes in managing complex credit risk scenarios.

5. What role does regulatory compliance play in credit risk management?

Regulatory compliance is critical in credit risk management as it ensures that financial institutions adhere to legal standards and industry regulations. Compliance helps in maintaining transparency, reducing risk exposure, and protecting the institution from potential legal and financial penalties.

An ideal candidate should emphasize the importance of staying updated with regulatory changes and implementing policies that align with compliance requirements. Look for responses that show an understanding of regulatory frameworks and their impact on credit risk management practices.

6. How do you stay updated with the latest developments and trends in credit risk management?

Staying updated with the latest developments in credit risk management involves continuous learning through industry publications, attending seminars and webinars, and participating in professional networks. It is also important to follow regulatory updates and market trends.

Candidates should demonstrate a proactive approach to professional development and a commitment to staying informed about industry advancements. Look for answers that reflect a genuine interest in the field and a dedication to continuous improvement.

7. What are the key components of a credit risk policy, and why are they important?

The key components of a credit risk policy include credit assessment criteria, risk rating systems, credit approval processes, and monitoring and reporting mechanisms. These components are essential for establishing a structured approach to managing credit risk and ensuring consistency in decision-making.

Candidates should be able to explain the significance of each component and how it contributes to effective credit risk management. Look for answers that show a thorough understanding of policy frameworks and their practical application in maintaining financial stability.

8. How would you evaluate the creditworthiness of a new client with limited financial history?

Evaluating the creditworthiness of a new client with limited financial history involves analyzing alternative data sources, such as payment behavior, cash flow patterns, and industry trends. It may also require a more qualitative assessment of the client's business model and management capabilities.

Candidates should discuss their approach to gathering and analyzing non-traditional data and how they balance risk and opportunity in such cases. Look for responses that demonstrate creativity and resourcefulness in assessing credit risk with limited information.

9. What measures would you take to mitigate credit risk in a volatile economic environment?

In a volatile economic environment, it is important to enhance risk monitoring, diversify the loan portfolio, and implement stricter credit assessment criteria. Additionally, stress testing and scenario analysis can help in identifying potential vulnerabilities and preparing contingency plans.

Candidates should highlight their experience with risk mitigation strategies and their ability to adapt to changing market conditions. Look for answers that show a proactive and strategic approach to managing credit risk in uncertain times.

20 Credit Risk interview questions to ask junior analysts

To help you identify promising junior analysts for your credit risk team, we've compiled a list of essential interview questions. These questions are designed to gauge candidates' knowledge, analytical skills, and practical experience in handling credit risk. Use this list during your interviews to find the best fit for your team or see more skills required for risk analyst.

- Can you explain the credit rating process and its importance?

- How do you approach building a credit risk model from scratch?

- What financial ratios would you consider crucial when assessing a company's creditworthiness?

- How do you differentiate between a good credit risk and a bad one?

- What software tools have you used for credit risk analysis?

- Explain how you would conduct a stress test on a credit portfolio.

- How do you handle incomplete or inaccurate financial data during analysis?

- Describe your experience with credit risk mitigation techniques.

- What steps would you take to monitor the credit risk of an existing client?

- Can you discuss the impact of macroeconomic factors on credit risk?

- How would you prioritize multiple credit risk assessments under tight deadlines?

- What is your experience with evaluating credit risk in different industries?

- How do you ensure your credit risk assessments are compliant with regulatory requirements?

- Explain how you would utilize both qualitative and quantitative data in credit risk analysis.

- What is your approach to ongoing credit risk training and development?

- Describe a time when you had to justify your credit risk assessment to senior management.

- How do you stay informed about changes in credit risk policies and regulations?

- What is the role of credit risk in the overall risk management framework of a financial institution?

- How do you handle conflicting information when assessing credit risk?

- Can you give an example of how you improved a credit risk process or policy in your previous role?

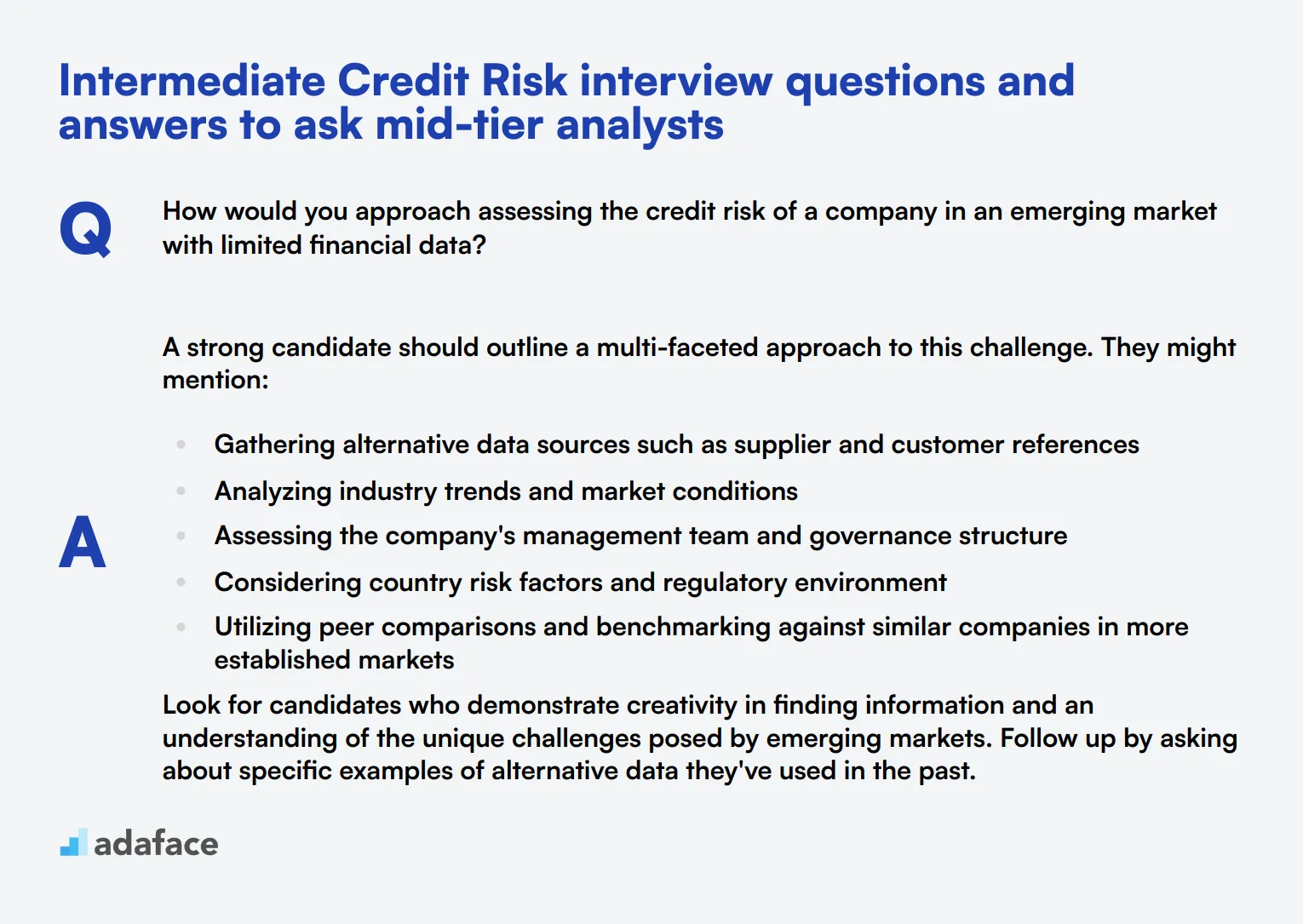

6 intermediate Credit Risk interview questions and answers to ask mid-tier analysts

Ready to level up your credit risk interview game? These intermediate questions are perfect for assessing mid-tier analysts who've got some experience under their belts. Use them to gauge the skills and knowledge of candidates who are ready to take on more complex credit risk challenges. Remember, the goal is to uncover their analytical thinking and problem-solving abilities, not just their textbook knowledge.

1. How would you approach assessing the credit risk of a company in an emerging market with limited financial data?

A strong candidate should outline a multi-faceted approach to this challenge. They might mention:

- Gathering alternative data sources such as supplier and customer references

- Analyzing industry trends and market conditions

- Assessing the company's management team and governance structure

- Considering country risk factors and regulatory environment

- Utilizing peer comparisons and benchmarking against similar companies in more established markets

Look for candidates who demonstrate creativity in finding information and an understanding of the unique challenges posed by emerging markets. Follow up by asking about specific examples of alternative data they've used in the past.

2. Can you explain the concept of expected loss and how it's calculated in credit risk assessment?

Expected loss is a key concept in credit risk management. It represents the average amount of credit loss a lender expects to incur on a loan or portfolio over a specific time period. The formula for expected loss is:

Expected Loss = Probability of Default (PD) × Loss Given Default (LGD) × Exposure at Default (EAD)

A strong candidate should be able to explain each component:

- PD: The likelihood that a borrower will default within a given timeframe

- LGD: The proportion of the exposure that will not be recovered if a default occurs

- EAD: The total value that the lender is exposed to when a default happens

Look for candidates who can provide real-world examples of how these components might be estimated and how expected loss is used in decision-making processes.

3. How would you incorporate environmental, social, and governance (ESG) factors into a credit risk assessment?

Incorporating ESG factors into credit risk assessment is becoming increasingly important. A knowledgeable candidate might discuss:

- Environmental factors: Assessing a company's exposure to climate risks, resource scarcity, and environmental regulations

- Social factors: Evaluating labor practices, product safety, and community relations

- Governance factors: Analyzing management quality, board structure, and transparency

Look for candidates who understand that ESG factors can impact a company's long-term financial stability and reputation. They should be able to explain how these factors might be quantified or integrated into existing risk models. Consider asking for specific examples of how ESG considerations have affected credit decisions in their experience.

4. What are the key differences between expected credit loss (ECL) under IFRS 9 and the incurred loss model?

A strong candidate should be able to articulate the fundamental shift in approach between these two models:

- Timing: ECL is forward-looking and recognizes potential losses earlier, while the incurred loss model only recognizes losses after a loss event has occurred

- Scope: ECL applies to a broader range of financial instruments

- Stages: ECL uses a three-stage model to determine impairment, considering changes in credit risk over time

- Data requirements: ECL requires more extensive data, including forecasts of future economic conditions

Look for candidates who can explain the implications of this change on financial statements and risk management practices. They should also be aware of the challenges in implementing ECL, such as increased complexity and the need for more sophisticated modeling techniques.

5. How would you explain the concept of risk-adjusted return on capital (RAROC) to a non-technical stakeholder?

A skilled candidate should be able to break down this complex concept into simple terms:

"RAROC is like a special measuring stick we use to see how well different investments or loans are performing, considering the risks involved. It's like comparing apples to apples when looking at different business opportunities."

They might use an analogy: "Imagine you have two fruit stands. One sells only apples, the other sells exotic fruits. The exotic fruit stand might make more money, but it's also riskier because the fruits can spoil quickly. RAROC helps us figure out which stand is actually doing better when we factor in all the risks."

Look for candidates who can communicate complex ideas clearly and relate them to everyday concepts. This skill is crucial for risk analysts who often need to explain their findings to various stakeholders.

6. Describe a situation where you had to challenge a credit decision made by a senior colleague. How did you approach it?

This question assesses both technical knowledge and soft skills. A strong answer might include:

- A clear explanation of the specific credit risk issue they identified

- The data and analysis they used to support their position

- How they communicated their concerns professionally and diplomatically

- The outcome of the situation and any lessons learned

Look for candidates who demonstrate analytical rigor, confidence in their assessments, and the ability to communicate effectively with senior stakeholders. Pay attention to how they balance respect for authority with the need to uphold risk management standards. This scenario also gives insight into their ethical standards and commitment to proper risk assessment.

14 Credit Risk interview questions about risk assessment methods

To assess candidates' understanding of risk assessment methods in credit risk, use these 14 interview questions. These questions will help you evaluate a candidate's practical knowledge and analytical skills in credit risk assessment, crucial for roles in financial institutions.

- How would you approach developing a scorecard model for credit risk assessment?

