Hiring the right bookkeeper is critical for maintaining accurate financial records and ensuring smooth business operations. A well-crafted set of interview questions can help you assess accounting skills and identify the most qualified candidates for your organization.

This blog post provides a comprehensive list of bookkeeping interview questions tailored for different experience levels and specific areas of expertise. From common questions for all candidates to specialized queries for junior and mid-tier bookkeepers, we cover a wide range of topics including financial records and internal controls.

By using these questions, you can effectively evaluate candidates' knowledge, skills, and problem-solving abilities in bookkeeping. Consider combining these interview questions with pre-employment assessments to get a more complete picture of each candidate's capabilities.

Table of contents

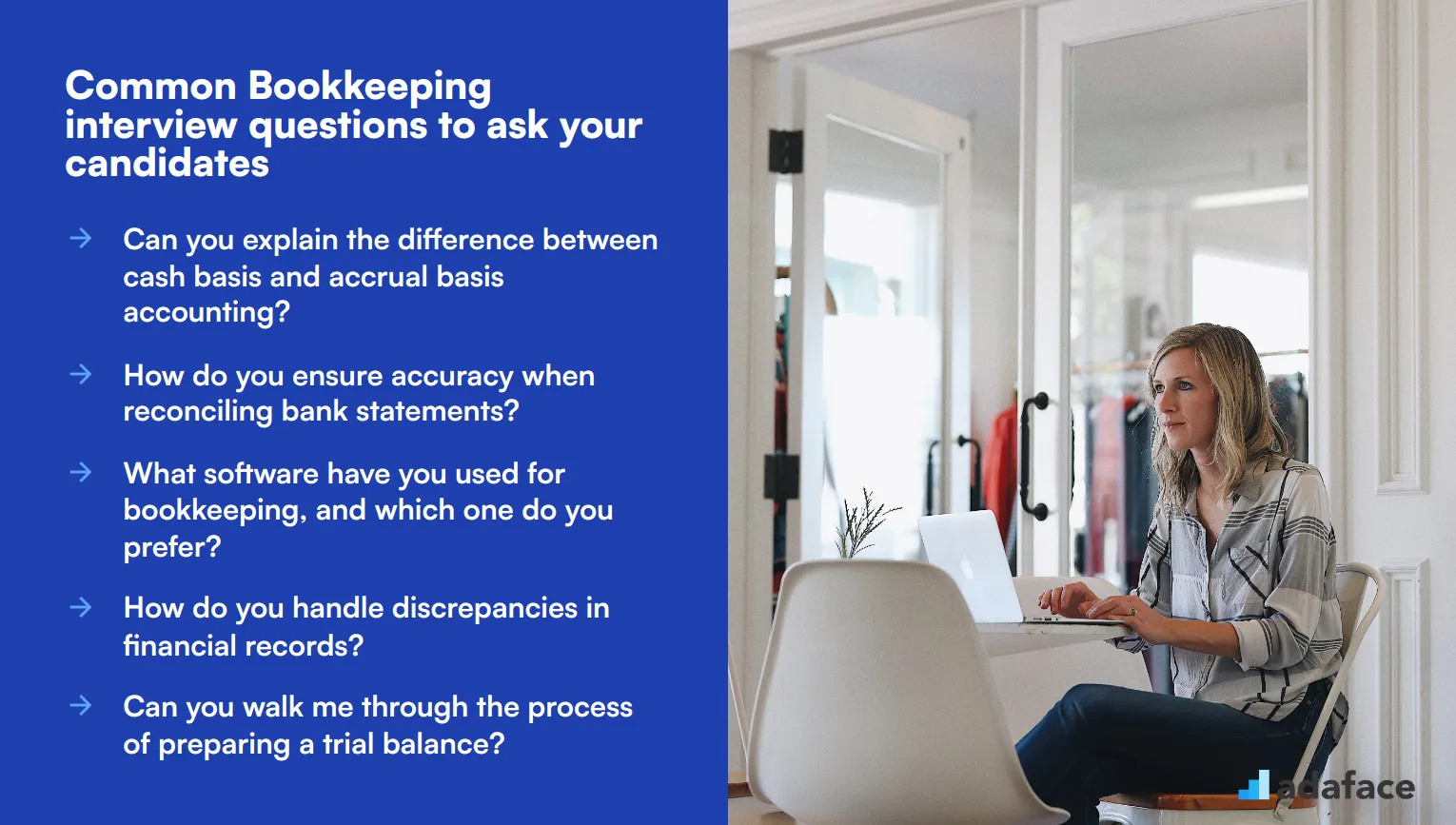

10 common Bookkeeping interview questions to ask your candidates

To assess your candidates' bookkeeping skills and knowledge effectively, use these 10 common bookkeeping interview questions. These questions cover essential aspects of the role and will help you identify the most qualified applicants for your organization.

- Can you explain the difference between cash basis and accrual basis accounting?

- How do you ensure accuracy when reconciling bank statements?

- What software have you used for bookkeeping, and which one do you prefer?

- How do you handle discrepancies in financial records?

- Can you walk me through the process of preparing a trial balance?

- How do you stay updated on changes in accounting regulations and tax laws?

- What steps do you take to maintain client confidentiality?

- How would you explain a complex financial concept to a non-finance team member?

- Can you describe a time when you caught and corrected a significant error in financial records?

- How do you prioritize tasks when managing multiple clients or projects?

8 Bookkeeping interview questions and answers to evaluate junior bookkeepers

Hiring the right junior bookkeeper is crucial for maintaining accurate financial records and ensuring smooth operations. Use the following questions to gauge their understanding and skills effectively during the interview process.

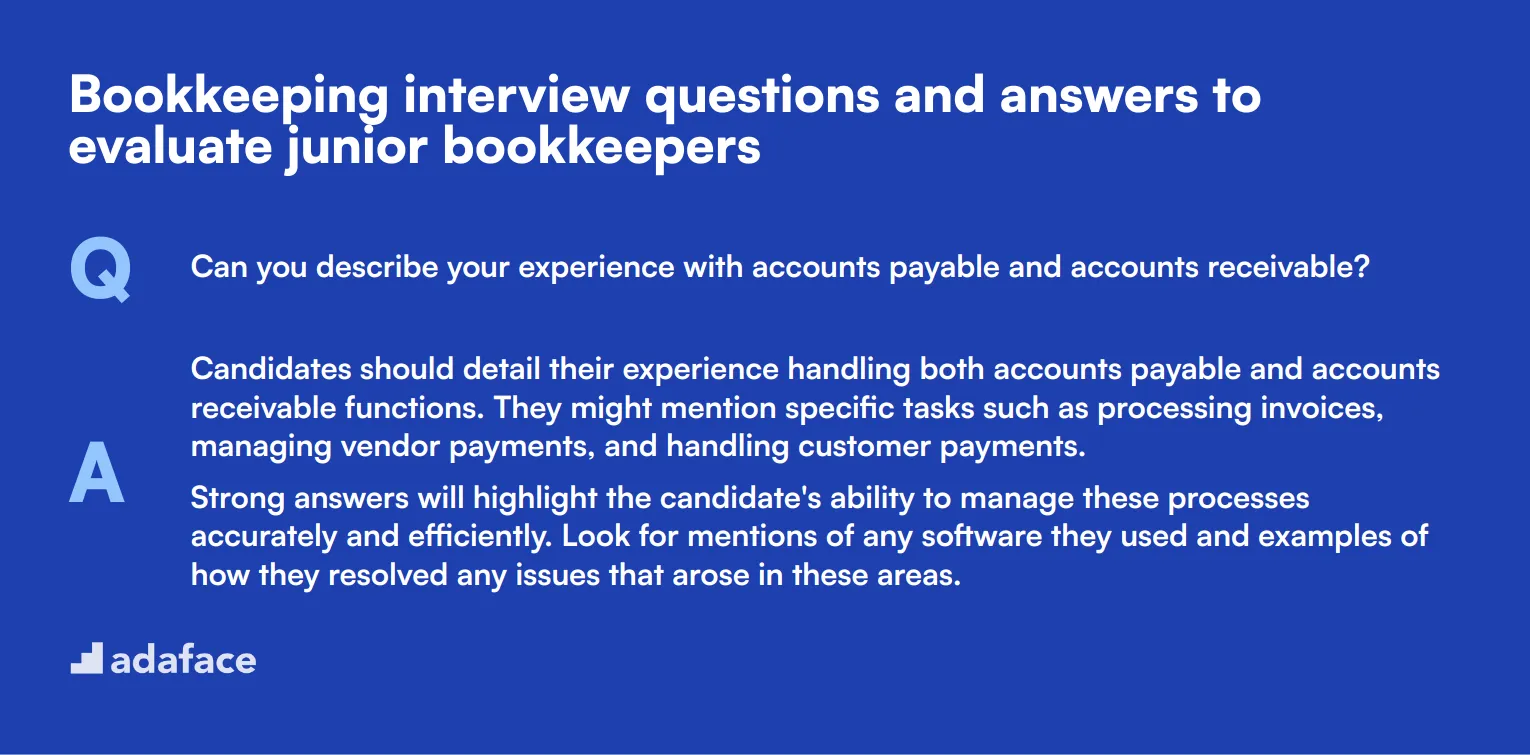

1. Can you describe your experience with accounts payable and accounts receivable?

Candidates should detail their experience handling both accounts payable and accounts receivable functions. They might mention specific tasks such as processing invoices, managing vendor payments, and handling customer payments.

Strong answers will highlight the candidate's ability to manage these processes accurately and efficiently. Look for mentions of any software they used and examples of how they resolved any issues that arose in these areas.

2. How do you manage your time when you have multiple deadlines to meet?

Candidates should explain their approach to prioritizing tasks and managing time effectively. They might mention using to-do lists, setting priorities, or using project management software to keep track of deadlines.

Look for answers that demonstrate a methodical approach and an ability to stay organized under pressure. An ideal candidate will provide examples of how they successfully managed multiple deadlines in the past.

3. What steps do you take to ensure accuracy in your work?

Candidates should outline specific steps they take to ensure their work is accurate. This could include double-checking entries, reconciling accounts regularly, and staying updated with accounting standards.

An ideal response will show a strong attention to detail and a commitment to maintaining accuracy in all bookkeeping tasks. The candidate might also mention any tools or software they use to help ensure accuracy.

4. Can you explain the process of creating financial reports?

Candidates should describe the steps involved in preparing various financial reports, such as balance sheets, income statements, and cash flow statements. They should mention gathering relevant data, organizing it, and using accounting software to generate reports.

Look for answers that demonstrate a clear understanding of the reporting process and the importance of accuracy and completeness in financial reporting. An ideal candidate might also discuss how they use reports to provide insights to management.

5. How do you handle a situation where you have to explain financial information to someone without an accounting background?

Candidates should discuss their approach to communicating complex financial information in a simple, understandable way. They might mention using analogies, breaking down information into smaller parts, or using visual aids like charts and graphs.

Strong candidates will show an ability to tailor their communication style to the audience's level of understanding. Look for examples of past experiences where they successfully explained financial information to non-financial team members.

6. How do you stay organized when dealing with a large volume of transactions?

Candidates should explain their methods for staying organized, such as using accounting software, maintaining detailed records, and setting up efficient filing systems. They might also mention prioritizing tasks and regularly reviewing their work.

Look for responses that show a systematic approach to managing large volumes of transactions. An ideal candidate will demonstrate an ability to stay organized and accurate even when dealing with high volumes.

7. Describe a time when you had to resolve a conflict with a colleague or client over financial issues.

Candidates should provide a specific example of a conflict they encountered and how they resolved it. They might mention identifying the root cause of the issue, communicating effectively, and finding a mutually agreeable solution.

An ideal response will show strong interpersonal skills and the ability to handle conflicts professionally. Look for candidates who demonstrate empathy, problem-solving skills, and a commitment to maintaining positive working relationships.

8. What do you find most challenging about bookkeeping, and how do you handle those challenges?

Candidates should identify specific challenges they have faced in bookkeeping, such as managing deadlines, ensuring accuracy, or staying updated with regulations. They should also discuss their strategies for overcoming these challenges.

Look for candidates who demonstrate self-awareness and proactive problem-solving skills. An ideal response will show that the candidate can identify challenges and take effective steps to address them.

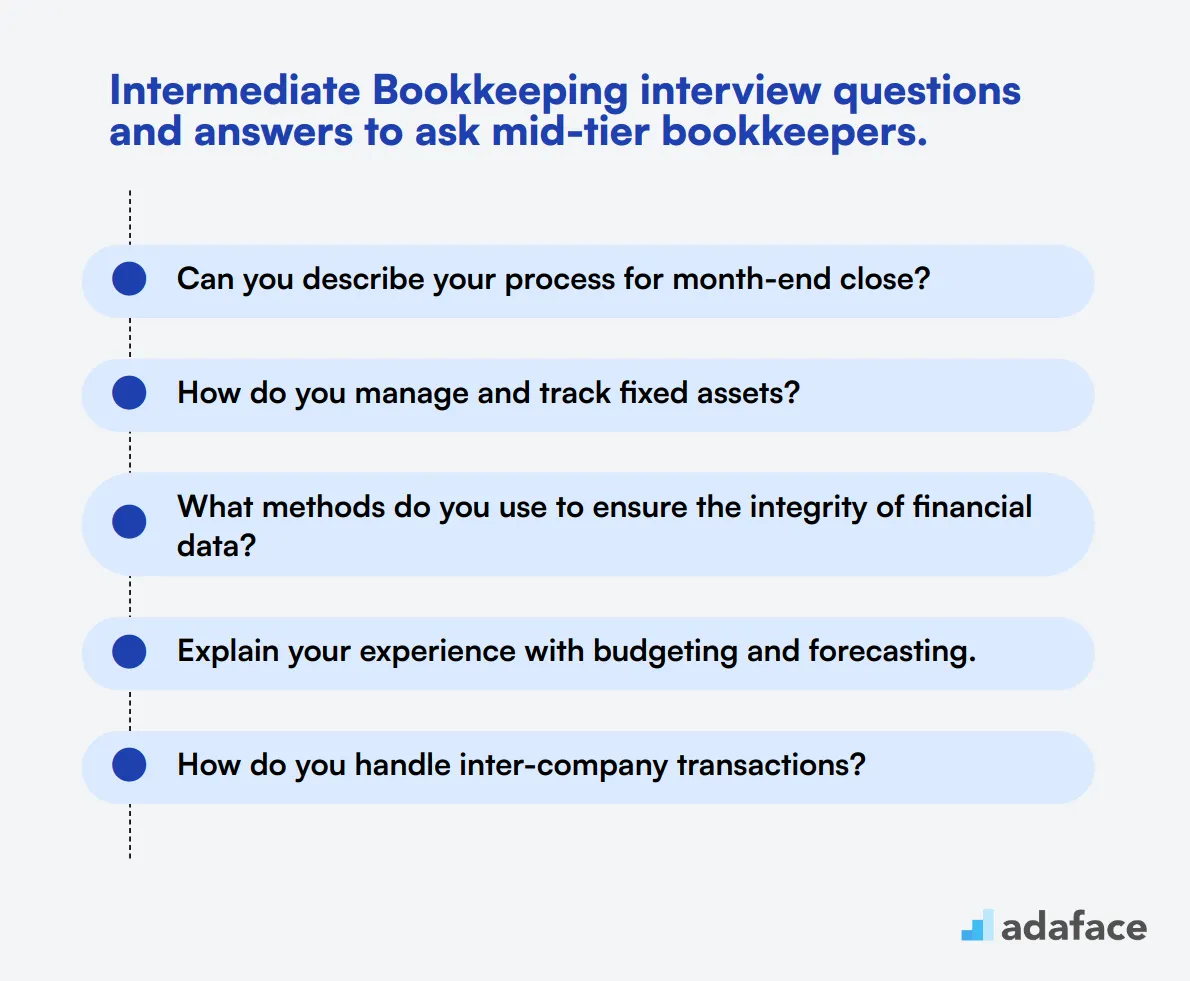

15 intermediate Bookkeeping interview questions and answers to ask mid-tier bookkeepers.

To ensure your mid-tier bookkeeping candidates have the required skills and experience, consider asking some of these intermediate bookkeeping interview questions. This list will help you identify candidates who are adept at managing more complex bookkeeping tasks and can handle increased responsibility within your organization. For more insights on essential accounting skills, check out this helpful guide.

- Can you describe your process for month-end close?

- How do you manage and track fixed assets?

- What methods do you use to ensure the integrity of financial data?

- Explain your experience with budgeting and forecasting.

- How do you handle inter-company transactions?

- Can you detail your experience with payroll processing?

- What is your approach to managing tax filings and compliance?

- Describe the steps you take when preparing for an audit.

- How do you handle discrepancies found during internal audits?

- What is your experience with financial statement analysis?

- How would you handle a situation where financial records do not balance?

- Can you discuss your experience with regulatory reporting?

- How do you stay organized when dealing with a high volume of transactions?

- Explain your experience with handling foreign currency transactions.

- What strategies do you use to improve efficiency in bookkeeping processes?

7 Bookkeeping interview questions and answers related to financial records

Ready to dive into the nitty-gritty of financial record-keeping? These seven bookkeeping interview questions will help you assess a candidate's knowledge and experience with handling financial records. Use them to gauge how well applicants understand the backbone of accounting processes and their ability to maintain accurate financial data.

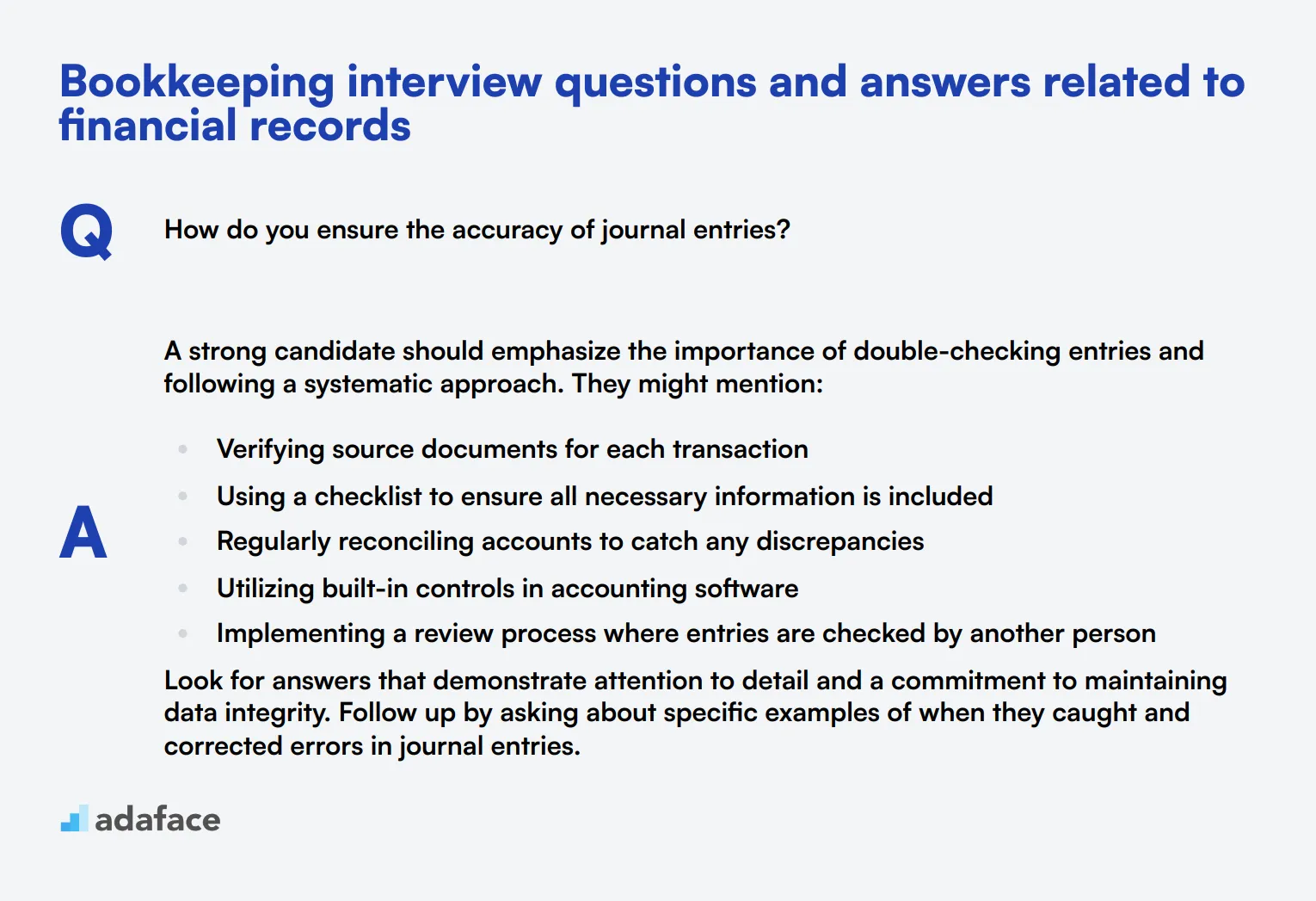

1. How do you ensure the accuracy of journal entries?

A strong candidate should emphasize the importance of double-checking entries and following a systematic approach. They might mention:

- Verifying source documents for each transaction

- Using a checklist to ensure all necessary information is included

- Regularly reconciling accounts to catch any discrepancies

- Utilizing built-in controls in accounting software

- Implementing a review process where entries are checked by another person

Look for answers that demonstrate attention to detail and a commitment to maintaining data integrity. Follow up by asking about specific examples of when they caught and corrected errors in journal entries.

2. Can you explain the concept of depreciation and its impact on financial statements?

A knowledgeable candidate should be able to explain that depreciation is the systematic allocation of an asset's cost over its useful life. They should mention that it:

- Reflects the gradual decrease in value of long-term assets

- Affects both the balance sheet (by reducing asset value) and income statement (as an expense)

- Helps match the cost of an asset to the revenue it generates over time

- Can be calculated using different methods (e.g., straight-line, declining balance)

Look for candidates who can clearly articulate the purpose of depreciation and its financial implications. Consider asking follow-up questions about different depreciation methods and when they might be applied.

3. How would you handle a situation where you discover a significant error in the previous year's financial statements?

A responsible candidate should outline a process that includes:

- Thoroughly investigating the error to understand its cause and impact

- Documenting the findings in detail

- Informing relevant stakeholders, including management and potentially auditors

- Determining the appropriate accounting treatment (e.g., restatement vs. current period adjustment)

- Implementing corrective measures to prevent similar errors in the future

Look for answers that demonstrate integrity, problem-solving skills, and an understanding of the importance of accurate financial reporting. Ask about any real-life experiences they may have had with similar situations.

4. What steps do you take to prepare for an external audit?

An experienced bookkeeper should describe a proactive approach to audit preparation, including:

- Reviewing and organizing all financial documents and records

- Reconciling all accounts and preparing schedules

- Ensuring all transactions are properly recorded and supported

- Preparing common audit schedules (e.g., fixed asset listings, accruals)

- Addressing any known issues or discrepancies beforehand

- Coordinating with other departments to gather necessary information

Look for candidates who emphasize the importance of organization, completeness, and cooperation with auditors. Consider asking about specific challenges they've faced during audits and how they resolved them.

5. How do you approach cost allocation in a multi-department organization?

A competent candidate should discuss a systematic approach to cost allocation, such as:

- Identifying all costs that need to be allocated

- Determining appropriate allocation bases (e.g., headcount, square footage, usage)

- Developing a consistent methodology for allocation

- Implementing the allocation process, possibly using specialized software

- Regularly reviewing and adjusting the allocation method as needed

Look for answers that demonstrate an understanding of cost accounting principles and the ability to think critically about fair and accurate allocation methods. Ask about specific examples of complex allocations they've handled in the past.

6. How do you ensure compliance with tax regulations when recording transactions?

A diligent bookkeeper should emphasize the importance of staying updated on tax laws and maintaining accurate records. They might mention:

- Regularly attending tax seminars or webinars

- Subscribing to tax publications or newsletters

- Consulting with tax professionals when needed

- Using tax-compliant accounting software

- Maintaining detailed documentation for all transactions

- Implementing a system for tracking tax-related items (e.g., sales tax, payroll taxes)

Look for candidates who show a proactive approach to tax compliance and an understanding of its importance in financial management. Consider asking about specific tax-related challenges they've faced and how they resolved them.

7. How do you handle accruals and deferrals to ensure proper revenue and expense recognition?

A knowledgeable candidate should explain the importance of the matching principle and describe a process for managing accruals and deferrals, such as:

- Identifying transactions that need to be accrued or deferred

- Calculating the appropriate amounts to record

- Creating journal entries to record accruals and deferrals

- Maintaining a schedule of outstanding accruals and deferrals

- Reversing entries in the subsequent period as needed

Look for answers that demonstrate an understanding of accrual accounting principles and attention to detail. Ask about specific examples of complex accruals or deferrals they've handled in the past.

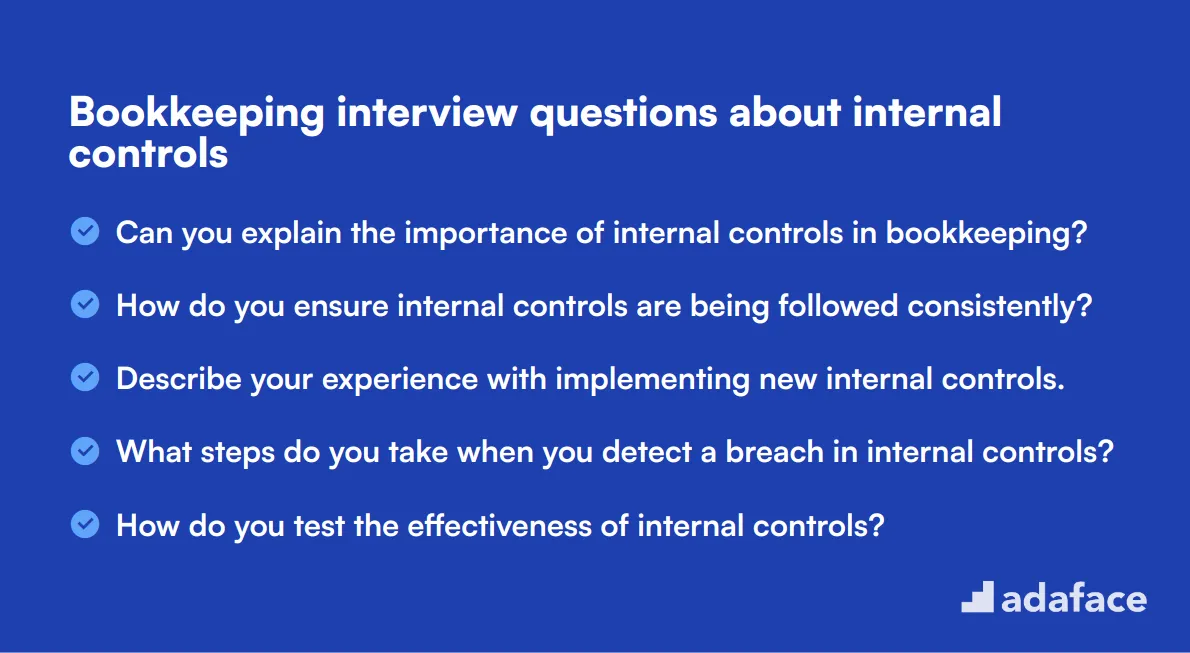

12 Bookkeeping interview questions about internal controls

To assess whether candidates have the right understanding and capabilities in managing internal controls, use these bookkeeping interview questions about internal controls. This will help you identify those who can ensure financial data integrity and compliance within your organization. For more insights on essential skills, explore the skills required for an accountant.

- Can you explain the importance of internal controls in bookkeeping?

- How do you ensure internal controls are being followed consistently?

- Describe your experience with implementing new internal controls.

- What steps do you take when you detect a breach in internal controls?

- How do you test the effectiveness of internal controls?

- Can you discuss a time when you identified a weakness in internal controls and how you addressed it?

- How do you ensure segregation of duties in a small team?

- What methods do you use to prevent and detect fraud?

- How do you document internal control procedures?

- Describe a situation where you had to enforce compliance with internal controls.

- How do you stay updated on best practices for internal controls?

- Can you explain the process of conducting an internal audit?

Which Bookkeeping skills should you evaluate during the interview phase?

While it's nearly impossible to assess every aspect of a candidate's ability during a single interview, there are essential bookkeeping skills that can provide valuable insights into their competency. Focusing on these core skills will help you identify candidates who are best suited for the role and ensure effective bookkeeping practices within your organization.

Attention to Detail

To filter candidates based on their attention to detail, consider using an assessment test with relevant MCQs. You can find a suitable test in our library that focuses on this skill. For instance, the Attention to Detail assessment can help you gauge this competency.

Additionally, you may ask targeted interview questions to further evaluate this skill.

Can you provide an example of how you ensured accuracy in your previous bookkeeping tasks?

When asking this question, look for specific examples that demonstrate their methodical approach to verifying data and processes. Strong candidates will share instances where they identified errors and the steps they took to rectify them.

Knowledge of Accounting Software

To assess knowledge of accounting software, consider using an assessment test that includes relevant MCQs from our library. Such tests can effectively evaluate a candidate's familiarity with various accounting tools.

You can also incorporate specific interview questions that target their experience with accounting software.

Which accounting software have you used in your previous roles, and what tasks did you perform with it?

Watch for responses that indicate a depth of experience and practical application of the software. Candidates who can explain their use of software in various financial tasks will likely be more effective in bookkeeping roles.

Understanding of Financial Regulations

Evaluate this skill through an assessment test that focuses on financial regulations. Unfortunately, there isn't a specific test in our library for this skill, but it can be beneficial to develop one tailored for your needs.

You might also consider asking questions that assess their knowledge of relevant regulations.

Can you explain how you ensure compliance with financial regulations in your bookkeeping practices?

This question should elicit answers that demonstrate their understanding of regulatory frameworks and practical applications in their previous roles. Look for candidates who can describe their systematic approach to staying compliant.

Hire top bookkeepers with skills tests and targeted interview questions

When hiring a bookkeeper, it's important to verify their skills accurately. This ensures you bring on board someone who can handle your financial records competently.

A smart way to assess bookkeeping skills is through online tests. The Bookkeeping Skills Test can help you evaluate candidates' knowledge and abilities objectively.

After using the skills test to shortlist top applicants, you can invite them for interviews. This two-step process helps you focus on the most promising candidates.

Ready to streamline your bookkeeper hiring process? Sign up to access our Bookkeeping Skills Test and other assessment tools tailored for finance roles.

Download Bookkeeping interview questions template in multiple formats

Bookkeeping Interview Questions FAQs

Key skills include accuracy, attention to detail, proficiency in accounting software, and a good understanding of financial statements.

Ask specific questions about the software they’ve used, challenges faced, and specific tasks they performed using the software.

Inquire about their understanding of internal controls, their experience implementing them, and their approach to ensuring compliance.

Pose questions about their experience with record-keeping, familiarity with financial regulations, and ask for examples of how they’ve managed financial records in previous roles.

Inconsistencies in their resume, lack of specific examples when discussing their experience, and an inability to explain technical terms or processes clearly.

Being detail-oriented is crucial for accuracy in bookkeeping, as even small errors can lead to significant problems down the line.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources