Hiring the right Accounts Receivable professionals is crucial for maintaining a company's financial health and cash flow. Asking the right interview questions helps recruiters and hiring managers assess candidates' skills, experience, and problem-solving abilities in managing accounts receivable effectively.

This blog post provides a comprehensive list of Accounts Receivable interview questions and answers for various experience levels. We cover basic, junior, intermediate, payment processing, and bad debt management questions to help you evaluate candidates thoroughly.

By using these questions, you can identify top talent and make informed hiring decisions. Consider combining these interview questions with pre-employment assessments to get a more complete picture of candidates' skills and abilities.

Table of contents

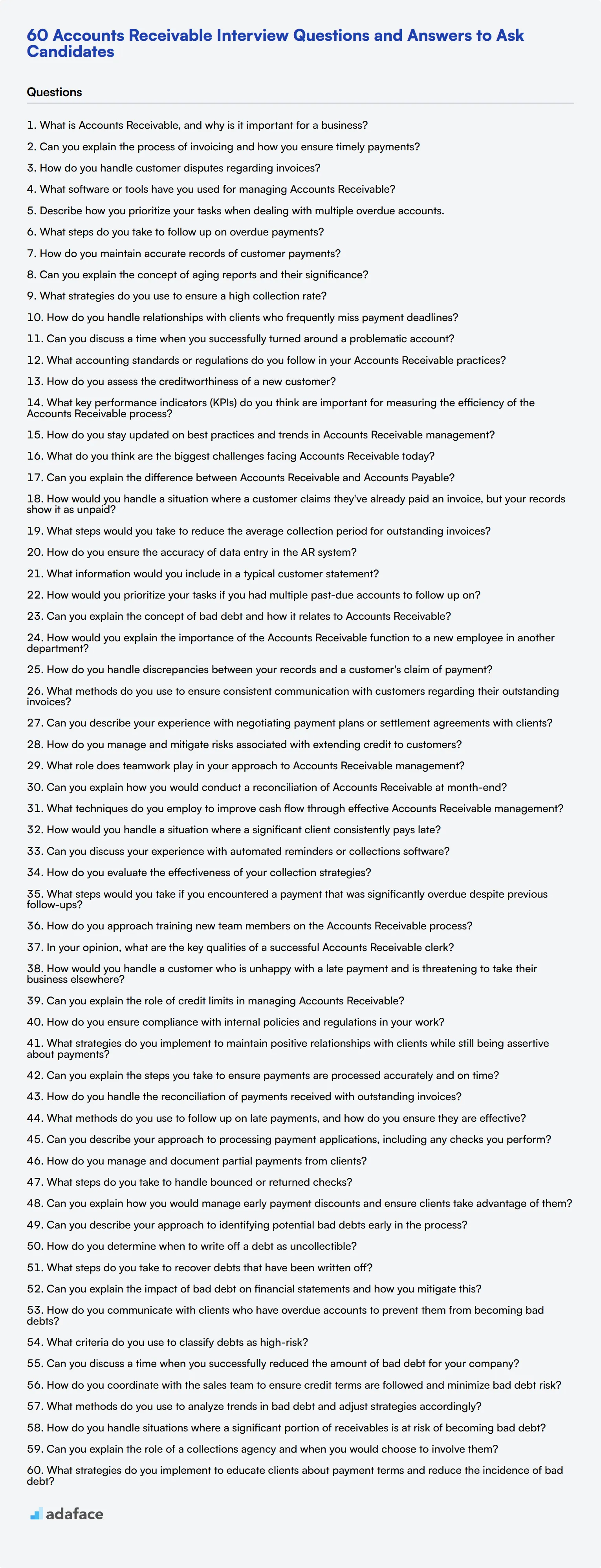

16 basic Accounts Receivable interview questions and answers to assess candidates

To assess whether candidates possess the essential skills and knowledge in Accounts Receivable, utilize this list of tailored interview questions. These questions can help you gauge their understanding of processes and their ability to handle various situations that may arise in the role, ensuring you make an informed hiring decision.

- What is Accounts Receivable, and why is it important for a business?

- Can you explain the process of invoicing and how you ensure timely payments?

- How do you handle customer disputes regarding invoices?

- What software or tools have you used for managing Accounts Receivable?

- Describe how you prioritize your tasks when dealing with multiple overdue accounts.

- What steps do you take to follow up on overdue payments?

- How do you maintain accurate records of customer payments?

- Can you explain the concept of aging reports and their significance?

- What strategies do you use to ensure a high collection rate?

- How do you handle relationships with clients who frequently miss payment deadlines?

- Can you discuss a time when you successfully turned around a problematic account?

- What accounting standards or regulations do you follow in your Accounts Receivable practices?

- How do you assess the creditworthiness of a new customer?

- What key performance indicators (KPIs) do you think are important for measuring the efficiency of the Accounts Receivable process?

- How do you stay updated on best practices and trends in Accounts Receivable management?

- What do you think are the biggest challenges facing Accounts Receivable today?

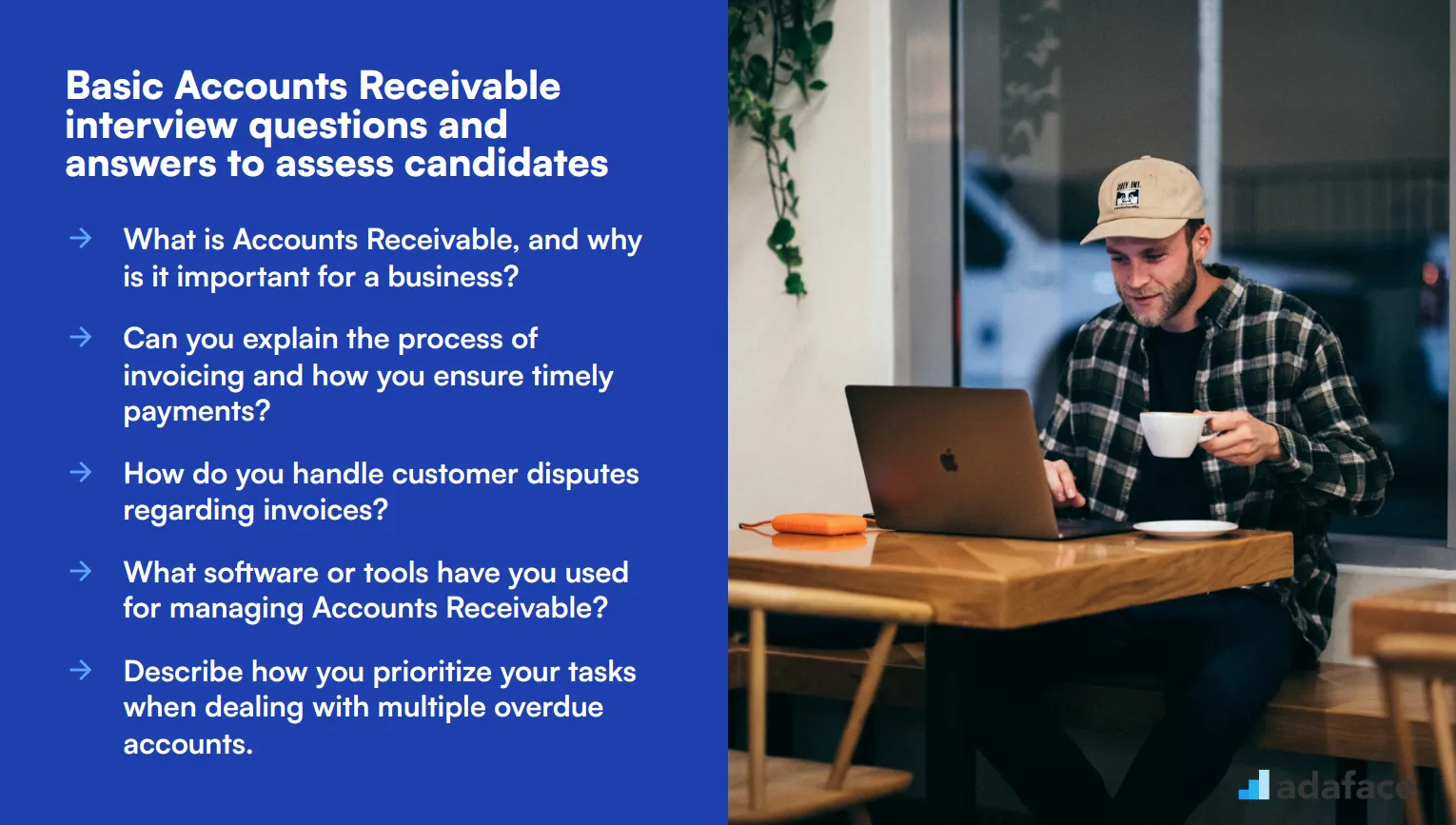

8 Accounts Receivable interview questions and answers to evaluate junior clerks

When interviewing junior clerks for Accounts Receivable positions, it's crucial to assess their basic understanding and practical skills. These eight questions will help you evaluate candidates' knowledge of fundamental AR processes and their ability to handle common scenarios. Use this list to gauge their potential and find the right fit for your accounting team.

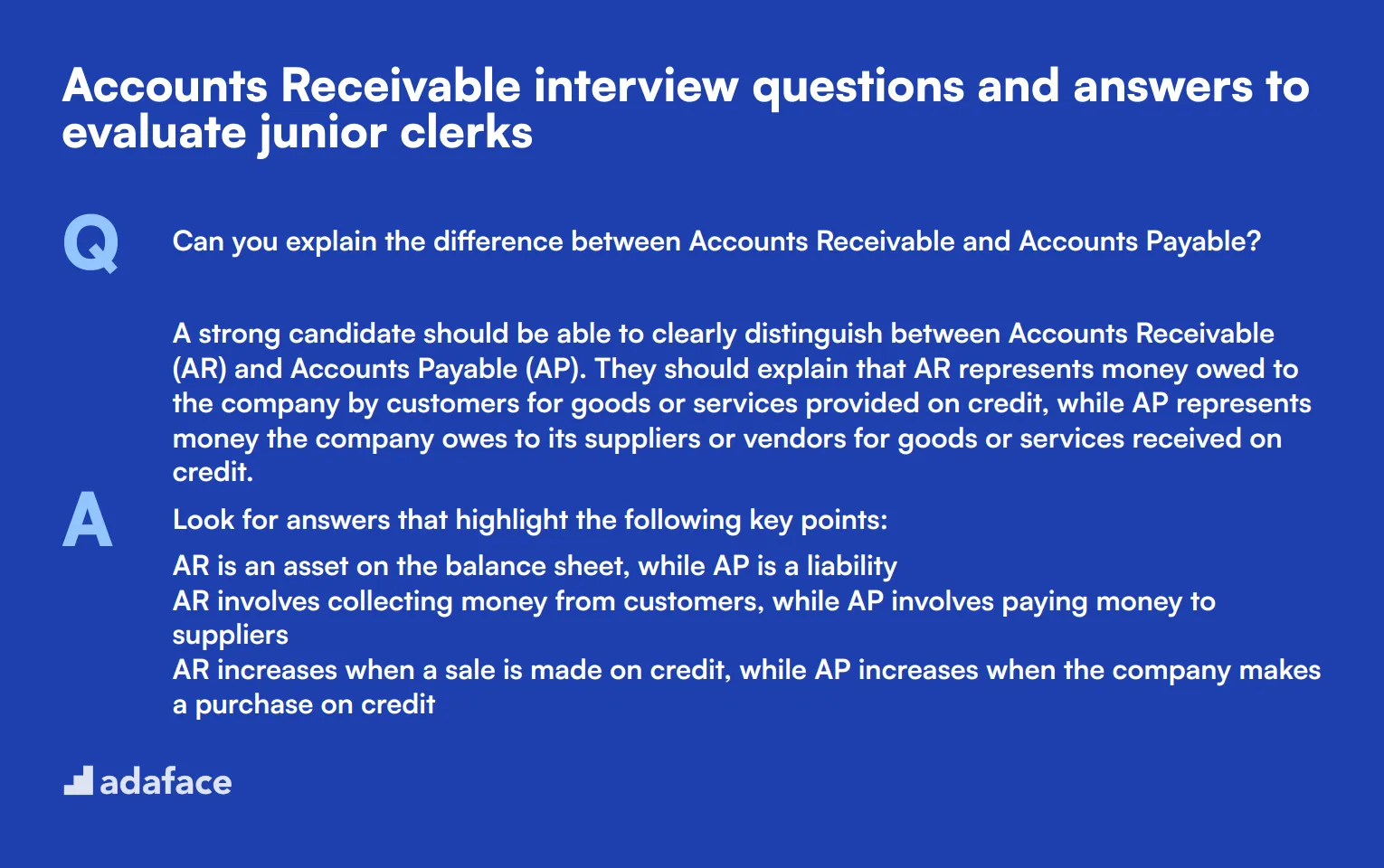

1. Can you explain the difference between Accounts Receivable and Accounts Payable?

A strong candidate should be able to clearly distinguish between Accounts Receivable (AR) and Accounts Payable (AP). They should explain that AR represents money owed to the company by customers for goods or services provided on credit, while AP represents money the company owes to its suppliers or vendors for goods or services received on credit.

Look for answers that highlight the following key points:

- AR is an asset on the balance sheet, while AP is a liability

- AR involves collecting money from customers, while AP involves paying money to suppliers

- AR increases when a sale is made on credit, while AP increases when the company makes a purchase on credit

2. How would you handle a situation where a customer claims they've already paid an invoice, but your records show it as unpaid?

A good response should outline a systematic approach to resolving the discrepancy:

- Remain calm and professional with the customer

- Double-check internal records for any oversight

- Ask the customer for proof of payment (e.g., bank statement, canceled check)

- Investigate possible reasons for the discrepancy (e.g., payment applied to wrong account, processing delay)

- Collaborate with other departments if necessary (e.g., banking, finance)

- Keep the customer informed throughout the process

- Once resolved, update records accordingly and apologize for any inconvenience

Look for candidates who emphasize the importance of maintaining good customer relationships while also protecting the company's financial interests. Their answer should demonstrate attention to detail and problem-solving skills.

3. What steps would you take to reduce the average collection period for outstanding invoices?

An ideal candidate should propose a multi-faceted approach to improving collections:

- Implement clear and consistent credit policies

- Send invoices promptly and ensure they are accurate

- Offer multiple payment options to customers

- Set up automated reminders for upcoming and overdue payments

- Provide incentives for early payment (e.g., discounts)

- Follow up personally with late-paying customers

- Consider using a collection agency for severely overdue accounts

Look for answers that demonstrate an understanding of the accounts receivable process and the ability to balance customer relationships with the company's cash flow needs. Strong candidates might also mention the importance of analyzing payment trends to identify and address systemic issues.

4. How do you ensure the accuracy of data entry in the AR system?

A strong candidate should emphasize the importance of accuracy in AR data entry and outline specific strategies to maintain it:

- Double-check all entries before finalizing

- Use data validation tools within the AR software

- Regularly reconcile AR records with bank statements

- Implement a system of checks and balances, such as having entries reviewed by a colleague

- Stay organized and focused to minimize distractions during data entry

- Regularly update and maintain customer information

Look for answers that demonstrate attention to detail and an understanding of the potential consequences of data entry errors. Candidates who mention the use of technology to improve accuracy or suggest process improvements show initiative and forward-thinking.

5. What information would you include in a typical customer statement?

A well-prepared candidate should be able to list the essential components of a customer statement:

- Customer's name and contact information

- Statement date and period covered

- Opening balance

- List of transactions (invoices, payments, credits) with dates and amounts

- Current balance due

- Payment terms and due date

- Company's contact information for payment or inquiries

Look for answers that demonstrate an understanding of clear communication with customers. Strong candidates might also mention the importance of customizing statements based on customer preferences or industry standards, or discuss how well-designed statements can facilitate faster payments.

6. How would you prioritize your tasks if you had multiple past-due accounts to follow up on?

An effective answer should outline a logical approach to task prioritization:

- Sort accounts by age and amount owed, focusing on the oldest and largest balances first

- Consider the customer's payment history and relationship with the company

- Check for any pending disputes or special circumstances that might affect collection

- Create a schedule for follow-ups, ensuring all accounts are addressed within a reasonable timeframe

- Balance time spent on collection efforts with other daily responsibilities

Look for candidates who demonstrate good time management skills and the ability to make decisions based on multiple factors. Strong answers might also mention the use of AR aging reports or other tools to assist in prioritization.

7. Can you explain the concept of bad debt and how it relates to Accounts Receivable?

A knowledgeable candidate should be able to explain that bad debt refers to accounts receivable that are unlikely to be collected. They should mention that it's an inevitable part of doing business on credit and affects the company's financial statements.

Key points to look for in the answer:

- Bad debt is recognized as an expense on the income statement

- It reduces the accounts receivable balance on the balance sheet

- Companies use the allowance method to estimate and account for potential bad debts

- Factors influencing bad debt estimates include historical data, economic conditions, and customer-specific information

Strong candidates might also discuss the importance of balancing credit policies to minimize bad debt while still encouraging sales growth.

8. How would you explain the importance of the Accounts Receivable function to a new employee in another department?

A good answer should highlight the critical role of AR in the company's financial health:

- AR manages the company's expected incoming cash flow

- It directly impacts the company's liquidity and ability to pay its own obligations

- Efficient AR processes help maintain positive customer relationships

- AR data provides valuable insights into customer behavior and market trends

- Proper AR management contributes to accurate financial reporting and forecasting

Look for candidates who can communicate complex financial concepts in simple terms. Strong answers might also touch on how AR interacts with other departments, demonstrating a broader understanding of business operations.

17 intermediate Accounts Receivable interview questions and answers to ask mid-tier clerks.

To effectively gauge the expertise of your candidates in handling mid-tier Accounts Receivable responsibilities, consider using this list of intermediate questions. These inquiries will help you uncover the depth of their knowledge and practical skills relevant to their role in your organization. For further insights, check out our accountant job description.

- How do you handle discrepancies between your records and a customer's claim of payment?

- What methods do you use to ensure consistent communication with customers regarding their outstanding invoices?

- Can you describe your experience with negotiating payment plans or settlement agreements with clients?

- How do you manage and mitigate risks associated with extending credit to customers?

- What role does teamwork play in your approach to Accounts Receivable management?

- Can you explain how you would conduct a reconciliation of Accounts Receivable at month-end?

- What techniques do you employ to improve cash flow through effective Accounts Receivable management?

- How would you handle a situation where a significant client consistently pays late?

- Can you discuss your experience with automated reminders or collections software?

- How do you evaluate the effectiveness of your collection strategies?

- What steps would you take if you encountered a payment that was significantly overdue despite previous follow-ups?

- How do you approach training new team members on the Accounts Receivable process?

- In your opinion, what are the key qualities of a successful Accounts Receivable clerk?

- How would you handle a customer who is unhappy with a late payment and is threatening to take their business elsewhere?

- Can you explain the role of credit limits in managing Accounts Receivable?

- How do you ensure compliance with internal policies and regulations in your work?

- What strategies do you implement to maintain positive relationships with clients while still being assertive about payments?

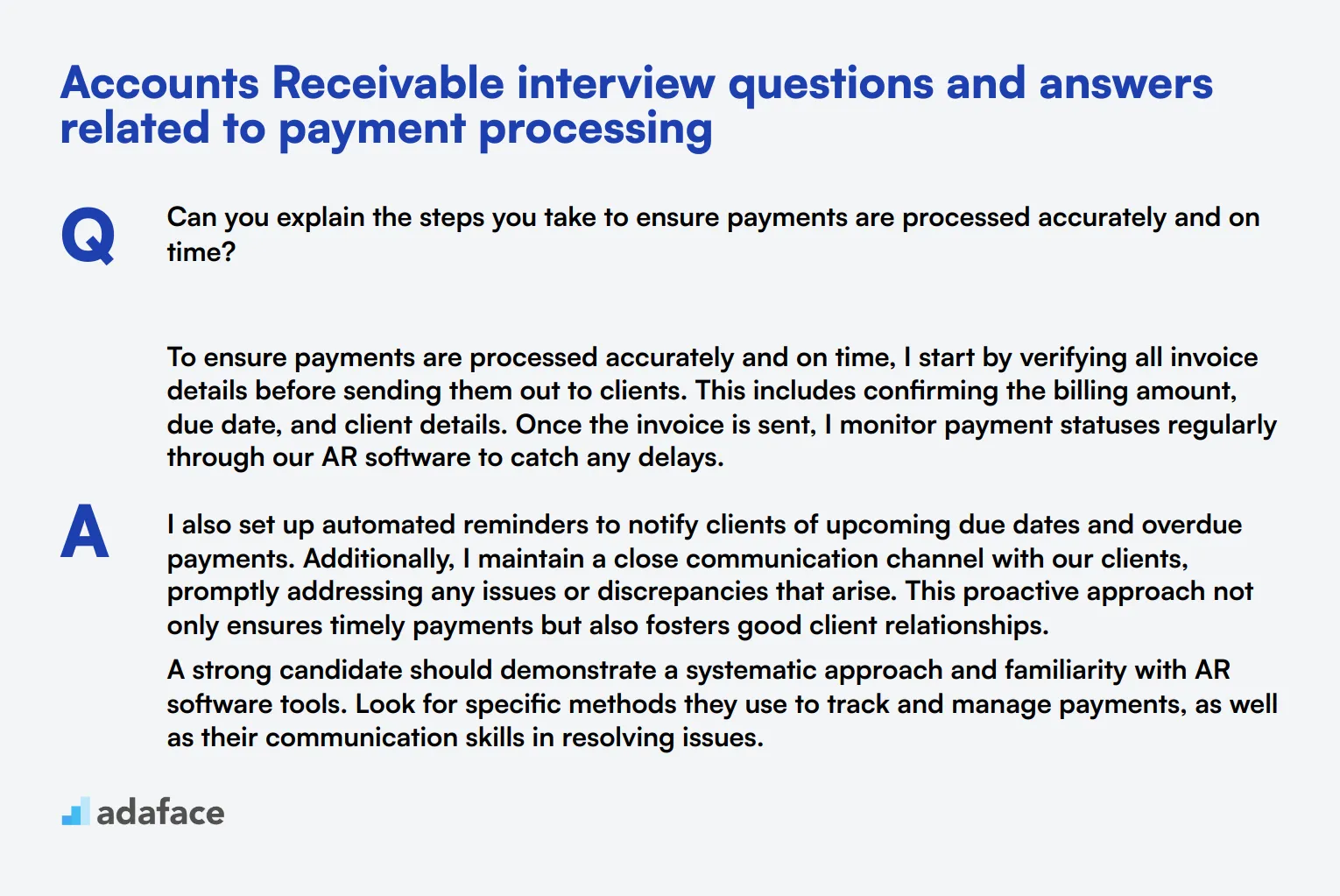

7 Accounts Receivable interview questions and answers related to payment processing

To gauge an applicant's handling of payment processing within Accounts Receivable, use this curated list of interview questions. These questions will help you assess their practical knowledge and ability to manage payment-related tasks effectively.

1. Can you explain the steps you take to ensure payments are processed accurately and on time?

To ensure payments are processed accurately and on time, I start by verifying all invoice details before sending them out to clients. This includes confirming the billing amount, due date, and client details. Once the invoice is sent, I monitor payment statuses regularly through our AR software to catch any delays.

I also set up automated reminders to notify clients of upcoming due dates and overdue payments. Additionally, I maintain a close communication channel with our clients, promptly addressing any issues or discrepancies that arise. This proactive approach not only ensures timely payments but also fosters good client relationships.

A strong candidate should demonstrate a systematic approach and familiarity with AR software tools. Look for specific methods they use to track and manage payments, as well as their communication skills in resolving issues.

2. How do you handle the reconciliation of payments received with outstanding invoices?

When reconciling payments received with outstanding invoices, I begin by matching the payment details provided by the client with our invoice records. This includes verifying amounts, payment dates, and any reference numbers. Any discrepancies are flagged for further investigation.

I also regularly update our financial records to reflect the latest payment statuses, ensuring that our accounts are always accurate. If there are any unresolved discrepancies, I reach out to the client for clarification and resolution.

The ideal response should show a candidate's attention to detail and their ability to systematically resolve discrepancies. They should also highlight the importance of maintaining up-to-date records for accurate financial reporting.

3. What methods do you use to follow up on late payments, and how do you ensure they are effective?

To follow up on late payments, I use a combination of automated reminders and personalized communication. Initially, automated emails are sent as reminders close to the due date and shortly after it has passed. If the payment remains outstanding, I make a personal phone call to the client to discuss the delay and arrange for prompt payment.

I also document all follow-up actions and responses in our AR system, which helps in tracking the effectiveness of our follow-ups and identifying any patterns or frequent defaulters. This documentation is crucial for future reference and analysis.

A good candidate should explain their multi-faceted approach to follow-ups and emphasize the importance of both automated and personal communication. Look for their ability to document and analyze follow-up actions to improve processes.

4. Can you describe your approach to processing payment applications, including any checks you perform?

When processing payment applications, my approach involves several key steps. First, I verify the payment details against the corresponding invoice to ensure accuracy. This includes checking the amount, invoice number, and any applicable discounts or adjustments.

Next, I ensure that the payment method is valid and has been processed correctly. For checks or bank transfers, this might involve confirming receipt with our bank. I also update our AR system to reflect the payment and generate a receipt for the client.

Candidates should highlight their attention to detail and their methodical approach to verifying payment details. It’s important to look for their ability to ensure accuracy and their familiarity with different payment methods.

5. How do you manage and document partial payments from clients?

Managing and documenting partial payments involves several steps. First, I record the partial payment in our AR system, ensuring that it is correctly allocated to the corresponding invoice. This helps in maintaining an accurate record of the outstanding balance.

I also issue an updated invoice or statement to the client, reflecting the partial payment and the remaining balance. Communication with the client is crucial here to ensure they are aware of the outstanding amount and any new due dates.

A strong candidate should emphasize the importance of accurate record-keeping and effective communication with clients. They should demonstrate their ability to manage partial payments without causing confusion or errors in the records.

6. What steps do you take to handle bounced or returned checks?

Handling bounced or returned checks starts with promptly notifying the client about the issue. I then investigate the reason for the return by contacting the bank if necessary. Once the cause is identified, I work with the client to resolve the issue, which could involve reissuing the check or arranging an alternative payment method.

I also update our AR records to reflect the returned check and any associated fees. This helps in maintaining accurate financial records and ensures that the outstanding balance is correctly reported.

Look for candidates who can demonstrate their ability to swiftly and effectively manage returned checks. They should highlight their communication skills and their methodical approach to updating financial records.

7. Can you explain how you would manage early payment discounts and ensure clients take advantage of them?

Managing early payment discounts involves clearly communicating the terms of the discount to clients when the invoice is issued. I highlight the discount details, including the amount and the deadline for eligibility, making it easy for clients to understand and take advantage of the offer.

To ensure clients are aware of the discount, I follow up with reminders as the discount deadline approaches. This can be in the form of automated emails or personal calls, depending on the client's preferences.

A good response should show the candidate's proactive approach to communication and their ability to manage incentives effectively. Look for their understanding of how early payment discounts can benefit both the client and the company.

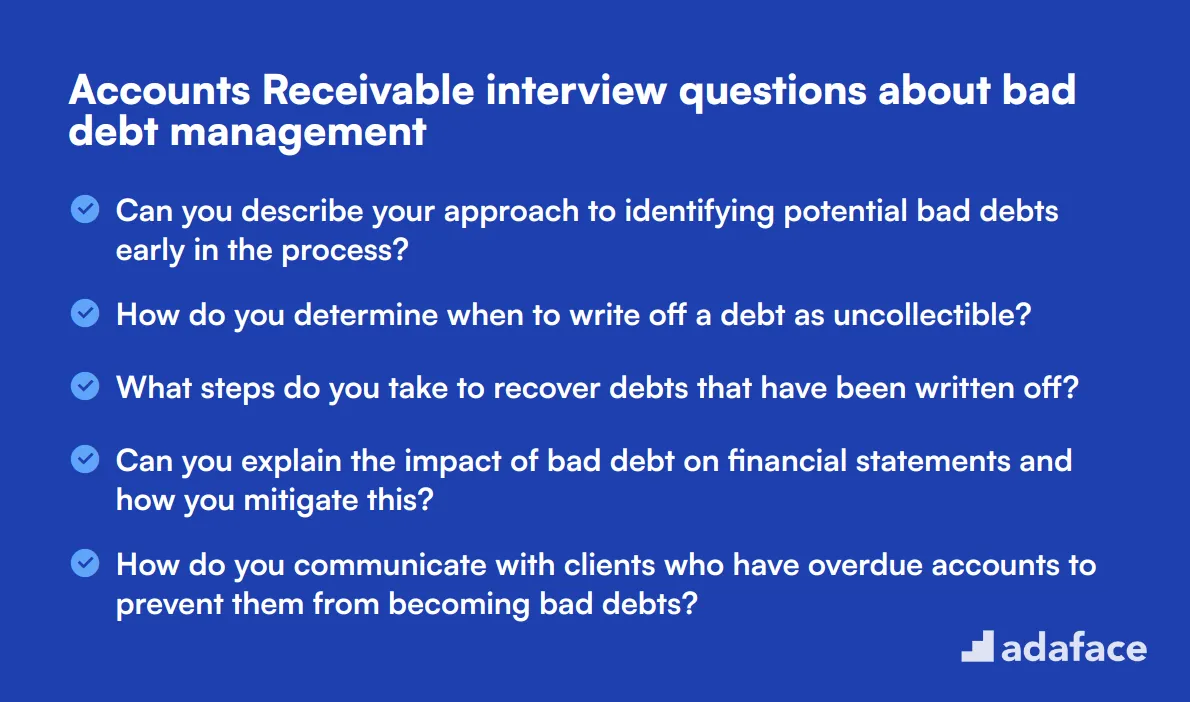

12 Accounts Receivable interview questions about bad debt management

To effectively evaluate an applicant's ability to manage bad debt within Accounts Receivable, use these interview questions to gain insights into their experience and strategies. This list will help you identify candidates who can maintain financial health and manage risk efficiently. For more on essential skills, check out skills required for accounting specialists.

- Can you describe your approach to identifying potential bad debts early in the process?

- How do you determine when to write off a debt as uncollectible?

- What steps do you take to recover debts that have been written off?

- Can you explain the impact of bad debt on financial statements and how you mitigate this?

- How do you communicate with clients who have overdue accounts to prevent them from becoming bad debts?

- What criteria do you use to classify debts as high-risk?

- Can you discuss a time when you successfully reduced the amount of bad debt for your company?

- How do you coordinate with the sales team to ensure credit terms are followed and minimize bad debt risk?

- What methods do you use to analyze trends in bad debt and adjust strategies accordingly?

- How do you handle situations where a significant portion of receivables is at risk of becoming bad debt?

- Can you explain the role of a collections agency and when you would choose to involve them?

- What strategies do you implement to educate clients about payment terms and reduce the incidence of bad debt?

Which Accounts Receivable skills should you evaluate during the interview phase?

While it's challenging to gauge a candidate's full potential from a single interview, focusing on key Accounts Receivable skills can provide valuable insights. The following skills are particularly important to evaluate, as they directly impact the efficiency and accuracy of the accounts receivable process.

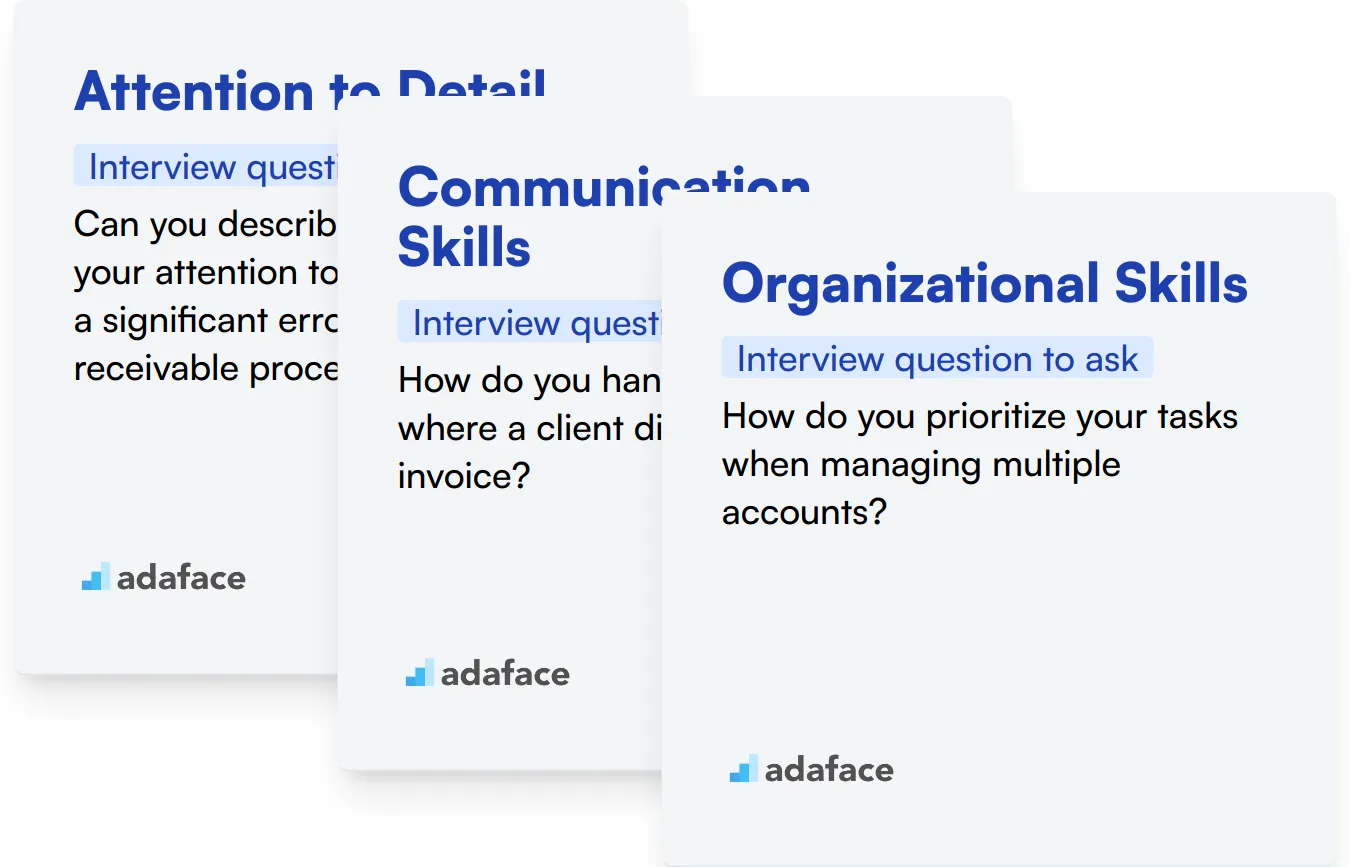

Attention to Detail

In Accounts Receivable, attention to detail is critical, as it ensures accuracy in invoice processing, payment tracking, and financial reporting. Errors can lead to significant financial discrepancies.

To assess attention to detail, consider using an attention-to-detail-test. This test includes relevant MCQs that help identify candidates who are meticulous and error-conscious.

In the interview, you can also directly assess this skill by asking the following targeted question:

Can you describe a time when your attention to detail prevented a significant error in the accounts receivable process?

Look for specific examples where meticulous scrutiny prevented or corrected errors, demonstrating the candidate's proactive approach to accuracy.

Communication Skills

Effective communication is essential in Accounts Receivable to coordinate with clients about payments, resolve disputes, and clarify misunderstandings quickly and diplomatically.

A focused assessment through a communication-test could help in filtering candidates who excel in verbal and written communication.

Evaluate this skill during the interview with the following question:

How do you handle a situation where a client disputes an invoice?

Candidates should demonstrate their ability to handle conflicts calmly and effectively, ensuring clear, professional communication.

Organizational Skills

Strong organizational skills are crucial in managing the multiple accounts and ensuring timely follow-ups and payment collections. It impacts the overall cash flow and financial health of the business.

To understand how candidates organize their workload, ask this question:

How do you prioritize your tasks when managing multiple accounts?

Look for methods and tools they use to stay organized and ensure nothing is overlooked in the accounts receivable process.

Enhance Your Hiring Process with Accounts Receivable Skills Tests and Targeted Interview Questions

If you're looking to hire someone with Accounts Receivable skills, it's important to verify these skills accurately before making a hiring decision.

The best way to assess these skills is through targeted skills tests. Consider using the Accounting Test or the Financial Accounting Test from Adaface to gauge the proficiency of candidates effectively.

After administering these tests, you can confidently shortlist the top candidates for interviews, ensuring that only the most skilled applicants move forward in your hiring process.

To start refining your recruitment strategy today, sign up for Adaface and explore our detailed Accounts Receivable Test options to find the perfect match for your needs.

Accounting Assessment Test

Download Accounts Receivable interview questions template in multiple formats

Accounts Receivable Interview Questions FAQs

Look for attention to detail, strong analytical skills, proficiency in accounting software, and good communication abilities.

Ask questions about their previous roles involving payment processing, specific challenges they faced, and how they resolved them.

Inquire about their experience with bad debt recovery, strategies they have used, and how they stay updated with relevant laws and regulations.

It helps assess the candidate's foundational knowledge and their ability to handle more complex tasks, ensuring a well-rounded evaluation.

Scenario-based questions help gauge a candidate's problem-solving skills, practical knowledge, and how they apply their expertise in real-world situations.

Technical proficiency is crucial as it ensures candidates can handle accounting software, manage financial data accurately, and streamline processes efficiently.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources