Hiring the right Accounts Payable (AP) professional is more than just filling a seat; it's about securing the backbone of your financial operations. A skilled AP team ensures vendor relationships stay strong and payments are handled with accuracy, preventing disruptions and maintaining a healthy cash flow, similar to the impact of strong attention to detail.

This blog post provides a list of Accounts Payable interview questions, tailored for various experience levels from freshers to seasoned professionals. We've also included Accounts Payable MCQs to help you assess candidates effectively.

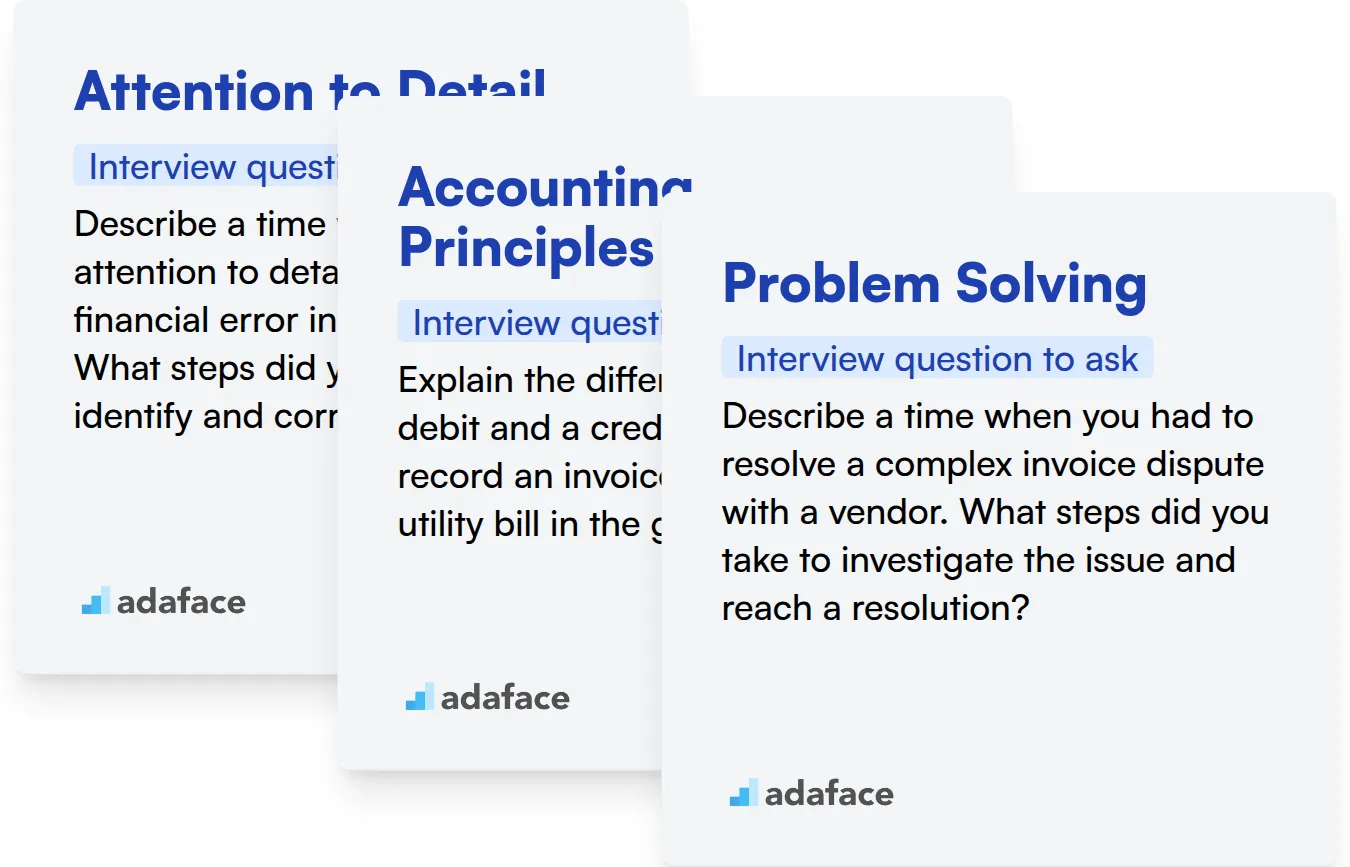

By using these questions, you'll be able to identify candidates who not only understand AP processes, but also possess the problem-solving skills to manage complex financial scenarios; before interviews, use Adaface's accounting test to filter for candidates with the right skills.

Table of contents

Accounts Payable interview questions for freshers

1. What do you know about the accounts payable process?

The accounts payable (AP) process is a crucial part of a company's financial operations. It involves receiving invoices from suppliers or vendors, verifying the accuracy of those invoices against purchase orders and receiving reports, and then scheduling and making payments to those suppliers. A typical AP process includes invoice receipt, invoice approval (often involving a matching process), payment processing, and record keeping.

Key objectives are to ensure timely and accurate payments, maintain good relationships with suppliers, prevent duplicate payments, and take advantage of early payment discounts. Automation and efficient workflows are often implemented to streamline the process and improve accuracy.

2. Can you explain the difference between a debit and a credit in simple terms?

In simple terms, think of it like this: a debit increases account balances of assets and expenses, while it decreases account balances of liabilities, owner's equity, and revenue. Conversely, a credit increases liabilities, owner's equity, and revenue, while it decreases assets and expenses.

Think of a debit as 'left' and credit as 'right'. The fundamental accounting equation (Assets = Liabilities + Equity) is always kept in balance by ensuring the total debits equal the total credits for every transaction.

3. What is a purchase order, and why is it important?

A purchase order (PO) is a commercial document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services the seller will provide to the buyer. It's essentially a formal offer to buy.

It's important because it:

- Formalizes the agreement, creating a legally binding document.

- Helps track orders and inventory.

- Provides a reference for invoicing and payment.

- Reduces errors and misunderstandings between buyer and seller.

- Assists with budgeting and forecasting.

4. How would you handle a situation where an invoice has a discrepancy?

If I encounter an invoice discrepancy, my first step is to thoroughly review the invoice against the purchase order, receiving documentation, and any contractual agreements. I'd verify quantities, pricing, and terms. If an error is confirmed, I'd promptly contact the vendor to discuss the issue and provide supporting documentation highlighting the discrepancy.

I would then work with the vendor to reach a mutually agreeable resolution, such as a corrected invoice or a credit memo. I would also document all communication and steps taken to resolve the discrepancy for audit purposes and update internal systems to reflect the corrected information. If the discrepancy involves significant amounts or complex issues, I would escalate it to my supervisor or the appropriate department (e.g., accounting, procurement) for further assistance.

5. What are some qualities you possess that would make you a good fit for an accounts payable role?

I possess several qualities that make me well-suited for an Accounts Payable role. I am highly detail-oriented and meticulous, which is crucial for ensuring accuracy in invoice processing and payment reconciliation. My strong organizational skills allow me to manage a high volume of documents and prioritize tasks effectively to meet deadlines.

Furthermore, I am proficient in data entry and have experience working with accounting software. I am also a quick learner and adaptable, enabling me to readily grasp new systems and procedures. My strong analytical skills allow me to identify discrepancies and resolve payment issues efficiently, and I am a good communicator, able to effectively interact with vendors and internal stakeholders.

6. Describe your experience with data entry and attention to detail.

I have several years of experience performing data entry tasks across various roles. I am proficient in accurately inputting and updating information into databases, spreadsheets, and other digital systems. I understand the importance of maintaining data integrity and consistency and adhere to established procedures to ensure accuracy.

My attention to detail is a strength I leverage in data entry. I meticulously review data for errors or inconsistencies before submission, and I am adept at identifying and correcting mistakes quickly and efficiently. I also use tools like data validation in excel to avoid data entry errors. For instance, when entering customer addresses, I double-check street names, postal codes, and city spellings to avoid any issues. I am committed to maintaining high levels of accuracy in all my data entry work.

7. What is the importance of maintaining accurate records in accounts payable?

Maintaining accurate records in accounts payable is crucial for several reasons. Firstly, it ensures accurate financial reporting, providing a clear and reliable picture of a company's liabilities and cash flow. This is vital for informed decision-making by management, investors, and creditors. It also helps in budgeting and forecasting future financial needs.

Secondly, accurate records are essential for compliance with tax regulations and internal audit requirements. Properly documented transactions facilitate smooth audits and minimize the risk of penalties or fines. Additionally, it strengthens internal controls, preventing fraud and errors, and providing an audit trail for all financial activities.

8. How do you ensure you meet deadlines when processing invoices?

To ensure I meet invoice processing deadlines, I prioritize and organize my tasks effectively. I start by immediately reviewing incoming invoices, noting the due dates, and identifying any urgent items. I utilize a system like a Kanban board or a simple to-do list to track the progress of each invoice through the processing stages (e.g., verification, approval, payment).

I also proactively communicate with vendors and internal stakeholders to resolve any discrepancies or missing information promptly. This helps prevent delays caused by incomplete or inaccurate invoices. Finally, I set reminders or calendar alerts for upcoming deadlines to ensure nothing slips through the cracks and to allow sufficient time for approvals and payment processing.

9. What is your understanding of the term 'three-way match'?

A three-way match is an accounting control used when processing invoices for payment. It ensures that the invoice amount is accurate and that the goods or services billed were actually ordered and received. The three documents involved are:

- Purchase Order (PO): This document confirms the items or services ordered and the agreed-upon price.

- Goods Receipt (GR) or Receiving Report: This document verifies that the ordered goods were received in the correct quantity and condition (or that the service was performed).

- Vendor Invoice: This is the bill from the vendor requesting payment.

The three-way match process involves comparing the information on these three documents. If all three match (quantity, price, terms, etc.), the invoice is approved for payment. Discrepancies trigger investigation and resolution before payment is authorized, preventing fraudulent or erroneous payments.

10. How comfortable are you with using computers and basic software like Microsoft Excel?

I am very comfortable using computers and basic software. I have extensive experience with Microsoft Excel, including creating spreadsheets, using formulas and functions, data analysis, and creating charts. I'm proficient with other Microsoft Office applications as well as various operating systems.

I am a quick learner and can easily adapt to new software and technologies. I'm confident in my ability to effectively utilize computers and software to accomplish tasks efficiently.

11. Imagine you receive an invoice without a purchase order. What steps would you take?

First, I'd verify the invoice's legitimacy by checking the vendor's details (name, address, contact information) against approved vendor lists and past invoices. Then, I would reach out to the vendor to confirm the invoice's validity and request any supporting documentation they might have.

Next, I'd internally investigate by contacting the department or individual who likely requested the goods or services. I'd ask if they recognize the invoice and if they can provide a purchase order number or any documentation related to the purchase. If the invoice is valid and the goods/services were received, I'd work with the relevant department to create a retroactive purchase order or obtain the necessary approvals for payment without a PO. If the invoice is determined to be invalid or unauthorized, I'd communicate this to the vendor and reject the invoice.

12. Why are you interested in starting your career in accounts payable?

I'm drawn to accounts payable because it offers a solid foundation in finance and accounting. It's a critical function for any organization, providing essential insights into cash flow management and financial stability. I'm eager to develop a strong understanding of these core principles.

Furthermore, I appreciate the detail-oriented nature of the work and the opportunity to contribute directly to a company's financial health. I am excited to learn the processes involved in processing invoices, managing vendor relationships, and ensuring accurate and timely payments, which are all essential to a company's success.

13. What is your understanding of vendor relationships, and why are they important?

Vendor relationships are the connections a company has with external suppliers who provide goods or services. These relationships range from simple transactional interactions to strategic partnerships.

They are important because they directly impact a company's operations, product quality, and overall success. Strong vendor relationships can lead to better pricing, improved service, faster delivery times, and access to innovative solutions. Conversely, poor vendor relationships can result in supply chain disruptions, higher costs, and decreased competitiveness. Managing these relationships effectively is crucial for maintaining a competitive edge.

14. Tell me about a time you had to solve a problem. What did you do?

In my previous role, we encountered a critical performance bottleneck in our data processing pipeline. The pipeline, responsible for transforming and loading data into our analytics warehouse, had slowed down significantly, impacting downstream reporting and decision-making. I took the initiative to investigate the issue. I began by monitoring resource utilization (CPU, memory, I/O) across the different stages of the pipeline.

Using monitoring tools, I identified a specific transformation step that was consuming a disproportionate amount of resources. Further analysis of the code revealed an inefficient algorithm. Specifically, a nested loop was used to compare records, resulting in O(n^2) complexity. I refactored the code to use a more efficient data structure (a hash map) for lookups, reducing the complexity to O(n). This optimization resulted in a significant performance improvement, reducing the processing time of that step by over 80% and resolving the overall bottleneck. The fix was deployed, and the pipeline returned to its expected performance levels.

15. What are some potential consequences of errors in accounts payable?

Errors in accounts payable can lead to several negative consequences. Paying the wrong amount or paying the wrong vendor damages relationships and can incur late payment fees or legal issues. Duplicate payments drain company funds and skew financial records, potentially leading to inaccurate financial reporting and poor decision-making.

Furthermore, incorrect or delayed payments can negatively impact a company's credit rating and ability to secure favorable terms with suppliers in the future. Internal control weaknesses exposed by AP errors can also increase the risk of fraud and compliance violations.

16. How would you describe your organizational skills?

I'm highly organized, and I believe it's crucial for efficiency. I use a combination of digital and analog tools to stay on top of things. For task management, I rely on a digital system (like Todoist or Trello) to prioritize tasks, set deadlines, and track progress.

I also maintain a detailed calendar (Google Calendar) for appointments and deadlines. For note-taking and knowledge management, I use a system that allows easy retrieval (like Notion or Evernote). These tools, combined with a clear understanding of priorities, help me stay organized and meet deadlines effectively.

17. What do you know about invoice approval workflows?

Invoice approval workflows are structured processes that ensure invoices are reviewed and authorized before payment. They typically involve routing invoices to the appropriate individuals or departments for verification against purchase orders, contracts, and received goods/services. Key steps often include:

- Invoice receipt and data capture.

- Matching the invoice to a purchase order and goods receipt (three-way matching).

- Routing to approvers based on predefined rules (e.g., amount thresholds, department codes).

- Approval or rejection with reasons.

- Payment processing upon final approval.

- Record keeping and reporting. The goal is to improve accuracy, prevent fraud, and ensure timely payments while maintaining proper documentation.

18. Have you ever worked with an accounting software? If so, which ones?

Yes, I have worked with accounting software. Specifically, I have experience using QuickBooks Online and Xero. I've used these platforms for tasks like:

- Generating financial reports (balance sheets, income statements, cash flow statements)

- Managing accounts payable and receivable

- Reconciling bank statements

- Processing payroll

While my experience is primarily user-focused, involving data entry, report generation, and basic reconciliation, I understand the underlying accounting principles that the software automates. I'm comfortable learning new platforms and adapting to different workflows.

19. What is the purpose of a credit memo?

A credit memo is a document issued by a seller to a buyer, reducing the amount the buyer owes. It's essentially a refund or discount applied after the original invoice has been issued. Common reasons include:

- Returned goods

- Damaged goods

- Pricing errors

- Discounts offered after the sale

20. How would you handle a situation where you accidentally made a duplicate payment?

If I accidentally made a duplicate payment, my immediate action would be to contact the recipient (vendor, individual, etc.) to inform them of the error. I would clearly explain the situation and request a refund for the duplicate payment. I would then document all communication, including dates, times, and the names of individuals I spoke with.

Following that, I would contact my bank or payment provider (e.g., credit card company, PayPal). I'd explain the situation and provide them with the documentation I've gathered. I would inquire about their process for disputing or reversing the duplicate charge. Depending on their advice, I might file a formal dispute or claim to help recover the funds if the recipient is uncooperative.

21. Describe a situation where you had to handle a large volume of work. How did you manage it?

In my previous role, we were launching a new product feature, which required a significant increase in our testing workload within a short timeframe. To manage this, I prioritized tasks based on impact and dependencies, breaking down the work into smaller, manageable chunks. I used a Kanban board to visualize progress and identify bottlenecks, and proactively communicated with the team to distribute the workload effectively.

Furthermore, I automated repetitive testing tasks using Python and Selenium, which significantly reduced the manual testing effort. I also implemented a system for triaging bugs based on severity and impact, ensuring that critical issues were addressed immediately. By combining prioritization, automation, and effective communication, we successfully met the deadline without compromising quality.

22. What questions do you have for us about this accounts payable role?

Thank you for the opportunity to ask questions. I'm interested in understanding more about the day-to-day responsibilities. Could you describe a typical week for someone in this role? Also, what are the biggest challenges the accounts payable team currently faces?

I'm also curious about the company's growth plans and how the accounts payable function is expected to evolve in the next few years. Finally, what opportunities are there for professional development and advancement within the accounts payable team or the broader finance organization?

Accounts Payable interview questions for juniors

1. What does 'net' mean when you see 'Net 30' on an invoice?

When you see 'Net 30' on an invoice, it means that the full payment is due 30 days from the invoice date. 'Net' refers to the total amount due, and '30' signifies the number of days the buyer has to pay that amount.

Essentially, it's a credit term indicating the payment deadline. If the invoice date is January 1st, 'Net 30' implies the payment should be received by January 31st.

2. Can you describe the typical steps in the accounts payable process, from receiving an invoice to making a payment?

The accounts payable (AP) process typically starts with receiving an invoice, either physically or electronically. The invoice is then usually recorded in the accounting system. This involves verifying the invoice details, matching it to a purchase order (if applicable) and goods receipt note to ensure accuracy and that the items/services were actually received. If discrepancies exist, the invoice might be disputed and put on hold until resolved.

Once the invoice is approved, it is scheduled for payment according to the agreed-upon payment terms. The payment is then processed, which can be done electronically (e.g., ACH, wire transfer) or by check. After payment, the transaction is recorded, and the invoice is marked as paid in the accounting system. Finally, reconciliation of the AP ledger with bank statements ensures accurate record-keeping and helps prevent fraud.

3. What do you understand by the term 'invoice'?

An invoice is a commercial document issued by a seller to a buyer, indicating the products, quantities, and agreed prices for products or services the seller has provided to the buyer. It represents a request for payment.

Essentially, it's a bill that includes details like: seller and buyer information, invoice number and date, a description of the goods or services, quantities, unit prices, total amount due, payment terms, and potentially taxes or discounts. It's a crucial document for accounting and record-keeping for both parties.

4. What is a purchase order and how does it relate to accounts payable?

A purchase order (PO) is a commercial document issued by a buyer to a seller, indicating the types, quantities, and agreed prices for products or services the buyer intends to purchase. It's essentially a formal offer to buy.

Purchase orders are a crucial part of the accounts payable (AP) process. AP uses the PO to verify that an invoice received from a vendor is legitimate and matches what was ordered. The AP department compares the PO, the receiving report (confirming receipt of goods/services), and the vendor's invoice in a process called 'three-way matching' to ensure accuracy before payment is made. This helps prevent fraudulent or incorrect payments.

5. What are some ways you would handle a situation where you receive an invoice for goods or services that were never received?

First, I'd verify internally with the relevant departments (e.g., receiving, procurement, the team that ordered the services) to confirm that the goods/services were indeed not received. I would also carefully review the invoice details, purchase order (if applicable), and any related contracts to ensure accuracy and identify any discrepancies.

Next, I would contact the vendor promptly to explain the situation, providing them with all relevant details and documentation. I would request clarification, proof of delivery or service completion, or a corrected invoice. If the vendor cannot provide satisfactory evidence or a reasonable explanation, I would formally dispute the invoice in writing, clearly stating the reasons for non-payment. I'd also keep a detailed record of all communication and actions taken. If necessary, I'd escalate the issue to a supervisor or legal counsel for further guidance.

6. Have you ever used any accounting software? If so, which ones?

Yes, I have experience with several accounting software packages. I've used QuickBooks Online and Xero extensively for tasks such as managing invoices, tracking expenses, reconciling bank accounts, and generating financial reports. I've also worked with more enterprise-level systems like SAP during a previous internship, primarily focusing on data entry and report extraction. My experience has given me a solid understanding of fundamental accounting principles and how they are implemented in different software environments.

7. What does it mean to reconcile an account?

Reconciling an account is the process of comparing two sets of records (e.g., bank statement and internal accounting records) to ensure that the balances agree. It involves identifying and investigating any discrepancies to determine the cause and make necessary adjustments to correct any errors. The goal is to provide assurance that the account balance is accurate and reliable.

Account reconciliation helps to detect fraud, identify errors in recording transactions, and improve the accuracy of financial reporting. It is a critical process for maintaining financial integrity and ensuring compliance with accounting standards. This can involve matching transactions one-to-one or using tools to automatically match and flag discrepancies.

8. How would you describe 'debit' and 'credit' in simple terms?

Debit and credit are the two sides of a double-entry accounting system. Think of it like this: debit increases asset and expense accounts, while credit increases liability, owner's equity, and revenue accounts. A simple way to remember it is:

- Debit: Left side; typically increases assets.

- Credit: Right side; typically increases liabilities and equity.

Every transaction affects at least two accounts – one with a debit and one with a credit – ensuring the accounting equation (Assets = Liabilities + Equity) always balances. For example, if you buy a computer for cash, you'd debit (increase) your 'Computer' asset account and credit (decrease) your 'Cash' asset account.

9. How would you handle finding a duplicate invoice?

Finding a duplicate invoice involves several steps. First, I'd define what constitutes a duplicate. Usually, it's matching on key fields like invoice number, vendor ID, date, and total amount. I would query the database using SQL, or other appropriate query language, to find records with matching values in these key fields. SELECT * FROM Invoices WHERE InvoiceNumber = 'XXX' AND VendorID = 'YYY' AND InvoiceDate = 'ZZZ' AND TotalAmount = 'AAA'; This query would identify potential duplicates.

Then, I'd investigate the identified potential duplicates further. This might involve manually reviewing the invoice images (if available) or contacting the vendor to confirm if it was indeed sent twice. Finally, based on the investigation, I would take action, such as voiding the duplicate invoice in the system or marking it as paid if it was a correction. Audit trails and proper documentation of the resolution steps are crucial.

10. Why is it important to keep accurate records in accounts payable?

Maintaining accurate records in accounts payable is crucial for several reasons. It ensures timely and correct payments to vendors, preventing late fees, damaged relationships, and potential legal issues. Accurate records also provide a clear audit trail, making it easier to track expenses, identify discrepancies, and comply with accounting regulations and internal controls. Good record-keeping supports accurate financial reporting, which is essential for making informed business decisions.

11. What is the importance of following up on outstanding invoices?

Following up on outstanding invoices is crucial for maintaining healthy cash flow. It ensures timely payments, reducing the risk of late payments or defaults. Consistent follow-up demonstrates professionalism and helps build strong relationships with clients, fostering trust and encouraging prompt payment habits.

Moreover, tracking and chasing overdue invoices helps identify potential issues early on, such as disputes over services or financial difficulties faced by clients. This allows businesses to proactively address these problems and prevent bad debt, ultimately protecting their financial stability and profitability.

12. What is 'petty cash' and how is it used?

Petty cash is a small amount of readily available cash kept on hand to pay for minor, incidental expenses where using a check or credit card is impractical. It's essentially a float of money managed locally.

Common uses include: postage, office supplies, small reimbursements to employees (e.g., parking), or emergency purchases. A custodian is usually responsible for managing the fund, disbursing cash, and reconciling it regularly to ensure funds are accounted for. Proper documentation (receipts) is crucial for tracking expenditures and maintaining the integrity of the petty cash fund.

13. What are some qualities that you think are important for someone working in accounts payable?

Several key qualities are crucial for success in accounts payable. Strong attention to detail is paramount, as even small errors can lead to significant financial discrepancies. Organizational skills are also essential for managing a high volume of invoices and payment requests. The ability to prioritize tasks effectively ensures timely payments and avoids late fees or strained vendor relationships. Excellent communication skills are necessary for interacting with vendors and internal stakeholders, resolving invoice issues, and clarifying payment terms.

Furthermore, a good understanding of accounting principles is vital for accurately coding invoices and reconciling accounts. Problem-solving skills are necessary to address discrepancies and investigate unusual transactions. Proficiency in relevant software and systems (e.g., ERP systems, accounting software) can greatly enhance efficiency and accuracy. Finally, someone in accounts payable should be reliable and trustworthy, given the sensitive nature of financial data they handle.

14. What is your understanding of 'three-way matching'?

Three-way matching is an accounting control used to prevent fraudulent or erroneous payments. It involves comparing three documents—the purchase order, the goods receipt note (or packing slip), and the invoice—before a payment is processed.

The process ensures that what was ordered, what was received, and what the supplier billed for all match. Discrepancies between these documents can indicate errors, such as incorrect pricing, quantity differences, or even fraudulent activity. By verifying these three documents, companies can significantly reduce the risk of overpayment or paying for goods or services not actually received.

15. If you noticed a large discrepancy on an invoice, what steps would you take?

First, I would verify the discrepancy by cross-referencing the invoice with the original purchase order, receiving documentation, and any relevant contracts or agreements. I would also check for any known pricing changes or special discounts that might apply.

Next, I would immediately contact the vendor or relevant internal department (e.g., accounts payable) to report the discrepancy and request clarification or a corrected invoice. I would clearly document the discrepancy, the date of the report, and the name of the person contacted, along with any reference numbers provided. If the discrepancy is significant, I would also escalate the issue to my supervisor.

16. How familiar are you with data entry, and what makes you good at it?

I have a solid understanding of data entry principles and have experience with various data entry tasks. I'm proficient in accurately and efficiently inputting data from various sources, including documents, spreadsheets, and online databases. I am comfortable using data entry software and tools.

I believe my attention to detail, accuracy, and speed make me well-suited for data entry roles. I am highly organized and can maintain focus on repetitive tasks while ensuring data integrity. I also possess strong typing skills and a commitment to meeting deadlines.

17. What does 'accrual accounting' mean to you?

Accrual accounting means that revenues and expenses are recognized when they are earned or incurred, regardless of when cash changes hands. It focuses on matching revenues with the expenses incurred to generate those revenues during a specific period.

For example, if a company provides a service in December but doesn't get paid until January, the revenue is recognized in December. Similarly, if a company receives an invoice in December for expenses incurred in December, the expense is recorded in December, even if it's not paid until January. This provides a more accurate picture of a company's financial performance than cash accounting.

18. Why do companies use a chart of accounts?

Companies use a chart of accounts (COA) for several key reasons. Primarily, it provides a standardized framework for organizing and categorizing all financial transactions. This standardization ensures consistency in financial reporting across different periods and departments, making it easier to analyze a company's financial performance.

Specifically, a COA allows businesses to accurately track assets, liabilities, equity, revenue, and expenses. This structured data is then used to generate financial statements like the balance sheet, income statement, and cash flow statement. This structured data also facilitates internal and external audits, compliance with regulatory requirements, and informed decision-making by management.

19. What is the difference between an invoice and a bill?

An invoice and a bill are essentially the same thing: a request for payment. The difference lies in the perspective of the issuer and the receiver. A seller sends an invoice to a buyer. The buyer receives a bill from the seller.

Think of it this way: If you're selling something, you create an invoice. If you're buying something, you receive a bill. They represent the same transaction, just from different sides.

20. How would you prioritize invoices for payment?

Invoice prioritization involves a few key factors. First, I'd consider due dates to avoid late payment penalties and maintain good vendor relationships. Next, I'd assess any early payment discounts offered, as taking advantage of these can improve cash flow. Critical vendors, those essential for business operations, would also receive high priority. Finally, I would also consider the amount, paying smaller value invoices more quickly to free up cash flow.

Using a scoring system can help. For example, assign points to invoices based on due date proximity, discount availability, vendor importance, and invoice amount. The invoices with the highest scores are then prioritized for payment. This provides a systematic, objective approach.

21. Describe a time you had to meet a tight deadline. How did you manage?

In my previous role, we were tasked with launching a new feature for our mobile app within a month, a deadline initially deemed challenging. To manage, I immediately broke down the project into smaller, manageable tasks and prioritized them based on dependencies. I then collaborated with the team to assign ownership and establish clear communication channels, holding daily stand-ups to track progress and address roadblocks promptly.

To maintain focus, I employed time-blocking techniques, dedicating specific periods to high-priority tasks and minimizing distractions. For example, when I was working on api_integration.py, I would set aside 2 hours exclusively for it. The team worked together to overcome any technical challenges. This structured approach, combined with effective communication and teamwork, allowed us to successfully launch the feature on time and within budget.

22. What are some potential red flags you would look for when reviewing an invoice?

When reviewing an invoice, I look for several potential red flags. Discrepancies between the purchase order and the invoice are a key indicator. For example, the quantity, unit price, or description of goods or services should match what was originally agreed upon. I also pay attention to unusual or unexpected charges, such as excessive shipping costs, vague "miscellaneous fees," or taxes applied incorrectly. Ensure the vendor's information, including their name, address, and tax identification number, is valid and consistent with our records.

Furthermore, I would check for duplicate invoice numbers, invoices that are significantly higher or lower than expected, or invoices received from unfamiliar vendors without prior authorization. Payment terms that differ from the standard agreement, like shortened payment windows or demands for upfront payment, should also raise suspicion. Finally, be wary of invoices with grammatical errors, typos, or formatting inconsistencies, as these could indicate fraudulent activity.

23. What is the purpose of a vendor statement?

A vendor statement provides a summary of all outstanding invoices and credits between a company and a vendor at a specific point in time. Its primary purpose is to reconcile the company's accounts payable records with the vendor's accounts receivable records, ensuring that both parties agree on the amount owed. This helps in avoiding payment disputes and maintaining a healthy business relationship.

Essentially, it acts as a confirmation of the vendor's records, detailing all transactions (invoices, payments, credits) for a particular period. By comparing the vendor statement to its own internal records, the company can identify discrepancies and resolve them promptly, ensuring accurate and timely payments.

24. What are some things you can do to ensure data accuracy when processing invoices?

To ensure data accuracy when processing invoices, several measures can be taken. First, implement robust data validation techniques. This includes checking data types, formats, and ranges for each field. For example, invoice numbers should conform to a specific pattern, dates should be valid, and amounts should be within reasonable limits. Utilizing automated data capture methods like OCR (Optical Character Recognition) can help reduce manual data entry errors, but these systems need careful configuration and validation to ensure accurate interpretation.

Secondly, establish clear data governance policies and procedures. This involves defining roles and responsibilities for data entry, validation, and approval. Implementing double-entry systems or multi-person verification can further minimize errors. Regularly auditing invoice data and comparing it against supporting documentation (e.g., purchase orders, receipts) can help identify and correct discrepancies. Finally, employee training on proper invoice processing procedures is crucial for maintaining accuracy.

25. What is the difference between a debit memo and a credit memo?

A debit memo (or debit memorandum) increases the balance of an account receivable, while a credit memo (or credit memorandum) decreases the balance of an account receivable. Think of it this way: from the seller's perspective, a debit memo means the customer owes more money (they are being debited), and a credit memo means the customer owes less money (they are being credited).

Common reasons for debit memos include price increases, previously under-billed amounts, or charges for services not originally included in the invoice. Credit memos are often issued for returns, allowances for damaged goods, or to correct over-billing errors.

26. What is your understanding of internal controls in accounts payable?

Internal controls in accounts payable (AP) are policies and procedures designed to ensure that payments are accurate, legitimate, and processed efficiently. They help to prevent fraud, errors, and unauthorized spending. Key controls include segregation of duties (separating invoice approval from payment processing), proper documentation and approval workflows, matching purchase orders to invoices and receiving reports (three-way matching), and regular reconciliation of AP sub-ledger to the general ledger.

Specifically, these controls cover areas such as vendor master data management (ensuring only legitimate vendors are added), invoice verification (confirming accuracy of charges), payment authorization (requiring appropriate approvals), and timely payment processing (avoiding late fees and maintaining good vendor relationships). Implementing robust internal controls in AP is crucial for maintaining financial integrity and mitigating risks.

27. What is the importance of maintaining good relationships with vendors?

Maintaining good relationships with vendors is crucial for several reasons. Positive relationships can lead to better pricing, improved service, and priority support when issues arise. Vendors who trust and respect your organization are more likely to go the extra mile to meet your needs. A strong relationship facilitates open communication, allowing for quicker resolution of problems and a deeper understanding of each other's requirements.

Furthermore, good vendor relationships can foster innovation and collaboration. Vendors may be more willing to share new technologies, offer customized solutions, or participate in joint projects when a strong partnership exists. This can provide a competitive advantage and contribute to the overall success of your organization. Building trust and mutual respect with vendors is an investment that pays off in the long run.

28. What are some ways to prevent fraud in accounts payable?

To prevent fraud in accounts payable, several internal controls can be implemented. Segregation of duties is crucial, ensuring that the same person doesn't approve invoices, create vendors, and issue payments. Require multi-level approvals for invoices exceeding a certain amount. Implement regular audits of vendor master data to identify duplicate or suspicious entries. Monitor employee expense reports for unusual patterns.

Furthermore, use technology effectively. Automate invoice processing with three-way matching (purchase order, receiving report, and invoice). Use data analytics to detect anomalies, such as duplicate invoices, payments to unauthorized vendors, or unusual payment amounts. Implement a robust system of access controls, limiting access to sensitive financial data based on roles. Conduct thorough background checks on new hires, particularly those in finance and accounting roles.

29. How do you stay organized when dealing with a large volume of invoices?

When dealing with a large volume of invoices, I prioritize organization by employing a multi-faceted approach. First, I implement a robust digital filing system, using clear and consistent naming conventions for all invoice files (e.g., VendorName_InvoiceNumber_Date). I leverage software with features like optical character recognition (OCR) to automatically extract key data from invoices, such as invoice number, date, amount, and vendor. This information is then used to populate a centralized spreadsheet or database for easy tracking and analysis.

Second, I establish a clear workflow for invoice processing, including defined steps for receipt, approval, payment, and reconciliation. This often involves setting up automated alerts for approaching due dates. I also use tools and techniques to automate invoice data entry. I utilize bulk processing features and integrations within my accounting software to streamline the process. Regularly reconciling invoices with bank statements and vendor statements is crucial to identify and resolve any discrepancies.

30. How would you handle a situation where a vendor is constantly sending incorrect invoices?

If a vendor consistently sends incorrect invoices, I would first document each instance of the error, noting the invoice number, date, and specific discrepancy. Then, I'd communicate the issues clearly and professionally to the vendor, providing detailed examples of the errors and requesting a corrected invoice. I would propose a call or meeting to discuss the errors and implement preventive measures, such as clarifying invoicing procedures or suggesting system updates on their end. If the errors persist after multiple attempts to resolve the issue, I would escalate the issue to my manager and potentially explore alternative vendors if the situation significantly impacts our business operations and financials.

Accounts Payable intermediate interview questions

1. How do you handle discrepancies between a purchase order, invoice, and receiving report?

When discrepancies arise between a purchase order (PO), invoice, and receiving report, a systematic approach is essential. First, I would carefully review all three documents to pinpoint the exact nature of the discrepancy. Is it a quantity mismatch, a price difference, or an incorrect item received? Clear communication is key, so I would reach out to the supplier and internal stakeholders (purchasing, receiving) to gather more information and understand the root cause.

Next, I would follow company policy for resolving such discrepancies. This usually involves documenting the issue, initiating a dispute process with the supplier if necessary, and adjusting the invoice or payment accordingly. If the discrepancy is minor and within an acceptable threshold, it might be resolved with internal approval. Larger discrepancies may require further investigation and potentially a revised purchase order or return of goods. Maintaining accurate records and documentation throughout the process is crucial for auditability and preventing future errors.

2. Describe your experience with different accounting software systems (e.g., SAP, Oracle, NetSuite).

I have experience with several accounting software systems. I've worked extensively with NetSuite, primarily in managing general ledger, accounts payable, and accounts receivable. My experience includes customizing reports and dashboards to provide real-time financial insights. I've also used SAP, specifically the FI/CO modules, where I was involved in month-end closing processes, financial reporting, and variance analysis.

While I have less hands-on experience with Oracle Financials, I understand its core functionalities and have used it for data extraction and reconciliation purposes. My exposure has allowed me to adapt quickly to new systems and understand the key differences and similarities in their functionalities and reporting capabilities.

3. Explain the three-way matching process in detail.

Three-way matching is a crucial process in accounts payable and procurement to ensure accurate and legitimate payments. It involves comparing three key documents: the purchase order (PO), the goods receipt note (GRN) (also known as receiving report), and the supplier invoice.

The process verifies that:

- The invoice matches the purchase order: This ensures that the goods/services billed were actually ordered, and the price aligns with what was agreed upon.

- The invoice matches the goods receipt note: This confirms that the goods/services invoiced were actually received in the correct quantity and condition.

- The purchase order matches the goods receipt note: This confirms that the quantity and items ordered match the items received.

4. What is your approach to prioritizing invoices for payment?

My approach to prioritizing invoices for payment involves several key factors. First, I prioritize invoices based on their due dates, ensuring that those closest to being overdue are addressed first to avoid late payment fees and maintain good vendor relationships. Second, I consider any early payment discounts offered, as taking advantage of these can result in cost savings for the company. Finally, I factor in the vendor's importance to our business operations; critical suppliers might be prioritized to ensure uninterrupted supply chains.

Specifically, I would look at a few key data points, such as vendor payment terms (e.g., net 30, net 60), the amount due, and any potential impact on our operational flow if the invoice is not paid on time. Based on these factors, a weighted prioritization can be calculated. This ensures a systematic and objective approach to invoice payment prioritization.

5. How do you ensure compliance with company policies and procedures in Accounts Payable?

I ensure compliance with company policies and procedures in Accounts Payable through several methods. Firstly, I meticulously review all invoices and payment requests to verify they adhere to established guidelines regarding approvals, coding, documentation, and authorized vendors. This involves cross-referencing against purchase orders, contracts, and receiving reports to ensure accuracy and legitimacy.

Secondly, I proactively stay updated on any changes to company policies and procedures through regular communication and training. I also perform periodic internal audits of processed transactions to identify any potential deviations or areas for improvement. Furthermore, I utilize automated systems and tools to enforce controls, such as matching invoices to purchase orders, flagging duplicate payments, and verifying vendor information against approved databases. This helps to minimize errors and prevent fraudulent activities, ensuring adherence to established guidelines.

6. Describe a time when you identified and resolved a significant error in Accounts Payable.

In a previous role, I identified a systematic error in our Accounts Payable process where vendor invoices were being paid twice due to a glitch in our automated payment system. The system was incorrectly duplicating payment requests for invoices with similar amounts and vendor names.

To resolve this, I first analyzed the payment history and identified a pattern of duplicate payments. I then worked with the IT department to debug the payment system, pinpointing the exact code responsible for the duplication. We implemented a fix that prevented the system from creating duplicate payment requests, and I also developed a script to identify and flag any existing duplicate payments that had already been made, allowing us to recover the overpayments from the vendors involved.

7. How do you stay updated on changes in accounting regulations and best practices?

I stay updated on accounting regulations and best practices through a variety of methods. I regularly review publications from authoritative bodies like the FASB, IASB, and AICPA, paying close attention to exposure drafts and final pronouncements. I also subscribe to industry newsletters and journals, and attend webinars and conferences offered by professional organizations to learn about emerging trends and interpretations.

Furthermore, I leverage online resources such as accounting blogs and forums to understand how these changes are being implemented in practice and to participate in discussions with other professionals. I also actively seek out opportunities for continuing professional education (CPE) credits related to accounting standards to ensure my knowledge remains current.

8. Explain your understanding of accrual accounting and its impact on Accounts Payable.

Accrual accounting recognizes revenues when earned and expenses when incurred, regardless of when cash changes hands. This impacts Accounts Payable (AP) because AP represents obligations to pay for goods or services already received (incurred), even if invoices haven't been paid yet. Accrual accounting mandates recording these liabilities in the financial statements (balance sheet) as AP, reflecting a more accurate picture of a company's financial position by matching expenses to the period they benefit, not just when cash is disbursed.

Specifically, an increase in expenses (e.g., utilities used) where an invoice hasn't arrived yet, results in a liability (an accrual entry). These accruals are recorded as increases in Accounts Payable, even before the invoice arrives, so the company's financial statements reflect the true economic activity that took place.

9. How do you handle rush or urgent payment requests?

When handling rush or urgent payment requests, my priority is to verify the legitimacy and urgency of the request. This involves confirming the request's origin, purpose, and the validity of the payment details with appropriate parties (e.g., requestor's manager, finance team). I'd then assess the potential impact of delaying the payment and balance that against the risk of bypassing standard procedures. If everything checks out, I'd expedite the payment process while adhering to internal controls as much as possible.

To expedite, I would communicate clearly with all relevant stakeholders (e.g., accounts payable, treasury) to ensure everyone is aware of the urgency and their roles in the process. I would document all steps taken and approvals received for audit purposes. If standard procedures can't be fully followed, I'd escalate to the appropriate authority for final approval and guidance, ensuring a clear audit trail of the deviation.

10. Describe your experience with vendor communication and relationship management.

Throughout my career, I've consistently interacted with vendors, focusing on clear communication and building strong relationships. This includes negotiating contracts, clarifying technical specifications, and resolving issues promptly. For example, when working on a project requiring specialized hardware, I managed the vendor relationship by clearly outlining our requirements, maintaining regular communication to track progress, and proactively addressing any roadblocks to ensure timely delivery and adherence to budget.

I've also implemented strategies to streamline vendor communication, such as establishing standardized reporting formats and scheduling regular check-in meetings. My approach emphasizes transparency, mutual respect, and a collaborative problem-solving mindset. I'm comfortable escalating issues when necessary, but always aim to find mutually beneficial solutions that maintain a positive working relationship.

11. What are some key performance indicators (KPIs) that you track in Accounts Payable, and why are they important?

Some key performance indicators (KPIs) tracked in Accounts Payable include:

- Invoice Processing Time: Measures the average time taken to process an invoice from receipt to payment. Important because shorter processing times can improve vendor relationships and potentially allow you to take advantage of early payment discounts.

- Cost Per Invoice: Calculates the total cost associated with processing a single invoice. Helps identify areas for process improvement and automation to reduce operational expenses.

- Payment Accuracy Rate: Tracks the percentage of payments made correctly and on time. Directly impacts vendor satisfaction and avoids late payment penalties and potential disruptions to supply chains.

- Duplicate Payment Rate: Measures the frequency of duplicate payments being made. A low rate indicates effective controls are in place. Reducing duplicates saves money and time spent on recoveries.

- Discount Capture Rate: Shows the percentage of available early payment discounts that are actually captured. Optimizing this KPI maximizes savings and improves cash flow.

- Days Payable Outstanding (DPO): Measures the average number of days it takes a company to pay its suppliers. A longer DPO can improve cash flow, but excessively long DPO may damage relationships with suppliers.

12. How do you handle employee expense reports and reimbursements?

I streamline employee expense reports and reimbursements using a systematic approach. Employees submit expense reports, usually via a dedicated platform like Expensify or Concur, which includes itemized receipts and clear descriptions for each expense. These reports are then reviewed for policy compliance and accuracy by designated approvers, often department heads or finance personnel. Once approved, the reimbursement is processed, typically through direct deposit or company check, within a defined timeframe outlined in the company policy.

To ensure transparency and efficiency, I maintain a detailed record of all submitted and processed expense reports. Regular audits are conducted to identify any discrepancies or potential fraud. I also prioritize clear communication with employees regarding expense policies and reimbursement procedures, addressing any queries or concerns promptly. Furthermore, using a proper and dedicated tool, provides the benefit of easier data analysis for trends and potential policy updates.

13. Explain your experience with processing payments via different methods (e.g., ACH, wire transfer, check).

My experience with processing payments involves working with various methods, including ACH, wire transfers, and checks, within accounting software and banking portals. I've handled the full cycle, from initiating payments and verifying bank details to reconciling transactions and resolving discrepancies. For example, I've used accounting software like QuickBooks and Xero to record outgoing payments and match them with invoices.

Specifically with ACH, I've worked with NACHA files and understood the importance of secure data transmission. While I have not directly written code for payment processing APIs, I've worked alongside developers who integrated payment gateways and processors such as Stripe or PayPal using their APIs. I assisted with user acceptance testing for the API calls and integration.

14. How do you handle debit memos and credit memos?

Debit memos increase the amount a customer owes or decrease the amount you owe a vendor. I ensure these are properly documented, approved (following company policy), and accurately entered into the accounting system (e.g., SAP, NetSuite). The corresponding expense or asset accounts are updated appropriately, and reconciliation is performed regularly to confirm accuracy.

Credit memos, conversely, decrease the amount a customer owes or increase the amount you owe a vendor. The handling is similar: proper documentation, approval, and accurate entry into the system. The corresponding revenue or liability accounts are adjusted. I pay close attention to the reasons for credit memos (returns, allowances, errors) as this can indicate underlying issues that need addressing to prevent future occurrences.

15. Describe your experience with month-end close processes in Accounts Payable.

My experience with month-end close in Accounts Payable includes a range of activities to ensure accurate and timely financial reporting. I've been involved in tasks like verifying that all invoices are processed and reconciled, accruing for any goods or services received but not yet invoiced, and reconciling vendor statements to the AP ledger. A key aspect is investigating and resolving any discrepancies, such as unmatched purchase orders or pricing differences, and ensuring proper documentation for audit trails.

I also participate in preparing various month-end reports, such as aging reports and payment summaries, which are used to analyze AP performance and identify potential issues. I’m familiar with the importance of meeting strict deadlines during the close process and collaborating effectively with other departments to gather necessary information and resolve any outstanding items promptly. Furthermore, I understand and apply internal controls related to AP to maintain data integrity and prevent fraud.

16. How do you ensure data accuracy and integrity in Accounts Payable?

To ensure data accuracy and integrity in Accounts Payable, several measures can be implemented. Firstly, implement a robust three-way matching process, verifying the purchase order, receiving report, and vendor invoice for discrepancies before payment. Secondly, establish clear data validation rules and controls within the AP system to prevent incorrect entries, such as mandatory fields and format checks. Regularly reconcile vendor statements with AP ledger balances to identify and resolve any discrepancies promptly. Additionally, implement segregation of duties to prevent fraud and errors. Finally, perform periodic audits of AP processes and data to identify weaknesses and improve controls.

Furthermore, user access controls limit who can create, modify, or approve invoices. Employee training on AP policies and procedures is also critical. Automation using Optical Character Recognition (OCR) to extract data from invoices can reduce manual data entry errors. Finally, continuous monitoring of key performance indicators (KPIs) such as duplicate payments and invoice processing time, and implementing corresponding actions is essential.

17. Explain your understanding of escheatment laws and unclaimed property.

Escheatment laws govern the process by which unclaimed property reverts to the state. Unclaimed property arises when an asset, typically financial, is abandoned by its owner, often due to inactivity or a failure to maintain contact with the institution holding the asset. States have laws requiring companies and financial institutions to report and remit these unclaimed assets after a specified dormancy period, which varies depending on the type of property and the state.

The primary purpose of escheatment is to protect consumers by safeguarding abandoned assets and providing a mechanism for owners or their heirs to reclaim them. States hold the property as custodians, and owners can file claims to recover their assets indefinitely in many jurisdictions. Common examples of unclaimed property include bank accounts, uncashed checks, insurance payouts, stocks, and dividends.

18. How do you handle invoices with missing or incomplete information?

When I encounter invoices with missing or incomplete information, my first step is to meticulously document the discrepancies. I then prioritize contacting the vendor or relevant internal department (e.g., purchasing, accounting) to obtain the missing data or clarification. This could involve requesting a revised invoice, a supporting document, or simply verifying the correct information.

While awaiting the missing information, I will flag the invoice in our system to prevent it from being processed prematurely. This ensures that payments are not made on incomplete or inaccurate data. I also maintain a log of all outstanding information requests and follow up regularly to expedite the resolution process. If it is a recurring problem with a vendor, I'll escalate it to the appropriate team for vendor management.

19. Describe your experience with automating Accounts Payable processes.

I have experience automating various Accounts Payable (AP) processes to improve efficiency and reduce manual effort. Specifically, I've worked with implementing OCR (Optical Character Recognition) solutions to automatically extract data from invoices, eliminating the need for manual data entry. This involved configuring the OCR software, training it to recognize different invoice formats, and integrating it with our accounting system. I've also automated the invoice approval workflow using a rules-based system, routing invoices to the appropriate approvers based on predefined criteria such as amount or vendor. This improved approval times and reduced bottlenecks.

Furthermore, I contributed to automating payment processing by integrating our AP system with our bank. This allowed for automatic generation of payment files and reconciliation of bank statements, minimizing manual intervention and reducing errors. My contributions also extend to creating automated reports to monitor key AP metrics, such as invoice processing time and payment accuracy. I have used tools like Python and RPA (Robotic Process Automation) for building custom automation solutions where needed.

20. How do you handle foreign currency transactions in Accounts Payable?

When processing foreign currency transactions in Accounts Payable, the key is to accurately record the transaction amount in both the foreign currency and the functional currency (usually the company's reporting currency). Here's how I'd typically handle it:

First, I'd obtain the exchange rate on the date of the invoice. Then, I'd convert the foreign currency amount to the functional currency using that rate. This converted amount is what gets recorded in the Accounts Payable system. If the payment is made on a different date with a different exchange rate, a gain or loss due to currency fluctuation may occur. This gain or loss would be recorded as a separate line item, impacting the profit and loss statement. I would also ensure proper documentation of exchange rates and calculations for audit purposes.

21. Explain your approach to documenting and maintaining Accounts Payable records.

My approach to documenting and maintaining Accounts Payable (AP) records involves a combination of organized processes and leveraging technology. Primarily, I ensure all invoices and supporting documentation are systematically filed, either physically or digitally, with clear naming conventions. I maintain a detailed AP ledger, accurately recording all transactions, payment dates, and invoice numbers. Reconciliation is a critical step, regularly comparing the AP ledger to vendor statements to identify and resolve discrepancies promptly.

For digital record keeping, I utilize accounting software features for document attachments and transaction notes. I also ensure there are clear audit trails by documenting who entered the transaction, when it was entered, and any subsequent modifications. Finally, I adhere to a retention policy for AP records, both physical and digital, in compliance with legal and regulatory requirements.

22. How do you reconcile vendor statements with Accounts Payable records?

Reconciling vendor statements with Accounts Payable (AP) records involves comparing the vendor's statement of account with the corresponding AP ledger to identify discrepancies. The process typically starts by matching invoices listed on the vendor statement to invoices recorded in the AP system, ensuring that invoice numbers, dates, amounts, and purchase order numbers align. Any discrepancies, such as missing invoices, incorrect amounts, or duplicate entries, are investigated and resolved.

To resolve discrepancies, supporting documentation like purchase orders, receiving reports, and payment confirmations are reviewed. Contacting the vendor to clarify any outstanding issues or obtain missing documentation is also crucial. Adjustments are then made to the AP records to reflect the correct information, and a reconciliation report is generated to document the process and ensure that the vendor statement and AP records are in agreement. Regular reconciliation helps maintain accurate financial records, prevent overpayments, and strengthen vendor relationships.

23. Describe a time when you had to work under pressure to meet a tight deadline in Accounts Payable.

During month-end closing at my previous role, our AP system experienced a significant outage, impacting our ability to process invoices and make timely payments. With numerous critical payments due to avoid late fees and maintain vendor relationships, I had to quickly adapt. I immediately contacted IT support to understand the estimated downtime, and then prioritized the most urgent invoices based on due dates and vendor importance. I manually tracked these high-priority invoices in a spreadsheet, communicated the situation to the team and our key vendors explaining the delay and assuring them of resolution, and prepared manual payment requests where possible, all while IT worked to restore the system.

Despite the system being down for several hours, we managed to process the most critical payments on time by working extended hours and implementing these workaround solutions. This experience taught me the importance of remaining calm under pressure, clear communication, and having backup plans to mitigate unforeseen challenges. We also documented this scenario and created a disaster recovery plan for future system outages to prevent similar disruptions.

24. How do you investigate and resolve payment discrepancies?

To investigate payment discrepancies, I typically start by gathering all relevant information: transaction IDs, customer details, payment amounts, dates, and any error messages. I then compare this data against our internal records (e.g., accounting system, payment gateway logs) to identify the point of divergence. For instance, I would check if the amount charged matches the amount authorized, and if the transaction status is consistent across all systems. Common discrepancies include incorrect amounts, duplicate payments, failed authorizations, or timing issues.

Resolution often involves coordinating with different teams (e.g., customer support, finance, engineering) and potentially external parties (e.g., payment processor, bank). Depending on the cause, I might initiate a refund, adjust the transaction record, or escalate the issue to the appropriate party for further investigation. It's crucial to document every step of the investigation and resolution process and communicate proactively with the customer to maintain transparency and trust.

25. Explain your understanding of internal controls related to Accounts Payable.

Internal controls related to Accounts Payable (AP) are policies and procedures designed to ensure that AP processes are efficient, accurate, and compliant with relevant regulations. They help prevent fraud, errors, and unauthorized payments. Key controls include segregation of duties (e.g., separating invoice processing from payment authorization), requiring purchase orders for all goods and services, matching invoices to purchase orders and receiving reports (three-way matching), and regular review and reconciliation of AP balances.

These controls aim to ensure that only valid and authorized payments are made to legitimate vendors, that payments are made in a timely manner to take advantage of discounts, and that AP records are accurate and complete for financial reporting purposes. Effective internal controls over AP are crucial for maintaining financial integrity and protecting company assets. Other examples include having a clearly defined approval process, maintaining a vendor master file with verified vendor information, and implementing automated payment systems with built-in controls.

Accounts Payable interview questions for experienced

1. Describe a time you identified and resolved a significant discrepancy in vendor payments. What steps did you take?

In my previous role, I noticed a recurring overpayment to a vendor providing marketing services. The payments were consistently higher than the agreed-upon rates in the contract.

My steps included first, verifying the payment history against the contract terms. Then, I contacted the vendor to discuss the discrepancy. After that, I reviewed the invoices thoroughly to identify the source of the error which turned out to be a misconfigured billing script on the vendor's end, creating duplicate entries that were being passed to our system. To fix it, I worked with our IT team to implement a new validation rule in our payment system, preventing future duplicate invoice processing. Finally, I successfully negotiated a refund for the overpayments and ensured the vendor corrected their billing process.

2. How do you ensure compliance with tax regulations related to vendor payments, such as 1099 reporting?

To ensure compliance with tax regulations related to vendor payments and 1099 reporting, I would implement a multi-faceted approach. First, I would establish a robust vendor onboarding process that includes collecting accurate vendor information, such as legal names, addresses, and Taxpayer Identification Numbers (TINs) (e.g., EIN or SSN), using W-9 forms. This data would be validated and stored securely.

Secondly, I would implement automated systems to track payments made to vendors throughout the year. This involves classifying payments correctly based on IRS guidelines to determine 1099 reportability. Systems would generate 1099 forms accurately and file them electronically with the IRS by the deadline, and also distribute copies to the vendors. Finally, periodically review and update processes to reflect changes in tax laws and regulations.

3. Explain your experience with implementing or improving accounts payable automation systems.

I have experience in streamlining accounts payable processes through automation. For example, at my previous company, I was involved in implementing an invoice processing system that automatically extracted data from invoices using OCR technology and machine learning. This reduced manual data entry by approximately 70% and significantly shortened invoice processing times.

Furthermore, I contributed to improving the matching of purchase orders, invoices, and goods receipts. I also configured automated workflows for invoice approvals based on pre-defined rules, ensuring timely payments and minimizing late payment penalties. Additionally, I worked with the IT team to integrate the AP automation system with our existing ERP system, enabling seamless data flow and improved reporting capabilities.

4. Walk me through your process for handling invoices in foreign currencies. How do you mitigate risks associated with currency fluctuations?

My process for handling invoices in foreign currencies involves several steps. First, I record the invoice amount in the foreign currency and the corresponding exchange rate on the invoice date. I then convert the amount to our base currency (e.g., USD) using that day's exchange rate for accounting purposes. I keep a record of the exchange rate used for each invoice.

To mitigate risks associated with currency fluctuations, I employ a few strategies. One common method is to use forward contracts to lock in an exchange rate for future payments. Another approach is to negotiate with vendors to invoice in our base currency or to agree on a fixed exchange rate. Finally, I closely monitor exchange rate movements and adjust pricing or payment timing where possible to minimize potential losses.

5. How do you manage relationships with vendors to ensure timely invoice submission and payment?

To manage vendor relationships and ensure timely invoice submission and payment, I focus on clear communication and proactive management. This includes establishing clear expectations upfront regarding invoice formats, submission deadlines, and payment terms in the vendor agreement. Regular check-ins, particularly before critical deadlines, help address any potential roadblocks. I also implement a system for tracking invoice receipt and processing, which might include using accounting software or a dedicated spreadsheet. Any discrepancies or issues are promptly communicated to the vendor for resolution.

Beyond the initial setup, maintaining open communication is key. I build rapport with vendor contacts to foster a collaborative relationship. This allows for easier discussions about any challenges either party faces. I ensure timely payments are made according to the agreed-upon terms to encourage continued cooperation and prompt invoice submissions.

6. Describe your experience with internal and external audits of the accounts payable function.

I have participated in both internal and external audits of the accounts payable function. My experience includes preparing documentation such as invoices, payment records, and vendor agreements for auditors. I've also assisted in reconciling accounts payable sub-ledgers to the general ledger and investigating discrepancies identified during the audit process. I understand the importance of maintaining accurate and well-organized records to facilitate a smooth audit process.

Specifically, during these audits, I've worked on tasks like verifying invoice approvals, ensuring compliance with company policies and procedures, and confirming proper segregation of duties. I've also helped to implement corrective actions in response to audit findings, such as improving internal controls or refining payment processes to minimize errors and improve efficiency. My goal is always to contribute to a successful audit outcome by providing accurate information and supporting the auditors' work.

7. What strategies do you use to negotiate favorable payment terms with vendors?

When negotiating payment terms with vendors, I prioritize building strong, long-term relationships. I start by researching industry standards for payment terms and the vendor's typical terms. This provides a benchmark for negotiation. I aim to negotiate extended payment terms (e.g., net 60 or net 90) to improve cash flow, especially for larger contracts.

I also explore options like early payment discounts in exchange for faster payment, which can benefit both parties. Volume discounts, phased payments tied to project milestones, and negotiating favorable currency exchange rates are other strategies I employ. Finally, I always ensure that the agreed-upon payment terms are clearly documented in the contract to avoid any misunderstandings later on.

8. How would you approach a situation where you suspect fraudulent activity within the accounts payable process?

If I suspected fraudulent activity within the accounts payable process, my initial approach would involve discreetly gathering as much information as possible without alerting the potential perpetrators. This includes carefully reviewing relevant documentation such as invoices, purchase orders, payment records, and vendor master data, looking for irregularities like unusual payment amounts, duplicate invoices, or unfamiliar vendor details. I would document all findings meticulously.

Next, I would escalate my concerns to the appropriate authority within the organization, such as the internal audit department, compliance officer, or my direct supervisor, providing them with the documented evidence I've collected. It's crucial to involve the right people who have the authority and expertise to investigate the matter thoroughly and take appropriate action, following established company protocols and legal requirements. I would cooperate fully with their investigation, providing any additional information or assistance needed while maintaining confidentiality.

9. Explain your understanding of GAAP principles as they relate to accounts payable.

GAAP (Generally Accepted Accounting Principles) provides the framework for standardizing financial reporting in the United States. As it relates to accounts payable, GAAP dictates how and when liabilities to suppliers and vendors should be recognized and reported on a company's balance sheet. A primary focus is on the accrual basis of accounting, which means expenses (and the corresponding liability in accounts payable) are recognized when the goods or services are received, regardless of when payment is made.

Key GAAP principles impacting accounts payable include the matching principle (matching expenses to revenues in the same period), the principle of conservatism (recognizing potential losses and liabilities when they are probable and reasonably estimable), and full disclosure (providing sufficient information about accounts payable so that financial statement users can make informed decisions). This involves ensuring proper documentation, accurate recording of transactions, and transparency in disclosing related-party transactions or significant payment terms. Furthermore, GAAP guides the classification of accounts payable as current liabilities due to their short-term nature, typically payable within one year.

10. How do you prioritize invoices for payment, and what factors do you consider?

I prioritize invoices for payment based on several factors to ensure timely and efficient processing. Key considerations include due date, payment terms (e.g., early payment discounts), vendor relationships (prioritizing critical suppliers), potential late payment penalties, and available cash flow. I also consider invoice amount, prioritizing smaller invoices to maintain good vendor relationships or larger invoices to avoid significant disruptions.