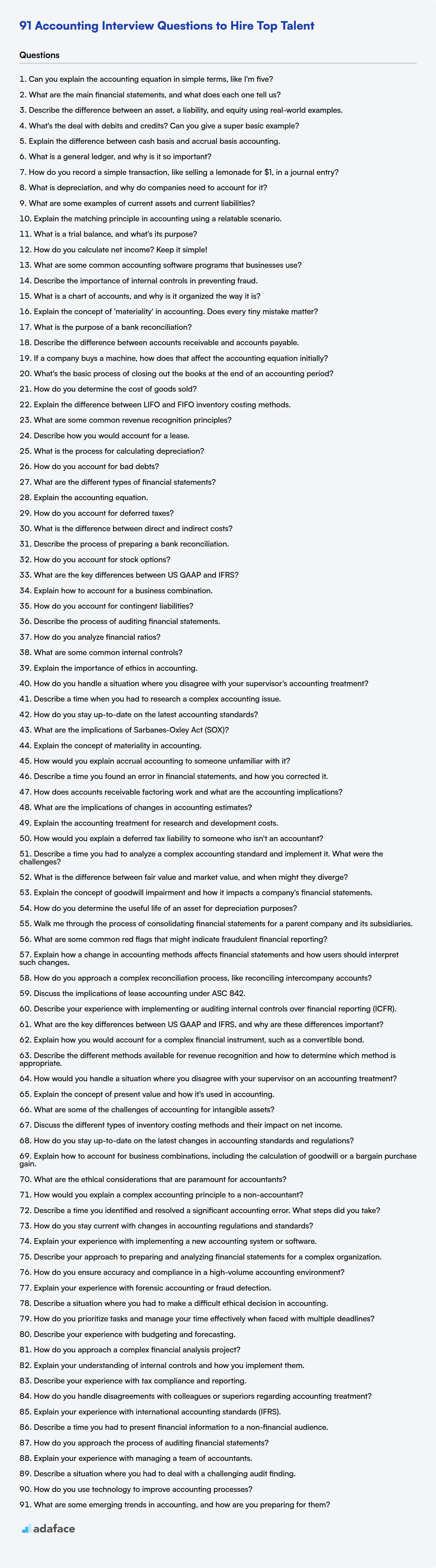

Interviewing accounting professionals can be tricky, as their expertise touches every part of a business. A well-prepared question list ensures you identify candidates who not only understand accounting principles, but also possess skills like attention to detail, problem-solving, and ethical conduct, as highlighted in our blog post on skills required for accountants.

This post provides a curated list of accounting interview questions, categorized by experience level, from basic to expert, including accounting MCQs. You'll be equipped to assess candidates on financial accounting, cost accounting, auditing, and their familiarity with accounting software.

By using these questions, you'll enhance your ability to hire the right accounting talent. Consider using an Accounting Test before interviews to filter candidates effectively.

Table of contents

Basic Accounting interview questions

1. Can you explain the accounting equation in simple terms, like I'm five?

Imagine you have a piggy bank. The accounting equation is like understanding what's inside and where it came from.

Everything you own (your stuff in the piggy bank - toys, candies, etc.) is called Assets. This stuff either came from your own savings (your Equity) or from borrowing from someone (maybe your parents, that's a Liability). So, the equation is: Assets = Liabilities + Equity. It basically means what you have (Assets) is equal to what you owe + what you truly own (Equity).

2. What are the main financial statements, and what does each one tell us?

The main financial statements are the Income Statement, Balance Sheet, and Statement of Cash Flows.

- The Income Statement (also known as the Profit and Loss statement) reports a company's financial performance over a period of time. It shows revenues, expenses, and ultimately, net income or net loss.

- The Balance Sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It follows the accounting equation: Assets = Liabilities + Equity.

- The Statement of Cash Flows tracks the movement of cash both into and out of a company during a period. It categorizes cash flows into operating, investing, and financing activities.

3. Describe the difference between an asset, a liability, and equity using real-world examples.

An asset is something a company owns that has future economic value. A liability is something a company owes to others. Equity represents the owners' stake in the company.

For example, a company's cash balance, buildings, and equipment are assets. Bank loans, accounts payable (money owed to suppliers), and salaries owed to employees are liabilities. The total investment made by the owners of the business plus any retained profits that remain in the business after payments (dividends) to the owner(s) is equity.

4. What's the deal with debits and credits? Can you give a super basic example?

Debits and credits are the fundamental building blocks of double-entry accounting. Every transaction affects at least two accounts. Debits increase asset, expense, and dividend accounts, while they decrease liability, owner's equity, and revenue accounts. Credits do the opposite; they increase liability, owner's equity, and revenue accounts, while decreasing asset, expense, and dividend accounts. The accounting equation (Assets = Liabilities + Equity) must always balance.

For example, if a company buys a computer for $100 cash, the asset 'Computer' increases (debit), and the asset 'Cash' decreases (credit). So, we would debit 'Computer' for $100 and credit 'Cash' for $100.

5. Explain the difference between cash basis and accrual basis accounting.

Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid out, regardless of when the actual transaction occurred. It's simple to use, especially for small businesses.

Accrual basis accounting, on the other hand, recognizes revenue when it's earned (regardless of when cash is received) and expenses when they're incurred (regardless of when cash is paid). This provides a more accurate picture of a company's financial performance over time because it matches revenues with the expenses used to generate those revenues.

6. What is a general ledger, and why is it so important?

A general ledger is the master record of all financial transactions of a company. It organizes and summarizes all debits and credits from journals, providing a complete history of every financial transaction. It is like the 'single source of truth' for a company's financial data.

It's important because it's the foundation for preparing financial statements (balance sheet, income statement, and statement of cash flows). Accurate financial statements are crucial for making informed business decisions, securing loans, attracting investors, and complying with regulatory requirements. Without a reliable general ledger, a company cannot accurately assess its financial performance or position.

7. How do you record a simple transaction, like selling a lemonade for $1, in a journal entry?

To record selling lemonade for $1, the journal entry would involve a debit to the cash account and a credit to the sales revenue account. This reflects the increase in cash and the recognition of revenue from the sale.

The entry would look like this:

- Debit: Cash - $1.00

- Credit: Sales Revenue - $1.00

8. What is depreciation, and why do companies need to account for it?

Depreciation is the accounting method of allocating the cost of a tangible asset over its useful life. It represents the gradual decrease in the value of an asset due to wear and tear, obsolescence, or usage.

Companies need to account for depreciation for several reasons. Firstly, it provides a more accurate picture of a company's financial performance by matching the expense of an asset to the revenue it generates over time. Secondly, it helps in accurately valuing a company's assets on its balance sheet. Finally, it is required by accounting standards (like GAAP or IFRS) for financial reporting purposes.

9. What are some examples of current assets and current liabilities?

Current assets are assets that a company expects to convert to cash or use up within one year or its operating cycle, whichever is longer. Examples include: Cash, Accounts Receivable, Inventory, Prepaid Expenses (like rent or insurance), and Marketable Securities.

Current liabilities are obligations a company expects to settle within one year or its operating cycle. Examples include: Accounts Payable, Salaries Payable, Short-Term Debt, Unearned Revenue, and Accrued Expenses (like utilities).

10. Explain the matching principle in accounting using a relatable scenario.

The matching principle dictates that expenses should be recognized in the same period as the revenues they helped generate. Imagine you own a lemonade stand. You buy lemons, sugar, and cups for $10 (expenses). You sell lemonade and make $25 in revenue. The matching principle says you should record the $10 expense in the same period you record the $25 revenue, giving you a profit of $15.

If, for example, you bought the lemons and sugar in one month but didn't sell the lemonade until the next, the $10 expense is still recognized in the second month, when the $25 revenue is recognized, not when the lemons were purchased. This accurately reflects the true profitability of your lemonade sales, ensuring that revenue and its related costs are reported together.

11. What is a trial balance, and what's its purpose?

A trial balance is a list of all the general ledger accounts (both debit and credit accounts) contained in the ledger of a business. It is used to prove that the total of all debit balances is equal to the total of all credit balances. This confirms the fundamental accounting equation (Assets = Liabilities + Equity) is in balance.

The purpose of a trial balance is primarily for error detection. If the debits and credits don't match, there's an error somewhere in the bookkeeping. It also serves as a foundation for preparing financial statements like the income statement and balance sheet, giving a summary of all accounts for easy reference.

12. How do you calculate net income? Keep it simple!

Net income is calculated by subtracting total expenses from total revenue. Simply put:

Net Income = Total Revenue - Total Expenses

This gives you the profit a company has earned over a period, taking into account all costs involved in earning that revenue. It's a key indicator of a company's profitability.

13. What are some common accounting software programs that businesses use?

Businesses use a variety of accounting software programs, both cloud-based and on-premise. Some of the most common include: QuickBooks (Online and Desktop versions), Xero, Sage Intacct, and NetSuite. These solutions range from simple bookkeeping tools for small businesses to more comprehensive enterprise resource planning (ERP) systems for larger organizations.

Other options that some businesses might use are: FreshBooks (popular with freelancers and service-based businesses), Wave Accounting (free option for very small businesses), and Microsoft Dynamics 365 (another ERP solution). The best choice depends on the specific needs and budget of the business.

14. Describe the importance of internal controls in preventing fraud.

Internal controls are crucial for preventing fraud by establishing a framework of policies and procedures that safeguard assets, ensure the accuracy of financial records, and promote operational efficiency. They act as a first line of defense, reducing the opportunities for fraudulent activities to occur and increasing the likelihood of detection if they do.

Effective internal controls help to deter fraud through various mechanisms: Segregation of duties (preventing one person from controlling all aspects of a transaction), Authorization and approval processes (requiring approval for significant transactions), Reconciliations (comparing records to identify discrepancies), Physical safeguards (protecting assets from theft or misuse), and Monitoring (regularly assessing the effectiveness of controls). By implementing these controls, organizations can minimize the risk of financial loss, reputational damage, and legal repercussions associated with fraudulent activities.

15. What is a chart of accounts, and why is it organized the way it is?

A chart of accounts (COA) is a structured list of all the accounts used in an organization's general ledger. It provides a framework for organizing financial transactions and ensures consistency in financial reporting. Each account is typically assigned a unique number or code, which facilitates data entry, analysis, and reporting.

The organization of a COA is crucial for effective financial management. It is usually structured hierarchically, often grouping accounts by type (assets, liabilities, equity, revenue, expenses). The specific organization depends on the industry, size, and reporting requirements of the company. A well-organized COA allows for easy identification of account types, simplifies the preparation of financial statements, and facilitates meaningful analysis of financial performance. It also ensures transactions are categorized correctly for taxes.

16. Explain the concept of 'materiality' in accounting. Does every tiny mistake matter?

Materiality in accounting refers to the significance of an omission or misstatement of accounting information. Information is considered material if its omission or misstatement could influence the economic decisions of users of financial statements. In simpler terms, it's about whether a mistake is big enough to matter to someone making a decision based on the financials.

Not every tiny mistake matters. While accuracy is important, accountants focus on whether errors are individually or collectively material. A trivial error that wouldn't affect anyone's decisions is generally not considered material and may not require correction, especially if the cost of correcting it outweighs the benefit. However, several immaterial items in aggregate can create a material error.

17. What is the purpose of a bank reconciliation?

The purpose of a bank reconciliation is to compare the cash balance on a company's balance sheet to the corresponding bank statement. It identifies any discrepancies between these two records, ensuring accuracy and detecting potential fraud or errors. Essentially, it's a process to verify that the company's accounting records match the bank's records.

The reconciliation process helps in uncovering items like outstanding checks (checks issued but not yet cashed), deposits in transit (deposits made but not yet reflected in the bank statement), bank charges, and errors made by either the bank or the company. By identifying and correcting these discrepancies, a more accurate view of the company's actual cash position is obtained.

18. Describe the difference between accounts receivable and accounts payable.

Accounts receivable (AR) represents money owed to your company by customers for goods or services delivered but not yet paid for. It's an asset on your balance sheet because it represents future cash inflow. Think of it as short-term credit you've extended to your customers.

Accounts payable (AP), on the other hand, represents money your company owes to its suppliers or vendors for goods or services received but not yet paid for. It's a liability on your balance sheet because it represents a future cash outflow. Essentially, it's short-term credit you've received from your suppliers.

19. If a company buys a machine, how does that affect the accounting equation initially?

When a company buys a machine, it increases one asset (the machine) and decreases another asset (typically cash) or increases a liability if the purchase is on credit. The fundamental accounting equation is Assets = Liabilities + Equity.

Initially, the purchase of a machine for cash results in a decrease in cash (an asset) and an increase in the machine (another asset). The net effect on the total assets is zero; the composition of assets changes, but the total dollar amount remains the same. If the machine is purchased on credit, assets (machine) increase and liabilities (accounts payable) also increase. Equity remains unchanged in both scenarios.

20. What's the basic process of closing out the books at the end of an accounting period?

Closing the books at the end of an accounting period involves zeroing out temporary accounts (revenue, expenses, and dividends) and transferring their balances to permanent accounts (retained earnings). This process ensures that each new accounting period begins with a clean slate for temporary accounts.

The basic steps include:

- Journalize and post closing entries: Create entries to close revenue, expense, and dividend accounts. Debit revenue accounts and credit retained earnings. Debit retained earnings and credit expense accounts. Debit retained earnings and credit dividends.

- Prepare a post-closing trial balance: Verify that debits equal credits after the closing entries have been posted. This ensures the accounting equation is still in balance.

- Start new accounting period: The temporary accounts are now reset to zero, ready to accumulate data for the next period.

Intermediate Accounting interview questions

1. How do you determine the cost of goods sold?

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of the goods sold by a company. It's calculated as: Beginning Inventory + Purchases - Ending Inventory. Beginning Inventory is the value of inventory at the start of the accounting period, Purchases are the cost of additional inventory acquired during the period, and Ending Inventory is the value of inventory remaining at the end of the period.

Different inventory costing methods, such as FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted-average cost, can significantly impact the COGS calculation. The method chosen affects how the cost of goods is assigned when inventory items are sold. For instance, FIFO assumes the oldest inventory is sold first, while LIFO assumes the newest inventory is sold first. Selecting the right one that closely reflects real world movement of inventory and any local laws or regulations is important.

2. Explain the difference between LIFO and FIFO inventory costing methods.

LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) are two different methods for valuing inventory. FIFO assumes that the first units purchased are the first ones sold. This means the ending inventory consists of the most recently purchased items. LIFO, on the other hand, assumes that the last units purchased are the first ones sold. Consequently, the ending inventory is valued at the cost of the oldest items.

The key difference lies in how the cost of goods sold (COGS) and ending inventory are calculated. In a period of rising prices, FIFO will generally result in a lower COGS and a higher net income, while LIFO will result in a higher COGS and a lower net income. The opposite is true in a period of declining prices. LIFO is not permitted under IFRS.

3. What are some common revenue recognition principles?

Common revenue recognition principles dictate when and how revenue should be recorded in a company's financial statements. A core principle is that revenue should be recognized when it is realized or realizable and earned. This generally means that goods or services have been transferred to the customer, and the company has received or is reasonably assured of receiving payment.

Specifically, the ASC 606 standard outlines a five-step process: 1) Identify the contract with the customer. 2) Identify the performance obligations in the contract. 3) Determine the transaction price. 4) Allocate the transaction price to the performance obligations. 5) Recognize revenue when (or as) the entity satisfies a performance obligation.

4. Describe how you would account for a lease.

Leases are accounted for based on whether they are classified as finance or operating leases. For a finance lease, the lessee recognizes an asset (the right-of-use asset) and a lease liability on the balance sheet. The asset is amortized over its useful life, and the lease liability is amortized such that the effective interest rate is constant over the lease term. For an operating lease, the lessee also recognizes a right-of-use asset and a lease liability. A single lease expense is recognized on the income statement, comprising the amortization of the right-of-use asset and the interest on the liability.

The main difference between finance and operating leases lies in the classification criteria. If the lease transfers ownership of the asset to the lessee by the end of the lease term, the lessee has an option to purchase the asset, the lease term is for the major part of the economic life of the asset, the present value of the lease payments amounts to substantially all of the fair value of the asset, or the asset is of such a specialized nature that only the lessee can use it without major modifications, then it is classified as a finance lease.

5. What is the process for calculating depreciation?

Depreciation calculation involves determining the depreciable base, useful life, and depreciation method. The depreciable base is typically the asset's cost minus its salvage value. Common methods include straight-line (cost - salvage value / useful life), declining balance (book value * depreciation rate), and units of production ((cost - salvage value / total units to be produced) * units produced this period).

For example, using the straight-line method, if an asset costs $10,000, has a salvage value of $2,000, and a useful life of 5 years, the annual depreciation expense would be ($10,000 - $2,000) / 5 = $1,600.

6. How do you account for bad debts?

Bad debts are accounted for using two main methods: the direct write-off method and the allowance method. The direct write-off method recognizes bad debt expense only when a specific account is deemed uncollectible. This isn't GAAP-compliant as it violates the matching principle.

The allowance method is GAAP-compliant. It involves estimating bad debts at the end of each accounting period and creating an allowance for doubtful accounts (a contra-asset account). This method uses either the percentage of sales method or the aging of accounts receivable method to estimate the uncollectible amount. When a specific account is deemed uncollectible, it's written off against the allowance account, not directly against bad debt expense. This provides a more accurate representation of accounts receivable and adheres to the matching principle.

7. What are the different types of financial statements?

The primary financial statements are the balance sheet, the income statement, and the statement of cash flows. The balance sheet presents a company's assets, liabilities, and equity at a specific point in time. The income statement reports a company's financial performance over a period of time, showing revenues, expenses, and net income. The statement of cash flows tracks the movement of cash both into and out of a company over a period of time, categorized by operating, investing, and financing activities.

Another key financial statement is the statement of retained earnings, which shows the changes in a company's retained earnings over a period of time. It links the income statement (net income) to the balance sheet (retained earnings). In addition to these, companies often provide notes to the financial statements which provide additional details and explanations about the items presented in the statements.

8. Explain the accounting equation.

The accounting equation is a fundamental principle that forms the basis of double-entry accounting. It states that a company's total assets are equal to the sum of its liabilities and equity. In other words: Assets = Liabilities + Equity.

- Assets are what a company owns (e.g., cash, accounts receivable, equipment).

- Liabilities are what a company owes to others (e.g., accounts payable, loans).

- Equity represents the owners' stake in the company (e.g., common stock, retained earnings). The equation must always balance to ensure that the accounting records are accurate.

9. How do you account for deferred taxes?

Deferred taxes arise from temporary differences between the book (financial reporting) and tax bases of assets and liabilities. We account for them by recognizing deferred tax assets and liabilities. Deferred tax assets represent future tax benefits from deductible temporary differences and operating loss carryforwards, while deferred tax liabilities represent future tax obligations from taxable temporary differences.

Calculating deferred taxes involves determining the future tax rates expected to apply when the temporary differences reverse. We then apply these rates to the temporary differences to calculate the deferred tax assets and liabilities. These are adjusted each reporting period to reflect changes in temporary differences and tax rates, with the corresponding adjustment recorded in the income statement as income tax expense or benefit.

10. What is the difference between direct and indirect costs?

Direct costs are expenses directly tied to the production of a specific good or service. They are easily traceable. Examples include raw materials and direct labor.

Indirect costs, on the other hand, are expenses that support the overall operations but aren't directly linked to a specific product. These are often shared across multiple activities and are more difficult to assign to a particular item. Examples include rent, utilities, and administrative salaries.

11. Describe the process of preparing a bank reconciliation.

Preparing a bank reconciliation involves comparing the bank statement balance to the company's cash balance in its accounting records to identify any discrepancies. The goal is to ensure both records accurately reflect the company's cash position. This process usually starts by adjusting the bank statement balance for items not yet recorded by the bank, such as outstanding checks (checks issued but not yet cashed) and deposits in transit (deposits made but not yet reflected on the statement). Then, the company's book balance is adjusted for items not yet recorded in the company's books, like bank service charges, interest earned, and errors.

After these adjustments, the adjusted bank balance should equal the adjusted book balance. Any remaining differences indicate errors that need further investigation and correction. Common discrepancies include errors made by either the bank or the company, fraudulent activities, or timing differences in recording transactions.

12. How do you account for stock options?

Stock options are accounted for using fair value accounting. The fair value of the options is estimated using an option-pricing model (like Black-Scholes or a binomial model) at the grant date. This fair value is then expensed over the vesting period of the options, usually on a straight-line basis.

The expense is recognized regardless of whether the employee eventually exercises the options. The corresponding credit is typically recorded in additional paid-in capital (APIC). When the options are exercised, cash is received, APIC is increased, and common stock is issued. Any forfeitures are accounted for by either estimating forfeitures (and adjusting expense accordingly) or accounting for forfeitures as they occur.

13. What are the key differences between US GAAP and IFRS?

US GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) differ primarily in their approach. GAAP is rules-based, providing specific, detailed guidelines. IFRS is principles-based, offering broader guidelines that require more judgment and interpretation. This leads to GAAP often being more prescriptive and IFRS allowing for more flexibility.

Key differences also exist in specific accounting treatments. Examples include inventory valuation (GAAP allows LIFO, IFRS doesn't), development costs (IFRS allows capitalization under certain conditions, GAAP generally expenses), and revenue recognition (GAAP had industry-specific guidance, IFRS provides a unified model). IFRS also emphasizes fair value more frequently than GAAP.

14. Explain how to account for a business combination.

Accounting for a business combination primarily uses the acquisition method. This method involves several key steps: identifying the acquirer, determining the acquisition date, recognizing and measuring the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree. The purchase consideration is also determined. If the purchase consideration exceeds the fair value of net assets acquired, goodwill is recorded. Conversely, if the fair value of net assets acquired exceeds the purchase consideration, a bargain purchase gain is recognized in profit or loss.

Specifically, all assets and liabilities of the acquiree are revalued at fair value as of the acquisition date. Direct costs of the acquisition (e.g., legal and consulting fees) are expensed in the acquirer's income statement, except for the cost to issue debt, which is amortized, and the cost to issue equity, which reduces additional paid-in capital. After the acquisition date, the acquirer includes the acquiree's results of operations in its consolidated financial statements.

15. How do you account for contingent liabilities?

Contingent liabilities are potential obligations that may arise depending on the outcome of a future event. Accounting for them depends on the probability of the future event occurring and the ability to estimate the potential loss.

If the contingent liability is probable (likely to occur) and the amount can be reasonably estimated, it should be recorded as a liability on the balance sheet and an expense on the income statement. If the liability is reasonably possible (more than remote, but less than probable), or if it's probable but the amount cannot be reasonably estimated, it should be disclosed in the footnotes to the financial statements. If the chance of occurrence is remote, no disclosure is required.

16. Describe the process of auditing financial statements.

Auditing financial statements is a systematic process to independently assess whether a company's financial records are a fair and accurate representation of its financial position and performance. The process begins with planning, which involves understanding the client's business and assessing risks. Auditors then gather evidence by performing procedures like examining documents, observing operations, and confirming balances with third parties. Evidence gathered should be sufficient to allow the auditor to make a professional judgement on the fairness of the financial statements.

After gathering sufficient evidence, auditors evaluate it to determine if the financial statements are free of material misstatement and conform to applicable accounting standards (e.g., GAAP or IFRS). Finally, the auditor forms an opinion and issues an audit report, which communicates the auditor's findings to users of the financial statements. The audit report will express an opinion such as an unmodified (clean) opinion, a qualified opinion, an adverse opinion, or a disclaimer of opinion, depending on the findings and materiality of any misstatements found.

17. How do you analyze financial ratios?

Analyzing financial ratios involves comparing a company's ratios to industry benchmarks, historical trends, and competitor data to assess its financial health and performance. This comparison helps identify strengths, weaknesses, and areas needing improvement. Key areas of focus include:

- Liquidity Ratios: Assessing the company's ability to meet short-term obligations.

- Solvency Ratios: Evaluating the company's long-term financial stability and debt levels.

- Profitability Ratios: Measuring the company's ability to generate profits from its operations.

- Efficiency Ratios: Examining how effectively the company uses its assets to generate revenue.

Trend analysis over several periods can reveal important insights. Consider looking for changes or anomalies in the ratios to help identify areas for deeper investigation.

18. What are some common internal controls?

Common internal controls are policies and procedures designed to safeguard assets, ensure the reliability of financial reporting, promote operational efficiency, and encourage compliance with laws and regulations. These controls can be preventative (designed to prevent errors or fraud from occurring in the first place) or detective (designed to detect errors or fraud that have already occurred).

Examples include:

- Segregation of duties: Dividing responsibilities among different people to reduce the risk of error or fraud.

- Reconciliations: Comparing two sets of records to ensure they agree.

- Authorizations and approvals: Requiring approval for certain transactions.

- Physical controls: Securing assets physically (e.g., locks, security cameras).

- Information processing controls: Ensuring data is accurate and complete (e.g., input validation, edit checks).

- Performance reviews: Analyzing actual performance against budgets or forecasts.

19. Explain the importance of ethics in accounting.

Ethics are crucial in accounting because they ensure financial information is reliable, transparent, and trustworthy. This is essential for maintaining public confidence in financial markets and protecting the interests of stakeholders, including investors, creditors, and the general public. Without strong ethical standards, accounting professionals could manipulate financial data for personal gain or to mislead others, leading to financial instability and economic harm.

Specifically, ethical principles like integrity, objectivity, confidentiality, and professional competence guide accountants in making unbiased judgments, avoiding conflicts of interest, and accurately representing financial information. Upholding these principles fosters trust and credibility, which are fundamental to the functioning of a healthy economy. Failing to adhere to ethical standards can result in severe consequences, including legal penalties, reputational damage, and the loss of professional certifications.

20. How do you handle a situation where you disagree with your supervisor's accounting treatment?

If I disagree with my supervisor's accounting treatment, my first step would be to thoroughly research the relevant accounting standards (e.g., GAAP, IFRS) and company policies to ensure I have a solid understanding of the correct treatment. Then, I would calmly and respectfully discuss my concerns with my supervisor, presenting the supporting documentation for my position. I would focus on the technical aspects and potential implications of the differing treatments, avoiding personal attacks or accusatory language.

If, after the discussion, my supervisor still maintains their position, and I believe the treatment is materially incorrect and unethical or illegal, I would escalate the issue through the appropriate channels, such as the company's ethics hotline or internal audit department, while documenting all steps taken. I would prioritize protecting the integrity of the financial statements and adhering to professional ethical obligations.

21. Describe a time when you had to research a complex accounting issue.

During an audit, I encountered a situation involving the proper accounting treatment for a complex lease modification. The initial lease agreement was fairly straightforward, but subsequent modifications introduced elements of both a finance and operating lease, based on different clauses. I began by thoroughly reviewing the original lease agreement and all subsequent amendments, paying close attention to the specific changes in lease terms, payment schedules, and transfer of ownership criteria.

Next, I consulted ASC 842, Leases, to understand the specific guidance on lease modifications and their impact on lease classification. I also researched interpretations and examples from accounting resources and industry publications to identify similar scenarios and their appropriate treatment. After carefully analyzing the facts and relevant literature, I documented my findings and presented them to the audit team, supporting my conclusion on the correct lease classification and accounting entries.

22. How do you stay up-to-date on the latest accounting standards?

I stay current with the latest accounting standards through a combination of resources. I regularly review publications from organizations like the FASB (Financial Accounting Standards Board) and the IASB (International Accounting Standards Board) to understand new and proposed standards. Subscribing to industry journals, newsletters, and attending webinars offered by accounting firms and professional organizations (e.g., AICPA) helps me stay informed about interpretations and practical applications of these standards.

Additionally, I leverage online resources and professional networks to discuss emerging issues and best practices with peers. This collaborative approach ensures I'm not only aware of the standards but also understand their implications in real-world scenarios. I also use continuing professional education (CPE) courses to stay updated.

23. What are the implications of Sarbanes-Oxley Act (SOX)?

The Sarbanes-Oxley Act (SOX) has several key implications, primarily aimed at protecting investors from fraudulent financial reporting by corporations. SOX mandates enhanced internal controls over financial reporting, requiring companies to establish and maintain adequate systems to ensure the accuracy and reliability of their financial statements. This includes documenting and testing these controls regularly.

SOX also increases corporate responsibility and accountability. Executives, particularly CEOs and CFOs, are required to personally certify the accuracy of their company's financial statements, making them directly liable for any misstatements. Furthermore, SOX introduced stricter penalties for fraudulent financial activity and established the Public Company Accounting Oversight Board (PCAOB) to oversee the audits of public companies, increasing the independence and quality of external audits.

24. Explain the concept of materiality in accounting.

Materiality in accounting refers to the significance of an omission or misstatement of accounting information. Information is material if its omission or misstatement could reasonably influence the economic decisions of users of financial statements. It's a threshold, not an absolute, and depends on the size or nature of the item judged in the particular circumstances of its omission or misstatement.

Essentially, an item is material if knowing about it would change someone's investment or business decisions. Auditors use materiality to determine the scope of their audit procedures, focusing on areas most likely to contain material misstatements. Companies use materiality to determine what information to disclose in their financial statements.

25. How would you explain accrual accounting to someone unfamiliar with it?

Imagine you're running a lemonade stand. Accrual accounting means you record revenue when you earn it, not necessarily when you receive the cash. Similarly, you record expenses when you incur them, not necessarily when you pay for them.

For example, if you sell lemonade on credit to a friend today, you record the revenue today (when you earned it), even if they pay you next week. If you buy lemons today but pay for them next week, you record the expense today (when you incurred it), not next week. This method provides a more accurate picture of your business's financial performance during a specific period.

26. Describe a time you found an error in financial statements, and how you corrected it.

During the monthly reconciliation of our accounts receivable, I noticed a discrepancy of $5,000 between the general ledger and the aging report. After thoroughly investigating, I discovered a data entry error where a payment from a customer was incorrectly posted to the wrong account. The payment had been applied to 'Customer A' instead of 'Customer B', leading to an overstatement of receivables for Customer A and an understatement for Customer B.

To correct the error, I first created a journal entry to reverse the incorrect posting. Then, I created a second journal entry to correctly apply the payment to Customer B's account. After posting both entries, the general ledger and the aging report were in agreement. I also documented the error and the correction process in detail, and shared this with the data entry clerk to prevent similar mistakes in the future. A review process for data entry was implemented to prevent such errors.

27. How does accounts receivable factoring work and what are the accounting implications?

Accounts receivable factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party (the factor) at a discount. The factor then assumes responsibility for collecting on those invoices. It's essentially a way for businesses to get immediate cash flow instead of waiting for customers to pay.

Accounting implications include:

- Derecognition of receivables: The business removes the factored receivables from its balance sheet.

- Recognition of a finance cost/loss on sale: The discount the business takes represents a cost.

- Potential impact on financial ratios: Ratios like accounts receivable turnover will be affected.

- Disclosure requirements: Factoring arrangements must be disclosed in the financial statement notes.

28. What are the implications of changes in accounting estimates?

Changes in accounting estimates are adjustments to the carrying amount of an asset or liability, or the amount of periodic consumption of an asset, that result from new information or new developments. The implications can be significant, primarily affecting the current and future financial statements. These changes are applied prospectively, meaning the adjustment is recognized in the period of change and future periods if the change affects both. Prior period financial statements are not restated.

The impact of changing accounting estimates can include adjustments to depreciation expense, allowance for doubtful accounts, warranty obligations, or the useful life of an asset. These adjustments directly affect the income statement (profit or loss) and the balance sheet (asset and liability values). While not impacting past reported earnings, changes can influence investor perceptions regarding management's foresight and the company's future performance.

29. Explain the accounting treatment for research and development costs.

Research costs are typically expensed as incurred. This is because it's difficult to predict whether research will lead to future economic benefits. Development costs, on the other hand, may be capitalized (recorded as an asset) if certain criteria are met. These criteria usually include technical feasibility of completing the intangible asset so that it will be available for use or sale, intention to complete the intangible asset and use or sell it, ability to use or sell the intangible asset, how the intangible asset will generate probable future economic benefits, availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset, and ability to measure reliably the expenditure attributable to the intangible asset during its development.

Advanced Accounting interview questions

1. How would you explain a deferred tax liability to someone who isn't an accountant?

Imagine your business pays taxes differently than how you report profits to shareholders. A deferred tax liability is like a future tax bill you know is coming, but haven't paid yet. It happens when you report lower taxes now than what you'll likely owe in the future because of temporary differences between accounting rules and tax rules.

Think of it like this: you're taking a deduction now that you won't be able to take later. This means you're paying less tax now, but you'll have to "make up" for it by paying more tax in the future when that deduction isn't available anymore. So, it's a liability because it's a future obligation to pay more taxes.

2. Describe a time you had to analyze a complex accounting standard and implement it. What were the challenges?

During the adoption of ASC 842, Leases, I was tasked with analyzing the new standard and leading its implementation. A significant challenge was understanding the diverse lease agreements across the company, ranging from real estate to equipment. Each lease required careful review to determine its classification (finance or operating) and the subsequent impact on the balance sheet and income statement.

Another hurdle was data collection. We needed to gather all relevant lease data (lease term, payments, discount rates, etc.) from various departments and consolidate it into a centralized database. We used Excel to consolidate and calculate the present values. The implementation also required me to collaborate with IT to ensure the accounting system was properly configured to handle the new lease accounting requirements. We faced some issues with discount rates and I had to do a lot of research before finalizing them.

3. What is the difference between fair value and market value, and when might they diverge?

Fair value represents the estimated price at which an asset could be sold, or a liability transferred, in an orderly transaction between knowledgeable, willing participants. Market value, on the other hand, is the price at which an asset is actually traded in the market. They often align, especially in liquid and efficient markets.

However, they can diverge for several reasons. Illiquidity (lack of active trading), market inefficiencies (information asymmetry), distress sales (forced liquidation), or unique asset characteristics (not easily comparable) can cause the market price to deviate from its true fair value. For example, a company facing bankruptcy might sell assets below their fair value to raise quick cash.

4. Explain the concept of goodwill impairment and how it impacts a company's financial statements.

Goodwill impairment occurs when the fair value of a reporting unit is less than its carrying amount, including goodwill. Goodwill, representing the excess of purchase price over the fair value of net assets acquired in an acquisition, is tested for impairment at least annually or more frequently if triggering events occur.

When impairment is identified, the carrying value of goodwill is reduced to its implied fair value, with the impairment loss recognized as an expense on the income statement. This reduces net income and shareholders' equity. It also lowers the company's total assets on the balance sheet. Importantly, goodwill impairment is a non-cash expense, meaning it does not affect cash flow from operations.

5. How do you determine the useful life of an asset for depreciation purposes?

The useful life of an asset for depreciation is an estimate of how long an asset will be productive and contribute to revenue generation. Several factors influence this estimate, including:

- Physical wear and tear: How much the asset will be used and the conditions it will be operated in.

- Technological obsolescence: How quickly the asset may become outdated due to newer, more efficient technologies.

- Legal or contractual limits: Any restrictions on how long the asset can be used, such as a lease term.

- Industry standards: Common practices within the industry for similar assets.

Companies often consult industry guidelines, engineering studies, and historical data to make a reasonable and supportable estimate. Also, tax regulations may prescribe specific useful lives for certain asset classes, which must be followed for tax depreciation purposes.

6. Walk me through the process of consolidating financial statements for a parent company and its subsidiaries.

The consolidation process combines the financial statements of a parent company and its subsidiaries into a single set of financial statements, as if they were one economic entity. The process begins with ensuring that the parent and subsidiaries' financial statements are prepared using consistent accounting policies and reporting periods. Intercompany transactions, such as sales, loans, and dividends between the parent and subsidiaries, are then eliminated to avoid double-counting. This includes removing intercompany receivables, payables, revenues, and expenses.

Next, the parent's investment in each subsidiary is eliminated against the subsidiary's equity. Any difference between the investment cost and the subsidiary's book value of equity at the acquisition date is recognized as goodwill (or a bargain purchase gain). Finally, the assets, liabilities, revenues, and expenses of the subsidiaries are combined with those of the parent company. Non-controlling interest (NCI), representing the portion of a subsidiary's equity not owned by the parent, is presented separately in the consolidated balance sheet and income statement.

7. What are some common red flags that might indicate fraudulent financial reporting?

Several red flags can signal fraudulent financial reporting. These often involve unusual or aggressive accounting practices, such as:

- Unexplained or complex transactions: Transactions lacking a clear business purpose or involving multiple layers of entities. Also frequent changes in auditors.

- Aggressive revenue recognition: Recognizing revenue prematurely or for transactions that are not fully completed. Also, inadequate internal controls and a dominant management team.

- Unrealistic growth or profitability: Performance significantly better than industry peers without a justifiable explanation. Also, a high turnover of key financial personnel.

8. Explain how a change in accounting methods affects financial statements and how users should interpret such changes.

A change in accounting methods impacts financial statements by altering reported figures for assets, liabilities, equity, revenues, and expenses. This lack of consistency makes it difficult to compare a company's performance across different periods. For example, switching from FIFO to weighted-average for inventory valuation can affect cost of goods sold and, consequently, net income.

Users should carefully analyze the notes to the financial statements, as companies are required to disclose the nature and justification for the change, as well as the impact on key financial metrics. Retrospective application, where prior periods are restated as if the new method had always been used, is often required to ensure comparability. Users should also consider the reasons for the change; was it to better reflect the economic reality of the business, or was it for earnings management purposes? Understanding the why is critical for proper interpretation.

9. How do you approach a complex reconciliation process, like reconciling intercompany accounts?

When approaching a complex reconciliation, especially intercompany accounts, I prioritize a structured and systematic approach. First, I gain a thorough understanding of the accounts involved, the source systems, and the nature of transactions between the companies. This includes identifying key data elements and potential discrepancies. Next, I focus on data gathering and validation. This involves extracting data from all relevant systems, ensuring data integrity, and cleansing the data as needed. A key part of this stage may involve:

- Identifying matching criteria for transactions across companies (e.g., invoice number, date, amount).

- Investigating unmatched items and determining the root cause of discrepancies. This may involve communicating with relevant teams and reviewing supporting documentation.

- Documenting all findings and actions taken. Finally, I would suggest process improvements to prevent future discrepancies by addressing the underlying causes.

10. Discuss the implications of lease accounting under ASC 842.

ASC 842 significantly changes lease accounting, requiring lessees to recognize most leases on the balance sheet as a right-of-use (ROU) asset and a lease liability. This increases a company's reported assets and liabilities, impacting financial ratios like debt-to-equity. The income statement impact depends on lease classification: finance leases result in amortization and interest expense (front-loaded expense), while operating leases yield a single lease expense recognized over the lease term.

Beyond financial statement presentation, ASC 842 requires more detailed disclosures about leasing activities, including lease terms, discount rates, and significant judgments. This can require new data collection and system implementations. Companies must carefully evaluate all contracts to identify embedded leases and ensure proper accounting treatment, potentially needing significant implementation effort, especially those with a large lease portfolio.

11. Describe your experience with implementing or auditing internal controls over financial reporting (ICFR).

I have experience implementing and auditing ICFR, specifically related to [mention specific area like revenue recognition, inventory management, or IT controls]. My involvement includes documenting key controls, performing walkthroughs to assess design effectiveness, and testing operational effectiveness through sample testing. I've used frameworks like COSO to identify risks, design controls to mitigate those risks, and evaluate the effectiveness of the control environment.

During my experience at [previous company/role], I [describe a specific task performed, e.g., 'developed a new reconciliation process for accounts receivable' or 'evaluated IT general controls related to access security']. This helped improve the reliability of financial reporting by [explain impact, e.g., 'reducing the risk of misstatement due to error or fraud' or 'ensuring data integrity']. I've also identified control deficiencies, documented the impact of those deficiencies, and recommended remediation plans.

12. What are the key differences between US GAAP and IFRS, and why are these differences important?

US GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are two sets of accounting standards used worldwide. Key differences exist in areas like inventory valuation (GAAP often uses FIFO/LIFO, while IFRS prohibits LIFO), revenue recognition (GAAP has detailed industry-specific guidance, IFRS is more principle-based), and impairment of assets (GAAP focuses on recoverability, IFRS focuses on whether the carrying amount exceeds the recoverable amount). These differences impact financial statement comparability across companies reporting under different standards.

The importance of these differences lies in the globalized nature of business. Investors need to understand these differences to accurately compare financial performance across companies, especially when considering investments in foreign companies or multinational corporations. Also, some companies might choose to adopt IFRS to make it easier for international investors to compare their financials with other similar companies that use IFRS. Understanding the differences allows for better financial analysis and investment decisions.

13. Explain how you would account for a complex financial instrument, such as a convertible bond.

Accounting for a convertible bond involves separating it into its debt and equity components. Initially, the bond is recorded at its fair value, which is allocated between the debt and equity portions based on their relative fair values at issuance. The debt component is typically valued as a similar bond without the conversion feature, and the remaining value is assigned to the equity component (often called a 'conversion option').

Subsequently, the debt component is accounted for as a regular bond, with interest expense recognized over its life. The equity component is generally recognized in equity and not remeasured. When the bond is converted, the carrying amount of the debt is transferred to equity, along with the initially recognized equity component. If the bond is redeemed before conversion, it's treated like a regular bond redemption. This accounting treatment ensures that both the debt and equity characteristics of the convertible bond are appropriately reflected in the financial statements.

14. Describe the different methods available for revenue recognition and how to determine which method is appropriate.

Revenue recognition methods include: recognizing revenue at a point in time (when goods are transferred or services are completed), recognizing revenue over time (for services performed continuously or projects completed over time), and the installment method (recognizing profit as cash is collected). Selecting the appropriate method depends on when control of the goods or services transfers to the customer. If control transfers at a specific point, recognize revenue then. If control transfers continuously over time, recognize revenue over time. The installment method is typically used when collectibility is not reasonably assured.

Factors to consider when choosing a method include the terms of the contract, the nature of the goods or services, and whether a right of return exists. Accounting standards like ASC 606 provide detailed guidance on revenue recognition, requiring a five-step process: identify the contract, identify performance obligations, determine the transaction price, allocate the transaction price, and recognize revenue when (or as) a performance obligation is satisfied.

15. How would you handle a situation where you disagree with your supervisor on an accounting treatment?

If I disagreed with my supervisor on an accounting treatment, my first step would be to thoroughly research the relevant accounting standards (e.g., GAAP, IFRS) and company policy to ensure I fully understand the basis for both my supervisor's position and my own. I would then schedule a private, respectful conversation with my supervisor to discuss the issue, presenting my research and rationale clearly and concisely. The goal is to have an open dialogue and understand their perspective. I would listen attentively to their explanation and be open to the possibility that I might be missing something. If, after the discussion, I still disagreed, I would politely reiterate my concerns, emphasizing the potential impact of the differing treatments on the financial statements. If the disagreement remained unresolved and I believed the treatment could materially misstate the financials, I would consider escalating the issue to a higher authority within the company (e.g., their supervisor, the CFO, or the audit committee), or the company's ethics hotline, always ensuring I'm acting in accordance with professional ethics and company policy. Documentation of the disagreement and the steps taken is critical.

16. Explain the concept of present value and how it's used in accounting.

Present value (PV) is the current worth of a future sum of money or stream of cash flows, given a specified rate of return. It's used in accounting to determine the fair value of assets and liabilities, especially when future cash flows are involved. The basic idea is that money received today is worth more than the same amount of money received in the future due to its potential earning capacity.

In accounting, PV is crucial for:

- Valuing long-term assets and liabilities: such as bonds, leases, and pension obligations.

- Capital budgeting: assessing the profitability of investments by comparing the present value of future cash inflows to the initial investment.

- Impairment testing: determining if the carrying amount of an asset exceeds its recoverable amount (the present value of future cash flows from the asset).

17. What are some of the challenges of accounting for intangible assets?

Accounting for intangible assets presents several unique challenges. A primary issue is determining the asset's fair value, especially when an active market doesn't exist. This often relies on subjective estimations and future projections, increasing the risk of misstatement. Another challenge lies in deciding the useful life and amortization method. Unlike tangible assets, intangible assets may have indefinite lives, requiring annual impairment testing instead of amortization.

Furthermore, accurately separating research and development costs to determine which qualify for capitalization as intangible assets versus those that should be expensed immediately can be complex and requires careful judgment. Tracking and monitoring intangible assets to ensure their continued value and adherence to accounting standards (like proper impairment assessment) is also ongoing process that demands diligent attention.

18. Discuss the different types of inventory costing methods and their impact on net income.

Inventory costing methods are used to assign costs to inventory and cost of goods sold (COGS). Common methods include: First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted-Average. FIFO assumes the oldest inventory is sold first. LIFO assumes the newest inventory is sold first (though its use is limited under IFRS). Weighted-Average calculates a weighted average cost based on the total cost of goods available for sale divided by the total units available for sale.

The impact on net income varies. In periods of rising prices, FIFO generally results in a lower COGS and higher net income because older, cheaper inventory is expensed first. LIFO (if permitted) would result in a higher COGS and lower net income because newer, more expensive inventory is expensed first. The Weighted-Average method typically falls between FIFO and LIFO in terms of its impact on net income. The choice of method can significantly affect a company's financial statements and tax obligations.

19. How do you stay up-to-date on the latest changes in accounting standards and regulations?

I stay updated on accounting standards and regulations through a combination of resources. I regularly review publications from organizations like the FASB, IASB, and AICPA. These provide updates, exposure drafts, and interpretations of new and existing standards. I also subscribe to industry newsletters and journals, attend relevant webinars and conferences, and participate in professional development courses to learn about specific changes and their implications.

Furthermore, I leverage online resources and databases that aggregate accounting and regulatory information. Networking with other accounting professionals and engaging in discussions on relevant topics also helps me stay informed about current issues and emerging trends in the field. Finally, I always ensure to meticulously review any new regulations or standards as and when they are published.

20. Explain how to account for business combinations, including the calculation of goodwill or a bargain purchase gain.

Business combinations are accounted for under the acquisition method. This involves several steps: (1) Identifying the acquirer; (2) Determining the acquisition date; (3) Recognizing and measuring the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree; and (4) Recognizing and measuring goodwill or a bargain purchase gain.

Goodwill is calculated as the excess of the consideration transferred (plus the fair value of any previously held equity interest in the acquiree, and any non-controlling interest) over the net fair value of the identifiable assets acquired and liabilities assumed. A bargain purchase gain arises when the net fair value of the identifiable assets acquired and liabilities assumed exceeds the consideration transferred (plus the fair value of any previously held equity interest in the acquiree, and any non-controlling interest). This gain is recognized in profit or loss on the acquisition date. The calculation involves careful valuation of all assets and liabilities acquired.

21. What are the ethical considerations that are paramount for accountants?

Accountants face numerous ethical considerations, primarily revolving around integrity, objectivity, confidentiality, and professional competence. Maintaining integrity means being honest and forthright in all professional and business relationships. Objectivity requires accountants to avoid bias, conflicts of interest, and undue influence from others, especially when making judgments or providing opinions. Confidentiality dictates that information acquired during professional engagements should not be disclosed to third parties without proper authority, unless there is a legal or professional duty to do so. Finally, professional competence and due care entail a continuous commitment to maintaining professional knowledge and skills at the level required to ensure that a client or employer receives competent professional service, acting diligently and in accordance with applicable technical and professional standards.

Violations of these ethical principles can lead to severe consequences, including damage to professional reputation, loss of clients, legal penalties, and disciplinary actions by professional accounting bodies. Therefore, accountants must always prioritize ethical behavior and adhere to the established codes of conduct, even when faced with difficult or conflicting pressures.

Expert Accounting interview questions

1. How would you explain a complex accounting principle to a non-accountant?

Imagine a business like a lemonade stand. A complex accounting principle is like the secret recipe for making sure the lemonade stand's financial health is tracked accurately. Instead of using accounting jargon, I'd explain it using simple, relatable terms. For example, if explaining depreciation (the decrease in value of an asset over time), I might say that the lemonade stand's pitcher gradually wears out with use and loses value over time. Accounting helps us track that wear and tear as an expense over the pitcher's lifespan rather than all at once, giving a more realistic picture of the business's ongoing profitability.

Essentially, I would focus on the why behind the rule, explaining how it impacts the business's financial picture in a way that the non-accountant can understand, using real-world analogies and avoiding technical language.

2. Describe a time you identified and resolved a significant accounting error. What steps did you take?

In my previous role, I discovered a significant error in our revenue recognition process. The sales team was prematurely recognizing revenue before the service was fully delivered, violating our company's accounting policy and ASC 606. I noticed a spike in unearned revenue accounts, which raised a red flag.

To resolve this, I first documented all instances of premature revenue recognition. I then worked with the sales and finance teams to adjust the recognition schedule to align with actual service delivery. I also implemented a training program for the sales team to ensure they understood the correct revenue recognition policies. Finally, I updated our internal controls to prevent similar errors in the future. This involved creating a new checklist for revenue recognition that requires verification from multiple parties before revenue can be booked.

3. How do you stay current with changes in accounting regulations and standards?

I stay current with changes in accounting regulations and standards through several methods. I regularly read publications from organizations like the FASB, IASB, and AICPA, paying close attention to exposure drafts, updates, and interpretations. Subscribing to industry newsletters and alerts from reputable accounting firms is also helpful.

Furthermore, I participate in continuing professional education (CPE) courses and webinars focused on accounting updates. Attending industry conferences and networking with other professionals allows me to discuss emerging issues and best practices. For specific research or clarification, I consult authoritative accounting literature databases.

4. Explain your experience with implementing a new accounting system or software.

In my previous role at Acme Corp, I was part of the team that implemented NetSuite to replace our outdated accounting software. My responsibilities included data migration, user training, and system configuration. Specifically, I worked on mapping our chart of accounts to the NetSuite structure, ensuring accurate financial reporting.

I also played a key role in testing the new system and resolving issues before the go-live date. This involved creating test scenarios, executing test scripts, and documenting any bugs or errors encountered. I collaborated closely with the IT department and NetSuite consultants to address these issues promptly, resulting in a smooth transition and minimal disruption to our accounting processes. Post-implementation, I continued to support users and troubleshoot any problems that arose.

5. Describe your approach to preparing and analyzing financial statements for a complex organization.

My approach to preparing and analyzing financial statements for a complex organization involves several key steps. First, I focus on thoroughly understanding the organization's structure, business processes, and accounting systems. This includes reviewing the chart of accounts, understanding the different departments or business units, and assessing the internal controls in place. Data integrity is crucial, so I'd validate data sources and reconcile key accounts to ensure accuracy.

Next, I'd prepare the financial statements (income statement, balance sheet, cash flow statement, and statement of retained earnings) in accordance with the relevant accounting standards (e.g., GAAP or IFRS). For analysis, I'd use techniques such as ratio analysis (liquidity, solvency, profitability), trend analysis (comparing performance over time), and variance analysis (comparing actual results to budget). I'd also perform a thorough review of the notes to the financial statements to understand significant accounting policies and disclosures. Finally, I'd communicate the findings and insights to management in a clear and concise manner, highlighting key risks and opportunities.

6. How do you ensure accuracy and compliance in a high-volume accounting environment?

In a high-volume accounting environment, ensuring accuracy and compliance requires a multi-faceted approach. Firstly, implement robust internal controls, including segregation of duties, regular reconciliations (bank, accounts receivable, accounts payable), and approval workflows. Leverage technology by using accounting software with built-in validation rules, automated data entry, and audit trails. Training programs are vital to keep staff updated on accounting standards and regulatory changes.

Secondly, perform frequent internal audits and consider external audits to identify and address potential weaknesses. Establish clear documentation standards for all accounting processes. Regularly review and update procedures based on audit findings and changes in regulations. Finally, use data analytics to identify anomalies or unusual transactions that may indicate errors or fraud. Continuously monitor key performance indicators (KPIs) related to accuracy and compliance to detect trends and proactively address issues.

7. Explain your experience with forensic accounting or fraud detection.

My experience in forensic accounting and fraud detection primarily involves applying data analysis techniques to identify anomalies and patterns indicative of fraudulent activity. I've utilized tools like Python with libraries such as Pandas and Scikit-learn to analyze large datasets, flagging suspicious transactions based on predefined rules and statistical outliers. For example, I developed a model to detect fraudulent insurance claims by identifying inconsistencies between claim details, policy information, and external data sources.

Additionally, I have experience in reviewing financial statements and internal controls to assess the risk of fraud. This includes evaluating the effectiveness of segregation of duties, authorization processes, and reconciliation procedures. My work has contributed to the investigation of potential embezzlement, bribery, and financial statement manipulation, providing actionable insights for remediation and prevention.

8. Describe a situation where you had to make a difficult ethical decision in accounting.

In a previous role, I encountered a situation where a senior manager was pressuring the accounting team to prematurely recognize revenue on a large project. The project milestones weren't fully met, and recognizing the revenue would have artificially inflated the company's earnings for the quarter, potentially misleading investors. I knew this was a violation of GAAP and presented a significant ethical concern.

I initially discussed my concerns with my direct supervisor, providing detailed documentation outlining the discrepancies. When the pressure continued, I escalated the issue to the company's ethics hotline. This led to an internal investigation, and ultimately, the company decided to defer the revenue recognition until the project milestones were properly achieved. While it was a difficult situation to navigate, upholding ethical standards and ensuring accurate financial reporting was my priority.

9. How do you prioritize tasks and manage your time effectively when faced with multiple deadlines?

When faced with multiple deadlines, I prioritize tasks using a combination of urgency and importance. I typically start by listing all tasks and estimating the time required for each. Then, I assess the deadlines and impact of each task, categorizing them based on the Eisenhower Matrix (urgent/important). I tackle urgent and important tasks first, schedule important but not urgent tasks, delegate urgent but not important tasks if possible, and eliminate tasks that are neither urgent nor important.

To manage my time, I utilize techniques like time blocking, setting realistic goals for each day, and minimizing distractions. I also leverage tools like calendars and to-do lists to stay organized and track my progress. Regularly reviewing my priorities and adjusting my schedule as needed helps me stay on track and meet deadlines effectively. If I encounter roadblocks, I proactively communicate with stakeholders to manage expectations and find solutions.

10. Describe your experience with budgeting and forecasting.

In my previous role, I actively participated in the budgeting and forecasting processes. I contributed to the creation of annual budgets by collaborating with department heads to gather data on projected expenses and revenue. I also analyzed historical financial data to identify trends and patterns that informed our forecasts. I used tools like Excel to build financial models, track variances, and prepare reports for management.

Furthermore, I was involved in the monthly forecasting cycle, where I helped update our financial projections based on actual performance and changing market conditions. This involved working closely with sales, marketing, and operations teams to incorporate their insights into the forecast. I also prepared variance analyses to explain any significant deviations between the budget and actual results, highlighting areas where corrective action was needed.

11. How do you approach a complex financial analysis project?

When tackling a complex financial analysis project, I prioritize a structured and methodical approach. First, I focus on clearly defining the project's objectives and scope, ensuring I understand the specific questions that need answering. I then gather and validate the necessary data from reliable sources, paying close attention to data quality and potential biases. Next, I break down the project into smaller, manageable tasks, like cleaning the data, creating visualizations, and building financial models.

After breaking down the project, I select the appropriate analytical techniques and tools, such as regression analysis or discounted cash flow models, depending on the objectives. I conduct the analysis, document the assumptions and methodologies used, and validate the results. Finally, I communicate the findings in a clear and concise manner, tailoring the presentation to the target audience and providing actionable recommendations.

12. Explain your understanding of internal controls and how you implement them.

Internal controls are processes implemented by a company to provide reasonable assurance regarding the achievement of operational efficiency, reliable financial reporting, and compliance with laws and regulations. They are designed to safeguard assets, prevent and detect fraud, and ensure the accuracy and integrity of financial information. I understand these controls as critical for mitigating risks and ensuring an organization operates effectively and ethically.

My implementation approach involves several key steps. First, I participate in risk assessments to identify potential vulnerabilities. Based on these assessments, I help design and implement specific controls, such as segregation of duties, authorization procedures, and regular reconciliations. I also assist in documenting these controls clearly and concisely. Furthermore, I conduct periodic testing to evaluate the effectiveness of existing controls and recommend improvements where needed. Finally, I stay updated on relevant regulatory changes and best practices to ensure our internal control framework remains robust and relevant.

13. Describe your experience with tax compliance and reporting.

My experience with tax compliance and reporting includes preparing and filing various tax returns, such as income tax, sales tax, and payroll tax returns. I'm familiar with tax regulations and deadlines, and I have experience using tax software to ensure accurate and timely filing. I have also assisted with tax audits, gathering documentation and responding to inquiries from tax authorities.

Specifically, I've worked with [mention specific software like QuickBooks, Xero, or TaxAct] and have experience reconciling accounts, preparing workpapers, and documenting tax positions. I am also familiar with [mention specific tax forms like 1040, 1120, 941 etc] and relevant schedules. I'm adept at researching tax issues and applying relevant tax laws and regulations.

14. How do you handle disagreements with colleagues or superiors regarding accounting treatment?

When disagreeing with colleagues or superiors about accounting treatment, I prioritize a professional and respectful approach. First, I thoroughly research the relevant accounting standards (e.g., GAAP, IFRS) to support my position. Then, I would calmly and clearly present my understanding, citing the specific standards and how they apply to the situation. I am also open to hearing and understanding their perspective and reasoning.

If the disagreement persists, I would suggest consulting with another qualified professional within the organization, such as a senior accountant or the controller, or even an external auditor, to gain an objective opinion. The goal is to arrive at a treatment that is compliant with applicable standards, ethical, and in the best interest of the company. I am willing to compromise if the alternative treatment is acceptable under accounting standards, but I would escalate the issue if I believe the proposed treatment violates those standards and could have a material impact.

15. Explain your experience with international accounting standards (IFRS).