- Can you explain the difference between PD, LGD, and EAD in credit risk modeling?

- What are the key considerations when using logistic regression for credit risk prediction?

- How would you handle multicollinearity in a credit risk model?

- Can you describe the process of validating a credit risk model?

- What are the advantages and disadvantages of using machine learning in credit risk assessment?

- How would you incorporate behavioral data into a credit risk model?

- Can you explain the concept of economic capital in the context of credit risk?

- What methods would you use to assess the credit risk of a sovereign entity?

- How do you approach setting appropriate cut-off scores in a credit risk model?

- Can you describe how you would use Monte Carlo simulation in credit risk assessment?

- What are the key differences between through-the-cycle and point-in-time credit risk models?

- How would you assess the credit risk of a complex financial instrument like a collateralized debt obligation?

- Can you explain the concept of loss given default (LGD) and how you would estimate it?

9 Credit Risk interview questions and answers related to risk management processes

Ready to dive into the world of credit risk management? These nine questions will help you assess candidates' understanding of risk management processes. Use them to gauge applicants' ability to navigate the complex landscape of credit risk and make informed decisions. Remember, the best answers will blend theoretical knowledge with practical experience.

1. How would you approach setting and reviewing credit limits for different types of clients?

A strong candidate should outline a systematic approach to setting credit limits. They might mention:

- Analyzing financial statements and credit reports

- Considering the client's industry and market conditions

- Evaluating past payment history and relationship with the institution

- Using internal risk rating models or scorecards

- Implementing different tiers of credit limits based on risk profiles

Look for answers that demonstrate a balance between risk mitigation and business growth. The ideal candidate should also mention the importance of regular reviews and adjustments to credit limits based on changing circumstances.

2. Can you explain the concept of risk-weighted assets and its importance in credit risk management?

Risk-weighted assets (RWA) is a concept used to determine the minimum amount of capital that must be held by banks and other financial institutions to reduce the risk of insolvency. The candidate should explain:

- RWA is calculated by adjusting each asset class for risk

- Higher-risk assets require more capital to be held against them

- RWA helps in comparing the risk of different asset classes

- It's crucial for regulatory compliance, particularly Basel III standards

A strong answer would also touch on how RWA influences strategic decisions in lending and investment, and how it relates to the overall risk management framework of the institution.

3. How would you handle a situation where a previously reliable client suddenly shows signs of financial distress?

An effective response should outline a proactive and measured approach:

- Immediately conduct a thorough review of the client's financial situation

- Engage in open communication with the client to understand the root causes

- Consider temporary measures such as restructuring debt or adjusting payment terms

- Increase monitoring frequency and potentially adjust internal risk ratings

- Prepare contingency plans for potential default scenarios

Look for candidates who emphasize the importance of balancing relationship management with risk mitigation. They should also mention the need to comply with internal policies and regulatory requirements throughout the process.

4. What strategies would you employ to manage concentration risk in a credit portfolio?

A knowledgeable candidate should discuss several strategies:

- Implementing and monitoring concentration limits across various dimensions (e.g., industry, geography, product type)

- Diversifying the portfolio through new client acquisition in underrepresented sectors

- Using credit derivatives or securitization to transfer risk

- Adjusting pricing to reflect concentration risk

- Regularly stress testing the portfolio to assess vulnerability to concentrated exposures

The ideal answer would also touch on the importance of regular reporting to senior management and the board on concentration risk levels. Look for candidates who can explain how these strategies align with the institution's overall risk appetite and regulatory requirements.

5. How do you approach incorporating forward-looking information into credit risk assessments?

A strong response should highlight the importance of forward-looking assessments in credit risk management. The candidate might mention:

- Analyzing macroeconomic forecasts and their potential impact on different industries

- Incorporating scenario analysis and stress testing into risk models

- Utilizing industry-specific leading indicators

- Considering technological disruptions and regulatory changes that might affect creditworthiness

- Regularly updating and calibrating predictive models

Look for answers that demonstrate an understanding of both quantitative and qualitative forward-looking factors. The ideal candidate should also discuss the challenges in balancing historical data with future projections and how they would address these challenges.

6. Can you explain the concept of loss given default (LGD) and how you would estimate it?

Loss Given Default (LGD) is the amount of money a bank or other financial institution loses when a borrower defaults on a loan, after all recovery efforts are exhausted. A competent candidate should explain:

- LGD is typically expressed as a percentage of the total exposure at the time of default

- Estimation methods include historical loss data analysis, market LGD (for bonds), and implied market LGD (using credit spreads)

- Factors affecting LGD include collateral value, seniority of the debt, and the effectiveness of the recovery process

- LGD is a key component in calculating expected loss and economic capital

Look for candidates who can discuss the challenges in estimating LGD, such as limited default data and the need to consider economic cycles. They should also mention the importance of regularly validating and updating LGD estimates.

7. How would you approach developing a scorecard model for credit risk assessment?

A well-informed candidate should outline a structured approach to developing a scorecard model:

- Define the objective and scope of the scorecard

- Collect and prepare relevant data

- Perform exploratory data analysis to identify potential predictive variables

- Select appropriate statistical techniques (e.g., logistic regression)

- Develop the model, including variable selection and weight assignment

- Validate the model using out-of-sample data

- Calibrate the model to align with business objectives

- Implement the model and monitor its performance

Look for candidates who emphasize the importance of involving both statistical expertise and business knowledge in the process. They should also mention the need for ongoing monitoring and recalibration of the scorecard to maintain its predictive power.

8. How would you incorporate environmental, social, and governance (ESG) factors into a credit risk assessment?

An up-to-date candidate should recognize the growing importance of ESG factors in credit risk assessment. They might discuss:

- Developing an ESG scoring framework or integrating third-party ESG ratings

- Assessing potential environmental risks (e.g., climate change impact, resource scarcity)

- Evaluating social factors (e.g., labor practices, community relations)

- Analyzing governance structures and their impact on long-term sustainability

- Incorporating ESG factors into existing risk models and stress testing scenarios

Look for answers that demonstrate an understanding of both the opportunities and challenges in incorporating ESG factors. The ideal candidate should also mention the need for standardization in ESG reporting and the potential regulatory developments in this area.

9. How would you approach setting appropriate cut-off scores in a credit risk model?

A knowledgeable candidate should explain that setting cut-off scores involves balancing risk tolerance with business objectives. They might outline the following approach:

- Analyze the score distribution of good and bad accounts

- Calculate approval rates and bad rates at different score points

- Assess the trade-off between approval rate and bad rate

- Consider the expected profitability at different cut-off points

- Align the chosen cut-off with the institution's risk appetite and strategic goals

- Implement different cut-offs for different products or customer segments if necessary

Look for candidates who mention the importance of regularly reviewing and adjusting cut-off scores based on portfolio performance and changing market conditions. They should also discuss how they would communicate the rationale behind chosen cut-offs to stakeholders.

8 situational Credit Risk interview questions with answers for hiring top analysts

To hire top credit risk analysts who can handle real-world challenges, use these situational interview questions. They will help you gauge how candidates think on their feet and tackle complex scenarios.

1. How would you manage a situation where a key client suddenly faces a downgrade in their credit rating?

In such a scenario, the first step would be to reassess the client's financial health and understand the reasons behind the downgrade. This includes reviewing their recent financial statements, understanding market conditions, and possibly discussing with the client directly to get more insights.

Next, I would evaluate the impact on our portfolio and determine any immediate actions required, such as adjusting credit limits or altering terms of agreement to mitigate potential risks. It's also crucial to communicate the situation and our proposed actions to senior management promptly.

An ideal candidate should demonstrate a methodical approach to risk assessment and management. Look for their ability to communicate effectively and make informed decisions under pressure.

2. Imagine you notice a pattern of late payments from a significant client. How would you handle this?

Firstly, I would gather all relevant data to confirm the pattern and analyze any potential reasons behind the late payments. This might involve looking into the client's payment history, financial health, and any external factors that could be impacting their cash flow.

I would then reach out to the client to discuss the issue and understand their perspective. Based on the findings, I might propose revised payment terms or other solutions to help them manage their obligations better, while protecting our interests.

Recruiters should look for candidates who show empathy, problem-solving skills, and a proactive approach in their responses. They should also exhibit strong communication skills when dealing with clients.

3. How would you approach a situation where you have to assess the credit risk of a new, high-potential client in an emerging market?

To assess the credit risk of a new client in an emerging market, I would start by gathering as much data as possible from various sources, including financial statements, market reports, and industry analyses. Given the limited data, I would also consider qualitative factors such as the client’s business model, management team, and market position.

Additionally, I would compare the client’s financial metrics with similar companies in the same market to get a relative sense of their creditworthiness. Conducting a thorough risk analysis would also involve understanding the macroeconomic and political environment of the emerging market.

Look for candidates who can balance both qualitative and quantitative data effectively. Ideal responses should show their ability to adapt to data limitations and still provide a well-rounded assessment.

4. If you notice discrepancies during a credit risk assessment, how would you proceed?

Upon noticing discrepancies, the first step would be to verify the data sources to ensure the accuracy of the information. This might involve cross-referencing with additional documents, speaking to the client, or consulting with other departments within our organization.

Once verified, I would document the discrepancies and analyze their potential impact on the credit risk assessment. Based on this analysis, I would adjust the risk profile accordingly and communicate any significant findings to the relevant stakeholders.

Candidates should demonstrate attention to detail, analytical skills, and a structured approach to resolving discrepancies. Their response should also highlight the importance of thorough documentation and clear communication.

5. How would you handle a situation where regulatory changes significantly impact your credit risk models?

I would start by thoroughly understanding the new regulations and identifying which parts of our credit risk models are affected. This might involve consulting with legal and compliance teams to ensure a comprehensive grasp of the changes.

Next, I would update the models to align with the new regulatory requirements. This could mean recalibrating risk parameters, adjusting assumptions, or even developing new risk metrics to comply with the changes. Finally, I would test the updated models to ensure they still provide reliable risk assessments.

An ideal candidate should show adaptability and a strong understanding of regulatory frameworks. Look for their ability to translate regulatory changes into practical adjustments in risk models.

6. Describe a time when you had to work with incomplete data to make a credit risk decision. How did you handle it?

In a situation with incomplete data, I would first use all available information to form a preliminary assessment. This might involve leveraging alternative data sources or using proxies to fill in gaps.

I would then quantify the uncertainty involved and implement conservative assumptions to mitigate potential risks. Throughout the process, maintaining transparent communication with stakeholders about the limitations of the data and the assumptions made is crucial.

Look for candidates who demonstrate resourcefulness and a methodical approach to dealing with incomplete data. They should also highlight the importance of transparency and effective communication in their response.

7. How would you approach integrating environmental, social, and governance (ESG) factors into credit risk assessments?

Integrating ESG factors starts with identifying the relevant metrics for environmental, social, and governance aspects that could impact the client’s creditworthiness. These might include carbon footprint, labor practices, and corporate governance structures.

I would then incorporate these metrics into the existing credit risk models, adjusting risk parameters to reflect the potential impact of ESG factors. Regularly updating these metrics and staying informed about ESG trends is also crucial for maintaining accurate assessments.

Candidates should show a comprehensive understanding of ESG factors and their relevance to credit risk. Ideal responses will emphasize the integration of both qualitative and quantitative data and the importance of ongoing monitoring.

8. If you had to justify a high-risk credit decision to senior management, how would you present your case?

I would start by clearly explaining the rationale behind the high-risk decision, including the data and analysis that led to this conclusion. This would involve presenting both the potential risks and rewards, supported by quantitative metrics and qualitative insights.

I would also outline the risk mitigation strategies in place to manage the identified risks. By providing a balanced view and demonstrating a thorough understanding of the situation, I would aim to build confidence in my assessment.

Candidates should exhibit strong analytical and presentation skills in their response. Look for their ability to communicate complex information clearly and persuasively to senior management.

Which Credit Risk skills should you evaluate during the interview phase?

When conducting a credit risk interview, it’s impossible to capture every nuance of a candidate's expertise in a single session. However, there are several core skills that are particularly important to evaluate. These skills will provide a solid foundation for assessing a candidate's suitability for a role in credit risk analysis.

Analytical Skills

Analytical skills are crucial for credit risk professionals as they must evaluate complex financial data to determine creditworthiness. This involves analyzing financial statements, credit reports, and market trends to make informed decisions.

To efficiently assess a candidate's analytical skills, consider using an assessment test that includes relevant MCQs. For example, our credit risk analyst test features questions designed to gauge these abilities.

Alternatively, you can ask targeted interview questions to judge a candidate's analytical skills during the interview.

Can you describe a time when you had to analyze a complex data set to make a credit decision? What was your approach?

Look for candidates who clearly explain their methodology, including data sources, analytical tools used, and how they interpreted their findings to make a credit decision.

Attention to Detail

Credit risk analysts must exhibit a high level of attention to detail to identify potential risks and ensure accurate assessments. Missing small details can lead to significant financial losses.

To screen for attention to detail, an assessment test with specific questions targeting this skill can be effective. The attention to detail test includes scenarios that require careful scrutiny.

In addition, consider asking interview questions aimed at understanding the candidate's attention to detail.

Describe a time when you caught an error in a credit report or financial statement that others missed. How did you address it?

Evaluate how meticulously the candidate describes their process for identifying the error and the steps they took to correct it.

Communication Skills

Effective communication is essential for credit risk analysts as they need to explain complex financial information clearly to stakeholders with varying levels of financial expertise.

Assessing communication skills can be done through an assessment test that includes relevant MCQs. Our communication skills test offers a variety of questions to evaluate this competency.

During the interview, you can also ask questions to gauge a candidate's ability to communicate effectively.

How do you present your credit risk findings to stakeholders who may not have a financial background?

Look for candidates who demonstrate the ability to simplify complex information and communicate it in a clear, concise manner.

3 tips for using Credit Risk interview questions

Before you start putting what you've learned to use, here are our top tips for using Credit Risk interview questions effectively.

1. Use skills tests to screen candidates before interviews

Skill tests can significantly streamline your interview process by filtering out unqualified candidates early.

Adaface offers a range of tests, such as the Financial Modeling Test and the Financial Analyst Test, to assess technical skills specific to Credit Risk roles.

Using these tests helps you focus your interview time on candidates who have already demonstrated their technical abilities, ensuring a more productive and insightful interview process.

2. Compile a targeted list of interview questions

Given the time constraints of an interview, it's crucial to ask the right questions that evaluate the most important aspects of the candidate's skills and experience.

Consider incorporating questions from related fields like Financial Modeling and Accounting to get a comprehensive understanding of the candidate's expertise.

A well-rounded set of questions helps you cover all necessary areas efficiently, ensuring you make the most of the limited time you have with each candidate.

3. Ask follow-up questions to gauge depth of knowledge

Relying solely on pre-set interview questions can sometimes lead to candidates providing rehearsed answers. Follow-up questions can help you probe deeper and understand their true level of expertise.

For example, if a candidate explains their experience in stress testing, you could follow up with, 'Can you describe a specific instance where stress testing changed your risk assessment outcome?' This helps you gauge their hands-on experience and ability to apply theoretical knowledge.

Evaluate Credit Risk Skills with Targeted Assessments and Interviews

When hiring for credit risk positions, it's important to accurately assess candidates' skills. Using skill tests is an effective way to do this. Consider using our Financial Analyst Test or Financial Modeling Test to evaluate candidates' credit risk abilities.

After using these tests to shortlist top applicants, you can proceed with interviews. For a complete hiring solution that combines skill assessments and interview management, check out our Online Assessment Platform. It streamlines the process of identifying and hiring talented credit risk professionals.

Financial Analyst Test

Download Credit Risk interview questions template in multiple formats

Credit Risk Interview Questions FAQs

Focus on risk assessment methods, risk management processes, analytical skills, and situational problem-solving abilities.

Use a combination of general, junior, and intermediate questions to gauge their knowledge depth and practical experience.

Yes, they help evaluate a candidate's ability to apply knowledge to real-world scenarios and make informed decisions.

Use a mix of theoretical and practical questions, and consider combining interviews with skills assessments for a comprehensive evaluation.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources